UTI Nifty Midcap 150 High quality 50 Index Fund is a brand new providing from UTI monitoring the Nifty Midcap 150 High quality 50 Index. DSP has an ETF primarily based on this index launched about three months in the past with an AUM of 36 Crores. Now that an index fund possibility is out there, ought to buyers contemplate this? A dialogue.

An element-based index is one during which parameters like volatility, momentum, alpha, ROE, PB, PE and many others are used to assemble the index as a substitute of market capitalization. That is one technique to cut back focus threat in conventional indices just like the Nifty and Sensex. This combines energetic rule-based inventory picks with passive investing and is often known as a tilt-weighted index (that’s biased to a sort of technique).

Whereas the NIfty 100 consists of the highest 100 firms primarily based on full market capitalisation from NIFTY 500, the Nifty Midcap 150 Index represents the following 150 firms (firms ranked 101-250) primarily based on full market capitalisation from NIFTY 500.

Development of the NIFTY Midcap150 High quality 50 Index

The Nifty Midcap 150 High quality 50 Index has 50 shares with greater profitability, decrease leverage and extra secure earnings from the Nifty Midcap 150 universe.

In response to the methodology doc, equal weight is given to return on fairness (final fiscal 12 months), debt to fairness (final fiscal 12 months) and final 5 12 months EPS progress variability. The debt to fairness issue will not be used for monetary companies shares.

For Non-Monetary Service sector firm:

Weighted Z rating= 0.33 * Z rating of ROE + 0.33 * – (Z rating of D/E) + 0.33* – (Z rating

of EPS progress variability)

For monetary companies sector:

Weighted Z rating= 0.5 * Z rating of ROE + 0.5*-(Z rating of EPS progress variability)

Right here Z scores confer with how a lot a selected issue deviates from the common worth divided by the usual deviation.

The index is weighted by the sq. root of the free float market cap instances the standard rating. Every inventory can both have a most publicity of 5% or 5 instances its weight within the father or mother index.

It have to be understood that this definition of “high quality” is bigoted.

Common readers could also be conscious that we’ve identified twice (Nov 2019 and as soon as in July 2020) that energetic midcap funds would wrestle to beat the Nifty Midcap 150 High quality 50 (NMC150Q30) index: Midcap mutual funds wrestle to beat this factor-based midcap index. In truth, we adopted this up with one other examine that reveals they’ve bother beating the Nifty Midcap 150 index too! Delusion Busted: Energetic mid cap mutual fund managers can simply beat the index.

So these are the pure questions we have to reply:

- Can we use UTI Nifty Midcap 150 High quality 50 Index Fund as a substitute of energetic mid cap funds?

- Can we use UTI Nifty Midcap 150 High quality 50 Index Fund as a substitute of Midcap 150 or Nifty Subsequent 50 passive funds?

- As an alternative of shopping for this index fund, can I construct a DIY portfolio of choose midcap funds primarily based on the index portfolio?

My fascination with factor-based investing has considerably waned due to this text: Information Mining in Index Development: Why Traders must be cautious. I’ve now come to understand that many of those elements are arbitrary in definition and designed for previous outperformance which can or could not maintain in future.

As we noticed yesterday – Ought to I exit Nifty Subsequent 50 due to Paytm, Zomato and Nykaa? – index curators can fortunately change the safety inclusion standards at will.

These issues apply to UTI Nifty Midcap 150 High quality 50 Index Fund as nicely. We are able to anticipate a TER of 0.4% to 0.5% for the direct plan much like UTI S&P BSE Low Volatility Index Fund (hyperlink factors to evaluation; disclosure invested) and UTI Nifty200 Momentum 30 Index Fund (hyperlink factors to evaluation).

Not like the definition for volatility, there is no such thing as a universally accepted definition for a “high quality inventory”. Questions like why the above-mentioned steadiness sheet metric and never others have been used can solely be answered by the curator.

Their index development is bigoted, to say the least. They’ve a Nifty 200 High quality 30 and a Nifty Midcap 150 High quality 50. Why solely 30 high quality shares from 200 shares however 50 high quality shares from 150 shares? Why solely issue fund from the mid cap universe? Although it might by no means be proved, it reeks of backtesting bias.

So the investor on this NFO have to be conscious that the nice previous efficiency of NMC150Q30 proven under could or could not maintain in future. The fund expense ratio and monitoring error play a job in defining returns and this can’t be backtested.

NMC150Q30 was launched solely in Oct 2019. A lot of the historical past (as much as April 2005) is backtested and doesn’t mirror index motion with real-time buying and selling and constituent modifications.

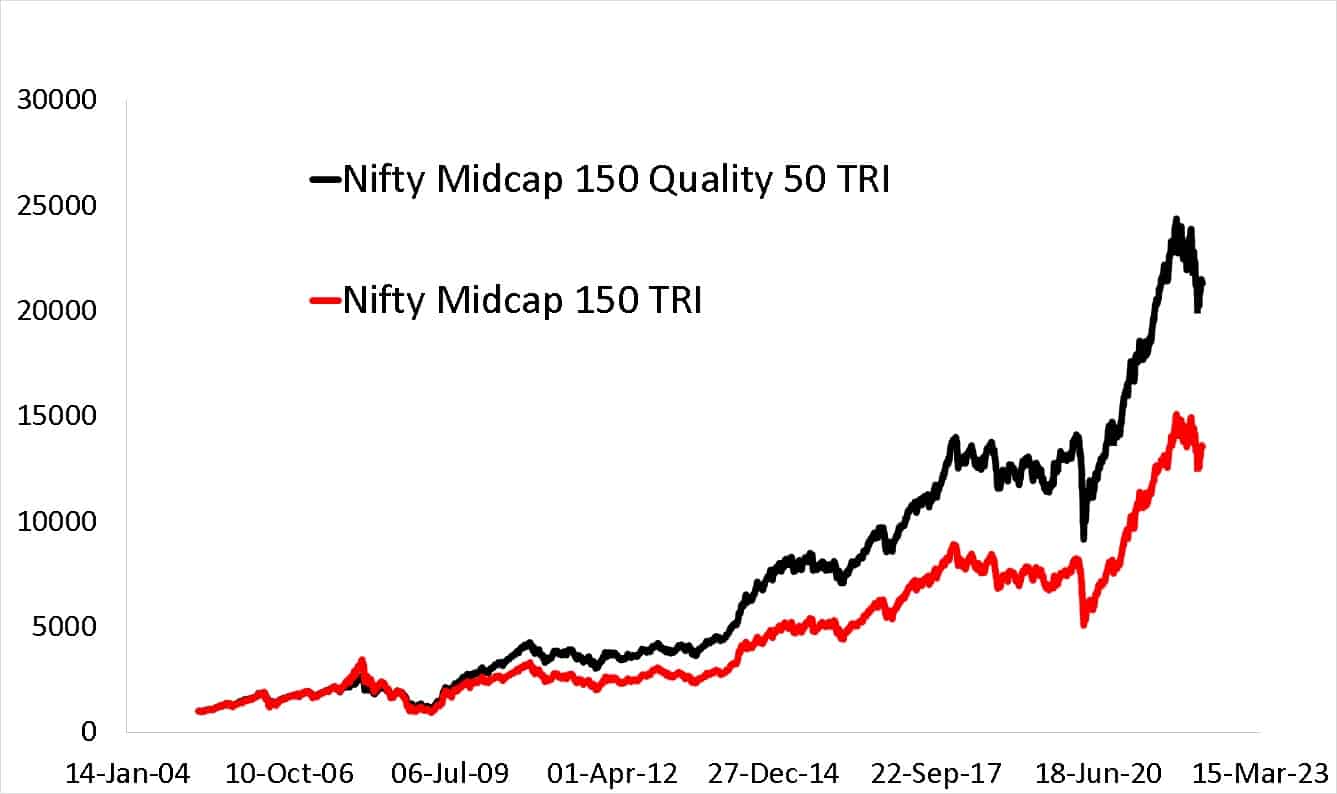

Efficiency of Nifty Midcap 150 High quality 30 Complete Returns Index

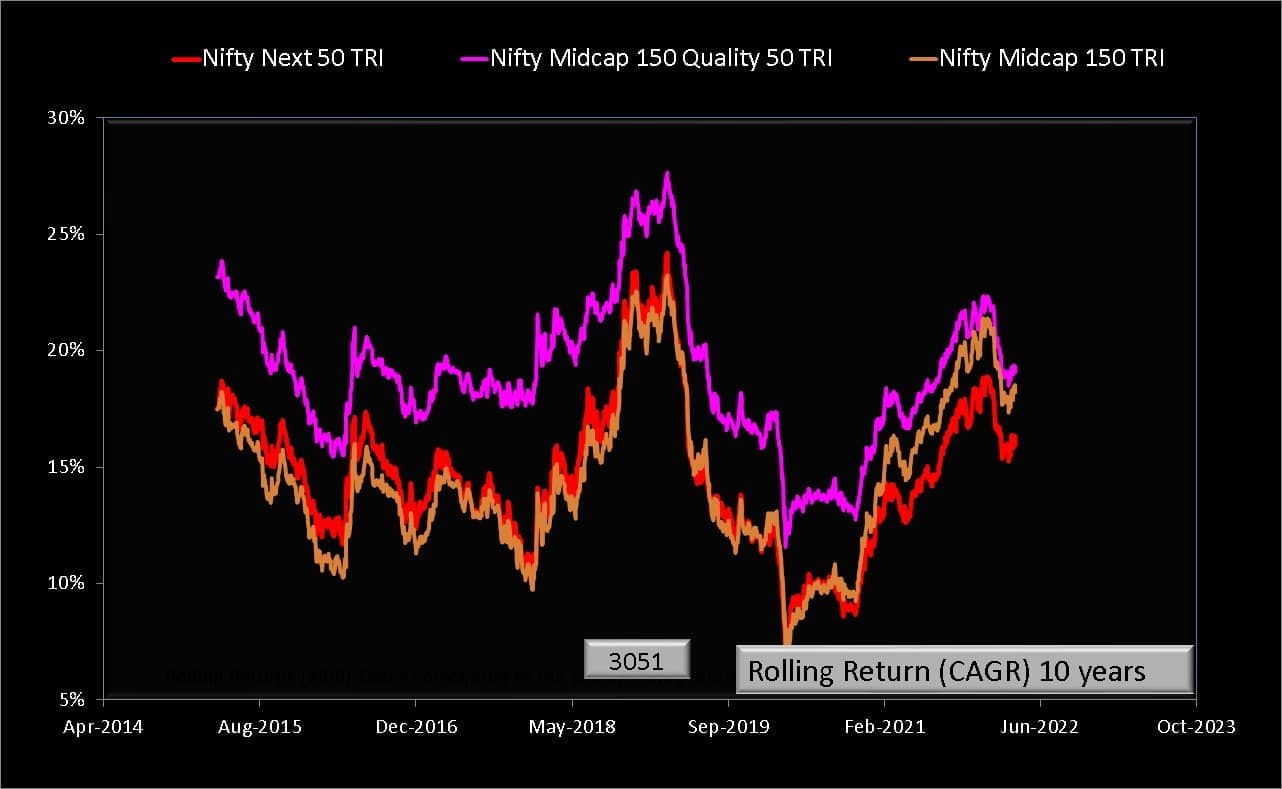

Over the past 10 years, if we contemplate the 5-year return of the index on any given day, generally it has outperformed Nifty Subsequent 50 and Nifty Midcap 150 and generally it’s been on par.

The ten-year rolling returns knowledge is best, however discover the time interval within the horizontal axis, it’s only within the final 5 years. That’s, the historical past is simply too quick for us to imagine that NMC150Q30 will at all times outperform the opposite two indices (No, the chart can’t be used as a likelihood!).

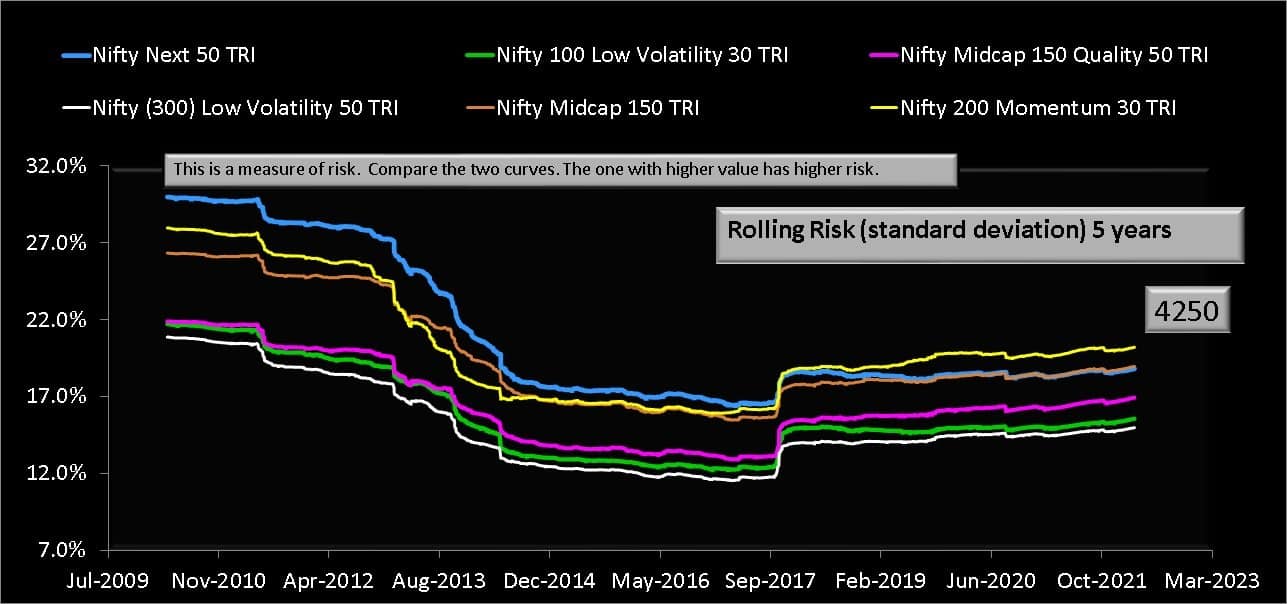

In each instances, the vary of doable returns for NMC150Q30 is decrease that means decrease threat as measured by volatility. This may be seen within the 5-year rolling commonplace deviation graph.

NMC150Q30 has decrease volatility than its father or mother index or Nifty Subsequent 50 and is corresponding to that of the Nifty 100 Low Volatility 20 index. That is presumably a sign that “high quality mid cap shares” are comparatively extra secure”.

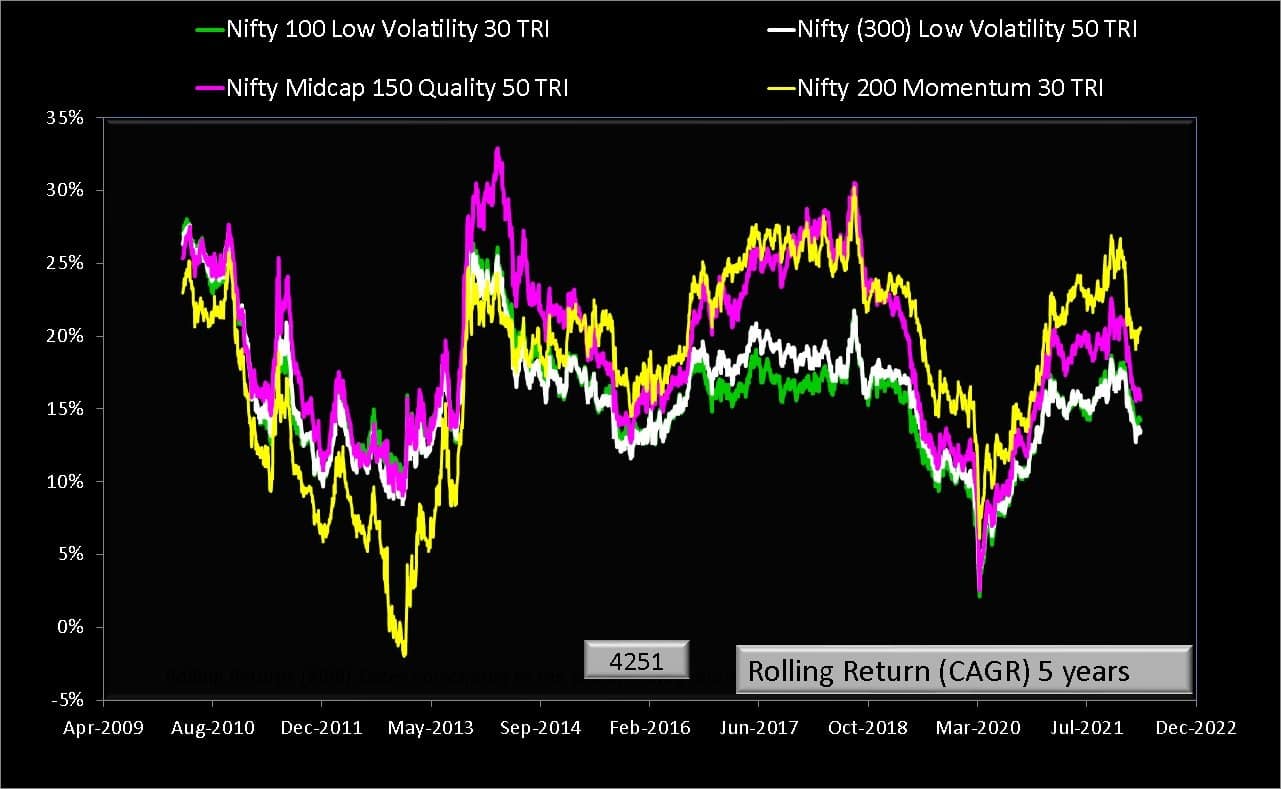

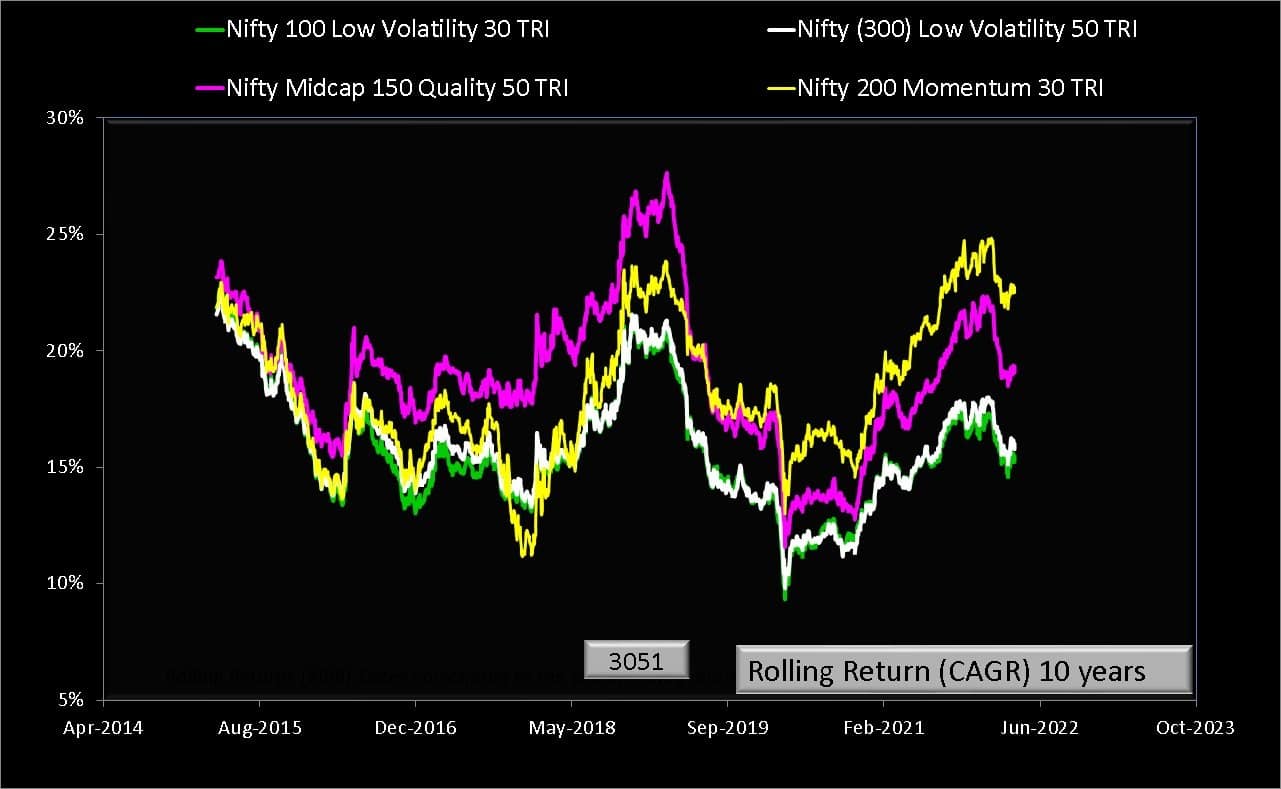

Now we will examine the issue indices (UTI has three of those now).

When it comes to 5Y threat spreads the momentum index is the best. Subsequent comes NMC150Q30 after which the low volatility indices.

The ten-year rolling returns knowledge tells us no technique will work always! The NMC150Q30 returns dropped dramatically in early 2018 when the midcap section began falling. Momentum has solely outperformed NMC150Q30 within the final couple of years.

Now allow us to attempt to reply some questions. We want to reiterate that readers admire the dangers of selecting factor-based funds earlier than studying the next!

Is UTI Nifty Midcap 150 High quality 50 Index Fund a more sensible choice than UTI S&P BSE Low Volatility Index Fund? (this index is comparable in threat/reward to the Nifty 100 Low Volatility 30 index as proven earlier than)

No. That will be a little bit of an apple vs orange comparability as low volatility indices have a big cap tilt (discover 50 low volatility shares from Nifty 300 are as rewarding as 30 low volatility shares from Nifty 100). It is mindless to ask if I can substitute a big cap index with a mid cap one.

So then can I maintain each? Sure, however provided that you admire the constraints of issue indices talked about above.

Please observe: there is no such thing as a pores and skin within the sport for me right here. I can’t be investing in UTI Nifty Midcap 150 High quality 50 Index Fund for the easy motive it isn’t required for my circumstances. So please guarantee due diligence earlier than investing.

If I’ve to decide on between high quality and low volatility, I might select low volatility as a result of it’s a easier product. The definition of volatility is nicely established and common whereas the definition of high quality is bigoted. Whereas metrics may be simply added or subtracted to the standard rating, it isn’t straightforward (a minimum of so far as my pondering takes me) to do that to low volatility with out altering the character of the fund.

Is UTI Nifty Midcap 150 High quality 50 Index Fund a more sensible choice than UTI Nifty 200 Momentum 30 Index Fund?

Once more a little bit of an apple vs orange comparability (mid cap vs massive and mid cap). Nonetheless, contemplating that the momentum technique doesn’t pay as typically because it ought to for the upper threat taken (see 10Y returns), if I’ve to decide on solely between these two, I might decide UTI Nifty Midcap 150 High quality 50 Index Fund.

Can we use UTI Nifty Midcap 150 High quality 50 Index Fund as a substitute of energetic mid cap funds?

Along with the extra complete proof introduced above, contemplate the next. From Feb 1st 2018 to Feb third 2020 (a month earlier than the crash), the mid cap section stored shifting down solely 8 out of 21 actively managed mid cap funds have been in a position to beat NMC150Q30. From twenty third March 2020 (market crash backside) to twenty third March 2022, 18 out of the 24 actively managed mid cap funds have been in a position to beat NMC150Q30.

Extra importantly, the winners within the first 2Y interval are the identical as that within the second 2Y interval. For instance, Mid Cap funds from Axis (the darling of buyers earlier than the crash), DSP and Taurus have been winners within the first 2Y interval however ended up on the shedding facet within the second 2Y interval.

Mid cap funds from Motilal Oswal, Invesco and Tata have been comfy winners within the first 2Y interval however nearly managed to get into the successful facet within the second 2Y interval. So there is no such thing as a assure of constant efficiency from an energetic mid cap fund.

If most actively managed mid cap funds can not beat a ruled-based midcap index throughout a market downturn, I might slightly take my probabilities with UTI Nifty Midcap 150 High quality 50 Index Fund if I perceive the constraints of issue investing and my aim is to beat the Nifty Midcap 150 index after bills.

Can we use UTI Nifty Midcap 150 High quality 50 Index Fund as a substitute of Midcap 150 or Nifty Subsequent 50 passive funds?

Though there may be not sufficient data-based help and I might nicely be fallacious, I’m inclined to say sure for many who don’t thoughts taking an opportunity.

Everyone knows how irritating it’s to carry Nifty Subsequent 50. How unhealthy can the mid cap high quality 50 fund be in comparison with that?! Additionally, Nifty Subsequent 50 funds are solely rather less costly than UTI issue funds (assuming this may also value about 0.4-0.5%). Once more the above-mentioned caveats apply.

Please observe: The above is a particular reply to a particular reader query. This doesn’t imply we suggest everybody to cease investing in Nifty Subsequent 50 and shift elsewhere!

Now wrt Nifty Midcap 150 index funds, we’ve already proven that the monitoring errors are massive – Not all index funds are the identical! Past prime 100 shares monitoring errors are big! Even when we anticipate UTI Nifty Midcap 150 High quality 50 Index Fund to be that unhealthy, the potential decrease volatility and better return is an opportunity price taking. Once more caveats apply!

As an alternative of shopping for this index fund, can I construct a DIY portfolio of choose midcap funds primarily based on the index portfolio?

This can’t be analyzed or backtested in any method. This route is simply appropriate for these already investing in shares and fascinated by mid cap shares. We don’t suggest this for brand new buyers.

All stated and achieved, readers should admire that UTI Nifty Midcap 150 High quality 50 Index Fund is a brand new fund. Whereas the above suggestions could apply to established buyers who don’t thoughts investing in an unknown fund, newer buyers could wait and watch the monitoring error for a couple of months earlier than deciding.

Do share if you happen to discovered this convenient

About The Writer

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him through Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on numerous cash administration matters. He’s a patron and co-founder of “Charge-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him through Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on numerous cash administration matters. He’s a patron and co-founder of “Charge-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Use our Robo-advisory Excel Template for a start-to-finish monetary plan! Now with a brand new demo video! ⇐ Greater than 900 buyers and advisors use this!

Our flagship course! Be taught to handle your portfolio like a professional to attain your objectives no matter market circumstances! ⇐ Greater than 2700 buyers and advisors are a part of our unique neighborhood! Get readability on easy methods to plan in your objectives and obtain the mandatory corpus it doesn’t matter what the market situation is!! Watch the primary lecture at no cost! One-time fee! No recurring charges! Life-long entry to movies! Cut back worry, uncertainty and doubt whereas investing! Discover ways to plan in your objectives earlier than and after retirement with confidence.

Our new course! Enhance your revenue by getting individuals to pay in your expertise! ⇐ Greater than 620 salaried staff, entrepreneurs and monetary advisors are a part of our unique neighborhood! Discover ways to get individuals to pay in your expertise! Whether or not you’re a skilled or small enterprise proprietor who needs extra shoppers through on-line visibility or a salaried particular person wanting a facet revenue or passive revenue, we are going to present you easy methods to obtain this by showcasing your expertise and constructing a neighborhood that trusts you and pays you! (watch 1st lecture at no cost). One-time fee! No recurring charges! Life-long entry to movies!

My new guide for youths: “Chinchu will get a superpower!” is now obtainable!

Most investor issues may be traced to an absence of knowledgeable resolution making. We have all made unhealthy selections and cash errors once we began incomes and spent years undoing these errors. Why ought to our kids undergo the identical ache? What is that this guide about? As dad and mom, if we needed to groom one potential in our kids that’s key not solely to cash administration and investing however for any facet of life, what would it not be? My reply: Sound Choice Making. So on this guide, we meet Chinchu, who’s about to show 10. What he needs for his birthday and the way his father or mother’s plan for it and educate him a number of key concepts of resolution making and cash administration is the narrative. What readers say!

Should-read guide even for adults! That is one thing that each father or mother ought to educate their children proper from their younger age. The significance of cash administration and resolution making primarily based on their needs and desires. Very properly written in easy phrases. – Arun.

Purchase the guide: Chinchu will get a superpower in your little one!

Methods to revenue from content material writing: Our new book for these fascinated about getting facet revenue through content material writing. It’s obtainable at a 50% low cost for Rs. 500 solely!

Wish to test if the market is overvalued or undervalued? Use our market valuation device (will work with any index!), otherwise you purchase the brand new Tactical Purchase/Promote timing device!

We publish mutual fund screeners and momentum, low volatility inventory screeners .each month.

About freefincal & its content material coverage Freefincal is a Information Media Group devoted to offering unique evaluation, reviews, critiques and insights on developments in mutual funds, shares, investing, retirement and private finance. We accomplish that with out battle of curiosity and bias. Comply with us on Google Information. Freefincal serves greater than three million readers a 12 months (5 million web page views) with articles primarily based solely on factual info and detailed evaluation by its authors. All statements made will likely be verified from credible and educated sources earlier than publication. Freefincal doesn’t publish any paid articles, promotions, PR, satire or opinions with out knowledge. All opinions introduced will solely be inferences backed by verifiable, reproducible proof/knowledge. Contact info: letters {at} freefincal {dot} com (sponsored posts or paid collaborations is not going to be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Objective-Primarily based Investing

Revealed by CNBC TV18, this guide is supposed that will help you ask the appropriate questions, search the proper solutions, and because it comes with 9 on-line calculators, you can even create customized options in your way of life! Get it now. Additionally it is obtainable in Kindle format.

Revealed by CNBC TV18, this guide is supposed that will help you ask the appropriate questions, search the proper solutions, and because it comes with 9 on-line calculators, you can even create customized options in your way of life! Get it now. Additionally it is obtainable in Kindle format.

Gamechanger: Overlook Startups, Be part of Company & Nonetheless Dwell the Wealthy Life You Need

This guide is supposed for younger earners to get their fundamentals proper from day one! It would additionally allow you to journey to unique locations at a low value! Get it or present it to a younger earner.

This guide is supposed for younger earners to get their fundamentals proper from day one! It would additionally allow you to journey to unique locations at a low value! Get it or present it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low cost flights, funds lodging, what to do when travelling, how travelling slowly is best financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 199 (on the spot obtain)

That is an in-depth dive evaluation into trip planning, discovering low cost flights, funds lodging, what to do when travelling, how travelling slowly is best financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 199 (on the spot obtain)

Free android apps