Take out a enterprise mortgage or have a mortgage in your brick-and-mortar? It’s possible you’ll cringe while you see your small business curiosity expense add up. However right here’s a bit of fine information—there’s a enterprise curiosity expense deduction chances are you’ll be eligible to assert (hooray!).

Learn on to study extra about enterprise curiosity bills, together with what forms of curiosity bills you may and might’t deduct in enterprise.

What’s a enterprise curiosity expense?

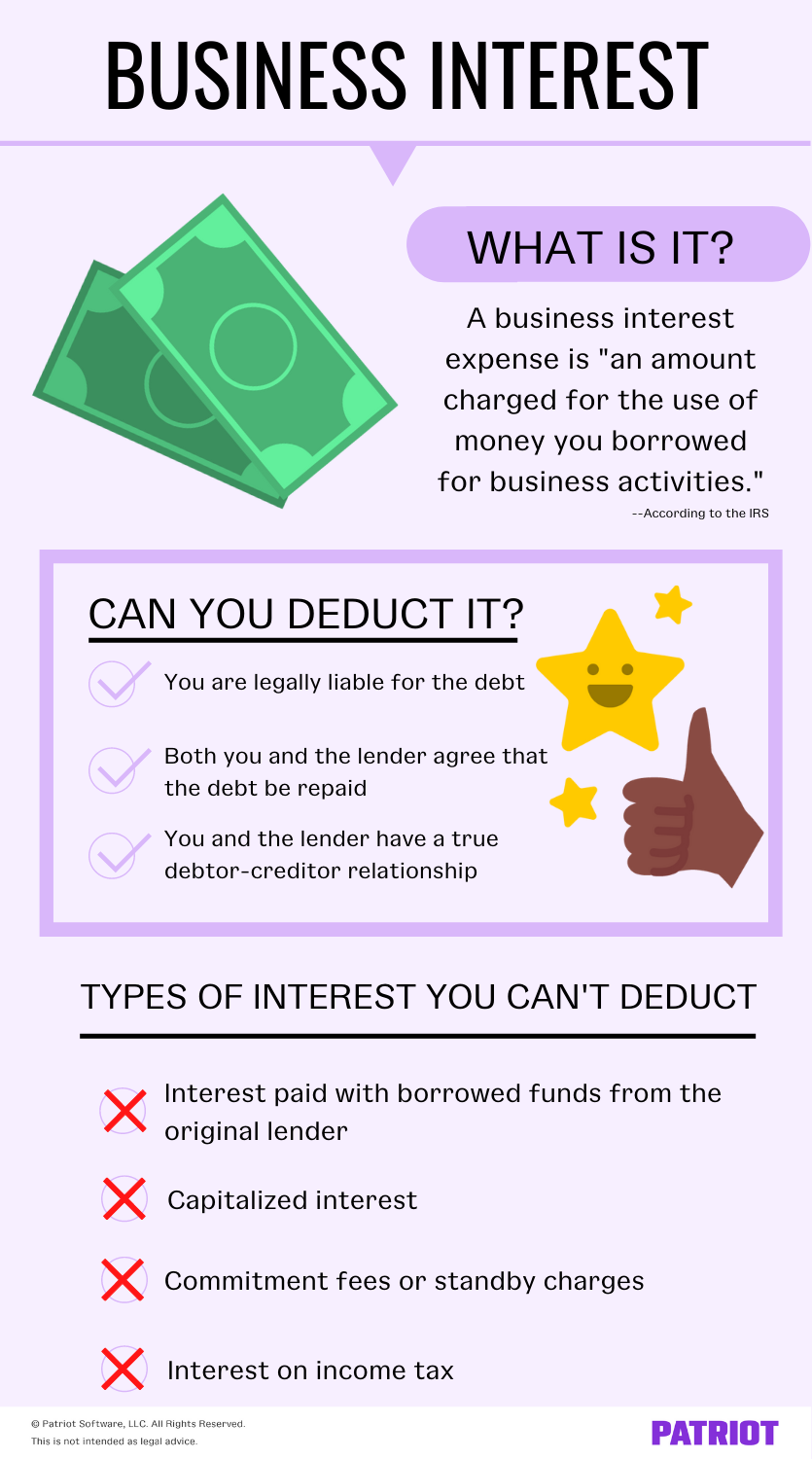

Based on the IRS, a enterprise curiosity expense is “an quantity charged for using cash you borrowed for enterprise actions.” Enterprise curiosity is curiosity that happens on the proceeds of a mortgage for a commerce or enterprise expense, no matter the kind of property securing the mortgage.

In enterprise, you doubtless accrue curiosity on:

- Loans

- Property mortgages

- Traces of credit score

- Funding property loans

Yikes—the extra loans and features of credit score you will have, the extra curiosity bills you accrue. To assist offset these excessive prices, companies can declare a particular curiosity expense deduction.

Deductible and non-deductible enterprise curiosity

So, is enterprise curiosity tax deductible on a regular basis? Not fairly.

Positive, the curiosity expense deduction is on the market—however just for sure forms of enterprise curiosity. Learn on for the forms of curiosity you may and might’t deduct.

Kinds of curiosity you may deduct

To deduct enterprise curiosity on a debt, you will need to meet all three of the next necessities:

- You might be legally chargeable for the debt

- Each you and the lender agree that the debt be repaid

- You and the lender have a real debtor-creditor relationship

For instance, for those who’re solely chargeable for a part of a enterprise debt, you may solely declare the deduction in your share of the whole curiosity.

Listed here are some examples of the forms of curiosity which are deductible:

- Mortgage curiosity on actual property you personal

- Authentic challenge low cost (OID)

- Employment tax deficiency curiosity

Kinds of curiosity you may’t deduct

Once more, you may’t deduct all forms of curiosity funds—or funds you assume could be curiosity. Typically, you may’t deduct curiosity that have to be capitalized or private curiosity.

Check out the next forms of curiosity (and funds chances are you’ll mistake for curiosity) you may’t deduct:

- Curiosity paid with borrowed funds from the unique lender

- Capitalized curiosity

- Dedication charges or standby costs

- Curiosity on revenue tax

For extra info on deductible and non-deductible curiosity, take a look at Publication 535, Enterprise Bills.

Curiosity expense deduction limitation

For a lot of companies, there’s a restrict to how a lot of an curiosity expense deduction you may declare. This restrict is named a piece 163(j) limitation.

Qualifying small enterprise taxpayers are usually not topic to the enterprise curiosity expense limitation. To qualify for the limitation exemption, you will need to:

- Meet the IRS gross receipts take a look at (aka you want common annual gross receipts of $26 million or much less for the three prior tax years) AND

- Not be a tax shelter (as outlined by the IRS)

In case you are topic to the part 163(j) limitation, the utmost enterprise curiosity expense deduction you may declare is proscribed to the sum of:

- Enterprise curiosity revenue,

- 30% of the adjustable taxable revenue, AND

- Ground plan financing curiosity

Unable to assert the total quantity of your small business curiosity expense? Typically, you may carry the quantity you don’t declare in a single tax 12 months to the next 12 months as a disallowed enterprise curiosity expense carryforward.

The best way to declare the enterprise curiosity expense deduction

Eligible to assert the curiosity expense deduction? Nice! Use your small enterprise tax return to assert the deduction:

- Schedule C: Sole proprietors and single-member LLCs

- Type 1065: Companions and multi-member LLCs

- Type 1120: Firms

In case you’re claiming funding curiosity deductions, use Type 4952, Funding Curiosity Expense Deduction, to calculate the quantity. Connect Type 4952 to your tax return.

Wish to make it even simpler to assert the deduction? Hold your books up-to-date all year long so that you’re not scrambling at tax time to seek out paperwork.

This isn’t supposed as authorized recommendation; for extra info, please click on right here.