“Former Tory

cupboard minister David Davis stated on Saturday that if the

Conservatives had been to change into referred to as the social gathering of excessive taxes, the

injury

to their financial popularity can be as deep and lasting as that

inflicted on John Main’s authorities by the catastrophe of Black

Wednesday in September 1992.” in accordance

to the Guardian. Is he proper to be frightened? As I

pointed

out after Sunak’s Spring Assertion, for the common

employee many of the fall in actual wages after tax over the following two

years is all the way down to larger taxes. By subsequent monetary yr in comparison with

final yr, the

common pre-tax wage is predicted to fall by 1%, however by 3% after tax

as Sunak’s tax rises take maintain.

The

motive is partly larger nationwide insurance coverage contributions, but additionally

Sunak’s determination final Autumn to freeze revenue tax allowances over a

variety of years, which at a time of excessive inflation brings in lots of

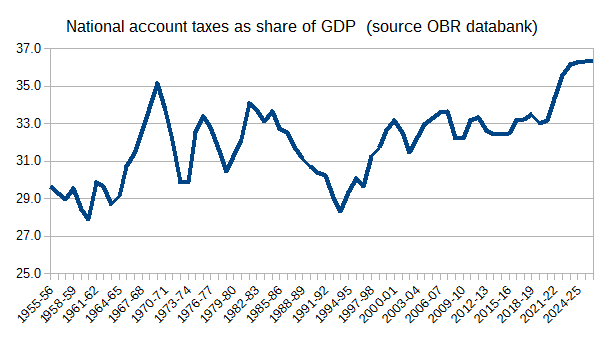

cash as a result of it takes a lot of cash off taxpayers. We will see the

impression that each of those tax will increase have on the federal government’s

total tax take by wanting on the OBR’s sequence for nationwide

account taxes.

As

many have identified, the share of complete taxes in GDP is now

anticipated to be larger than

at any time since WWII.

It

was partly Conservative MPs’ unhappiness with this prospect that

led Sunak to deal with tax slicing in his Spring Assertion quite than

serving to the poor deal with rising costs. Sadly, due to these numbers from the OBR, slicing taxes a bit after you

had raised them rather a lot simply six months earlier

didn’t actually reduce it with public opinion. Partly because of this, Sunak

is reported

to be livid

with the OBR, making the OBR yet one more a part of the UK’s pluralist

democracy (after the courts and the civil service) that Tory

ministers are livid with. (In Hungary, whose authorities is so

admired by some on the correct, the unbiased fiscal establishment was

the primary to go.)

Sunak’s

political failure of some weeks in the past is not going to cease him making an attempt the

identical trick once more, shortly earlier than the following basic election. He has

already pledged to chop the essential charge of revenue tax by 1 share

cent level, and if issues go to plan he has scope to do greater than

that but nonetheless declare debt as a share of GDP is falling. Nevertheless,

until he’s very fortunate, the share of taxes in GDP will stay larger

than it has ever been.

So

how did Sunak discover himself elevating taxes as Chancellor for a

political social gathering that likes to see itself because the tax slicing social gathering? As

I’ve argued on various events, it isn’t as a result of both the

Chancellor or Prime Minister is extra left wing than earlier

Conservative holders of that workplace. As a substitute it’s the results of two

elements: well being spending and austerity.

The

actuality that’s outlined in all of the OBR’s long run fiscal

projections is that, because the UK inhabitants grows older and for different

causes, the share of spending in GDP on well being and social care is

sure to rise over time, simply because it has since WWII (see the third

chart right here,

for instance). As well being

care is

supplied by the state within the UK, that implies that taxes should rise (or

borrowing should enhance by an increasing number of annually).

That

is why there’s an underlying upward pattern within the share of taxes in

nationwide revenue, which is evident from the Chart above. The one

sustained exception to this inevitability of upper taxes was over

the Thatcher interval, however that was each short-lived (reversed whereas

the Conservatives had been nonetheless in energy) and the results of two one-off

elements: North Sea Oil (see right here)

and privatisation. After all good macroeconomics implies that neither

ought to have been used to chop taxes, however that’s one other subject.

This

upward pattern in taxes can be much more evident if it wasn’t for

two different issues: falling defence spending after the tip of the chilly

struggle (the ‘peace dividend’) and 2010 austerity. The previous is over

(and there’s no apparent candidate to take its place), and the latter

can’t be repeated as a result of most areas of public spending have been

reduce to ranges that danger political prices for these in energy. This

contains the NHS, the place ready lists are now

longer

than at another time.

On

NHS spending the Chancellor specifically, and this authorities extra

usually, have made two large errors which can imply the additional

spending they’ve supplied for the NHS and social care will do

little to enhance well being companies. The primary mistake was to declare

the pandemic over earlier than

it was,

which intensified the stress of Covid on the NHS and is prone to

imply ready lists will proceed to rise for a while. The second

was to not deal with any ‘catching up’ from operations delayed by the

pandemic as a price to be paid for by larger borrowing (just like the

furlough scheme) quite than by larger taxes. Sunak was too fast to

try to display his deficit slicing prowess, quite than

accepting that the pandemic would have fiscal prices even after it had

really ended.

One other

potential mistake could also be to permit larger inflation to boost taxes,

however to go away quick time period nominal spending plans unchanged. The

speedy issue it will trigger is to squeeze even additional

(relative to the personal sector) public sector pay. Public sector

staff will after all try to keep away from this squeeze, and it’s unclear

whether or not any disruption that follows might be extra politically pricey

to the federal government or opposition. The long run issue is that this represents an extra squeeze to actual ranges of public spending, which austerity had already reduce to the bone.

As

2010-17 austerity has squeezed the general public sector so far as politics

will permit, and stress from an ageing inhabitants implies that public

spending is sure to rise over time, that implies that any Chancellor,

of no matter color, is prone to have to boost taxes as a share of

GDP over their interval of workplace, until that interval may be very quick. A

Conservative Chancellor might elevate taxes and public spending by much less

than a Labour Chancellor, however ‘elevating taxes by much less’ doesn’t

have the identical electoral attraction as ‘tax slicing’ for Conservative

MPs.

Is

there any means out of this arithmetic for Conservative MPs? Ending the

NHS, and changing it by some type of insurance coverage scheme, is an

different that has attracted some ministers prior to now, however it

faces a political impediment that might be very exhausting to keep away from. Beside

the goodwill most voters have for the NHS, any insurance coverage scheme will

be notably costly for older voters, who after all are inclined to

vote closely Conservative.

Privatisation,

which is ongoing, just isn’t instantly pricey in political phrases

(as a result of it’s hidden from most voters), however it’s prone to make the

NHS extra quite than cheaper and due to this fact will enhance the

stress to boost taxation. It’s because the NHS, despite the fact that it

is closely under-resourced, is fairly environment friendly. Thus if it stays

free on the level of use, provision in personal palms will find yourself

being extra pricey for the federal government to pay for, as a result of personal

provision, even whether it is equally environment friendly, must divert some

revenue to shareholders. So NHS privatisation, whereas it could be pursued

for different causes, doesn’t get the Conservatives out of their want

to boost taxes.

So

Conservative MPs who assume their social gathering can as soon as once more change into one which

reduces the general tax burden live a fantasy. After all the

social gathering and its Chancellor can, and can, elevate taxes to chop them by

much less later and hope some individuals don’t discover the trick being performed.

As well as the social gathering and its Chancellor can, and can, elevate some

taxes in order that others will be reduce and hope some individuals don’t discover

the trick being performed. However the want to be a tax slicing social gathering will

imply that the majority public companies together with the NHS will, beneath a

Conservative authorities, be completely and chronically underfunded

as a result of the social gathering, and its Chancellor, nonetheless has the dream of slicing

taxes.