The brand new monetary yr 2022-23 is right here and we’re hopefully abandoning the craziness that began with the brand new calendar yr.

I’m certain there was a cut-off date while you thought that the world as we all know it’s going to collapse…properly, perhaps it’s going to, nonetheless.

We’re hopeful creatures although. So, right here we’re, with a brand new hope in a brand new samvat.

What can we do higher this yr?

I put this out lately.

You assume the market makes you wealthy or takes away your cash. Properly, I hate to interrupt the information, however really, IT’S YOU!

— Unovest (@unovest) April 2, 2022

I maintain saying that we have to insulate from the noise, concentrate on the correct indicators to maintain us sane and make the most effective choices. That’s the place you get your behavioural alpha.

However how? It’s unimaginable to not get caught in narratives thrown at us from throughout.

Frankly, you and I would like a special mindset, a system, so to say, to have the ability to do that for us.

The place we don’t have to fret on a regular basis in regards to the markets, the place we really spend a lot much less time with it and but get extra out of it, with confidence

Ironic, however attainable!

So, with this new yr, I’m beginning down on a brand new journey and welcome you too. A journey known as – MarketLess. It’s a easy system…

- A system that will get your MORE from the market even while you spend much less time there.

- A system that helps you construct wealth to succeed in your monetary targets.

- A system that helps you keep away from huge silly strikes.

- A system that helps us execute with confidence.

There are 2 elements of this method that are already reside. Each aimed to comply with a system to assist us do much less and get extra.

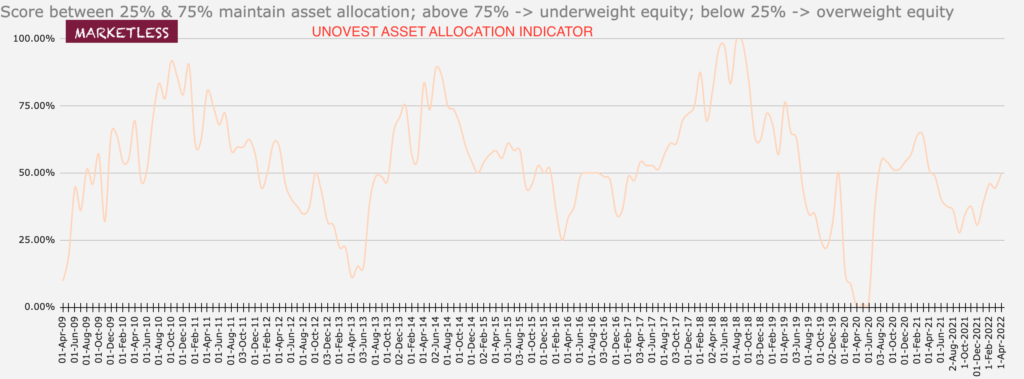

#1 You already know the primary one because the Market Indicator of Asset Allocation.

That is the generic half serving to us see what’s the neatest thing to do on the present market stage.

As you may see, the indicator says maintain investing systematically. It did NOT ask you to promote however to rebalance and preserve your asset allocation.

#2 SmallCase Portfolios

The opposite one is extra particular and is showcased within the two portfolios on the Smallcase platform.

#2.1 Core / strategic 60:40 portfolio. It respects asset allocation and allocates cash for development and safety of capital. A portfolio that ought to work regardless of the markets for long run targets. It may be used for lumpsum investments too.

#2.2 Tactical WealthCase 30. An energetic and dynamic allocation throughout market caps, sectoral and thematic passive methods. A tactical technique for driving alpha from the markets. Greatest outcomes with common investments over a minimal 3 yr interval.

Each the portfolios use ETFs to execute their respective methods. I’m blissful to say that they’ve now settled down.

I encourage you to subscribe to them as part of your portfolios. There’s a reduction accessible for individuals who subscribe to those portfolios within the month of April.

There’s going to be much more to MarketLess over time, every step designed to make you are worried much less about markets and but get extra in wealth creation, with easy to know and execute concepts.

And, lastly this…

A really highly effective thought.

“Wealth is measured on a calendar, not a calculator.” – Jack Butcher

— Unovest (@unovest) April 5, 2022

True wealth, actually, is time!

Asserting subsequent Digital Session – Our subsequent digital session “The way to go MarketLess in 2022” to speak about cash, investing, cash mindset, portfolios, markets, mutual funds, rates of interest, inflation goes to be on Saturday, April 9, 2022 from 10:30 am to 12:30 am. In the event you want to attend, please register right here.