That is going to be brief weblog in reply to a reader’s query.

It’s a query I get requested considerably typically.

Sharing the reply as a weblog might be a good suggestion as it could give me a weblog to level to in future.

So, the reader desires to know why Prime Up my Medisave Account (MA) when the cash can’t be withdrawn?

The reader might be referring to the Primary Healthcare Sum (BHS) which must be maintained within the MA as soon as we flip 65.

In any other case, in fact, the BHS could be drawn upon for particular functions.

For me, the target of the MA is to have funds for medical bills in case of arduous instances.

To be trustworthy, I hope I do not ever need to do a withdrawal.

If I have to draw upon the cash in my MA, it signifies that I’m very sick and experiencing monetary hardship.

Anyway, the subsequent factor I’m going to say is one thing I’ve blogged about earlier than.

Having a maxed out MA additionally signifies that I get free medical insurance coverage.

Need to know the way?

See:

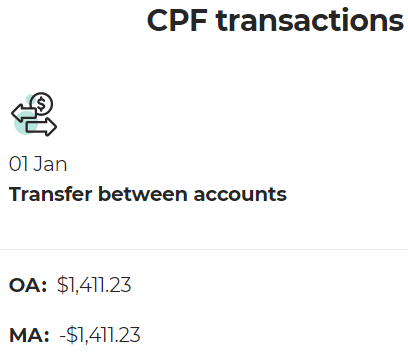

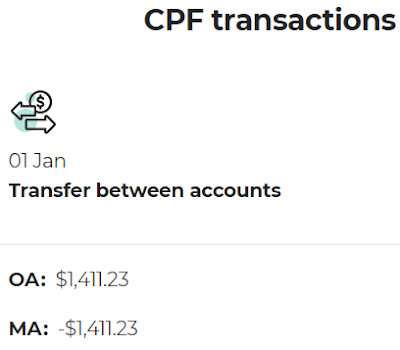

Because the reader’s focus appears to be on CPF funds withdrawal at age 55, it ought to be fascinating to notice that any extra curiosity revenue generated by our MA will move into our Particular Account (SA) or into our Strange Account (OA) if our SA has hit the Full Retirement Sum (FRS.)

For me, it flows into my OA.

See:

Because the MA has the identical rate of interest of 4% because the SA, this mechanism makes it enticing as an extra revenue generator since cash within the OA and SA could be withdrawn as soon as now we have put aside the FRS in our Retirement Account (RA) at age 55.

Some readers may additionally have an interest on this weblog:

If we are able to afford to take action, I imagine that maxing out our MA is a good suggestion.

Max it out and let compound curiosity do its magic.

As ordinary, that is simply me speaking to myself, in fact.

Just lately printed: