In actual property investing, rental information is such a necessity that any investor will go to any size to entry the most recent data.

Desk of Contents

- Utilizing Rental Knowledge to Discover the Proper Funding Property for You

- Utilizing Rental Knowledge to Your Benefit

- Wrapping It Up

Any actual property investor price their salt is aware of how stats and data was once a hit-or-miss factor previously. Gathering correct data and information, particularly for out-of-state investments, was fairly laborious to perform until you possess sufficient money and time to make a number of journeys to do your individual analysis.

In the present day, with the usage of expertise, buying the required rental market information for revenue property investments is quite a bit simpler and extra environment friendly. Nonetheless, getting information is one factor; understanding learn how to use it’s one other. What ought to an investor do with the normal or brief time period rental information? How does it determine into actual property investing?

Utilizing Rental Knowledge to Discover the Proper Funding Property for You

On this weblog, we are going to speak about rental information, its significance to actual property traders, the place to search out them, and most significantly, learn how to put them to make use of for traders to make smart selections.

Defining Rental Knowledge

Most actual property traders search for funding properties that don’t value an arm and a leg however may also give them a good sufficient revenue to generate a very good money movement. It isn’t depending on whether or not they intend to hire the property out as a standard or trip rental or plan to speculate and repair and flip homes. The aim of every investor is to make a very good return on funding.

For them to realize their funding targets, they should carry out intensive due diligence to allow them to make correct projections and computations. Ensuring the mathematics checks out is significant to any funding enterprise, particularly in actual property, the place huge cash is concerned.

Whereas there are a number of methods of investing in actual property, one of the crucial well-liked choices traders take is rental properties. And one of many methods to make sure a very good ROI for rental property investments is to have the proper rental information available.

Rental information is just necessary details about rental properties that give traders an concept of a particular property’s profitability. It contains, however shouldn’t be restricted to, the next data:

- Variety of market listings

- Month-to-month rental revenue

- Common money on money return

- Common cap fee

- Common occupancy/emptiness fee

When contemplating beginning a rental property enterprise, no matter whether or not it’s a standard rental or an Airbnb enterprise, traders must take all of this information into consideration.

Associated: Calculate ROI on Rental Property: The 2022 Information

Rental Evaluation: What Is It?

Buying information is simply one of many many steps needed to finish a very good feasibility evaluation on one property. After you have the data available, it’s essential be sure that the numbers align along with your standards and funding targets. That is what rental evaluation is all about.

A rental evaluation takes no matter information and statistics you could have and cross-checking every of them towards your very best projections to see whether or not a property is price paying for or not.

The factor about rental evaluation is that it’s a very taxing and exhausting course of that takes an excessive amount of effort and time to spend on only one property. Now think about simply how lengthy the method will probably be for those who’re truly contemplating a number of properties. It’s essential analyze every property so you may slender down your selections to the best choice that you could afford.

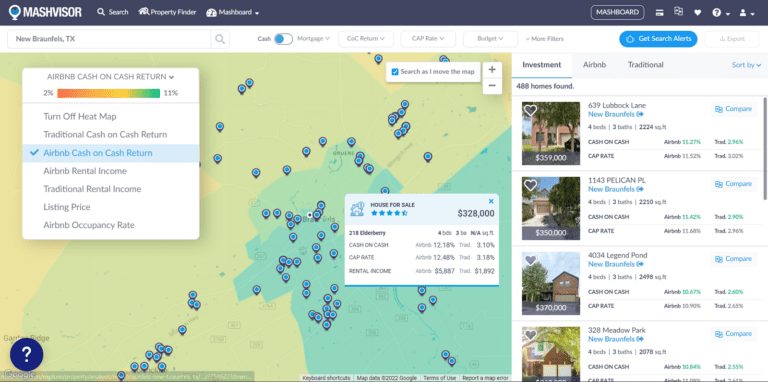

Fortuitously, a web site like Mashvisor exists. One of many foremost causes for its existence is to assist actual property traders carry out extremely environment friendly actual property evaluation in a fraction of the time. It gives customers a number of instruments that make analyzing conventional and trip rental information a smoother course of.

As an illustration, if an investor is contemplating shopping for an funding property in New Braunfels, TX, all they should do is enter the placement within the search area. Search outcomes for obtainable rental properties will present up on the web page. You’ll be able to navigate by the totally different tabs and filters to search out out the necessary long run and brief time period rental market information in New Braunfels.

Listed here are the newest conventional and trip rental market information from Mashvisor’s huge database:

New Braunfels, TX

- Variety of Listings for Sale: 347

- Median Property Worth: $584,878

- Common Worth per Sq. Foot: $252

- Days on Market: 96

- Variety of Conventional Listings: 720

- Month-to-month Conventional Rental Earnings: $1,692

- Conventional Money on Money Return: 0.73%

- Conventional Cap Price: 0.75%

- Worth to Lease Ratio: 29 (excessive)

- Variety of Airbnb Listings: 361

- Month-to-month Airbnb Rental Earnings: $4,945

- Airbnb Money on Money Return: 5.37%

- Airbnb Cap Price: 5.47%

- Airbnb Day by day Price: $261

- Airbnb Occupancy Price: 48%

- Stroll Rating: 74

Primarily based on these numbers, traders already get an concept of whether or not investing in New Braunfels is sweet for them or not. The principle figuring out issue is the investor’s targets and the way the market’s efficiency matches them.

We’ll go into additional element about every of the numbers in a bit.

To start out on the lookout for and analyzing the very best funding properties in your metropolis and neighborhood of selection, click on right here.

The Advantages of Rental Knowledge to Actual Property Traders

We can not stress sufficient how helpful rental information is to actual property traders and entrepreneurs seeking to begin a rental property enterprise. For these questioning learn how to spend money on actual property, know as early as now that it is best to by no means get into the rental property enterprise with out the data and information required to carry out correct funding property evaluation.

Acquiring all the required information will provide you with a greater understanding and perception into the market you’re contemplating. Gone are the times of estimating rental charges manually. When performed the old fashioned manner, landlords are inclined to both overestimate or underestimate their properties’ rental worth. Rental information evaluation offers them market-accurate figures that permit them to provide you with aggressive costs. Doing it leads to greater probabilities of occupancy, which results in extra dependable revenue.

Rental information additionally offers traders an concept of whether or not a specific location is price investing in or not. Let’s have a look at the New Braunfels, TX market once more. Relying on their targets, traders may need totally different emotions about this explicit location. The low money on money return and cap fee for conventional leases will certainly not sit effectively with traders seeking to hire a property out for extra prolonged durations. Alternatively, the very good money on money return and cap fee on Airbnb properties make it a very good market to begin short-term leases.

On prime of the standard information that have an effect on rental costs, a number of non-conventional variables additionally have an effect on rental charges in a specific market. Issues corresponding to stroll rating, entry to public facilities (hospitals, parks, colleges, eating places, public transportation, and so on.), and even Yelp enterprise critiques have a direct impression on the rental charges of a given market.

Superior rental information analytics can even level traders to at the moment undervalued properties which have very excessive income-generating potential.

Whether or not you’re an actual property investor, a property supervisor, or an agent, with the ability to entry correct rental information is one thing that you’d wish to get your arms on. The data you collect will show to be invaluable to your decision-making in a while.

The place Does One Get Rental Knowledge?

The query now’s, the place does one get dependable rental information that’s extremely correct?

If individuals from earlier than did issues the laborious (and most frequently, inaccurate) manner, there’s no excuse for traders at this time. Rental information can now be acquired simply on-line by actual property web sites like Mashvisor. When you can nonetheless exit for a drive to have a look at a number of rental properties in your space, it can value you somewhat extra further time and money to do. Alternatively, on-line actual property marketplaces already present numerous the data you have to to make an knowledgeable determination.

The most effective methods to go about conventional and Airbnb rental information acquisition is to go to Mashvisor and entry its up to date database that covers nearly all actual property markets throughout all 50 states. Subscribers are given entry not simply to the positioning’s huge database however to its totally different investing instruments, corresponding to the true property heatmap and rental property calculator, to make investing faster and extra environment friendly.

To study extra about how Mashvisor will help you discover profitable funding properties, schedule a demo.

Associated: The 2022 Information to Utilizing Heatmap Evaluation to Determine Areas for Rental Funding

Mashvisor’s Actual Property Heatmap software helps traders discover worthwhile properties and make knowledgeable funding selections.

Utilizing Rental Knowledge to Your Benefit

Now that we all know the place to search for probably the most up-to-date data and information, what do all of them imply? How can an investor use this data to their benefit?

Interpretation of information is sort of essential on the subject of information evaluation. The extra you perceive what a sure statistic represents, the extra you perceive the market circumstances and the way they’ll have an effect on your future funding.

Whereas the median property worth, the common worth per sq. foot, and days on market are all necessary within the grand scheme of issues, particular conventional and Airbnb rental information play a task to play in figuring out whether or not a property is appropriate for investing or not.

The next part breaks down the various factors traders must search for when contemplating rental properties in any given market. The phrases already communicate for themselves, however for the next breakdowns, we are going to use the most recent Mashvisor information on New Braunfels, TX, as our instance of deciphering information.

Conventional Rental Knowledge

Beneath are the issues traders must know in the event that they’re contemplating going the normal rental route:

Variety of Conventional Rental Listings

The variety of conventional rental listings in an space signifies what number of long-term leases are publicly listed and obtainable. On this occasion, there are 720 obtainable listings in New Braunfels, in response to Mashvisor. It signifies that there’s loads of competitors on this small Texas city.

Traders additionally want to think about how a lot competitors they are going to be going through if they’re to proceed. The excessive variety of obtainable conventional rental properties can imply both a low demand for long-term leases or a slight overabundance in provide.

Month-to-month Conventional Rental Earnings

The month-to-month conventional rental revenue is principally what a landlord makes month-to-month from renting out a property long-term. New Braunfels’ month-to-month rental revenue of $1,692 is near the common nationwide rental fee. It makes renting a home within the city reasonably priced to the common American.

Conventional Money on Money Return

Money on money return is among the determiners utilized by traders to venture their ROI. Money on money return is simply your annual pre-tax money movement divided by the amount of money invested on the property. Consultants and business professionals all agree that wholesome money on money return is between 8% and 12%. Nonetheless, realistically talking, such offers are few and much between. So money on money return that’s 1.0% and above is already thought-about good.

On this case, New Braunfels conventional leases solely acquire a 0.73% money on money return. Maybe, it’s led to by the overabundance of rental stock. Getting right into a long-term rental enterprise within the city now may not be as profitable as one would count on.

Conventional Cap Price

Cap fee is one other metric traders have a look at to find out profitability. The principle distinction between a cap fee and money on money return is that with a cap fee, the NOI is split by the property’s market worth and never the overall amount of money invested.

The cap fee for conventional leases on this Texan city is a low 0.75%, which makes loads of sense on condition that cap charges and money on money return charges aren’t that far off from one another. If the money on money fee for New Braunfels implies that investing in conventional leases is a bit dangerous right now, the cap fee just about confirms it.

Worth to Lease Ratio

A worth to hire ratio is a metric utilized by actual property professionals and traders to see if it’s higher to purchase a property in a neighborhood or simply hire out one. It’s divided into three classes:

- Low rating of 15 and beneath – It signifies that property costs are decrease in comparison with rental charges, which suggests it’s higher to only purchase than hire.

- Medium rating of 16 to twenty – It signifies that there’s a wholesome steadiness of property and rental costs out there. Rental demand and profitability are each reasonable, which signifies that whether or not individuals determine to hire or purchase doesn’t make that vast a distinction to an investor.

- Excessive rating of 21 and above – It implies that housing affordability is a big problem, and it makes extra sense to hire out in markets like this than to purchase a home.

In New Braunfels’ case, its worth to hire ratio is a excessive 29, which suggests persons are most probably out there on the lookout for property to hire.

Airbnb Rental Knowledge

Traders who’re pondering of getting properties and getting them listed on Airbnb and different related platforms ought to know the next market information:

Variety of Airbnb Rental Listings

Much like conventional listings, it reveals the variety of obtainable rental properties listed on Airbnb. And whereas 361 New Braunfels Airbnb listings could appear quite a bit, it’s a wholesome quantity based mostly on the dimensions of the city and what it might provide vacationers and guests.

New Braunfels is conveniently positioned between San Antonio and Austin, which makes it a fascinating location for vacationers and guests who’ve a enterprise to handle in each massive cities. Hundreds of individuals flock to New Braunfels yearly and there’s no scarcity of tourists, particularly with the lifting of COVID-19 journey restrictions. Including yet one more New Braunfels trip rental property on Airbnb would possibly truly be a very good factor for the city’s financial system.

Month-to-month Airbnb Rental Earnings

Typically, the common month-to-month Airbnb rental revenue is sort of bigger than the common conventional rental revenue. It’s fairly evident in New Braunfels as the most recent information reveals that Airbnb homeowners get about $4,945 month-to-month. Whereas it could be greater than twice what conventional rental landlords are getting, one of many downsides is that Airbnb revenue nonetheless depends upon the occupancy/emptiness fee.

Airbnb Money on Money Return

Airbnb money on money return fee is sort of just like its counterpart, solely that it’s computed for trip rental properties. The identical set of requirements is used for Airbnb money on money return. Provided that New Braunfels gives a 5.37% money on money return fee tells traders that it’s a very wholesome marketplace for short-term rental investments.

Airbnb Cap Price

Equally, the New Braunfels Airbnb cap fee of 5.47% confirms that the place is, certainly, a very good location to arrange a short-term rental enterprise.

Airbnb Day by day Price

In contrast to conventional leases, Airbnb may be rented out on a per-day foundation, relying on the visitor’s wants. The day by day fee, coupled with the occupancy fee, will finally decide the common month-to-month rental fee for an Airbnb host. Based on Mashvisor, the most recent common Airbnb day by day fee in New Braunfels is a really affordable $261.

Airbnb Occupancy Price

Occupancy fee will make or break a trip rental enterprise. A low occupancy/excessive emptiness fee signifies that the Airbnb host will most probably lose more cash sustaining the property. Alternatively, a excessive occupancy/low emptiness fee signifies that the rental property is producing sufficient optimistic income to handle itself and provides the proprietor a good revenue. The upper the occupancy fee, the higher the month-to-month rental revenue will probably be.

New Braunfels Airbnb properties present a median occupancy fee of 48%, simply a few factors shy of fifty%, which nonetheless makes for a good quantity. Airbnb occupancy charges are inclined to fluctuate relying on the season.

Associated: Prime 10 Tricks to Purchase a Rental Property for Sale

Wrapping It Up

Now that we’ve talked in regards to the significance of rental information and learn how to apply it to your funding determination, it is usually necessary for traders to acquire the suitable funding instruments. An internet site like Mashvisor not solely offers a large database crammed with extremely correct information but additionally a wide selection of investing instruments that make the method easier and simpler.

To get entry to our actual property funding instruments, click on right here to enroll in a 7-day free trial of Mashvisor at this time, adopted by 15% off for all times.