AI (synthetic intelligence) has been a game-changer for every thing from speech recognition to language translation and … accounting? Sure, AI in accounting continues to remodel the method of bookkeeping. How so?

Many accounting software program platforms use AI to streamline tedious accounting duties like information entry and financial institution assertion reconciliation. Need to be taught extra about it? Learn on in your starter information to synthetic intelligence in accounting.

What’s AI in accounting?

At first, what precisely is AI? In keeping with Britannica, synthetic intelligence is:

The flexibility of a digital laptop or computer-controlled robotic to carry out duties generally related to clever beings … comparable to the power to purpose, uncover which means, generalize, or be taught from previous expertise.”

Each accountants and companies use synthetic intelligence programs to streamline mundane and repetitive duties. Though AI isn’t an alternative choice to accounting duties that require full accuracy or skilled recommendation, it may act as a supporting device to save lots of time.

Machine studying in accounting

Synthetic intelligence in accounting software program typically comes within the type of machine studying, which is a sort of AI. Machine studying is the method of giving machines information to allow them to be taught from the info and make ideas based mostly on it.

Let’s have a look at an instance. Whenever you buy one thing on-line, you might obtain suggestions for different objects based mostly in your buy. The system makes use of machine studying to make ideas based mostly on what different folks with “related pursuits” have purchased.

In accounting software program, machine studying could make labeling and grouping ideas based mostly on what different customers have finished.

Advantages of synthetic intelligence in accounting software program

As a enterprise proprietor, you might be questioning how AI in accounting can assist you. Should you use accounting software program, your system could have AI that can assist you:

- Categorize transactions in the appropriate accounts

- Reconcile accounts (e.g., financial institution assertion reconciliation)

- Spot information entry errors

- Robotically match information

- Establish safety threats

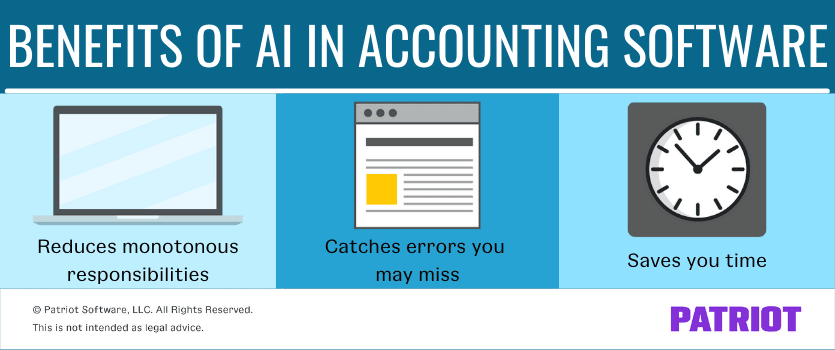

In brief, AI can deal with and streamline a variety of accounting duties. Take a better have a look at three primary advantages of AI accounting.

1. Reduces monotonous duties

Let’s face it: Knowledge entry is time-consuming. It could possibly suck up time that you can higher spend rising your corporation.

For instance, Patriot Software program’s Good Suggestion streamlines the method of categorizing transactions throughout financial institution imports. You could categorize every transaction beneath the proper accounts. However with Good Suggestion, you don’t must manually choose accounts. The machine studying characteristic makes account categorization ideas based mostly on the identical or related transactions different customers have had. Your accountability? Merely settle for or dismiss the ideas.

Different sensible options in accounting software program that may scale back monotonous duties embrace:

- Computerized financial institution transaction imports

- Recurring invoices

- Computerized bill fee reminders

Remember that synthetic intelligence accounting doesn’t take away you from the equation. Usually, it’s essential approve or decline ideas and categorizations, so be able to nonetheless carve out a while in your duties.

2. Catches errors you might miss

One thing out of the odd? AI in accounting can assist spot irregularities you will have in any other case missed.

Not solely can this make it easier to catch innocent information entry errors, however it may additionally warn you to safety threats.

3. Saves you time

On the finish of the day, one of many greatest advantages of machine studying in accounting is time financial savings.

Good options can streamline the method of reconciling and categorizing accounts so you possibly can concentrate on what issues most: your corporation.

This isn’t meant as authorized recommendation; for extra data, please click on right here.