Credit score scores consider the chance that you just’ll repay a mortgage. They assist lenders decide mortgage qualification, credit score limits, and rates of interest.

A credit score rating could be a mystifying quantity, but it surely’s an necessary quantity. Usually, you want a credit score rating of 600 to even qualify for a mortgage. Loans apart, chances are you’ll want a good credit score rating to lease an condo, amongst different issues. You’ll additionally must use a credit score reference to have the ability to borrow cash for a mortgage. A credit score reference gives an summary of your credit score historical past background and creditworthiness.

There are a couple of completely different sorts of credit score scores which you could have, however the two commonest credit score fashions which might be used to find out credit score are VantageScore and FICO. It’s necessary to concentrate on the everyday rating with the intention to see how your credit score rating compares. The common credit score rating is round 675, however this differs by age and state.

So– how is a credit score rating calculated and what impacts your credit score rating?

Quite a lot of elements are considered. It is best to know all of them so each time a monetary scenario arises that mandates a credit score test, you’ll have already labored towards constructing a excessive rating.

Within the earlier chapters, we answered the questions “What’s a credit score rating” and “Why do you want a credit score rating?” However on this chapter, we’ll study the classes which might be utilized by credit score reporting companies to find out your credit score rating, in addition to credit score rating myths. Maintain studying to search out out extra about what impacts credit score scores and what doesn’t.

1. Fee Historical past

Fee historical past is commonly probably the most closely weighed issue that impacts your credit score rating. Credit score reporting companies will test to see when you’ve been paying your debt on time. If you happen to promptly make funds on all of your accounts, chances are you’ll earn a better credit score rating. Constantly making late funds could lead to a decrease credit score rating.

It’s necessary to keep in mind that late funds on lease or utilities won’t have an effect on your credit score rating—except the problem has been taken to court docket. Credit score reporting companies are primarily taking a look at funds on debt: bank card funds, mortgages, auto loans, and so on.

Credit score reporting companies could probe:

- How typically do you pay late?

- When did you final pay an account late?

- What number of days late have you ever made funds?

Unpaid debt could severely dent your credit score rating, particularly money owed which have been assumed by assortment companies. If you happen to develop poor credit score because of late funds, it’ll be tougher to do issues like buy a automotive, qualify for a mortgage, and even make a down cost.

How influential is cost historical past?

Fee historical past is the most influential issue in figuring out your credit score rating. If you happen to pay your current debt promptly, you then’re extra prone to pay your new debt promptly—that’s the way in which credit score reporting companies see it. Fee historical past is a powerful, however not all the time good, indicator of whether or not you’re able to accountable reimbursement.

How do I maximize my credit score rating on this class?

Ensure you pay your payments on time. Contemplate organising automated funds on debt so that you just’ll by no means miss an installment or bank card cost. Paying your payments on time is a good credit score behavior to develop to make sure you by no means miss a cost.

What if I don’t have an extended cost historical past?

Some individuals don’t have a really lengthy historical past of debt funds; they’ve by no means taken out a mortgage or mortgage, they’ve by no means used a bank card, or they’ve solely been making funds for a brief time frame.

If you wish to set up a historical past of immediate debt cost, take into account opening a bank card. Nonetheless, when you’re unable to open a bank card (because of a low credit score rating—which is likely to be the results of a brief credit score historical past), take into account constructing your credit score by opening a retailer bank card.

Retailer bank cards aren’t weighed as closely as financial institution bank cards, however they’re one solution to show your reliability in paying money owed, they usually could construct your credit score. Whether or not you open a financial institution bank card or retailer bank card, simply bear in mind to make your funds on time!

It takes time to develop an extended cost historical past, but it surely’s useful to concentrate on tips on how to construct credit score as a younger grownup with the intention to get began as shortly as doable. We’ll be discussing numerous credit score constructing methods afterward in Chapter 8 of this collection.

2. Age of Credit score and Sort of Credit score

The state of your present credit score accounts is the second most influential issue that impacts your credit score rating. Credit score reporting companies could consider:

- The age of your current credit score

- The sorts of credit score accounts you might have

Why does the age of my credit score matter?

You would possibly earn a better credit score rating when you’ve often paid your debt over an extended span of time.

Credit score reporting companies might even see this as a future indicator; if—over a span of years—you’ve been immediate at paying off your debt, you’re extra doubtless to take action sooner or later.

Credit score age alone won’t increase your credit score rating. If a credit score account has been open for some time however you often make late funds, credit score reporting companies will see you as being extra prone to make late funds sooner or later. That will lead to a decrease credit score rating.

Why does my credit score sort matter?

You would possibly obtain a better credit score rating when you efficiently keep a mixture of credit score accounts: installment loans and revolving credit score accounts.

Sustaining a mixture of installment and revolving credit score could exhibit that you just’re in a position to handle various kinds of loans.

Revolving credit score calls for a excessive quantity of accountability because of the different quantity of debt chances are you’ll accumulate in a given month. A historical past of efficiently managing revolving credit score could lead to a better credit score rating.

How do I maximize my credit score rating on this class?

That is one other tough class for individuals who don’t have an extended credit score historical past.

Many individuals have scholar loans or auto loans, however not a revolving mortgage. Contemplate opening a bank card when you solely have installment loans.

Be cautious about taking out an installment mortgage when you don’t actually want one. An installment mortgage will add to your total debt, which additionally impacts your credit score rating.

3. Credit score Utilization Ratio

Credit score utilization ratio measures the ratio of your bank card stability to your accessible credit score limits. For instance, in case your bank card restrict is capped at $1,000 per thirty days, a stability of $500 in your account would make your credit score utilization ratio 50%.

TransUnion advises that you just hold your credit score ratio underneath 35%. So, in case your credit score restrict is capped at $1,000, you must use not more than $350.

How influential is credit score utilization ratio?

Your credit score utilization ratio is weighed simply as closely as Class #2.

The next credit score utilization ratio means that your balances are excessive. In case your balances are excessive, there’s a better chance that you just’ll be unable to repay your debt.

A decrease credit score utilization ratio means that your balances are low. In case your balances are low, there’s a better chance that you just’ll repay your debt on time.

How do I maximize my credit score rating on this class?

As prompt by TransUnion, you must hold your credit score balances low. However watch out for protecting your credit score account too idle.

If you happen to go a while with out charging something to your bank card, then credit score reporting companies may have no latest credit score exercise to attract upon, which received’t assist your credit score rating improve.

When you have a revolving credit score account, take into account making a couple of small funds per thirty days. You’ll hold your credit score stability low, however you’ll additionally present credit score reporting companies with exercise to judge. If you happen to repay delicate balances promptly and recurrently, chances are you’ll obtain a better credit score rating.

4. Whole Balances and Debt

Credit score reporting companies will consider the entire quantity of debt that you just owe. Larger quantities of debt could lead to a decrease credit score rating, whereas much less debt could lead to a better rating. It’s necessary to concentrate on the that means of debt to credit score ratio, which is the quantity of debt you owe in comparison with your accessible credit score. You must have a low debt to credit score ratio with a view to enhance your credit score rating.

How influential are complete balances and debt?

This can be a reasonably influential class—not weighed as closely as Class #2 and Class #3, and positively not as a lot as Class #1.

When you have a considerable quantity of debt, there’s a better chance that you just’ll be unable to tackle new debt. That’s why increased debt negatively impacts your credit score rating.

However massive quantities of debt are usually not all the time an indicator that reimbursement is much less doubtless—and that’s why this class isn’t weighed as closely because the prior classes.

Somebody may have a considerable quantity of debt to repay, but when that particular person persistently makes funds on time—and over a reasonable span of time—it might recommend that particular person is sort of able to immediate reimbursement.

Credit score reporting companies don’t take an individual’s revenue under consideration when figuring out that particular person’s credit score rating. Somebody with a considerable quantity of debt may additionally have a excessive revenue, and thus be very able to making immediate funds. For that purpose, too, this class isn’t weighed as closely because the prior ones.

How do I maximize my credit score rating on this class?

Decreasing your total debt could lead to a better credit score rating. You’ll be able to scale back the general debt you owe by paying off your loans. Contemplate paying off installment loans first. When making funds on installment loans, you might contribute greater than the required minimal so that you just’ll repay the mortgage quicker.

If you happen to’re closely burdened by revolving credit score debt, you would possibly take into account taking out an installment mortgage to assist pay it off. Your debt wouldn’t instantly be diminished, however you might have your funds reorganized into smaller increments which might be simpler to pay. Do not forget that constant, on-time funds could mirror properly in your credit score rating. You don’t need unpaid revolving debt to build up—which will lower your credit score rating.

5. Current Credit score Inquiries

Credit score reporting companies will consider whether or not you’ve made any latest “arduous” inquiries. Inquiries happen while you get an analysis of your credit score rating from a credit-reporting company. There are two sorts of inquiries.

A delicate inquiry is while you request an analysis of your credit score rating with out truly making use of for brand new credit score. For instance, you would possibly want your credit score rating to lease an condo, or perhaps you’re solely making an attempt to watch modifications in your credit score rating.

A tough inquiry is while you request your credit score rating for the aim of making use of for brand new credit score—for a mortgage, new bank card, and so on.

A tough inquiry could drop your credit score rating.

Once you’re making use of for brand new credit score, you’re taking up new debt. By having debt, you naturally have extra danger—that’s why your credit score rating could drop. Most arduous inquiries, although, will solely drop your credit score rating by a couple of factors.

A delicate inquiry won’t have an effect on your credit score rating.

How influential are latest credit score inquiries?

This can be a much less influential class in figuring out your credit score rating. Simply since you’re buying new debt, doesn’t essentially imply you’re much less able to well timed repayments. And also you would possibly even be opening new credit score since you’re in a great monetary scenario to take action. For that purpose, arduous inquiries are usually not a closely weighted issue.

Nonetheless, opening too many new credit score accounts could drop your rating considerably.

Too many new bank cards and loans tremendously improve the chance that you just’ll overextend your self and get behind on funds, or default.

How do I maximize my credit score rating on this class?

Keep away from opening too many new accounts, and solely open accounts that you just actually want.

If you happen to should open new credit score accounts, attempt to apply for all of them inside a brief span of time. You don’t need new credit score accounts to be counted as separate arduous inquiries—which will drop your credit score rating. However when inquiries are made inside a brief span of time, credit score reporting companies will do one thing referred to as deduplication, the place a number of arduous inquiries of the identical sort are merged right into a single inquiry.

VantageScore permits 14 days for deduplication. For instance, when you have been opening a brand new bank card, taking out a mortgage, and making use of for an auto mortgage, you’d need to submit all functions inside 2 weeks in order that they’d be counted as one inquiry.

6. Accessible Credit score

Credit score reporting companies will study how a lot revolving credit score you might have accessible that you just haven’t used.

Accessible credit score is expounded to credit score utilization ratio. The credit score utilization ratio primarily measures your credit score account stability. Accessible credit score measures the unused credit score—versus your used credit score.

A considerable amount of accessible credit score means that your funds are extra secure as a result of you might have a lot of respiratory room.

Nonetheless, “respiratory room” doesn’t essentially point out that somebody is unlikely to make well timed repayments. For instance, somebody might need a small quantity of accessible credit score, however in addition they might need a near-flawless historical past of debt reimbursement. For that purpose, accessible credit score isn’t weighed very closely and is a much less influential class in figuring out your credit score rating.

How do I maximize my credit score rating on this class?

As mentioned in Class #3, you might attempt to hold your revolving credit score debt underneath 35% of your accessible credit score. A bigger quantity of accessible credit score could improve your credit score rating.

Be suggested that some lenders could have limits on the quantities of accessible credit score or open accounts you might have, and when you exceed these limits, they could decline your software for a brand new credit score account.

Contemplate opening solely the quantity of credit score that you just actually want.

What Doesn’t Have an effect on Your Credit score Rating

So that you now know what impacts your credit score rating, however what about what doesn’t impression your credit score rating?

Quite a lot of private particulars may have no impression in your credit score rating, like:

- Race

- Faith

- Gender

- Nationality

Different non-factors embrace:

1. Age

Many individuals suppose that age impacts your credit score rating analysis. Nevertheless it’s credit score historical past—not age—that impacts your credit score rating.

It’s true that youthful persons are extra prone to have a shorter credit score historical past, however even older adults could have a brief credit score historical past in the event that they’ve by no means taken out a mortgage or used a bank card.

Age itself isn’t factored by credit score reporting companies.

2. Marital Standing

Married {couples} don’t share credit score scores; every partner maintains their very own.

If a married couple shares a joint credit score account, nonetheless, one’s credit score conduct could have an effect on the opposite. For instance, if one partner makes a late cost, the opposite partner who shares the account may additionally get penalized for it on his or her credit score rating. Below-average credit in a wedding is one thing you need to be conscious of as it may have an effect in your personal monetary well being.

3. Employment

Credit score scores are not affected by your employment standing, employer, occupation, or revenue. None of those issue into your creditworthiness. Excessive revenue and employment elements are not any indicator that money owed shall be repaid in a well timed method.

4. Belongings

Your complete belongings are additionally not an indicator of well timed debt reimbursement.

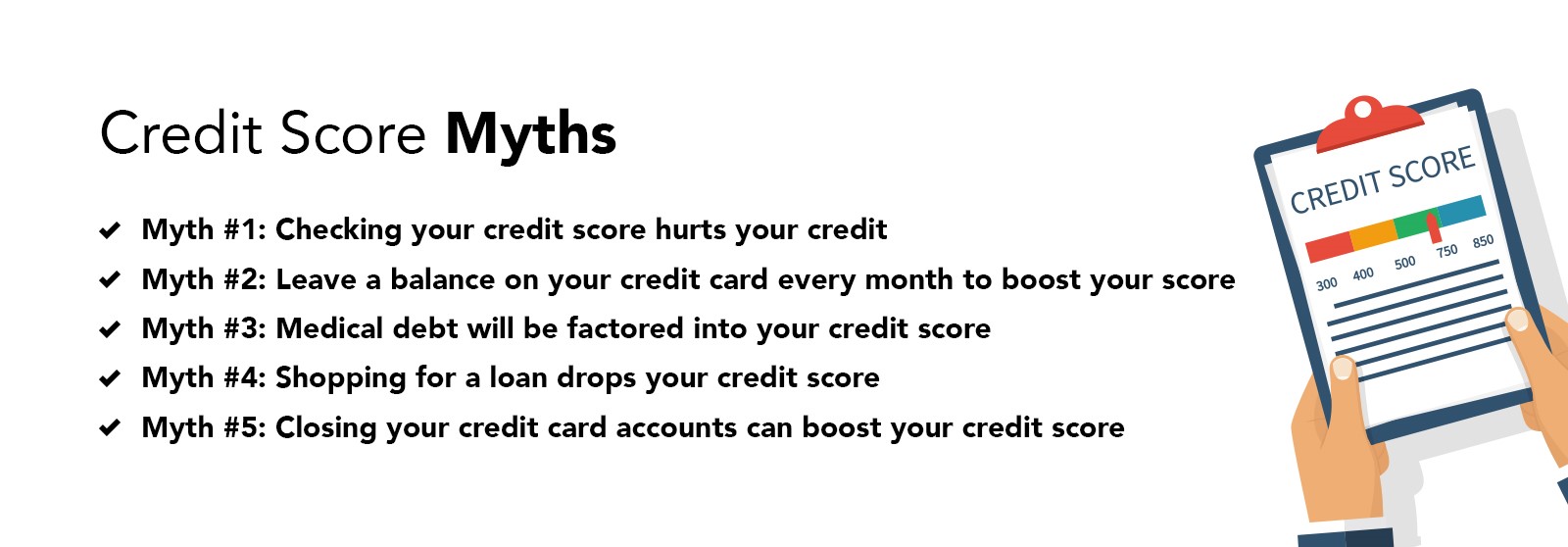

Credit score Rating Myths

There are some necessary issues that have an effect on your credit score rating, however there are additionally many elements which might be irrelevant. The truth is, there are numerous widespread myths about what boosts or drops your credit score rating. Let’s deal with a couple of of the preferred myths.

Fantasy #1: Checking your credit score rating hurts your credit score.

A tough inquiry could drop your credit score rating, however arduous inquiries solely happen while you submit functions for brand new credit score accounts. A delicate inquiry doesn’t have an effect on your credit score rating.

You will get your credit score rating from credit score reporting companies even when you’re not making use of for brand new credit score, and this counts as a delicate inquiry. Your credit score rating received’t be penalized for a credit score test. The truth is, shoppers are inspired to often test their credit score rating or have it monitored.

Checking your credit score rating often is necessary with the intention to have a greater concept of your monetary standing. It’s additionally necessary with the intention to catch potential fraudulent exercise or incorrect data.

If you happen to discover incorrect data in your credit score report, be sure you comply with the credit score dispute course of to get it eliminated earlier than it may impression your credit score rating. You’ll be able to keep on prime of your credit score historical past with a free credit score rating report, which you may get yearly.

Fantasy #2: Go away a stability in your bank card each month to spice up your rating.

Many individuals imagine that when you go away a single stability unpaid, you’ll construct your credit score rating quicker.

That is unfaithful. You’ll be able to construct your credit score rating by paying your debt in full each month, or by protecting your balances as little as doable when you can’t.

Fantasy #3: Medical debt shall be factored into your credit score rating.

Medical debt isn’t factored into your credit score rating except it has been assumed by collections.

Fantasy #4: Searching for a mortgage drops your credit score rating.

A tough inquiry would possibly drop your credit score rating by a couple of factors. However shoppers are inspired to search for one of the best mortgage charges doable. As mentioned in Class #5, VantageScore has a 14-day window the place all inquiries are deduplicated. As long as you submit mortgage functions inside this window, you received’t be penalized for a number of arduous inquiries.

Fantasy #5: Closing your bank card accounts can increase your credit score rating.

You could suppose that fixing closed accounts in your credit score report can enhance your credit score rating, however that’s not all the time the case. Closing your bank cards may very well drop your credit score rating.

Older revolving credit score accounts are prone to increase your credit score rating, as long as you’ve managed them responsibly. Quite the opposite, your credit score rating could drop while you open new credit score accounts. Thus, you need to hold revolving accounts open for so long as doable.

Moreover, closing a well-managed bank card means you received’t profit from the credit score utilization ratio. Closing an account would possibly improve your balance-to-limit ratio, which can lead to a decrease credit score rating.

If a bank card has quite a few late funds and mismanagement connected to it, closing the cardboard received’t immediately take away these blemishes out of your credit score report. It would take years for credit score reporting companies to take away these accounts.

Fairly than closing a bank card account, it might be higher to maintain the account open and profit from its growing older and credit score utilization ratio. You can work to enhance a file of late funds with well timed funds.

Closing a bank card account is likely to be a necessity for you underneath sure circumstances. Simply be sure you have the numbers crunched so that you just’re conscious of how your credit score rating is likely to be affected. Monitoring your credit score rating would possibly show you how to keep away from drastic modifications while you’re contemplating such choices as closing an account.

A Abstract: What Impacts Your Credit score Rating

At first look, it would appear to be the VantageScore classes that credit score reporting companies use to find out your credit score rating are relatively dense and sophisticated.

However a disciplined adherence to a couple rules could go a good distance in boosting your credit score rating with ease.

One of the necessary guidelines to comply with is:

- Make debt funds on time.

That is probably the most closely weighted think about figuring out your credit score rating. If you happen to should, arrange automated funds so that you just’ll by no means miss one.

As well as, you could possibly increase your credit score rating by:

- Sustaining quite a lot of credit score accounts—to complement installment loans, open a bank card and make small fees on it every month. Remember to pay these balances in full.

- Let your credit score accounts age, and don’t open new ones except it’s important to.

- Once you open a number of new accounts, submit all functions inside 14 days so you possibly can deduplicate inquiries.

- On revolving credit score accounts, strive to hold your balances underneath 35% of your accessible credit score restrict.

- Scale back your debt as a lot as you possibly can. Attempt to repay any installment loans, and contribute greater than the required quantity every month.

By being conscious of what impacts your credit score rating, you is likely to be in your solution to constructing a excessive credit score rating.

Within the subsequent chapter, we’ll focus on what the credit score rating ranges are, so you possibly can perceive the place your credit score rating falls and what which means.

Sources: Experian | FICO 1 2 | TransUnion

Associated