A lot of the nation’s massive banks are actually promoting special-offer 5-year mounted charges above 4%.

This contains RBC, TD, BMO, CIBC and Nationwide Financial institution of Canada, together with many different mortgage lenders.

Amongst nationwide suppliers, insured 5-year mounted charges are actually averaging 3.98% whereas uninsured mortgages common 4.12%, in response to information tracked by Rob McLister, charge analyst and editor of Mortgage Logic. That’s up about 25 foundation factors because the begin of April and up 10 bps since Wednesday alone.

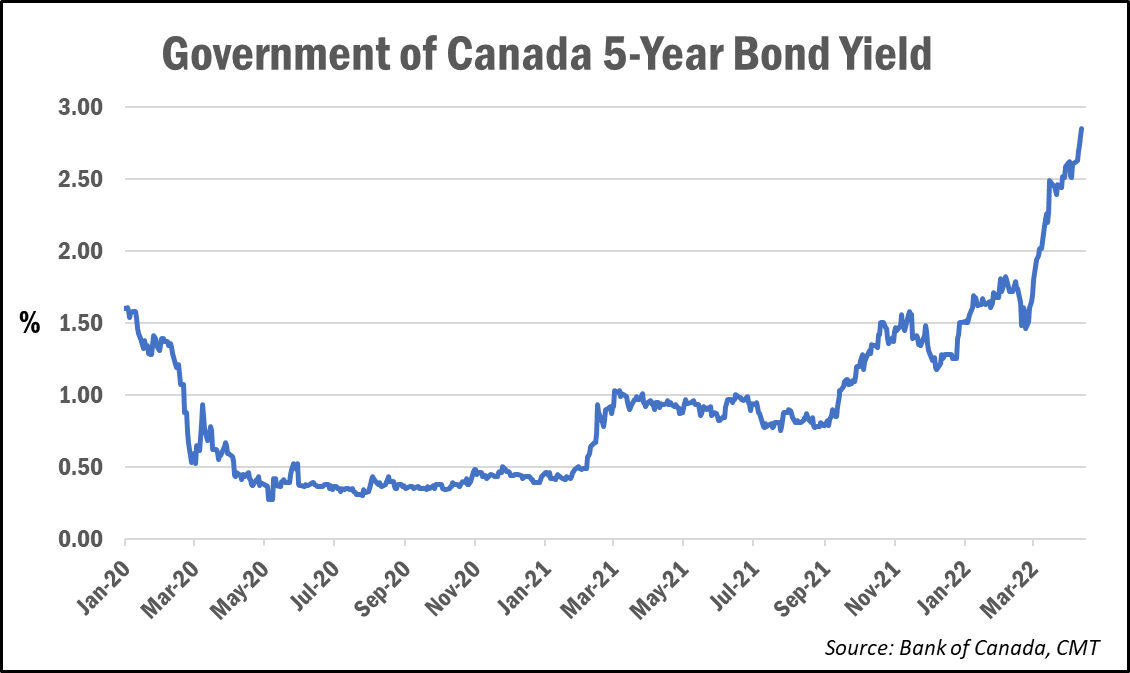

The transfer follows the newest leg-up within the Authorities of Canada 5-year bond yield, which soared to a contemporary 11-year excessive of two.80% final week on higher-than-expected inflation information.

On Wednesday, Statistics Canada reported that the headline client value index got here in at a 30-year excessive of 6.7% in March, up from the February studying of 5.7%.

As inflation considerations persist, markets have upped their expectations for future Financial institution of Canada charge hikes so as to carry its benchmark charge to the central financial institution’s impartial vary of 2-3% (the in a single day goal charge is presently 1%).

Rising charges a “sport changer” for housing market: RBC

With the speedy rise in mounted charges seen so far, and the additional will increase to variable charges anticipated within the coming months, Canada’s housing market is prone to quickly really feel the consequences.

“Rising charges are an issue and can nearly actually weight considerably on [housing] demand via the rest of the yr except issues change shortly,” wrote analyst actual property Ben Rabidoux of Edge Realty Analytics.

“Resale markets throughout the nation are nonetheless exceptionally tight, however we are actually seeing a big stock construct the likes of which we haven’t seen since 2010.”

Whereas the affect of upper mounted charges has been muted as far as mortgage debtors took benefit of charge holds and shifted to decrease variable charges, RBC’s Robert Hogue mentioned the approaching variable-rate will increase will depart debtors “with no escape” and have a direct affect on affordability.

“Each purchaser throughout the nation will really feel the pinch of rising charges. However these in the most costly markets will really feel it most,” he wrote. “We count on downward value stress to be extra intense in Vancouver, Toronto and different dear markets. It will translate into bigger annual value declines in 2023 in British Columbia and Ontario.”

In Alberta, the place native markets “have extra catching as much as do,” Hogue says exercise and costs ought to stay extra resilient.

Hogue provides that there may very well be a silver lining in all of this.

“Moderately than pose a significant risk, we expect rising rates of interest are prone to carry welcome adjustments to the market—together with extra sustainable exercise, fewer value wars, extra balanced situations, and modest value reduction for patrons,” he mentioned. “After the intense value will increase and heated bidding wars of the final yr, this is able to be a constructive shift.”