Fast: Off the highest of your head, how a lot cash is your corporation bringing in? How a lot are you spending? In some unspecified time in the future, buyers, lenders, and (cough) you’ll need to know. However don’t panic when somebody asks about your organization’s income and bills. Simply whip out your revenue assertion. What’s an revenue assertion, you ask?

Your corporation’s revenue assertion is vital to realizing your monetary well being, getting investments or loans, and a lot extra. On this article, we’ll go over:

- What’s an revenue assertion?

- Components of the revenue assertion

- Methods to put together an revenue assertion

- Earnings assertion instance

What’s an revenue assertion?

An revenue assertion is a report of your corporation’s income and losses over a selected interval. Additionally it is referred to as a revenue and loss assertion (P&L). You need to use the revenue assertion to summarize month-to-month, quarterly, or annual operations.

The aim of revenue statements is to indicate the profitability of your corporation. That method, you may keep away from spending greater than you may afford. Use the P&L to see whether or not you will have a internet revenue (yay!) or loss (boo) for the time interval on the final line of your revenue assertion. This is called your organization’s backside line.

The revenue assertion isn’t the only real report you need to use to get monetary perception into your corporation. There are three major monetary statements:

- Earnings assertion

- Stability sheet

- Money stream assertion

The steadiness sheet studies on your corporation’s property, liabilities, and fairness. The money stream assertion studies your organization’s incoming and outgoing cash to indicate you ways a lot money you will have available. Not like the steadiness sheet and money stream assertion, the revenue assertion reveals you whether or not your corporation has a internet revenue or loss throughout a interval.

Methods to use an revenue assertion in enterprise

So, what are revenue statements used for? Why’s it such an enormous deal to make revenue statements in your corporation?

You need to use a P&L to:

- Examine year-over-year (YOY)

- Make adjustments to your finances

- Measure your energy in gross sales

- See how a lot leftover cash you will have

- Decide what bills to chop again on

- Safe investments or loans

- Ask your accountant for his or her recommendation on making your corporation worthwhile

After you generate an revenue assertion, don’t let the data sit on a digital shelf. Use the information for decision-making in your corporation.

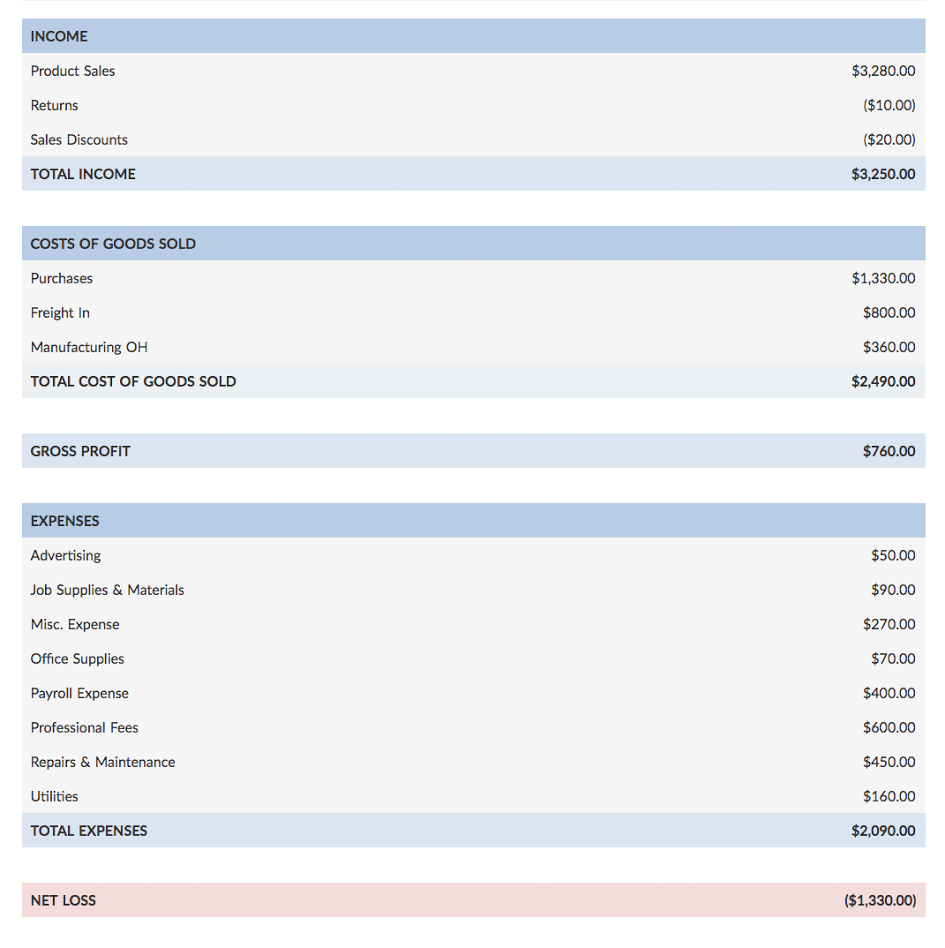

Components of the revenue assertion

So, what’s on an revenue assertion? The revenue assertion format can range, relying on your corporation. However, all revenue statements start with gross sales and finish with your corporation’s internet revenue or loss.

Components of the revenue and loss assertion embrace:

Income (revenue)

Your revenue assertion’s first part is the quantity of income (i.e., revenue) your corporation generated through promoting items or offering providers.

Bear in mind to subtract returns and gross sales reductions from the overall quantity you earn from gross sales.

Price of products bought

Embody your organization’s value of products bought (COGS) as the subsequent a part of your revenue assertion.

COGS embrace the price of producing your items or performing providers (e.g., uncooked supplies and direct labor bills).

Gross revenue

Gross revenue is the quantity you’re left with after subtracting COGS from your corporation’s income. Use the gross revenue components to get your complete:

Gross Revenue = Income – Price of Items Bought

Not like internet revenue (the underside line of the P&L), gross revenue reveals you your organization’s revenue earlier than subtracting bills. In case you have a wholesome gross revenue and a considerably decrease internet revenue, you can also make expense-cutting selections.

Working bills

How a lot did you spend on XYZ throughout the interval? Embody your organization’s varied working bills on the revenue assertion. Working bills are the prices your corporation incurs throughout every day operations.

Examples of working bills embrace:

- Worker salaries (not together with direct labor)

- Workplace provides

- Lease

- Insurance coverage

- Utilities

After you record out your corporation’s bills, calculate your complete prices throughout the interval.

Taxes and curiosity

Owing taxes and curiosity comes with proudly owning a enterprise. The elements of the revenue assertion earlier than taxes and curiosity present your organization’s EBIT, or earnings earlier than curiosity and taxes.

Web revenue or internet loss

The final line of the revenue assertion tells you ways a lot of a revenue or loss your corporation has throughout the time interval. If the quantity is constructive, the final line ought to learn internet revenue or internet revenue. If the quantity is damaging, it ought to learn internet loss.

Understanding whether or not you will have a internet revenue or loss determines the adjustments you must make in your corporation. When you will have a internet loss, work on chopping again bills and growing gross sales. And when you have a internet revenue, dig into what labored.

Methods to put together an revenue assertion

Earlier than you should use the data in your revenue assertion, you must know the way to put together it.

To organize an revenue assertion, you must:

- Perceive the widespread sections to incorporate (verify! See above)

- Hold detailed information so you may pull the information

- Determine the way to create your P&L (by hand or utilizing software program)

Making ready your P&L by hand: For those who determine to create your P&L by hand, you should use revenue assertion templates to get the ball rolling. Needless to say you should manually enter your organization’s income, COGS, and bills throughout the interval and make calculations your self.

Producing your P&L through software program: For those who go for accounting software program, you may generate your corporation’s revenue assertion in a matter of seconds—so long as you will have the information in your account for it. And since accounting software program streamlines the best way you observe and handle your corporation’s incoming and outgoing cash, it’s simple to maintain up-to-date information.

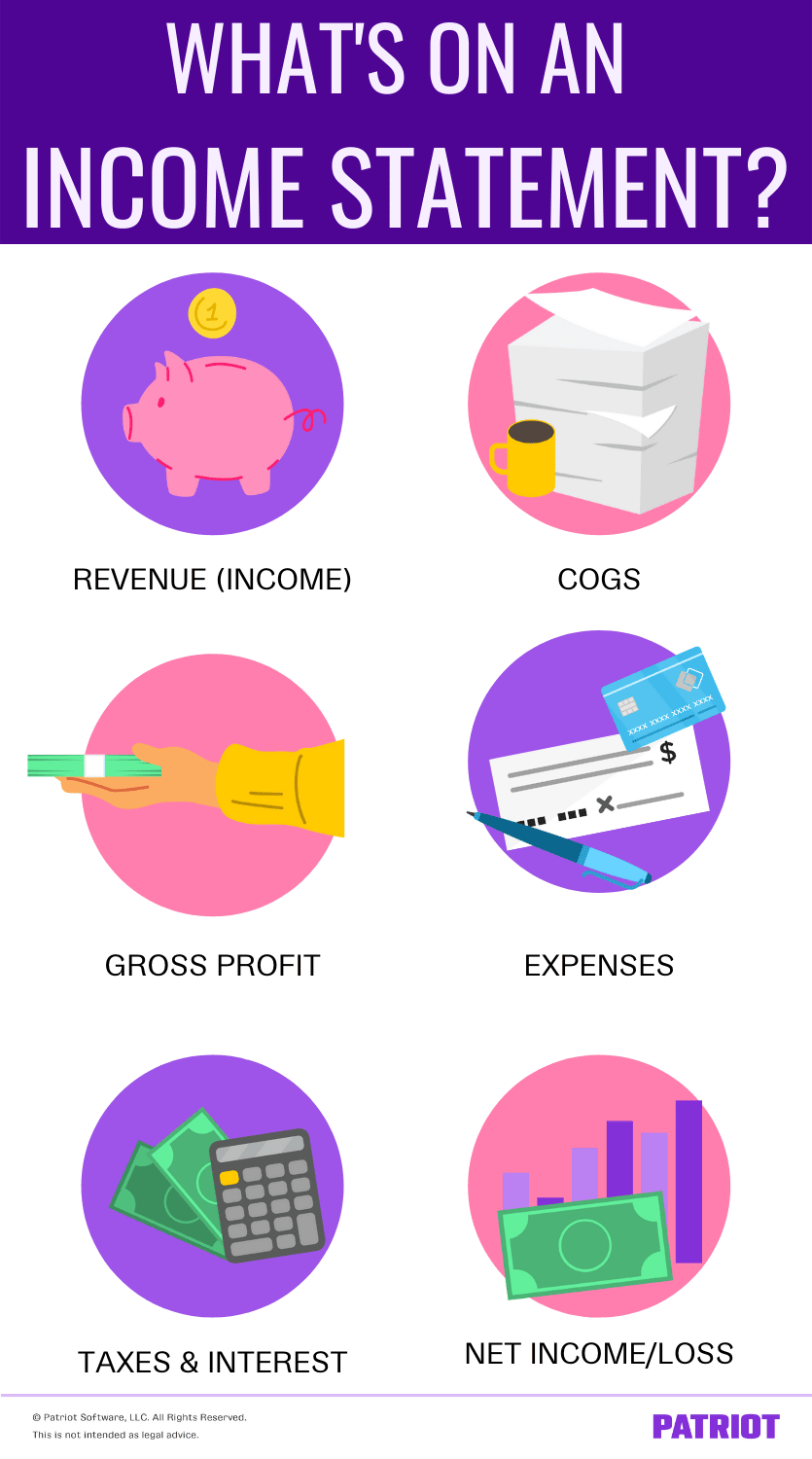

Earnings assertion instance

Want a visible to carry dwelling the revenue assertion idea? Right here’s a easy revenue assertion you may consult with:

On this instance of revenue assertion, the enterprise has a internet loss for this time interval. The enterprise proprietor can use this data to chop again on bills and work towards growing product gross sales.

This text has been up to date from its authentic publish date of 11/11/2014.

This isn’t meant as authorized recommendation; for extra data, please click on right here.