The pandemic forbearance for federal pupil loans was lately prolonged for a sixth time—marking a historic thirty-month pause on federal pupil mortgage funds. The first publish on this collection makes use of survey knowledge to assist us perceive which debtors are prone to wrestle when the pandemic forbearance ends. The outcomes from this survey and the expertise of some federal debtors who didn’t obtain forbearance throughout the pandemic recommend that delinquencies may surpass pre-pandemic ranges after forbearance ends. These considerations have revived debates over the potential of blanket forgiveness of federal pupil loans. Requires pupil mortgage forgiveness entered the mainstream throughout the 2020 election with most proposals centering round blanket federal pupil mortgage forgiveness (usually $10,000 or $50,000) or mortgage forgiveness with sure earnings limits for eligibility. A number of research (examples right here, right here, and right here) have tried to quantify the prices and distribution of advantages of a few of these insurance policies. Nevertheless, every of those research both depends on knowledge that don’t absolutely seize the inhabitants that owes pupil mortgage debt or doesn’t separate pupil loans owned by the federal authorities from these owned by industrial banks and are thus not eligible for forgiveness with most proposals. On this publish, we use consultant knowledge from anonymized credit score stories that permits us to determine federal loans, calculate the overall value of those proposals, discover essential heterogeneity in who owes federal pupil loans, and study who would doubtless profit from federal pupil mortgage forgiveness.

This evaluation presents a granular have a look at outcomes beneath varied coverage choices. We discover that smaller forgiveness insurance policies distribute a better share of profit to debtors with low- and mid-range credit score scores and residing in low- and middle-income neighborhoods. Rising the per-borrower most forgiveness shifts bigger shares of forgiven debt to greater credit score rating debtors and better earnings neighborhoods. In contrast, limiting forgiveness eligibility by earnings reduces the overall value of the coverage whereas distributing bigger shares of forgiveness to low- and middle-income neighborhoods, low- and mid-credit rating debtors, and majority minority neighborhoods.

Knowledge and Definitions

We use the New York Fed/Equifax Client Credit score Panel (CCP) which is a nationally consultant 5 p.c pattern of all U.S. adults with a credit score report. We straight observe a borrower’s age, credit score rating, and pupil mortgage steadiness, however we don’t observe a person’s earnings or demographic info. As a substitute, we use Census block group identifiers from the CCP to match a person to details about their neighborhood, resembling median family earnings and demographics, from the five-year American Group Survey 2014-2018. We determine pupil loans which are held by the federal authorities by deciding on loans that entered automated administrative forbearance firstly of the COVID-19 pandemic. These embrace Direct loans that have been disbursed by the federal authorities and loans initially disbursed by means of the Household Federal Training Mortgage (FFEL) Program however have been subsequently consolidated into the Direct program or bought to the federal authorities. These additionally embrace loans disbursed from both the Direct or FFEL program which are in default.

Prices of Forgiveness Insurance policies

We estimate the overall value of federal mortgage forgiveness insurance policies by calculating the greenback worth of the loans that will be forgiven beneath every coverage. We restrict the pattern of loans eligible for forgiveness to solely these owned by the federal authorities since this has been the main target of most cancellation proposals. The overall excellent steadiness for federally-owned (together with defaulted) pupil loans in December 2021 was $1.38 trillion. Limiting forgiveness to a most of $50,000 per borrower would value $904 billion and would forgive the complete steadiness for 29.9 million (79 p.c) of the 37.9 million federal debtors, leading to a mean forgiveness of $23,856 per borrower. This threshold would additionally forgive 77 p.c of all federal pupil loans that have been delinquent or in default previous to the pandemic. In the meantime, forgiveness of $10,000 per borrower would forgive a complete of $321 billion of federal pupil loans, remove your entire steadiness for 11.8 million debtors (31.1 p.c), and cancel 30.5 p.c of loans delinquent or in default previous to the pandemic forbearance. Underneath this coverage, the typical borrower would obtain $8,478 in pupil mortgage forgiveness.

Subsequent, we discover the affect of including earnings limits for figuring out eligibility for forgiveness. Since we don’t straight observe a borrower’s earnings, we simulate eligibility by sampling from the distribution of family earnings for every borrower’s Census block group and take the typical complete forgiveness over 100 simulations. Including a family earnings restrict of $75,000 reduces the overall value of a $50,000 forgiveness coverage from $904 billion to $507 billion, a discount of virtually 45 p.c. Equally, the identical earnings restrict reduces the price of a $10,000 forgiveness coverage from $321 billion to $182 billion.

One caveat is that the estimate for the price of potential pupil mortgage forgiveness insurance policies is probably going the higher sure. Particularly, among the balances forgiven beneath these hypothetical blanket insurance policies will ultimately be forgiven beneath the Public Service Mortgage Forgiveness (PSLF) program or by means of income-driven compensation plans. For these loans, the web value of blanket forgiveness now wouldn’t be the overall excellent quantity of every mortgage (as we calculate) however as an alternative can be the stream of month-to-month funds on these loans till they’re cancelled beneath present forgiveness insurance policies.

Who Advantages from Forgiveness?

BY AGE

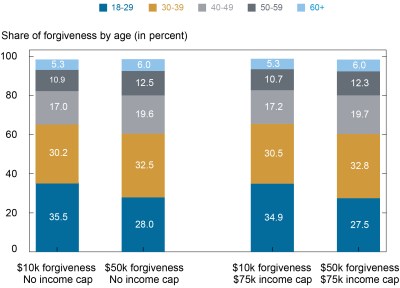

We start by finding out who holds federal pupil mortgage balances and who would obtain forgiveness by age beneath the varied insurance policies. Sixty-seven p.c of pupil mortgage debtors are beneath 40, nonetheless solely 57 p.c of balances are owed by these beneath 40, displaying that these with bigger balances usually tend to be older (doubtless as a consequence of borrowing for graduate faculty). Underneath every of the thought of insurance policies (forgiveness on the $10,000 or the $50,000 stage, with and with out earnings caps), over 60 p.c of forgiven mortgage {dollars} profit these beneath 40 years outdated. Whereas earnings caps don’t considerably change the share of forgiveness going to every age group, growing the forgiveness quantity from $10,000 to $50,000 shifts a bigger share of forgiven debt to older debtors. Nevertheless, these over 60 years outdated profit the least from forgiveness. Regardless of being 32 p.c of the U.S. grownup inhabitants, these 60 and older solely obtain round 6 p.c of forgiven {dollars}, roughly in keeping with the share of this age group that owes federal pupil loans.

Pupil Mortgage Forgiveness Predominately Advantages These Underneath 40

Observe: Whole shares for every coverage could not sum to one hundred pc as a consequence of rounding or lacking identifiers.

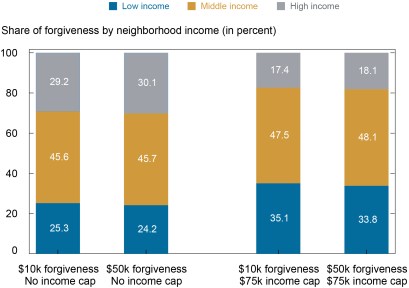

By Neighborhood Earnings

Subsequent, we research who advantages from pupil mortgage forgiveness by earnings. Since we don’t straight observe earnings for people within the knowledge, we assign people to an earnings class by the median earnings of their neighborhood by means of Census block group designations. We break up earnings into quartiles with the bottom quartile outlined as low-income (with a median annual earnings under $46,310), the center two quartiles as middle-income (between $46,310 and $78,303 per 12 months), and the very best quartile as high-income ($78,303 and above per 12 months). Debtors dwelling in high-income areas usually tend to owe federal pupil loans and maintain greater balances. Regardless of being 25 p.c of the inhabitants, debtors who dwell in high-income neighborhoods maintain 33 p.c of federal balances whereas debtors residing in low-income areas maintain solely 23 p.c of balances. Underneath each forgiveness ranges with out earnings caps, low-income neighborhoods obtain roughly 25 p.c of debt forgiveness whereas high-income neighborhoods obtain round 30 p.c of forgiveness. Rising the edge from $10,000 to $50,000 ends in a touch bigger share of forgiveness to high-income areas. The typical federal pupil mortgage borrower dwelling in a high-income neighborhood would obtain $25,054 whereas the typical borrower dwelling in a low-income neighborhood would obtain $22,512. In contrast, including a $75,000 earnings cap for forgiveness eligibility considerably shifts the share of advantages. The share of forgiven {dollars} going to high-income areas falls from round 30 p.c to round 18 p.c and the share of forgiven debt going to low-income areas will increase from round 25 p.c to round 34 p.c.

Rising Pupil Mortgage Forgiveness Distributes a Bigger Share of Advantages to Larger-Earnings Neighborhoods, however Earnings Caps Counterbalance this Pattern

Notes: We assign people to an earnings class by the median earnings of their neighborhood by means of Census block group designations. The low-income group represents these with a neighborhood earnings median under $46,310 per 12 months, the middle-income group between $46,310 and $78,303, and the high-income group $78,303 or extra. Whole shares for every coverage could not sum to one hundred pc as a consequence of rounding or lacking identifiers.

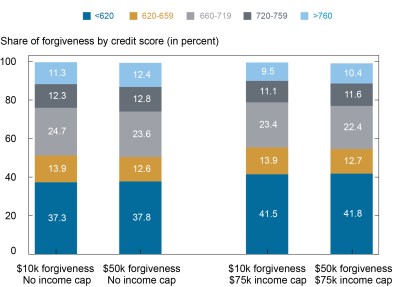

By Credit score Rating

We additionally observe the share of federal pupil mortgage forgiveness that will profit folks with totally different ranges of economic stability by categorizing them into credit score rating bins. Credit score scores function a proxy for each earnings and monetary stability so debtors with decrease credit score scores usually tend to wrestle with funds whereas debtors with greater scores usually tend to be of upper earnings and extra financially secure. We use credit score scores from February 2020 since beforehand delinquent federal pupil mortgage debtors skilled giant credit score rating will increase when their accounts have been marked present as a consequence of pandemic forbearance. In comparison with the inhabitants of U.S. adults with a credit score report, pupil mortgage debtors have considerably decrease credit score scores. Roughly 34 p.c of all credit score scores are better than 760, however solely 11 p.c of pupil mortgage debtors have these tremendous prime scores. When weighted by steadiness, pupil mortgage debtors have greater scores suggesting that these with excessive balances even have greater credit score scores. Underneath all 4 insurance policies, greater than half the share of forgiven debt would go to debtors with a credit score rating under 660. As with our evaluation by earnings, growing the edge from $10,000 to $50,000 will increase the share of forgiven balances going to these with credit score scores of 720 or greater, suggesting {that a} greater per borrower forgiveness quantity tends to profit debtors of upper socioeconomic standing extra. Nevertheless, earnings caps cut back the share of advantages going to these with tremendous prime scores and distributes a bigger share of forgiveness to these with decrease credit score scores.

Most Forgiven Debt Would Go to Pupil Mortgage Debtors with Decrease Credit score Scores

Observe: Whole shares for every coverage could not sum to one hundred pc as a consequence of rounding or lacking identifiers.

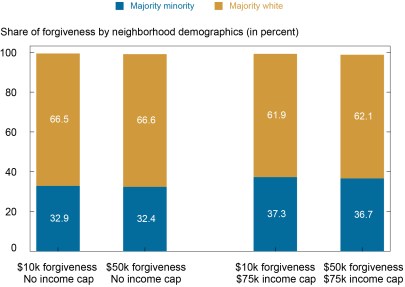

By Neighborhood Demographics

We subsequent study who advantages from forgiveness primarily based on demographic traits of a borrower’s neighborhood. We separate debtors into two classes: those that dwell in a Census block group with greater than 50 p.c of residents figuring out as white non-Hispanic (majority white) and those that dwell in a Census block group with at most 50 p.c white non-Hispanic residents (majority minority). These dwelling in majority white and majority minority neighborhoods are equally prone to owe pupil loans; roughly 67 p.c of the inhabitants and 67 p.c of federal pupil mortgage debtors reside in majority white neighborhoods and steadiness shares are break up roughly in the identical proportion. Underneath a $10,000 forgiveness coverage, 33 p.c of forgiveness would go to majority minority neighborhoods whereas 67 p.c would go to majority white neighborhoods. Additional growing forgiveness from $10,000 to $50,000 doesn’t considerably change these shares. Nevertheless, introducing an earnings cap of $75,000 for eligibility considerably will increase the share of forgiven loans going to majority minority neighborhoods—from roughly 33 p.c of forgiven debt to 37 p.c at each forgiveness ranges.

Earnings Caps Shift a Bigger Share of Forgiven Pupil Loans to Majority Minority Neighborhoods

Notes: We separate debtors into two classes: those that dwell in a Census block group with at most 50 p.c white non-Hispanic residents (majority minority) and those that dwell in a Census block group with greater than 50 p.c of residents figuring out as white non-Hispanic (majority white). Whole shares for every coverage could not sum to 100 p.c as a consequence of rounding or lacking identifiers.

Conclusion

On this publish, we study who advantages from varied federal pupil mortgage forgiveness proposals. On the whole, we discover that smaller pupil mortgage forgiveness insurance policies distribute a bigger share of advantages to decrease credit score rating debtors and to people who dwell in much less rich and majority minority neighborhoods (relative to the share of balances they maintain). Rising the forgiveness quantity will increase the share of complete forgiven debt for greater credit score rating debtors and people dwelling in richer neighborhoods with a majority of white residents.

We discover that including an earnings cap to forgiveness proposals considerably reduces the price of pupil mortgage forgiveness and will increase the share of profit going to debtors who usually tend to wrestle repaying their money owed. A $75,000 earnings cap drops the price of forgiveness by virtually 45 p.c for both a $10,000 or $50,000 coverage. Additional, it drastically modifications the distribution of advantages. Underneath a $10,000 coverage, an earnings cap raises the share of forgiven mortgage {dollars} going to debtors in low-income neighborhoods from 25 p.c to 35 p.c and the share going to decrease credit score rating debtors from 37 p.c to 42 p.c. Earnings caps additionally improve the share of loans forgiven that have been delinquent previous to the pandemic. Including an earnings cap to a $10,000 coverage will increase the share of forgiveness canceling loans that have been delinquent earlier than the pandemic from 34 p.c to 60 p.c. Underneath any coverage, means testing would extra straight goal forgiveness to debtors going through a better wrestle with compensation, which might lead to a considerably much less regressive coverage.

Jacob Goss is a senior analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Daniel Mangrum is an economist within the Financial institution’s Analysis and Statistics Group.

Joelle Scally is a senior knowledge strategist within the Financial institution’s Analysis and Statistics Group.

cite this publish:

Jacob Goss, Daniel Mangrum, and Joelle Scally, “Who Are the Federal Pupil Mortgage Debtors and Who Advantages from Forgiveness?,” Federal Reserve Financial institution of New York Liberty Avenue Economics, April 21, 2022, https://libertystreeteconomics.newyorkfed.org/who-are-the-federal-student-loan-borrowers-and-who-benefits-from-forgiveness/.

Disclaimer

The views expressed on this publish are these of the authors and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the authors.

Disclosure

An writer owes federal pupil loans that might be cancelled beneath a few of these insurance policies.