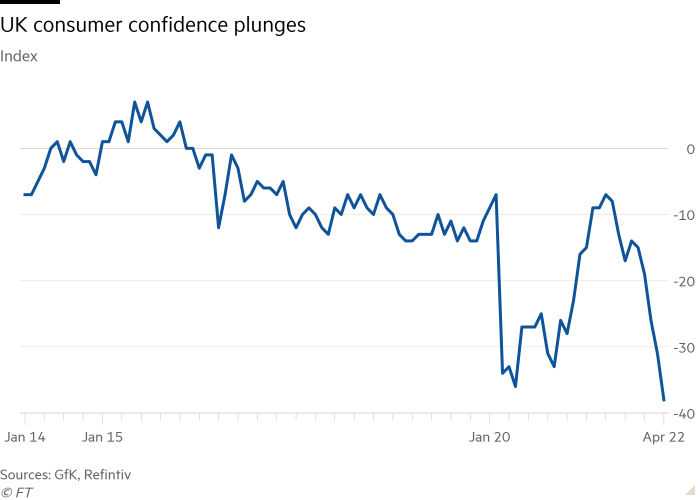

British client confidence has fallen to a close to all-time low pushed by issues over the hovering value of dwelling, in keeping with a intently watched survey, fuelling fears of a renewed financial downturn within the second quarter.

The UK client confidence index, a measure of how individuals view the state of their private funds and wider financial prospects, crashed seven factors to minus 38 in April, its lowest stage since 2008 when it was minus 39, in keeping with analysis firm GfK.

Joe Staton, shopper technique director GfK, mentioned “the fee crunch is actually hitting the pockets of UK shoppers”.

UK inflation rose to 7 per cent in March, reaching a 30-year excessive. The stress on family budgets is predicted to develop following a pointy leap in vitality payments this month and the knock-on results of Russia’s invasion of Ukraine.

The patron confidence rating, primarily based on interviews performed within the first half of April, was near the bottom stage since data started in 1974 and worse than the minus 33 forecast by economists polled by Reuters.

Individuals’s confidence of their private monetary state of affairs, which is intently linked to family spending habits, additionally fell. “There’s clear proof that Brits are considering twice about purchasing,” mentioned Staton, who attributed the pattern to issues over rising inflation and rates of interest mixed with low development and declining incomes.

These elements coupled with a rise in nationwide insurance coverage contributions from this month have led many analysts to forecast that the financial system will contract within the second quarter.

The autumn in client confidence bodes unwell for future spending urge for food. This issues as a result of “how households reply to the autumn in actual incomes will go a protracted technique to figuring out whether or not or not there’s a recession”, mentioned Ruth Gregory, an economist at Capital Economics.

Information from Deloitte, KPMG and Financial institution of America have proven related sharp declines in client confidence. In a BoA survey, greater than half of shoppers mentioned they’d reduce on spending due to rising utility payments this month.

Most households have been in search of to save lots of prices by decreasing garments purchasing and consuming out, discovered BoA and KPMG, whereas a 3rd of shoppers have been dipping into their financial savings to offset dwelling prices.

Deloitte famous that saving patterns assorted amongst revenue brackets. Its analysis confirmed that simply 5 per cent of households with an revenue of £10,000 and below have been capable of save within the first quarter, in contrast with 38 per cent of households with an total revenue of £100,000.

Céline Fenech, client perception lead at Deloitte, mentioned that “shoppers are clearly feeling the pinch of rising dwelling prices”, with inflation “affecting the lowest-income households essentially the most”.