When unsure, allocate your tax refund to your emergency financial savings account

Opinions and suggestions are unbiased and merchandise are independently chosen. Postmedia might earn an affiliate fee from purchases made by way of hyperlinks on this web page.

Article content material

After submitting our taxes, we anxiously stay up for getting a few of our hard-earned {dollars} again. Many individuals have plans for that cash lengthy earlier than the refund is obtained. For some, it may be a welcome reduction from a good price range. For others, it may imply paying down money owed or the chance to splurge on a luxurious merchandise. However maybe there’s a higher means to make use of that cash, that will help you get extra of what you need or want year-round.

Commercial 2

Article content material

Earlier than deciding the place that cash can have the most important affect, it’s necessary to first assess your price range. When you discover you’re always operating a deficit, utilizing your tax return to eradicate a month-to-month expense or debt might unlock money move. For instance, in case you can pre-pay your automotive insurance coverage or property taxes for the yr, that may unlock cash that will usually have gone to that month-to-month invoice. This cash can imply affording some new garments or visiting the dentist or optometrist. Doing a little a lot wanted self-care might be a wonderful means to make use of these funds.

Article content material

Generally our price range shortfalls can’t be rectified by a once-a-year inflow of money. There could also be particular expenditures in your price range which might be inflicting a deficit. Utilizing your annual tax return to “get caught up” gained’t remedy the issue; it simply delays the results. To construct a working price range, monitor the place your cash goes. In case your bills exceed your revenue, then chopping again to stability your price range is value contemplating. If decreasing your bills is just not an choice, it could be mandatory to extend your revenue to make sure you’re overlaying all of your bills and obligations.

Commercial 3

Article content material

Typically, excessive debt funds may end up in ongoing price range deficits. If so for you, it may very well be useful to make use of your tax refund to scale back a few of that debt load. Nonetheless, in case your tax refund is just not enough to repay sufficient debt to have the specified affect in your price range, it may be time to hunt skilled assist.

One choice is to use for a consolidation mortgage together with your financial institution or credit score union to decrease your month-to-month funds and curiosity. You too can be taught extra about tackling your money owed by speaking to a credit score counsellor totally free at a not-for-profit credit score counselling company. They’ll additionally enable you enhance your budgeting and cash administration expertise to attain a balanced price range, which is tremendous necessary in case you consolidate your money owed with a mortgage.

Commercial 4

Article content material

When you discover you’re utilizing your tax refund to repay Christmas payments, contemplate including financial savings to a vacation price range into your price range year-round as a substitute of all the time taking part in catch-up. Simply as with house repairs, it’s a lot cheaper to make use of your individual saved funds moderately than paying 20-plus per cent on a bank card.

-

Bank card rewards might be a necessary instrument to assist cut back millennials’ debt

-

Giving whilst you’re residing and different choices for the large $30-trillion intergenerational wealth switch

-

Mendacity low will not be the very best plan of action in relation to short-term spousal help claims

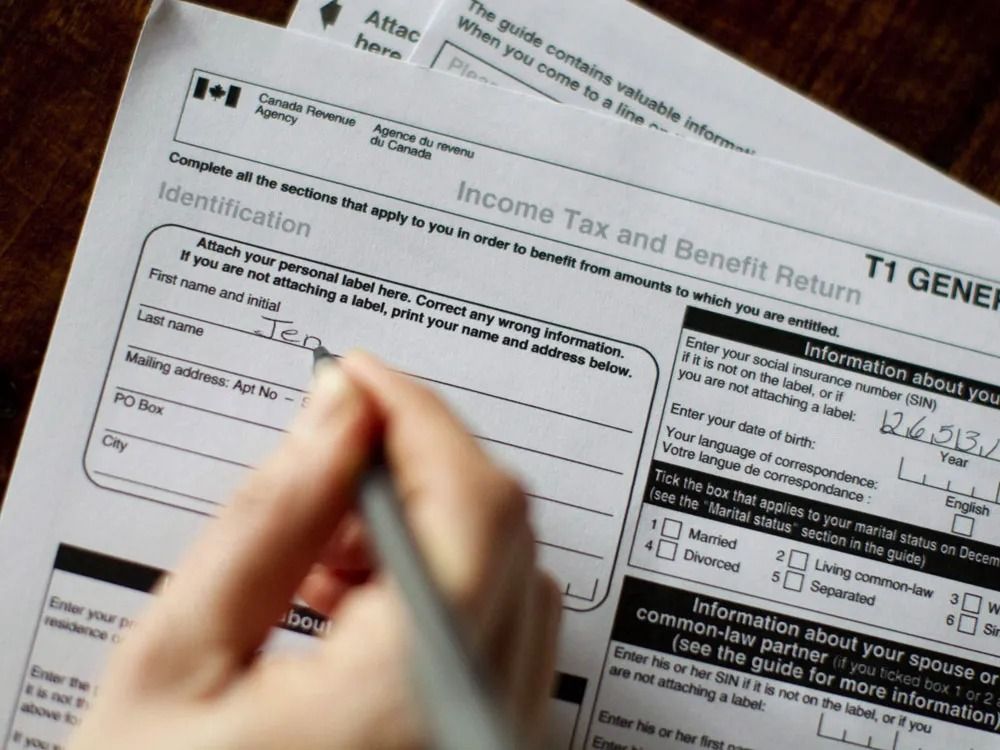

Many individuals’s aim is to make sure they get a reimbursement on their taxes. They’re, in essence, utilizing it like pressured financial savings and it’s a good way to maintain that cash protected from your self. Nonetheless, Canada Income Company (CRA) doesn’t pay you any curiosity on the cash they maintain for you. When you discover you persistently get giant tax refunds and your price range runs brief every month, one of many methods to extend your revenue is to scale back the quantity of tax withheld all year long.

Commercial 5

Article content material

That is attainable in case you have any tax credit included on the TD1 type you undergo the payroll division at work. As an alternative of benefiting out of your credit yearly, you’ll be able to profit every month when rather less is taken off every of your paycheques. As good as it’s to obtain that large lump sum each spring, the stress reduction from having a little bit of respiratory room each month shall be even higher.

You too can use your revenue tax refund to cowl anticipated, however considerably non-compulsory annual bills comparable to your summer season trip or desired house enhancements. Yearly since we’ve been debt free, my husband and I’ve used our refund cash to spend money on our house. There’s all the time one thing we need to do. If we are able to’t consider something immediately, we put the cash in our “house upkeep” financial savings account till we’re prepared to make use of it. We choose to make use of our personal cash, moderately than borrow and pay curiosity to the financial institution for our house enhancements.

Commercial 6

Article content material

When unsure, allocate your tax refund to your emergency financial savings account. Whether or not you’ve debt or not, having an emergency fund is essential to not being pressured to make use of credit score when an emergency arises. If residing by way of two years of the pandemic has taught us something, it’s how necessary it’s to be ready for the sudden. Having financial savings will enable you climate most issues that life can throw at you, together with a record-setting dump of snow in April.

Sandra Fry is a Winnipeg-based credit score counsellor at Credit score Counselling Society, a non-profit group that has helped Canadians handle debt for greater than 25 years.

_____________________________________________________________

For extra tales like this one, join for the FP Investor e-newsletter.

______________________________________________________________