Passive investing is selecting up tempo in India. That is evident from the sharp leap within the variety of NFOs (New fund provide) within the passive area by mutual fund corporations.

In my put up on Learn how to Construct a Lengthy-Time period portfolio, the core fairness portfolio consisted on index funds and ETFs. And no portfolio is full with out together with the Nifty (Sensex) ETF or index fund. That is regardless of my findings within the put up on Learn how to assemble the perfect portfolio utilizing index funds and ETFs.

Assume you could have taken the leap of religion from actively managed funds to passive funds. You are actually searching for a Nifty 50 index fund to put money into. Which Nifty index fund/Nifty ETF to put money into? Which is the perfect Nifty index fund?

Chances are you’ll ask, aren’t all of the Nifty index funds the identical? Don’t all of them merely offer you Nifty returns?

Nicely, that’s the goal however there may be monitoring error.

Monitoring error = Index Returns – Index fund returns

(The right time period is Monitoring Distinction and never Monitoring Error. For extra on this, confer with this doc. Thanks for Swapnil Kendhe for pointing this out. Nevertheless, since most of us relate to monitoring error higher, I’ll confer with Monitoring Distinction as monitoring error on this put up.)

And the monitoring error can range throughout the varied Nifty index funds/ETFs.

Clearly, you’ll need to index decide funds with decrease monitoring error.

Why would the Index Funds have monitoring error?

This can be a legitimate query since a Nifty 50 index fund has the identical portfolio because the index.

Why can’t the Index funds monitor the indices completely?

Nicely, there are particular prices and sensible points that create this drag and eat into returns from index funds and ETFs.

- Expense ratio (the AMC received’t run the index fund free of charge)

- Securities transaction tax (STT) and brokerage: The fund should pay the brokerage on every purchase and promote transaction. Primarily based on the volumes, the AMC can nonetheless negotiate on the brokerage. No such aid with STT. STT (0.1%) is relevant on sale of shares. This creates drag on the time of rebalance. Nifty 50 TRI doesn’t pay any STT or brokerage.

- Slippage/Impression value: On the rebalance date, the benchmark index rebalances on the day finish value. Nevertheless, to impact this variation within the index fund, the fund supervisor should purchase and promote the shares on the markets. When purchase on the markets, there may be liquidity, affect value and many others. to deal with. Buy and sale might occur at completely different costs.

- Money inflows and outflows: Even aside from the rebalance, the fund supervisor should purchase shares to handle money inflows and promote shares to handle outflows. Brokerage, STT and slippage once more. And this can have an effect on smaller index funds extra.

- Money drag: The index fund might maintain a small share in money to handle money outflows. This will create distinction (each methods).

- Dividends: Dividend report date shall be completely different from the date of precise receipt of funds. TRI will contemplate dividends reinvested on the report date. The AMC might get dividends after just a few days. The distinction of timing in dividend reinvestment also can trigger a distinction (each methods).

Then we simply want to select the Index fund with the bottom expense ratio

A easy solution to choose Nifty index funds could possibly be to match the expense ratios and decide the one with the smallest expense ratio.

That is tremendous when you imagine

Nifty Index Fund return = Nifty Complete Returns index return – Fund expense ratio

Shut however not precisely true.

We’ve got seen the explanations above. The monitoring error comes not solely from the expense ratio and may be a lot greater than the expense ratio. There are different elements too. Low value (and slippage) commerce execution is essential in protecting the monitoring error (unexplained by expense ratios) low.

Don’t belief me? Let’s have a look at efficiency knowledge of assorted index funds.

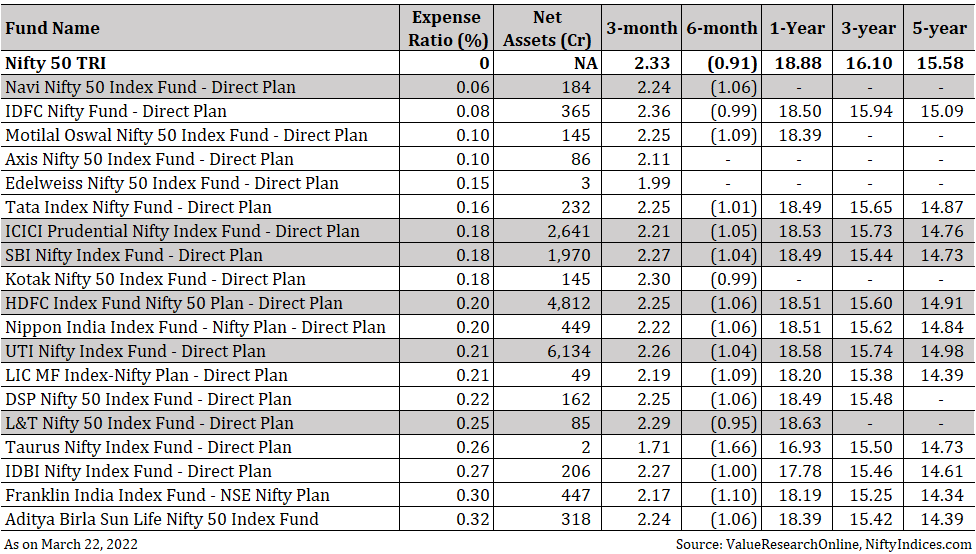

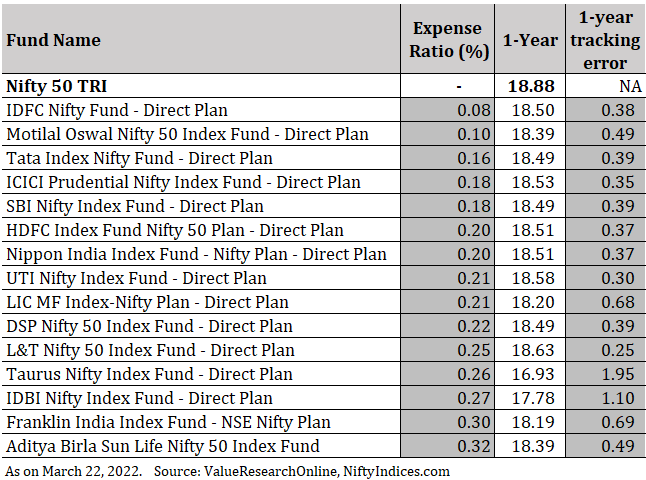

I’ve listed down all of the Nifty index funds and sorted in ascending order based mostly on expense ratios. You’ll be able to see that the monitoring error is way greater than the expense ratio. Or the expense ratio doesn’t clarify your complete monitoring error.

You’ll be able to see that Navi Nifty 50 index fund has the bottom expense ratio. A brand new fund. Nevertheless, in its restricted historical past, there are different costly funds which have been capable of monitor the Nifty 50 index higher.

Be aware: The expense ratios of the index funds maintain altering. That is utterly on the AMC’s discretion. Good half is that the competitors is not going to allow them to improve the expense ratios an excessive amount of. Moreover, I’ve picked up solely direct plans. Efficiency of standard plans of Nifty index funds shall be a lot inferior.

What about Nifty ETFs?

Consider ETFs as index funds that commerce on the inventory exchanges. Many deserves and some demerits.

ETFs are superior merchandise than index funds offered there may be satisfactory liquidity within the counter and you’ll navigate the Worth-NAV distinction.

Why?

ETFs often have decrease expense ratios than index funds. The fund home needn’t fear about money inflows and outflows. This reduces drag on the portfolio. For extra on distinction between index funds and ETFs, confer with this put up.

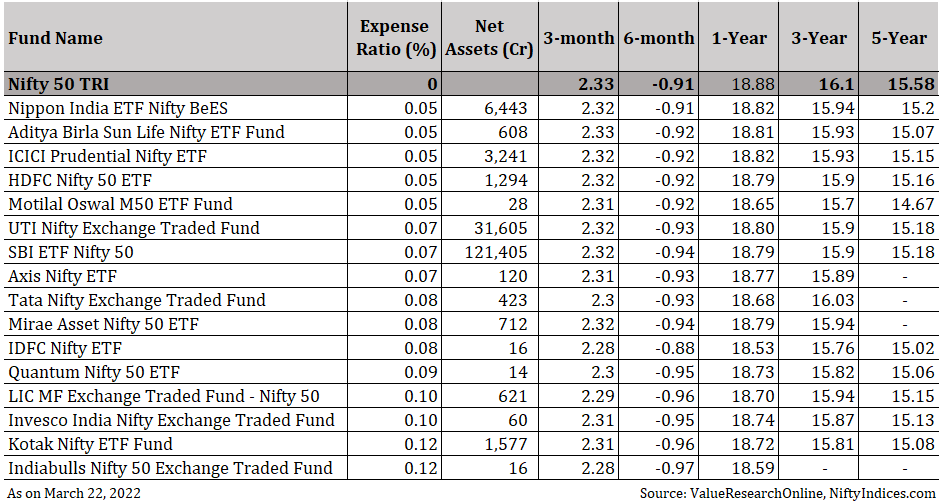

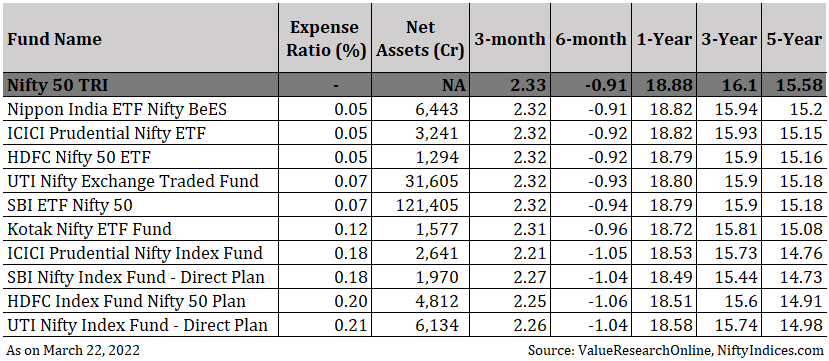

For those who examine the efficiency of Nifty ETF with Nifty index funds, virtually all of the Nifty 50 ETFs have crushed even the perfect Nifty index fund on each timeframe.

The monitoring error of the Nifty ETFs is way decrease than the Nifty index funds.

Within the desk under, I’ve listed all of the Nifty ETFs and Nifty index funds whose AUM is larger than Rs 1,000 crores. You’ll be able to see the ETFs constantly beat the index funds.

Shouldn’t you be investing in Nifty ETFs as a substitute of Nifty index funds?

Proper however there are just a few caveats.

- It’s worthwhile to demat account to purchase ETFs. No such requirement for investing in index funds. Therefore, for many people, index funds are straightforward to speculate and do SIPs in.

- The Nifty ETF efficiency proven above relies on day-end NAV. NAV is the full worth of the portfolio divided by the variety of models.

- Nevertheless, you don’t purchase ETF at their NAV. You purchase and promote on the inventory exchanges identical to you purchase shares. And buying and selling value may be completely different from the underlying NAV. As a purchaser, you wouldn’t need to buy at a value greater than the NAV. As a vendor, you wouldn’t need to promote a value a lot decrease than the NAV.

- Sadly, the distinction between Worth and NAV is sort of excessive for a lot of ETFs (there are lots of ETFs monitoring different indices too). Luckily, for just a few Nifty 50 ETFs, the distinction is manageable.

- You should pay brokerage if you purchase ETFs. No such value whereas shopping for index funds. Plus, you will have to pay greater than the NAV (to purchase).

- Alternatively, in ETFs, you incur this value simply as soon as. In index funds, you’re feeling drag till you’re invested.

Which is the Finest Nifty Index Fund?

I want Nifty index funds with low expense ratio and not-too-small measurement.

Among the many bigger Nifty index funds, UTI Nifty Index Fund stands out.

Additionally notice, there may be not a lot distinction. Don’t spend an excessive amount of time on selecting the perfect Nifty index fund. For those who examine the 1-year return as on March 22, there are 8 funds between 18.49% and 18.58%. So, in case you are investing in HDFC Nifty Index fund as a substitute of UTI Nifty Index, that’s alright. The expense ratios and monitoring error can change.

Regulate Navi Nifty 50 index fund too. It’s the lowest value index fund (expense ratio of 6 bps in comparison with 20 bps in UTI Nifty Index Fund). Would anticipate this to ultimately begin exhibiting up because the fund matures. A little bit of underperformance within the fund could also be due to small measurement, the place money inflows and outflows can create drag.

In case you are searching for a Nifty ETF, my vote goes to Nippon India ETF Nifty Bees .

Be aware: I might have in contrast 1-year rolling returns on Nifty 50 index funds/ETFs to get a extra correct image. Nevertheless, since these are index funds, I’ve simply gone forward with lookback knowledge as on March 22, 2022.

Further Learn/Supply/Credit score

CapitalMind: Which is the perfect Nifty index fund?