Now that 30-year fastened mortgage charges are flirting with 5%, there’s been fairly the uptick in housing bubble chatter.

The fundamental reasoning is as a result of rates of interest are larger, the balloon that’s inflated house costs should definitely pop.

On the floor, it’s a seemingly logical argument. The financing price of a house buy has gone up considerably, so the value ought to come down.

However the price of nearly all the things has gone up, and we’re nonetheless shopping for it, whether or not it’s bread, toothpaste, bathroom paper, gasoline, you title it. As a result of we would like and wish it, just like shelter!

Right here I try to argue why the charges up, costs down concept won’t be right. And why we may very well be speeding the eventual downturn.

Do Increased Mortgage Charges Actually Decrease Dwelling Costs?

I’ve already written a complete article on the supposed detrimental correlation between mortgage charges and residential costs.

However to revisit, the straightforward argument is that if one goes down the opposite goes up. And vice versa.

For instance, if rates of interest go up (the price of financing a house buy), property values should go all the way down to compensate.

In essence, nothing modifications, the web value stays the identical? You get a decrease mortgage fee however the next house value.

A better mortgage fee however a decrease house value? The price of housing simply stays fixed it doesn’t matter what?

When you begin to look past this obvious apparent correlation, it appears to make lots much less sense, not less than to me.

My automotive didn’t go down in value as a result of gasoline costs went up. Each rose in tandem! Now it’s costlier to purchase a automobile and to function the factor! What provides?

Nicely, as a result of I would like and wish a automotive, as does everybody else. And there’s a restricted provide. So costs go up, even when it prices extra to personal one.

Equally, mortgage charges and residential costs can rise or fall on the identical actual time. There’s no particular stability that should be adhered to within the universe.

Dwelling Worth Features Can Average On account of Increased Mortgage Charges

I feel of us usually jumble falling house costs with moderating house value positive factors.

In different phrases, larger rates of interest could be a headwind to house value appreciation, particularly if it’s been tremendous sturdy.

For instance, over the previous few years we’ve seen double-digit positive factors in house costs yearly.

Now that we’ve loved these large positive factors AND mortgage charges are lots larger, subsequent positive factors could also be harder to come back by.

That is just like larger mortgage charges going even larger – hopefully the current massive positive factors will make it harder for them to interrupt even larger.

However that’s not even essentially true…

Anyway, the brand new mortgage fee actuality doesn’t imply house costs simply plummet. However it may make it tougher for property values to rise one other 20% in 2022.

In fact, Zillow just lately mentioned it expects annual house worth development to proceed accelerating by way of the spring, peaking at a whopping 22% in Could.

Then to step by step decelerate to a nonetheless exceptional 17.8% by February 2023.

In the meantime, housing market specialists and economists polled by Zillow between February sixteenth and March 2nd predicted house values to rise 9% (on common) in 2022.

In fact, most of these responses have been made earlier than mortgage charges jumped, and the a lot larger mortgage charges may dampen these estimates.

Both manner, the 9% acquire could be lower than half the 19% house value appreciation seen in 2021, which implies decelerating house costs, not falling house costs.

It additionally means the following housing market crash might not happen till 2024 or past.

Are Dwelling Costs as Excessive as Everybody Thinks?

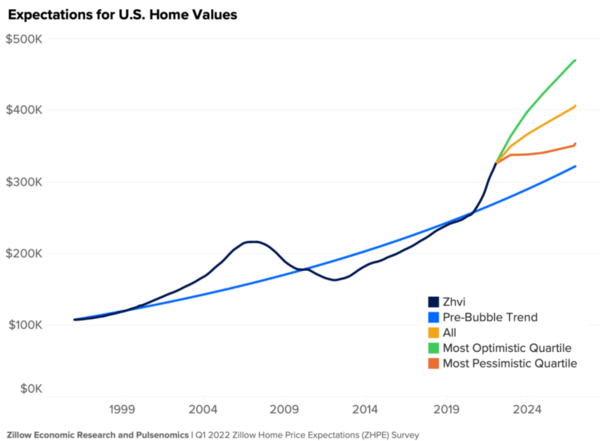

That very same Zillow survey exhibits the place house costs are, per the Zillow Dwelling Worth Index (ZHVI) and the place housing specialists count on them to be.

Extra notably to me, is the pre-bubble development of house costs, which exhibits the place they’d be with out the bubble and bust within the early 2000s.

Apparently, house costs as we speak are just a few years forward of this anticipated development. And it wasn’t till just lately that they even started to deviate from that course.

In case you look again to round 2006, house costs obtained manner forward of themselves. In the present day, they’re just a few years forward of themselves.

Nonetheless, even probably the most pessimistic quartile of respondents expects them to maneuver larger from present ranges, albeit not by a lot.

The fundamental rationalization is that house costs underperformed for a number of years post-housing disaster, specifically between 2008-2013, then ultimately took off.

They’ve since made up for misplaced time, however when seen by way of a wider lens, possibly aren’t as loopy excessive as everybody thinks.

And the lock-in impact of upper mortgage charges (for current householders) makes the provision/demand imbalance even worse, which once more helps even larger costs.

Don’t We Nonetheless Want a Few Years of Artistic Financing Earlier than Issues Go Kaput?

The very last thing I’ll point out is artistic financing, which is often what results in bubbles within the first place.

The housing disaster within the early 2000s was brought on by really appalling mortgages, specifically choice ARMs with a 1% cost characteristic.

In the present day’s house loans are just about all 30-year fastened mortgages. Oh, and a few 15-year fastened mortgages.

They’re additionally totally underwritten through the verification of revenue, property, employment, and credit score historical past.

The mortgages of yesteryear have been principally said all the things. AKA I’ll inform you what I do, what I make, how a lot cash I’ve, and so forth. However don’t truly confirm it. And we paid for that, massive time.

Logic tells me banks and mortgage lenders are going to need to get artistic now that quantity has dried up seemingly in a single day.

This implies introducing and/or pitching extra dangerous mortgage merchandise akin to adjustable-rate mortgages, interest-only mortgages, and so forth.

As I famous the opposite day, the 5/1 ARM is now pricing about 1% under the prevailing fee on a comparable 30-year fastened.

Dwelling patrons might select to go along with such loans to maintain prices down. And whereas the 5/1 ARM is in no way a poisonous choice ARM, it does carry extra threat than a 30-year fastened.

If lenders go much more dangerous, properly, these merchandise mixed with even larger house costs may result in the inevitable finish we’ve all been frightened about.

Nonetheless, that might take a few years to play out, not less than…so whereas the housing bears will ultimately be proper, it won’t be this yr and even subsequent.

Learn extra: What’s going to trigger the following housing market crash?