How’s this for a dramatic headline: “House costs are falling!”

However earlier than you get too excited, assuming you’re a potential dwelling purchaser, there are some strings.

What was virtually unthinkable a month or two in the past is now apparently changing into actuality.

A brand new evaluation from Realtor.com discovered that asking costs are literally down year-over-year in a number of giant metropolitan areas nationwide.

Does this imply the vendor’s market is lastly coming to an finish, pushed by markedly larger mortgage charges? Let’s discover out.

The place House Costs Are Down the Most

The Realtor.com knowledge staff analyzed year-over-year median checklist costs within the 100 largest metros nationwide within the month of March.

They then restricted their checklist to only one metro per state as a way to making sure “geographic range.”

The result’s a top-10 checklist of metros “the place dwelling costs are falling essentially the most.”

The checklist is as follows:

1. Toledo, Ohio (-18.7%)

2. Rochester, New York (-17%)

3. Detroit, Michigan (-15.4%)

4. Pittsburgh, Pennsylvania (-13.7%)

5. Springfield, Massachusetts (-5.8%)

6. Tulsa, Oklahoma (-5%)

7. Los Angeles, California (-5%)

8. Memphis, Tennessee (-4.6%)

9. Chicago, Illinois (-3.7%)

10. Richmond, Virginia (-3.4%)

As you possibly can see, there may be fairly a variety in itemizing worth drops among the many high ten, with a excessive of -18.7% in hard-hit Toledo, to a mere 3.4% drop in Richmond, VA.

So what precisely is occurring right here? Weren’t dwelling costs anticipated to maintain rising, regardless of considerably larger mortgage charges?

Nicely, in Toledo particularly, the problem has been an elevated unemployment price, coupled with an overheated housing market.

This has put an enormous pressure on affordability as mortgage charges jumped from sub-3% ranges in late 2021 to their present mid-5% vary.

The identical is essentially true of the opposite 4 metros within the high 5, which all occur to be positioned within the Rust Belt as properly.

In these communities, dwelling costs might have merely gotten means too forward of themselves, and are merely falling again right down to earth.

After all, earth is relative as a result of they’re possible nonetheless up tremendously from their lows seen a decade in the past.

Is the Housing Market Merely Evolving?

They are saying actual property is native, in that you simply shouldn’t fear in regards to the nationwide development as a lot because the neighborhood through which you’re seeking to purchase a house.

In different phrases, who cares if dwelling costs are down in Toledo in the event you’re making an attempt to buy a property in Phoenix?

That being stated, there seems to be an rising development within the remaining 5 metros on the checklist that’s extra indicative of an evolving housing market.

In locations like Chicago, Los Angeles, and Tulsa, it seems smaller properties are making their approach to market.

As such, the median itemizing worth is “down” from a yr in the past, however usually occasions the value per sq. foot is up.

That is considerably much like your bag of Doritos nonetheless costing 99 cents however containing a number of much less chips.

For instance, a potential dwelling purchaser in Los Angeles might now be settling for a 1,500-square-foot cottage as a substitute of say a 2,500-square foot dwelling.

And in Chicago, there are apparently 6,000 condominium models in the marketplace, which additionally drags the median checklist worth decrease.

Condos are all the time cheaper than single-family properties, so the -3.7% discount in median itemizing worth is likely to be a bit deceiving.

Typically occasions, condos start to creep larger in worth throughout the latter levels of a vendor’s market as patrons search for extra reasonably priced choices.

That might clarify a few of what we’re seeing on this early, seemingly destructive knowledge.

The opposite motive itemizing costs is likely to be down is solely a advertising tactic. Actual property brokers are itemizing decrease to garner curiosity, as a substitute of taking the chance of getting to make a worth minimize.

This implies the properties should still promote for greater than what they bought for a yr in the past when all is claimed and performed.

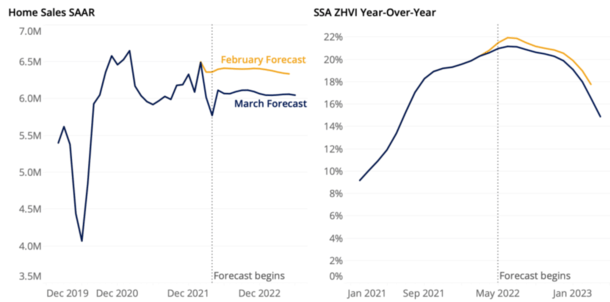

On a nationwide foundation, dwelling costs are nonetheless anticipated to rise a whopping 14.9% by way of March 2023, per Zillow.

That’s down barely from the 16.5% year-over-year forecast made in February, as seen within the picture above.

What’s unbelievable is this is able to nonetheless be the best dwelling worth development ever recorded by Zillow previous to June 2021.

And the 6.09 million in anticipated current dwelling gross sales could be the second greatest yr since 2006.

So whereas there is likely to be some indicators of a slowdown in sure markets, don’t get your hopes up.

House costs possible aren’t falling simply but, regardless of some cracks beginning to present.

Lastly, if mortgage charges peak and start to get well, we might see a brand new surge in purchaser curiosity…