As an employer, you will have a number of choices for paying your staff. Widespread choices embrace direct deposit, money, or test. Some employers might handwrite checks whereas others print them. Different employers might go for early wage entry for his or her staff. However, there may be another choice: pay playing cards.

This text will reply questions comparable to:

- What’s a pay card?

- How do pay playing cards work?

- Are there legal guidelines about pay playing cards?

- What are the professionals and cons of pay playing cards?

What’s a pay card?

Payroll playing cards for workers act like pay as you go playing cards that employers can use to pay staff their wages. Every payday, the employer hundreds the cardboard with the worker’s earnings for the pay interval. A pay card is also called a payroll debit card or payroll card.

Pay playing cards are like reloadable debit playing cards. Employers direct deposit employees’ earnings onto the cardboard as an alternative of into their checking account.

How do payroll playing cards work?

If an employer chooses to make use of payroll playing cards for workers’ wages, they work with a card issuer to obtain playing cards for his or her staff. The playing cards are bodily plastic playing cards just like debit or bank cards. Employers distribute the playing cards to staff who select pay playing cards as a cost possibility. Consider it like a direct deposit paycheck to bank card as an alternative of to a checking account.

When paying payroll, the employer points an digital fund switch (EFT) to the worker’s pay card. The worker can entry their wages with the cardboard as quickly because the funds are loaded.

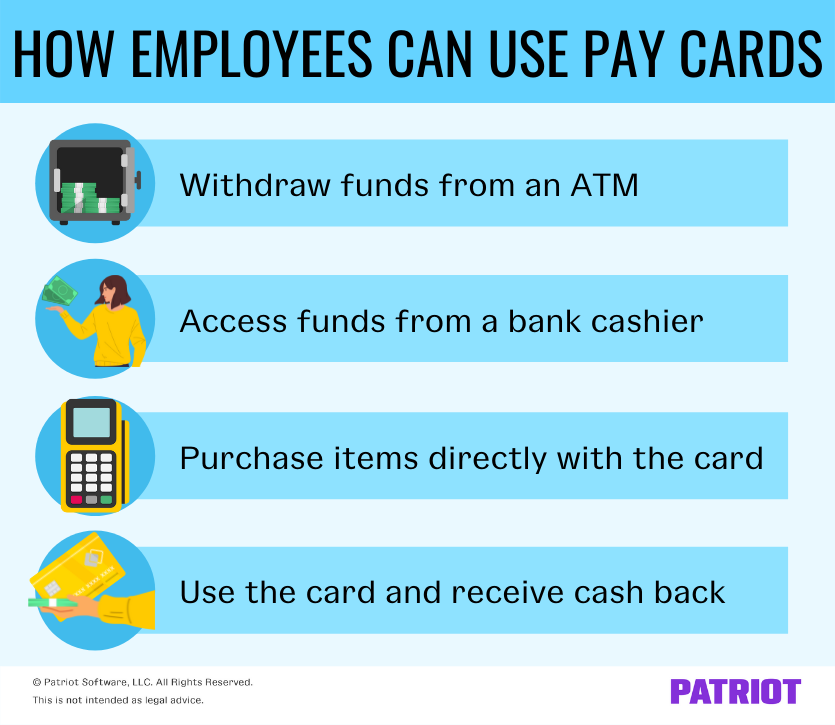

Workers have the choice to do the next with a pay card:

- Withdraw funds from an ATM

- Entry funds from a financial institution cashier

- Buy objects with the cardboard straight

- Use the cardboard and obtain money again the place relevant

Pay playing cards, like direct deposit, are topic to the Nationwide Automated Clearing Home Affiliation (NACHA) guidelines and laws. And, they could be topic to Automated Clearing Home (ACH) timing. ACH timing might be as little as the identical day or as many as 4 enterprise days.

Are there legal guidelines about pay playing cards?

There are each federal and state legal guidelines about utilizing payroll playing cards to pay your staff. The federal authorities regulates pay playing cards beneath the next:

- Honest Labor Requirements Act (FLSA)

- Digital Fund Switch Act (EFTA)

- Regulation E

- Regulation Z

States might have their very own guidelines and laws.

Federal pay card legal guidelines

Employers should abide by all minimal wage legal guidelines beneath the FLSA when utilizing payroll playing cards. Pay playing cards might have related charges which decrease an worker’s wages under the minimal wage. Notify staff about card substitute and fund withdrawal charges earlier than utilizing a pay card for direct deposit. And, proceed to watch the charges for the playing cards to make sure you don’t violate any minimal wage legal guidelines.

Moreover, employers should supply a minimal of 1 different type of cost to staff beneath the Digital Fund Switch Act and Laws E and Z. The act prohibits employers from forcing staff to obtain their wages by way of pay card. Laws E and Z require employers to observe EFT laws and the Fact in Lending Act. Employers should present written disclosure of all pay card account-related info to their staff.

Different Federal Reserve Regulation E necessities beneath the EFTA embrace:

- Workers should know of any charges they may have from utilizing a pay card.

- The cardboard issuer should make the cardboard’s transaction historical past obtainable for overview by the worker.

- The worker’s legal responsibility for unauthorized card use is restricted.

- Monetary establishments should reply to a shopper’s report of errors so long as it’s inside a sure period of time.

State pay card legal guidelines

Federal legal guidelines usually are not the one legal guidelines to remember earlier than paying staff by way of payroll playing cards. Try pay card legal guidelines by state earlier than continuing with the cost technique.

Many states even have basic legal guidelines that say employees ought to obtain their pay in full and with out reductions. The payroll card laws have made this cost technique controversial since staff can’t all the time obtain their full pay from ATMs and since parts of their wage could also be taken away in charges.

Test together with your state authorities to seek out out if it’s good to observe any state-specific pay card guidelines.

What are the professionals and cons of pay playing cards?

Nonetheless on the fence about pay playing cards? Check out a number of details:

- A 2019 survey confirmed that 28.5% of employers use payroll playing cards, a rise from 2% that used them in 2015.

- The Federal Deposit Insurance coverage Company’s (FDIC) most up-to-date survey reveals that 5.4% of American households didn’t have a checking account.

- One other report confirmed that as many as 18.7% of People used non-bank options.

With this info in thoughts, study the professionals and cons of payroll playing cards for workers.

Execs of payroll playing cards

Once more, 5.4% of American households (roughly 7.1 million) didn’t have a checking or financial savings account in 2019, making them “unbanked.” Payroll playing cards present vital advantages to unbanked employees who can’t obtain direct deposits. And, pay playing cards can cut back the big check-cashing charges for paper checks. So, staff can obtain their pay and instantly use it.

Employers might also lower your expenses utilizing pay playing cards. Why? As a result of, in contrast to test inventory, payroll playing cards are reloadable. So, employers would not have to buy new playing cards every payday or purchase paper test inventory.

Workers also can use their pay playing cards like debit playing cards at most companies as a result of they’re distributed by frequent playing cards corporations (e.g., Visa, MasterCard, and so on.).

Cons of payroll playing cards

One of the vital frequent cons to utilizing payroll playing cards for workers is that staff might be hit with charges. These potential charges embrace ATM, substitute, inactivity, and steadiness inquiry charges. Over time, the charges may trigger staff to lose vital parts of their wages.

One other downside to pay playing cards is that ATMs don’t disburse precise greenback and cent quantities. So, employees might not be capable of withdraw their whole paycheck.

Moreover, employers might have to spend time making certain that the charges and laws for payroll playing cards don’t change. If there are adjustments from the pay card issuer, the employer should notify staff in writing of any adjustments as quickly as potential.

This text has been up to date from its authentic publication date of August 18, 2015.

This isn’t meant as authorized recommendation; for extra info, please click on right here.