So we’ve reached Chapter 10 of our credit score collection, and at this level it’s best to have a stable understanding of the fundamentals of credit score, like methods to examine your credit score rating, why credit score scores are vital, what your starting credit score rating is, the elements that have an effect on your credit score rating, and extra.

However chances are you’ll be questioning, how do I repair an error on my credit score report?

It’s not unusual to search out credit score report errors on occasion, but it surely’s crucial what to do about them. One of many rights afforded to us below the Honest Credit score Reporting Act is the power to problem data on our credit score stories with which we don’t agree.

There are a number of methods to dispute credit score errors. The credit score dispute course of is free and usually takes lower than a month. There’s some confusion, nonetheless, in regards to the impression a credit score dispute can have in your credit score scores. On this publish, we’ll cowl what occurs while you dispute an error on a credit score report, how a credit score dispute impacts your credit score rating, what’s disputable, and the way you are able to do so.

Forms of Credit score Report Errors to Search for

There are a few various kinds of credit score report errors that it’s best to preserve an eye fixed out for. With the ability to establish these errors is vital so as to dispute them as shortly as potential.

A few of the various kinds of credit score report errors to search for embrace:

- Identification errors: This contains data like a improper identify or cellphone quantity, or if there’s an account listed or another person with an analogous identify.

- Incorrect reporting of account standing: This contains issues like a closed account in your credit score report being listed as open, an incorrect date for final fee, and accounts which can be incorrectly reported as late.

- Knowledge administration errors: This contains errors like incorrect data being reinserted even after it was corrected and accounts that seem a number of occasions with completely different collectors listed.

- Stability errors: This contains accounts with an incorrect present steadiness and accounts with an incorrect credit score restrict.

When Can I Dispute an Error on My Credit score Report?

While you file a dispute with the credit score reporting businesses, they’re required by the Honest Credit score Reporting Act to indicate that the merchandise is “in dispute.” They accomplish this by putting the code “XB” on the offensive credit score entry.

The XB code is what’s referred to in my world as a “Compliance Situation Code.” When it’s positioned in your credit score report, it reads as “Shopper disputes, investigation in course of” or some spinoff of that wording.

Basically, it signifies that the credit score bureaus acquired your dispute and are actively investigating the knowledge.

The Impression of “XB”

When the XB code is current on an account, a public report, or a set, credit score scoring programs deal with it in another way than they’d if the account was not actively in dispute.

That is the place the confusion comes from. The FICO rating will not enable an merchandise that’s actively being disputed to hurt your rating. How does it accomplish this?

FICO is not going to think about an merchandise with the XB code current for both its Fee Historical past or Debt associated measurements. So, you probably have a bank card account with late funds and also you’re disputing these late funds, the FICO rating will select to not think about these late funds. And, you probably have a bank card account with a big steadiness and also you’re disputing the steadiness, the FICO rating is not going to think about the steadiness.

So, does disputing a credit score report damage your rating? No. The act of disputing gadgets in your credit score report doesn’t damage your rating. Nevertheless, the result of the dispute may trigger your rating to regulate. If the “unfavourable” merchandise is verified to be right, for instance, your rating would possibly take a dip.

Observe: this dip just isn’t as a result of the dispute was confirmed inaccurate, however as a result of the XB code is taken off. Alternatively, if the disputed merchandise is confirmed to be inaccurate, this might increase your credit score rating.

The truth that the FICO rating is briefly ignoring these things could cause your scores to be greater. Having stated that, the rating enchancment is momentary and may’t be used to “recreation” the system.

In case your rating does take a dip as a consequence of a dispute, it’s not the top of the world. There are numerous methods you’ll be able to increase your credit score rating quick and get again to the good credit score rating you had earlier than. The impression of a spotty credit rating may be lengthy lasting when you don’t do something about it, so act as quickly as your credit score rating drops.

There are a few issues that you are able to do to achieve your highest potential credit score rating and construct your credit score up over time, like by all the time paying your assertion steadiness on time. So long as you observe the following pointers, it’s best to be capable of obtain an above common credit score rating.

You could be questioning about issues that may negatively impression your credit score rating, like unemployment or a partner with spotty credit. Occurring unemployment is not going to impression your credit score rating, however having a partner with spotty credit usually will. Simply one thing to concentrate on!

What occurs if the disputed merchandise is discovered to be correct?

If the merchandise has been verified as correct, then the credit score bureaus are now not investigating it. Meaning the credit score bureaus will take away the “in dispute” label by eradicating the XB code.

As soon as the XB code is gone, then the merchandise is honest recreation within the eyes of FICO as a result of it has been verified and is, arguably, correct.

This course of isn’t information, and lenders additionally learn about it, which is why you’ll be able to’t simply go and dispute all the things that’s dangerous in your credit score stories, have your FICO scores shoot by way of the roof, after which go apply for a mortgage.

Most lenders, particularly mortgage lenders, require that each one gadgets DO NOT have the “in dispute” label earlier than they course of an software for closing. They understand the rating that has been calculated is possible not the patron’s most correct rating as a result of the mannequin is ignoring sure elements of the credit score report.

And FICO isn’t the one scoring system that has this specialised therapy of things which can be presently being investigated. You may have a number of credit score scores as a consequence of completely different credit score fashions, so when you examine your credit score rating utilizing the VantageScore mannequin, chances are you’ll run into an analogous scenario.

Though there are completely different credit score rating fashions, all of them use a reasonably related credit score rating vary, so your credit score rating shall be across the similar quantity whatever the mannequin you employ.

What if the merchandise continues to be being disputed?

If you weren’t profitable in getting the offensive credit score entry eliminated or modified, then you’ll be able to nonetheless have it proven as being “in dispute” for so long as it stays in your credit score stories. However, that’s not the identical as an merchandise that’s in dispute AND being investigated.

That’s to say, lenders will nonetheless possible think about the merchandise when evaluating your credit score rating because the XB code has been eliminated.

For those who nonetheless disagree with an merchandise you’ll be able to have a label added to your credit score stories displaying as a lot. However, that’s not going to trigger the rating to mirror that label for Fee Historical past and Debt measurements.

How one can Dispute a Cost on Your Credit score Report

If, after reviewing what occurs while you dispute a credit score report, you resolve it may very well be the best plan of action for you, right here’s how one can get the ball rolling.

Step One: Get hold of a latest copy of your credit score report

In an effort to dispute an merchandise in your credit score report, you’ll must show to the powers that be that your credit score report is inaccurate. To take action, you’ll wish to have a replica of your credit score report helpful. Shoppers are entitled to at least one free credit score report annually from every of the three essential credit score reporting businesses. For those who’re a Mint consumer, you’ll be able to simply view your credit score rating within the Mint app everytime you please!

When you’ve obtained your credit score report in entrance of you, pull out that purple pen of yours and notate any gadgets on the report which can be inaccurate or with which you don’t agree.

Step Two: Decide whether or not it’s best to or shouldn’t dispute

After you’ve reviewed a latest credit score report, think about the next causes to dispute gadgets on credit score report that will help you resolve if it’s price a shot:

- There’s incorrect private data in your credit score report, resembling your identify or Social Safety Quantity

- There’s a unfavourable merchandise that’s past the statute of limitations for reporting

- The report reveals that you just carry a debt steadiness which you’ve already settled

- There’s duplicate data proven in your credit score report

- You could have a duplicate credit score report or combined data for your self and one other individual

- There are fraudulent gadgets in your report, like a brand new bank card or mortgage that you just didn’t open or apply for

Step Three: Determine which credit score dispute technique to make use of

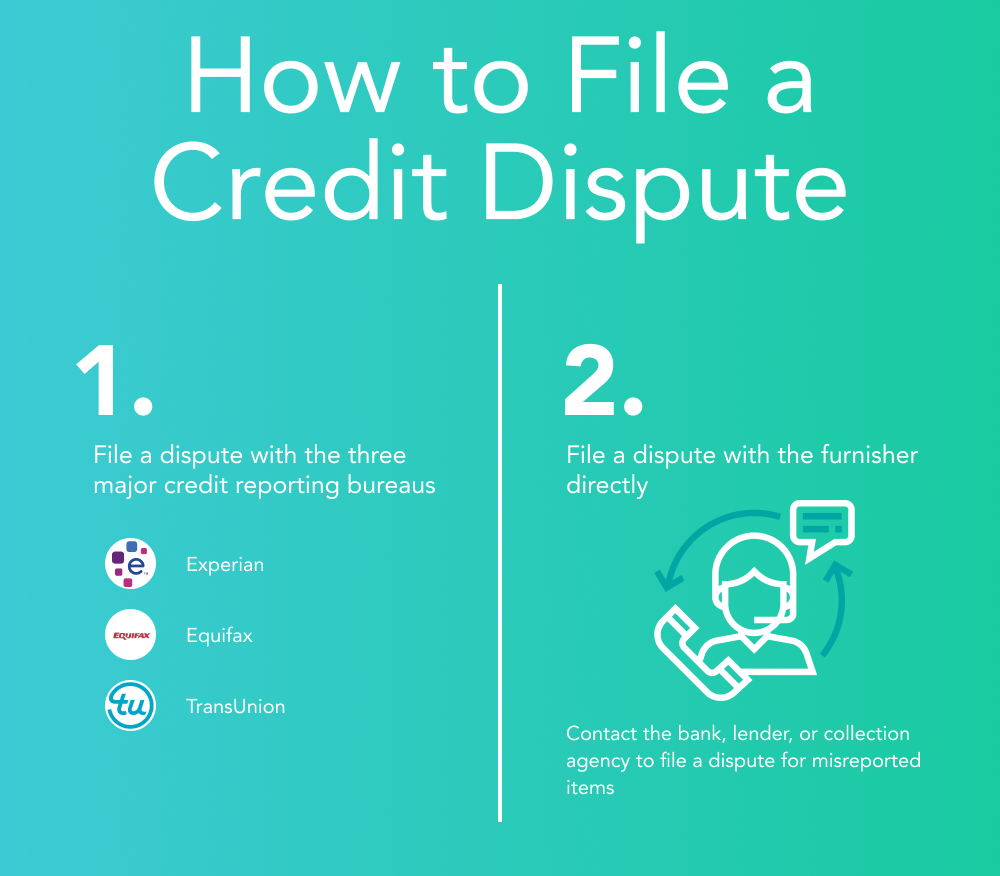

File a report with the credit score bureau: That is the most typical technique customers use to dispute credit score stories. Every of the credit score reporting bureaus—Experian, Equifax, and TransUnion—have dispute kinds on their web site which you’ll be able to fill out.

Right here’s the place you will discover them:

If the error seems throughout every of the credit score bureaus’ stories, you’ll must file a separate report for every. Every of the credit score dispute processes differ barely, however normally, you’ll want to incorporate the dispute kind with an evidence of the error(s) in addition to a replica of your report with the identical error(s) notated.

Report the error to the furnisher: One other technique you should use to dispute a debt in your credit score report is to go on to the supply—the lender, financial institution, bank card firm, or assortment company that misreported data. While you dispute the merchandise, the furnisher will then be required to report the dispute to every of the credit score bureaus, making your job a bit simpler.

Step 4: Monitor your credit score report back to see if the dispute was permitted

When you dispute an error in your credit score report, it’s essential proceed to observe your credit score report to verify the dispute was permitted. It could possibly take a while for updates to look, so be affected person.

If it takes longer than a few months for the replace to look, you’ll wish to contact the credit score bureau and the furnisher to verify your data is being reported to the bureaus.

How Lengthy Does It Take to Dispute an Error on Your Credit score Report

A client company is required to inform you of the outcomes of a dispute inside 5 days of finishing the investigation. They usually have 30 days to research the dispute as soon as they obtain it, so it should take a bit over a month to dispute an error on a credit score report.

Takeaways

To wrap up, let’s evaluate just a few of the important thing takeaways we lined:

- Does disputing a credit score report damage your credit score rating? No, credit score disputes don’t damage your credit score rating.

- When an merchandise in your report is being investigated, the credit score bureaus will notate this in your credit score report utilizing “XB” code which indicators to lenders that the merchandise is below evaluate and shouldn’t be thought of of their analysis.

- Relying on the result of your dispute, your credit score rating could also be adjusted to mirror the up to date data. If a unfavourable merchandise is eliminated, the dispute may enhance your credit score rating.

- To dispute an merchandise in your credit score report, observe these steps:

- Get a replica of your credit score report

- Determine whether or not or not it’s best to dispute the merchandise

- File a dispute with the furnisher or the three main credit score bureaus with a dispute kind and a replica of your credit score report

For extra data on credit score disputes, try this weblog to be taught methods to win a credit score dispute.

Protecting Credit score Report Errors in Verify is Extremely Helpful

It’s crucial that you know the way to dispute an error in your credit score report so as to repair an error earlier than it has an opportunity to impression your credit score rating. Eradicating a unfavourable merchandise out of your credit score report can considerably enhance your credit score rating, which might result in higher monetary alternatives.

Now that you just efficiently know methods to dispute credit score report errors, be taught methods to get your free credit score rating with Mint so you can begin utilizing it to control your credit score well being.

Sources: Shopper Monetary Safety Bureau 1, 2 | Federal Commerce Fee

Associated