Yves right here. On the one hand, these authors little doubt carried out their provide chain evaluation and largely wrote their paper earlier than the Ukraine conflict and its sanctions onslaught. On the opposite, it illustrates how specialists and individuals have blind spots in regards to the potential for paradigm shifts, in giant measure as a result of they’ve robust incentives to protect the present establishment, regardless of how creaky it has gotten. In ECONNED, we referred to as this course of paradigm breakdown:

Paradigm breakdown, that means key parts of the present system are not viable, however that may be a risk that nobody is ready to face, for the reason that outdated system appeared to work properly for a protracted interval. Thus the authorities reflexively put duct tape on the equipment reasonably than hazard a teardown.

Covid disruptions, chook flu, and pre-war fertilizer shortages had been already creating critical meals value will increase within the US. However the sanctions on Russia are creating a completely totally different and extra sturdy modifications, not mere disruptions or “shocks”, given the near-certainty that the US is not going to roll them again, even when Zelensky agrees to a peace treaty with Russia. The West goes to undergo lasting shortages of key supplies, comparable to palladium, nickel, aluminum, metal, copper and platinum. Ukraine is a serious provider of neon, essential to chip-making. Russia gives a number of essential inputs to fertilizer, so meals will turn out to be extra scarce and dear. And that’s earlier than we get to the influence of wheat shortages (and the West being a less-preferred buyer) and better power costs (which emergency reserve releases can reasonable for less than a matter of months).

Papers like this remind me of Keynes’ statement about bankers:

A ‘sound’ banker, alas! isn’t one who foresees hazard and avoids it, however one who, when he’s ruined, is ruined in a standard and orthodox manner alongside together with his fellows, in order that nobody can actually blame him.

Making Russia extra of an autarky, which Russia can survive, goes to drive the remainder of the world in that path. Only a few appear prepared to get in entrance of that improvement…save the intense gloom and doom varieties, aka preppers, who’re typically seen as extremists, and might be….until they’re finally confirmed proper.

By Richard Baldwin, Professor of Worldwide Economics at The Graduate Institute, Geneva; Founder & Editor-in-Chief of VoxEU.org; ex President of CEPR and Rebecca Freeman, Commerce Affiliate, Centre for Financial Efficiency (LSE). Initially revealed at VoxEU

Provide disruptions attributable to systemic shocks comparable to Brexit, Covid, and Russia-Ukraine tensions have catapulted the difficulty of threat in international provide chains to the highest of coverage agendas. In some sectors, nevertheless, there’s a wedge between personal and social threat urge for food, or elevated dangers on account of lack of provide chain visibility. This column discusses the kinds of dangers to and from provide chains, and the way provide chains have recovered from previous shocks. It then proposes a risk-reward framework for desirous about when coverage interventions are mandatory.

The previous couple of years have been rife with upheaval – whether or not we’re talking of individuals’s day-to-day lives, disruptions to business-as-usual, or worldwide commerce flows. The Brexit shock in Britain sparked preliminary issues in regards to the influence on international provide chains (GSCs). This was adopted by the a lot bigger and wider shock from the Covid-19 pandemic. The present political state of affairs between Russia and Ukraine, together with many nations’ sanctions and bans on the import of Russian merchandise, is more likely to perpetuate the spectre of broad and long-lasting shocks to a number of economies.

What must be finished about this? Noting many challenges to international provide chain resilience, Seric et al. (2021) study how companies concerned in international provide chains will help mitigate the results of provide disruptions. Additional, latest analysis on international provide chain dangers has proven that stock administration helps companies mitigate international provide chain shocks (Lafrogne-Joussier et al. 2022).

This column, based mostly on Baldwin and Freeman (2021), (1) examines how the literature has considered sources of shocks, threat and resilience within the context of worldwide provide chains, together with whether or not a shift within the pondering round threat is named for; and (2) presents a short dialogue on how you can apply our proposed framework to coverage discussions and future work on the subject.

Sources of Shocks

GSCs are composed of companies and companies face dangers. A few of these dangers are exogenous provide and demand shocks, different shocks emanate from different companies or transportation disruptions.

- Provide shocks embrace ‘basic’ disruptions comparable to pure disasters, labour union strikes, suppliers going bankrupt, industrial accidents, and so forth (Miroudot 2020), in addition to disruptions from broader sources like commerce and industrial coverage modifications, and political instability. They are often concentrated (e.g. the 2011 Japan earthquake) or broad (e.g. the Covid-19 pandemic).

- Transportation is a part of the providers sector, and thus doubtlessly topic to totally different shocks than items.

- Demand shocks confront companies with dangers stemming from harm to product and firm status, buyer chapter, entry of latest opponents, insurance policies limiting market entry, macroeconomic crises, and alternate price volatility.

One other essential dimension of threat issues the idiosyncratic-versus-systematic nature of shocks. Most companies concerned in international provide chains are conscious of idiosyncratic shocks – these which have an effect on single sectors or factories in single nations. These are frequent. Systemic shocks are a distinct matter.

From the Nineteen Nineties till not too long ago, shocks not often concerned many sectors/nations concurrently. That is actually what was new in regards to the Covid-19 shocks to international provide chains, which had been pervasive, persistent, and affected a number of sectors without delay. And whereas many companies do have contingency methods in place, few companies engaged in international provide chains – not even probably the most subtle multinationals – had ready for systemic shocks. This can be a actual change.

The Enterprise Continuity Institute Provide Chain Resilience Report 2021, which surveyed 173 companies in 62 nations, discovered that over 1 / 4 of companies skilled ten or extra disruptions in 2020, whereas the determine was beneath 5% in 2019. Companies cited Covid-19 for a lot of the rise in disruptions, though Europe-based companies additionally pointed to Brexit as an essential supply of shocks.

There are two different probably sources of systemic shocks: local weather change and geostrategic tensions. Briefly, systemic shocks could turn out to be the norm and thus require modifications to enterprise fashions worldwide.

Regardless that the pandemic waxed and waned regionally, it has been international in nature. Due to this, the influence was felt in nearly all items producing sectors. We can’t know the way continuously future pandemics or disruptive international occasions will happen, however it’s probably that Covid-19 will proceed to be disruptive for a lot of months or years.

Financial Evaluation of GSC Dangers, Resilience, and Robustness

The literature has targeted on three elements of worldwide provide chain dangers:

- The propagation of micro into macro shocks

- Whether or not international provide chains amplify the commerce influence of macro shocks

- The prices and results of delinking/decoupling from GSCs (e.g. by means of reshoring).

Our paper opinions these three literatures, however for the sake of house, we think about coverage points right here. Earlier than doing so, we contact upon the crucial distinction between resilience (capacity to bounce again shortly after a shock) and robustness (capacity to proceed manufacturing in the course of the shock). To make sure resilience, a lot of the main focus is on designing the availability chain with an eye fixed to the riskiness of places general. In distinction, robustness methods focus extra on guaranteeing redundancy of exterior suppliers or having a number of manufacturing websites for internally produced inputs (Martins de Sa et al. 2019, Brandon-Jones et al. 2014).

Do We Want New GSC Insurance policies?

A touchstone precept of the social market economic system is that authorities intervention is merited if there are gaps between the personal and public evaluations of prices, advantages, and/or dangers. In the case of GSC coverage, we argue that coverage could enhance market outcomes when there’s a wedge between personal and social evaluations of threat.

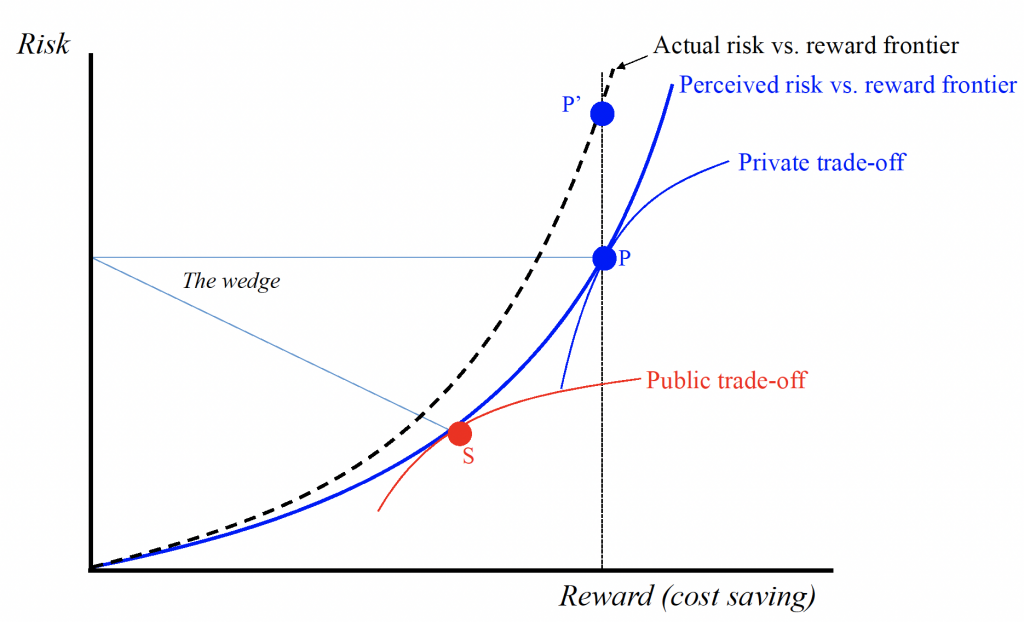

We illustrate this for international provide chains with a ‘wedge diagram’ (Determine 1). The diagram, styled on basic optimal-portfolio evaluation, has threat and reward on the y-axis and the x-axis, respectively. Companies like cost-savings and dislike threat (as proven by the indifference curves), however their selections are constrained by the elemental risk-reward frontier proven. The frontiers take their form since placing all manufacturing within the most cost-effective location will increase threat by reducing geo-diversification.

The place does the wedge come from? Public versus personal threat urge for food. Within the GSC world, divergences in public-private threat preferences can come up from a variety of mechanisms whereby particular person companies don’t internalise the total threat of their actions. Non-public companies optimally select level P given their preferences. In some sectors, many governments have preferences that give higher weight to threat discount, so the general public trade-off results in a lower-risk optimum, making a wedge between private and non-private threat evaluations. This divergence is evident in sectors comparable to banking the place, prior to now, authorities offered ensures when the danger went unsuitable, and in meals manufacturing the place particular person producers underinvest in anti-famine actions.

Misperception of the situation of the frontier. One other market failure can come up on account of data asymmetries. Trendy international provide chains are massively advanced and even probably the most subtle companies could be unaware of the situation of their third-tier suppliers and past (Lund et al. 2020). In consequence, personal companies could face extra threat than they know. This case is depicted because the precise risk-reward trade-off happening above the perceived trade-off, which might additionally lead to a wedge. When that is the case, personal companies are at level P’ after they suppose they’re at P.

Determine 1 The general public-private wedge evaluation of GSC dangers

Supply: Baldwin and Freeman (2021).

Insurance policies to Mitigate Danger

Danger mitigating insurance policies – comparable to these in banking and agriculture – are clearly warranted when such a public-private wedge exists. Banking is the basic sector with a wedge, however meals has one as properly provided that it’s nearly universally thought-about too crucial to nationwide wellbeing to be left to the market. Most nations have insurance policies that promote home manufacturing create buffer shares to easy demand and provide mismatches, or each. These usually contain giant scale outlays such the US Farm Invoice and the EU’s Frequent Agricultural Coverage.

It appears probably that crucial sectors, together with medical provides and semiconductors, can be considered extra like agriculture and banking going ahead than they’ve been, for the reason that notion is that they’re marked by a public-private wedge. Insurance policies that deal with the wedge could be usefully categorised into tax/subsidy measures, regulatory measures, and direct governmental management. And, as companies usually tend to shift manufacturing buildings after they understand a everlasting coverage shift (Antràs 2020), we speculate that these sectors are probably to restructure and reorganise their GSCs. On the coverage aspect, there have been clear strikes to guage crucial sectors. For instance, the Biden administration has established a Provide Chain Disruptions Process Power to deal with the challenges arising from a pandemic-affected financial restoration (White Home 2022).

A Goal-Wealthy Analysis Surroundings

We finish our paper, and this column, with a name for analysis. On the commerce idea aspect, nearly no analyses had delved into the function of threat in GSCs once we began circulating our paper in 2021. For instance, within the obtained knowledge literature (Grossman and Rossi-Hansberg 2008), the fundamental trade-off activates separation prices versus cost-saving beneficial properties in a mannequin with out threat. Because the dialogue of the Worldwide Enterprise literature in our paper makes clear, the risk-GSC nexus serves up a wealthy menu of un-modelled, but essential phenomena. After all, threat issues usually are not completely new (Costinot et al. 2013), however the idea has largely assumed away threat for comfort, and this has been echoed within the empirics.

On the empirical aspect, the chances are even higher. Nothing helps econometricians greater than really exogenous shocks. The years 2020 and 2021 had been bursting with exogeneity. Due to this, coupled with the supply of large, high-frequency, on-line information, and headline-grabbing significance, we conjecture that there’s a substantial amount of impactful empirical analysis to be finished on threat and the form and nature of GSCs. General, we see thrilling occasions forward for GSC researchers. Issues have, as they are saying, modified a lot that not even the longer term is what it was once. It’s riskier than we thought!

See authentic publish for references