A whale with some huge cash to spend has taken a noticeably bullish stance on United Parcel Service.

Taking a look at choices historical past for United Parcel Service UPS we detected 13 unusual trades.

If we contemplate the specifics of every commerce, it’s correct to state that 61% of the traders opened trades with bullish expectations and 38% with bearish.

From the general noticed trades, 9 are places, for a complete quantity of $538,851 and 4, calls, for a complete quantity of $223,742.

What’s The Worth Goal?

Bearing in mind the Quantity and Open Curiosity on these contracts, it seems that whales have been focusing on a worth vary from $165.0 to $220.0 for United Parcel Service over the past 3 months.

Quantity & Open Curiosity Improvement

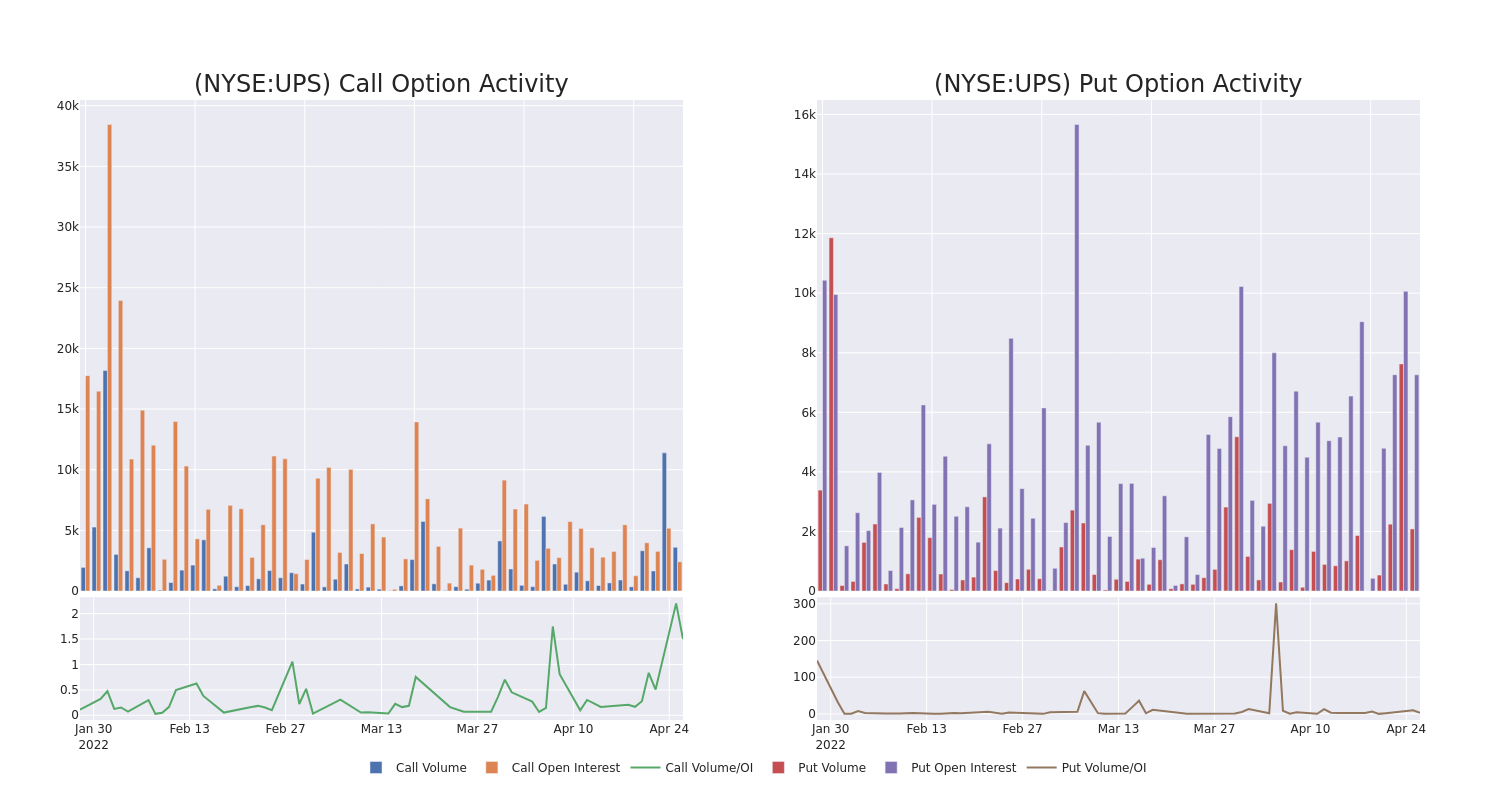

By way of liquidity and curiosity, the imply open curiosity for United Parcel Service choices trades at present is 805.58 with a complete quantity of 5,691.00.

Within the following chart, we’re in a position to observe the event of quantity and open curiosity of name and put choices for United Parcel Service’s huge cash trades inside a strike worth vary of $165.0 to $220.0 over the past 30 days.

United Parcel Service Possibility Quantity And Open Curiosity Over Final 30 Days

Largest Choices Noticed:

| Image | PUT/CALL | Commerce Kind | Sentiment | Exp. Date | Strike Worth | Complete Commerce Worth | Open Curiosity | Quantity |

|---|---|---|---|---|---|---|---|---|

| UPS | PUT | TRADE | BULLISH | 07/15/22 | $220.00 | $153.6K | 432 | 0 |

| UPS | PUT | TRADE | BULLISH | 06/17/22 | $180.00 | $108.9K | 1.0K | 1.0K |

| UPS | CALL | TRADE | BULLISH | 01/20/23 | $185.00 | $74.4K | 813 | 53 |

| UPS | PUT | TRADE | BULLISH | 01/20/23 | $210.00 | $72.9K | 1.3K | 55 |

| UPS | CALL | SWEEP | BEARISH | 04/29/22 | $187.50 | $65.4K | 788 | 2.0K |

The place Is United Parcel Service Standing Proper Now?

- With a quantity of 5,675,407, the value of UPS is down -2.7% at $184.52.

- RSI indicators trace that the underlying inventory could also be oversold.

- Subsequent earnings are anticipated to be launched in 0 days.

Choices are a riskier asset in comparison with simply buying and selling the inventory, however they’ve increased revenue potential. Severe choices merchants handle this threat by educating themselves each day, scaling out and in of trades, following a couple of indicator, and following the markets intently.

If you wish to keep up to date on the newest choices trades for {d[company_name]}, Benzinga Professionaloffers you real-time choices trades alerts.