Rates of interest have elevated twice within the UK and the Fed has signaled will increase to come back. To some the explanation for this might sound apparent. Inflation is 7% within the US and anticipated to be over

7% within the UK by April. Certainly the job of rate of interest setting central banks is to make use of greater charges to regulate inflation? Whereas it’s not

so simple as this, the truth that some folks suppose it’s can weigh

closely on financial coverage resolution makers.

In actuality that’s

not the central financial institution’s job for 2 causes. First, generally the

economic system is hit by short-term shocks, like greater vitality costs, which

will solely increase inflation for a yr or two. Second, it takes time (2

years?) for the total results of upper rates of interest to impression

inflation, and it really works primarily by miserable output. Put the 2

collectively, and elevating charges following short-term shocks would do

little to scale back the dimensions of these shocks, and as a substitute would cut back

inflation simply because it was coming down anyway. Extra importantly, it

would result in pointless instability in output, incomes and

unemployment.

Crudely, this was

the view of central banks in 2021 as inflation started to rise. So what

has modified in 2022 within the US and UK? The reply, for these within the

US, was not fiscal stimulus, as a result of the bounce in inflation has been

fairly related in character throughout the G7 [1]. As a substitute, I imagine, it

is earnings development within the context of a good labour market produced

by the restoration from the pandemic that’s worrying central bankers.

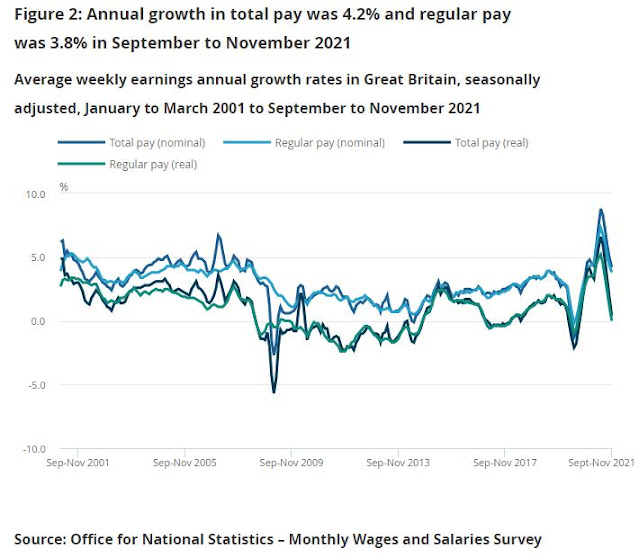

Listed below are two charts, for the US and UK. Supply US,

UK.

How ought to we

interpret these charts? If we’re fascinated with how home

inflation is more likely to develop, actual wages (the spending

energy of wages) as proven within the UK chart is the improper measure.

As a substitute we should always have a look at nominal wage development, subtract possible

underlying productiveness development (as a result of wages ought to get the profit

of productiveness development), and see if that’s above or under the

inflation goal of two%.

Sadly what

underlying productiveness development will probably be after the pandemic is just not

recognized for sure. However within the UK the Financial institution of England is anticipating

productiveness development of about 1% a yr. Meaning wage inflation of

3% a yr is just not inflationary, however pay will increase on the finish of final

yr had been considerably greater than this, and the Financial institution’s brokers

recommend companies are planning wage will increase within the 4+% vary. That

could be inconsistent with the Financial institution’s inflation goal of two%. US

forecast productiveness could also be barely greater than 1%, however very current

numbers for each the Atlanta Fed’s tracker above and the EPI

wage tracker recommend wage will increase are working at an

inflation goal busting degree.

This was why the

Governor of the Financial institution of England took the weird step final week (as

the MPC raised charges to 0.5%) of interesting for wage restraint (extra

under). The background behind greater wage will increase is a good labour

market as output finishes its restoration from the pandemic. The explanation

for the tight labour market within the UK is just not buoyant demand (the UK

has solely simply reached pre-pandemic exercise ranges) however a withdrawal

of numerous employees from the labour market in comparison with

pre-pandemic ranges. Demand is greater within the US, however the identical

phenomenon is occurring there. There are theories why that is

occurring, however little sturdy proof.

The tight labour

market is why this episode is so totally different from 2011, when the ECB

raised charges following greater commodity costs however the Fed and BoE

didn’t (simply). Then there was widespread unemployment, so no threat

that wage inflation would rise. In that episode the ECB ended up

trying very silly. Right this moment is extra just like the interval between 2004-7,

when oil costs rose slowly however considerably, and UK and US curiosity

charges rose considerably.

However, however, however, you

would possibly say, the buying energy of wages are falling quite a bit! Certainly it’s cheap for

employees to have greater wage will increase in these circumstances?

Sadly, to the extent that the upper gas and meals costs are

completely greater, you need to first reply this query: who

finally pays for greater meals and vitality costs? Replying “somebody

else” is just not a very good reply, as a result of it results in precisely what these

central banks need to keep away from, which is a wage worth spiral as employees

and companies attempt to cross on these greater prices to one another.

Whereas the financial

logic of that is sound, the politics will not be, which is why the

Governor’s remarks on wage settlements had been badly judged. Telling

folks their dwelling requirements should fall by much more due to

greater vitality costs and ignoring what is occurring to, for instance,

the income of vitality firms is simply asking for bother. The

governor of the Financial institution of England ought to seem even handed on such

delicate points, and never single out wages for particular pleading.

There are two main explanation why elevating charges quickly is likely to be a significant mistake, notably within the UK the place the

restoration within the economic system because the pandemic is far weaker than the

US. The primary threat is that the current enhance in earnings seems

to be short-lived of its personal accord. The annualised three month wage

inflation

knowledge (HT @BruceReuters) for the UK offers a touch of

that. The Financial institution is inserting plenty of weight on their agent surveys.

Wage inflation might tail off as a result of those that have withdrawn from

the labour market might be enticed again in by the upper wages we

have already seen. As well as, if the Omicron wave dies down (as

appears possible as we transfer away from winter) will companies be capable to

utilise their present workforce extra successfully, negating the necessity

for greater wages to draw employees?

The second threat is the impression on the economic system. Once more the UK is especially susceptible, as no

fiscal main stimulus has or will happen through the pandemic restoration

interval. There are already loads of forces dragging demand down, You possibly can see the issue for the UK within the Financial institution’s personal

forecasts. In its central forecast, with charges

persevering with to rise and vitality costs staying excessive, the Financial institution expects

inflation to overshoot its goal, falling to 1.5% in 2025Q1 (the top of their printed

forecast), with rising unemployment and demand lower than provide. In

distinction with charges staying at 0.5%, inflation comes down to focus on

in 2025Q1. So why go additional than 0.5%, as some MPC members needed

final week? As well as, if vitality costs begin falling because the market

expects, inflation will probably be decrease sooner.

To chop an extended story

quick, if charges proceed to rise we might discover the Financial institution in a yr or

two’s time slicing charges as shortly as they’re anticipated to lift

charges this yr, within the context of a really gloomy outlook for the UK

economic system. Exercise is extra bouyant within the US, however related dangers apply there, with the extra political prices of bringing an anti-democratic political occasion into energy. Worse nonetheless, if central banks are sluggish to scale back charges, within the context of

an enormous hit to private incomes, we might be speaking a couple of new

recession that UK and/or US central banks have contributed to.

So what would possibly at first look like an inevitable rise in rates of interest following a big inflationary shock, in truth represents a giant gamble by central banks that might backfire badly.

[1] As I’ve

prompt earlier than,

that fiscal stimulus might have raised US inflation earlier and

barely greater than elsewhere, however as it’s more likely to be short-term if

the pandemic unwinds, it appears a worth nicely value paying for a

restoration that’s as much as 4% of GDP stronger within the US.