House gross sales in Canada fell in March, whereas the tempo of worth progress eased, doubtlessly signalling the beginning of a slowdown as rates of interest development greater.

House gross sales had been down 16.3% in comparison with final 12 months’s document excessive, falling to 55,000 items, in line with knowledge from the Canadian Actual Property Affiliation (CREA).

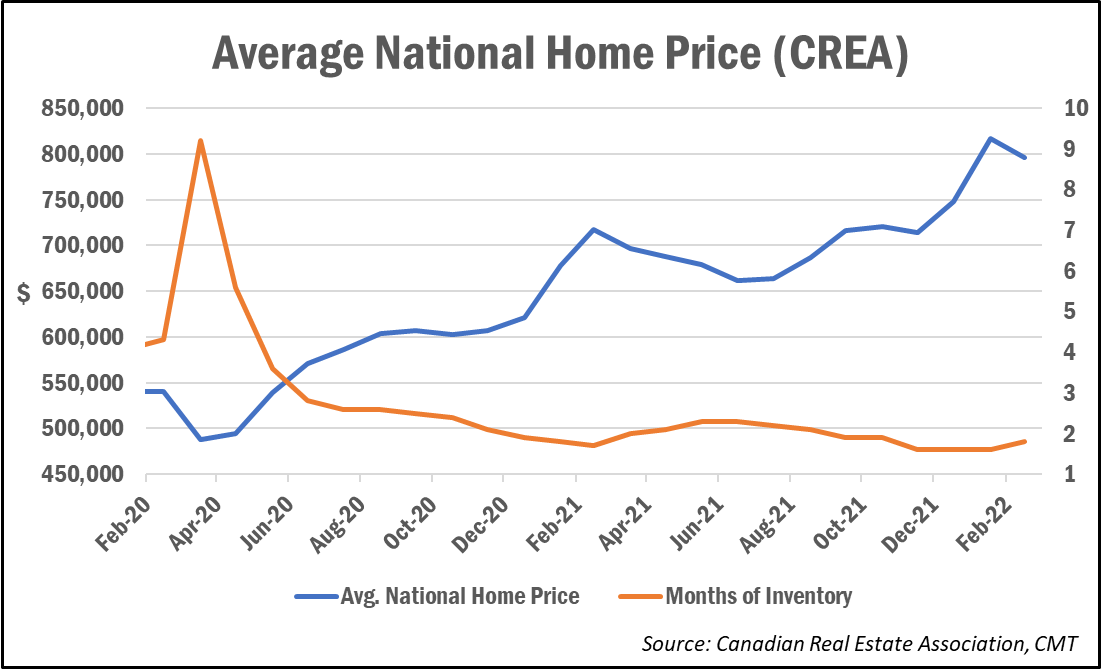

In the meantime, the common house worth got here in at $796,068, down 1.5% from February, whereas year-over-year worth progress eased to 11.2%, down from the annualized 20.6% rise seen in February,

“Whereas the market stays traditionally very energetic, March positively noticed a slowdown in comparison with February when it comes to each exercise and worth progress,” stated Jill Oudil, Chair of CREA. “One month doesn’t make a development, so we’ll have to attend and see if that is the start of the long-awaited cooling off of this market.”

The MLS House Worth Index, which removes a number of the volatility from seasonality, recorded a month-over-month acquire of 1%—slower than the three.5% tempo seen in February—and was up 27.1% in comparison with a 12 months in the past (vs. the 29.2% annualized enhance recorded in February).

The variety of months of stock rose to 1.8, up from its all-time low of 1.6 over the previous three months. The long-term common, nevertheless, is over 5 months.

CREA famous that about two-thirds of native markets are thought of to be “vendor’s markets” primarily based on the sales-to-new listings ratio. The opposite third of markets are in “balanced market” territory.

Eradicating the high-priced markets of the Larger Toronto and Vancouver areas, the common worth stands at $633,068, which is $76,240 greater than a 12 months in the past.

Cross-country roundup of house costs

House costs continued to rise in most areas, though the tempo of progress was slower in comparison with what was seen in February. Up to now month, common costs elevated by $36,000 within the Larger Toronto Space (vs. $80,000 within the earlier month), $47,100 within the Larger Vancouver Space (vs. $58,200), $17,800 in Barrie, ON, and district (vs. $60,300), $20,200 in Ottawa (vs. $40,600) and $19,400 in Calgary (vs. $25,200).

In different markets, notably Atlantic Canada, house worth progress remained sturdy. 12 months-over-year, costs had been nonetheless up 37% in Halifax, NS, 31% in Fredericton, NB and 29.5% in Saint John, NB.

Right here’s a take a look at some extra regional and native housing market outcomes for March:

- Nova Scotia: $390,200 (+37.4%)

- Ontario: $1,052,920 (+18.3%)

- B.C.: $1,089,600 (+15.2%)

- Quebec: $499,209 (+14.7)

- Alberta: $472,746 (+7.1%)

- Halifax-Dartmouth: $493,200 (+37%)

- Barrie & District: $958,400 (+35.6%)

- Larger Toronto Space: $1,376,000 (+34.8%)

- Victoria: $978,300 (+28.7%)

- Larger Vancouver Space: $1,360,500 (+20.7%)

- Larger Montreal Space: $562,500 (+18.4%)

- Calgary: $503,400 (+17.3%)

- Ottawa: $750,500 (+14.1%)

- Winnipeg: $348,900 (+13.5%)

- Edmonton: $364,400 (+9.3%)

- St. John’s: $289,900 (+9.2%)

Are rising rates of interest already having a cooling impact?

As CREA Chair Jill Oudil famous above, one month doesn’t make a development. Nevertheless, observers counsel rising rates of interest might already be having an impression on homebuying tendencies.

Mounted mortgage charges have already surged roughly a proportion level to the 4% mark over the previous couple of months, whereas the Financial institution of Canada has now raised its benchmark fee by 75 foundation factors, sending prime fee, and variable mortgage charges by extension, greater.

“Whereas purchaser’s fatigue doubtless performed a task in cooling gross sales in March, rates of interest additionally elevated fairly considerably,” famous TD economist Rishi Sondhi. “And, with the Financial institution of Canada set to hike charges aggressively, house gross sales are more likely to development even decrease shifting ahead. This could assist steadiness the market and weigh on house worth progress.”

Nationwide Financial institution of Canada economist Daren King agrees, however stated the housing market ought to stay sturdy via the spring since many consumers nonetheless have aggressive fee holds in place.

“In our opinion, the housing market ought to stay energetic in the course of the spring resulting from many individuals who’ve secured advantageous rates of interest and [who] will wish to act earlier than the tip of their rate of interest assure,” he wrote. “Nevertheless, with the latest enhance in mortgage rates of interest and the worst affordability circumstances on document, we count on the residential market to decelerate within the second half of the 12 months.”