Employers juggle many tasks, together with calculating and withholding payroll taxes and different deductions. However, what precisely does payroll taxes embody? And, how are you aware how a lot to withhold from staff’ wages? Should you’re questioning about understanding payroll taxes, by no means worry—your payroll taxes breakdown is right here.

What are payroll taxes?

How do payroll taxes work? Payroll taxes are a particular sort of employment tax. Not all employment taxes are payroll taxes. As a substitute, payroll taxes include the Federal Insurance coverage Contributions Act (FICA) tax. So, what’s FICA tax?

FICA tax is the mixture of Social Safety and Medicare taxes. The federal government makes use of funds from the 2 taxes for various applications:

- Social Safety tax: Funds advantages for retirement, dependents of retired staff, and the disabled and their dependents.

- Medicare tax: Funds medical advantages for folks age 65 and older, the disabled, and people with qualifying well being circumstances.

Social Safety and Medicare tax have totally different tax charges. And, there may be an extra Medicare tax for qualifying staff (we’ll get to that later).

What are payroll taxes levied on? Employers should withhold these taxes from their staff’ wages. However, don’t withhold your entire quantity of every tax from the worker. Employers share the duty of paying FICA taxes with their staff. Present payroll tax on paystub in your staff.

Self-employed people usually are not exempt from paying federal payroll taxes. As a substitute of paying FICA tax, they need to pay self-employment tax. The Self Employed Contributions Act (SECA) tax requires self-employed people to pay Social Safety and Medicare taxes. SECA doesn’t cut up the tax between worker and employer. As a substitute, self-employed people should pay the whole thing of the tax themselves.

Different taxes in payroll

Once more, not all employment taxes are payroll taxes. Folks generally seek advice from all taxes deducted in payroll as payroll taxes. However, there are lots of kinds of employment taxes.

Employment taxes embody:

- Federal revenue tax

- State revenue tax

- Native revenue tax

- Federal unemployment (FUTA) tax

- State unemployment (SUTA) tax

Staff don’t pay all employment taxes. And likewise, employers don’t pay all employment taxes.

Earnings taxes solely come out of the workers’ wages. Federal unemployment taxes are employer-only taxes. State unemployment taxes are sometimes employer-only, however some states require each employers and staff to contribute to the tax (e.g., Pennsylvania).

Payroll tax charges

Staff pay the identical quantity of FICA payroll tax as employers as a result of the full quantity is cut up evenly. Self-employed people should pay your entire quantity of each taxes. So, how a lot are payroll taxes for workers, employers, and self-employed staff?

Social Safety and Medicare tax charges

To know the way a lot FICA tax to pay or withhold, break it down into the 2 elements of the tax: Social Safety and Medicare.

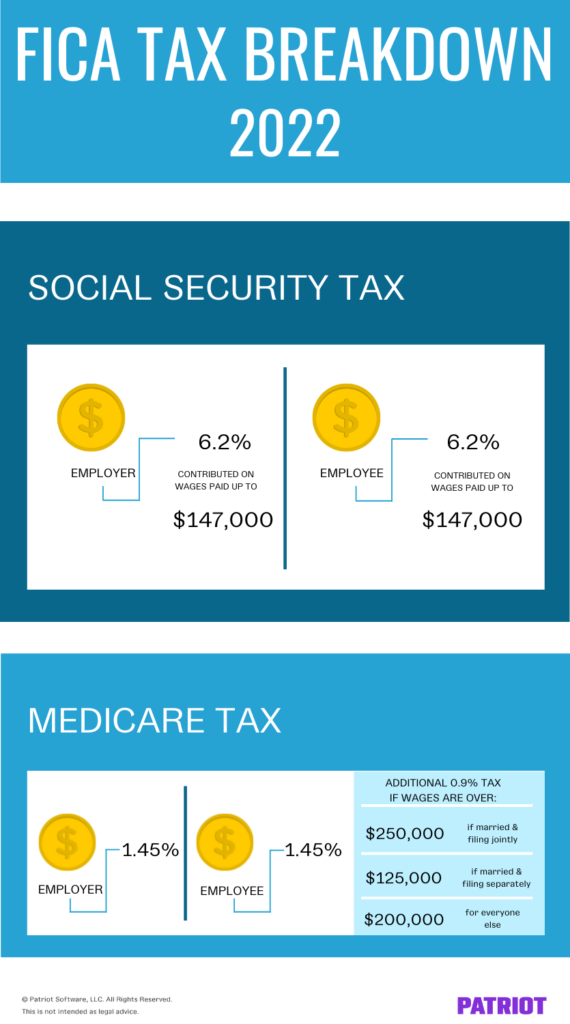

Social Safety tax has a better tax charge. It’s a flat 12.4% however solely applies to the primary $147,000 an worker earns in 2022. The Social Safety wage base sometimes adjustments annually. Equally divide the full proportion between you and your staff. Withhold 6.2% out of your staff’ wages and contribute 6.2% because the employer (12.4% / 2).

Medicare tax has a flat tax charge of two.9%. Like Social Safety tax, staff and employers equally share the full tax. So, employers and staff every pay 1.45% (2.9% / 2). In contrast to Social Safety, there isn’t any wage base or cap to the wages topic to the Medicare tax. As a substitute, there may be an extra Medicare tax of 0.9% as soon as staff earn above a specific amount.

Further Medicare taxes apply to staff based mostly on submitting standing:

- Married submitting collectively: $250,000

- Married submitting individually: $125,000

- Single: $200,000

Staff who earn above the edge should pay 2.35% for Medicare tax (1.45% + 0.9%). Employers proceed to pay 1.45% as a result of the extra Medicare tax charge solely applies to staff.

Self-employment tax charge

SECA tax is mainly the identical as FICA tax, besides one individual pays the full quantity for every tax.

Social Safety tax is 12.4% and Medicare is 2.9% whole. So, the mixed charge for SECA tax is 15.3%.

Self-employment Social Safety taxes solely apply to the primary $147,000 in wages a self-employed individual earns with a most tax of $18,228 (12.4% X $147,000) in 2022.

A self-employed particular person should additionally pay the total 2.9% of Medicare tax. Self-employment wages are additionally topic to extra Medicare tax (0.9%). If the extra Medicare tax applies, the full tax charge is 3.8% (2.9% + 0.9%). There is no such thing as a most quantity of Medicare tax a person pays.

Payroll tax FAQs

Nonetheless have some questions on payroll taxes? Check out some ceaselessly requested questions.

1. Is federal withholding tax a payroll tax?

Federal withholding is a tax calculated throughout payroll, however it’s not a payroll tax. As a substitute, federal withholding is an employment tax. One other identify for federal withholding is federal revenue tax.

2. Can employers make staff pay the full quantity of FICA tax?

No. Federal regulation requires employers to evenly cut up FICA tax with their staff. Solely self-employed people pay the whole thing of Social Safety and Medicare taxes.

3. What occurs if an worker meets the Social Safety wage base in the course of a pay interval?

If an worker meets the Social Safety worker tax wage base in the course of the pay interval, solely calculate the tax on wages as much as the quantity.

Say an worker receives biweekly paychecks and hits the wage base on the finish of the primary week of the pay interval. The worker’s whole paycheck is $6,000. Divide the gross pay by two and apply the Social Safety tax to the primary half of the gross wages ($6,000 / 2 = $3,000).

This text is up to date from its authentic publication date of October 20, 2015.

This isn’t meant as authorized recommendation; for extra data, please click on right here.