Final Up to date on March 28, 2022

On this article, we clarify how we are able to use the freefincal robo advisory software to trace the progress of our monetary objectives. The robo software as many readers would know is a monetary planning software. It automates the method of systematic threat administration and suggests a variable asset allocation schedule with step-wise fairness discount.

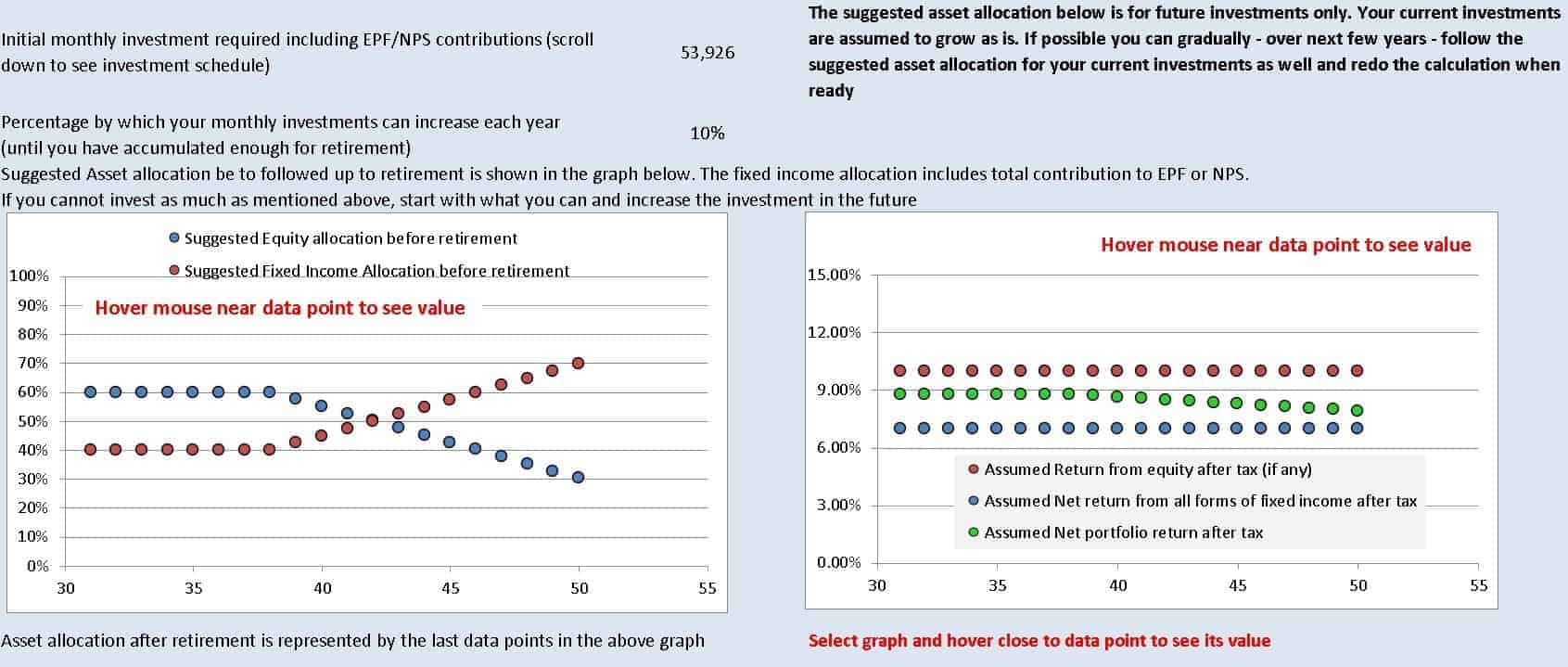

The above options have been demonstrated in a number of illustrations earlier than. A screenshot of the variable asset allocation schedule and the way the anticipated portfolio return adjustments are proven under. The funding schedule elements into these adjustments from day one.

As well as, the software additionally gives an in depth retirement bucket technique implementation plan to generate inflation-protected earnings after retirement by making an allowance for as much as three completely different sources of earnings (pension, hire and so forth.).

Video: Options of the Robo software defined

The right way to use the robo software to trace the progress of our monetary objectives?

Instance 1:

Take into account a 30-year-old with Rs. 40,000 month-to-month bills that may proceed in retirement. As well as, he has Rs. 40,000 as annual bills too (medical insurance premium and so forth,)

| Age he needs to retire | 50 |

| Years to retirement | 20 |

| Complete common month-to-month bills (annual/12) | 43,333 |

| Proportion by which month-to-month investments can enhance every year (till you’ve got collected sufficient for retirement) | 10% |

| Submit-tax return anticipated from fairness investments % | 10 |

| Submit-tax return anticipated from present taxable mounted earnings % | 6 |

| Fee of return anticipated from present tax-free mounted earnings % | 7 |

These percentages might be freely modified by the consumer on the back-end (settings web page).

We are going to assume no present investments.

| Inflation earlier than retirement (%) | 8 |

| The assumed life expectancy of the youthful partner (if married) | 90 |

| Inflation throughout retirement (%) | 8 |

| Years to retirement | 20 |

| Month-to-month bills within the first yr of retirement | 2,01,975 |

| Years in retirement (till youthful partner reaches age 90) | 40 |

Outcomes

| NET corpus required at retirement (assuming cash might be invested in several buckets. That is after accounting for the longer term worth of present investments, post-retirement advantages (cells C14-C18 in step 2) any post-retirement earnings laid out in step 2) | 9,53,63,113 |

| The GROSS Corpus required for retirement is (offered just for data. Your funding goal is the online corpus above | 9,53,63,113 |

So the goal corpus is about Rs. 9.5 Crores.

The beneficial asset allocation is 60% fairness for the following eight years after which steadily lowering to 36% on the time of retirement.

| Preliminary month-to-month funding required together with EPF/NPS contributions (scroll all the way down to see funding schedule) | 68,451 |

| Proportion by which your month-to-month investments can enhance every year (till you’ve got collected sufficient for retirement) | 10% |

So these are the outcomes obtained upon the primary use of the robo software.

One yr later, assuming the individual has invested as per the schedule and assuming his fairness and debt devices have grown to (together with positive aspects) Rs. 4L and Rs. 7 lakhs and Rs. 4 lakhs respectively.

If we account for this, the required corpus decreases. It is because we now have factored in how a lot the present funding will develop.

| NET corpus required at retirement (assuming cash might be invested in several buckets. That is after accounting for the longer term worth of present investments, post-retirement advantages (cells C14-C18 in step 2) any post-retirement earnings laid out in step 2) | 8,26,30,524 |

| The GROSS Corpus required for retirement is (offered just for data. Your funding goal is the online corpus above | 8,82,99,179 |

The month-to-month funding required additionally has decreased.

| Preliminary month-to-month funding required together with EPF/NPS contributions (scroll all the way down to see funding schedule) | 68,081 |

| Proportion by which your month-to-month investments can enhance every year (till you’ve got collected sufficient for retirement) | 10% |

Thus all a consumer has to do is to redo the calculations with recent inputs every year. Making an allowance for the collected corpus, the required goal corpus and the funding required will steadily lower. It is a sensible method to discover how shut we’re to reaching our purpose. The consumer can merely copy the above outcomes and paste them on a brand new sheet to examine their progress throughout years.

The proof of the pudding is to see the funding quantity required steadily lower. The robo software affords an correct method to observe the progress of our monetary objectives. Within the above-mentioned new tracker, we could have primary purpose monitoring options however these are primarily based on simplistic assumptions and is simply a ballpark estimate.

Instance 2:

Take into account a 45-year previous investor who needs to retire by 50. He needs to know the worth of his present corpus. Can he retire now as a substitute of 5 years from now? (additionally see video information under).

To do that, the consumer should set the retirement age as 45.

(a) Suppose he has about 1 Crore in belongings about 50% in fairness and 50% in debt. The software would say:

| Corpus mandatory to offer inflation-protected earnings for the primary 15Y in retirement. This quantity consists of an emergency corpus for about 13.3 Lakhs | 1,24,83,733 |

| Complete quantity in presently in hand | 1,00,00,000 |

| You won’t be able to generate an listed pension, along with common pension (if any), please think about shopping for an annuity along with your corpus preserving at the least the sum talked about (cell C36) above as emergency corpus |

So the consumer is aware of how rather more he has to build up. He can set the retirement age as 46, 47 and so forth. to learn how rather more he has to speculate.

(b) Suppose we enhance the present corpus to 75 Lakhs in fairness and 75 Lakhs in debt and set the retirement age again to 45. The present fairness: debt asset allocation is not going to affect the suggestions.

| Corpus mandatory to offer inflation protected earnings for first 15Y in retirement.This quantity consists of an emergency corpus for about 13.3 Lakhs | 1,24,83,733 |

| Complete quantity in presently in hand | 1,50,00,000 |

| ‘extra’ corpus accessible for funding | 25,16,267 |

| Corpus required to offer inflation protected earnings after the primary 15Y in retirement to the rest of your lifetime | 1,55,40,667 |

For an individual who remains to be working this is sufficient to say that they don’t seem to be but able to give up! For somebody who has stopped working, that is dangerous information. The software would additional say:

“The required corpus (cell B39) is simply too excessive. Chances are you’ll want to purchase an annuity along with your corpus at some point of your life. Please seek the advice of a trusted SEBI registered fee-only monetary planner, who expenses a flat charge to overview this case*”. Most advisors would additionally concur with this view and advocate an annuity with some stash for emergencies and a drastic discount in bills.

*The software recognises that there are various gray areas in retirement planning and a human advisor could also be mandatory for these. Whether or not they would do a greater job or not is an unknown although. Any consumer who appreciates commonsense ought to recognize the outcomes.

If the consumer will not be proud of these outcomes, a DIY bucket technique sheet is obtainable to design their very own retirement bucket (not beneficial at low corpus ranges).

(c) Suppose the consumer has belongings of about 3 crores, then the software is lastly pleased and outputs a retirement bucket technique. This implies the consumer is able to retire.

It is a snippet of the complete message. All return assumptions might be various. As well as, there’s a DIY bucket technique sheet accessible.

| Retirement Buckets | Quantity to be invested in every bucket |

| Earnings bucket (100% liquid mounted earnings) to offer earnings in retirement with a return of 6 % p.a. This can guarantee earnings for the primary 15 years in retirement | 1,19,05,373 |

| low threat bucket with 50 % mounted earnings (relaxation fairness) expeced to develop at a fee of 9 % p.a. | 73,13,253 |

| medium threat bucket with 30 % mounted earnings (relaxation fairness) expeced to develop at a fee of 9 % p.a. | 53,03,464 |

| Excessive threat bucket with 0 % mounted earnings (relaxation fairness) expeced to develop at a fee of 10 % p.a. | 39,77,910 |

Thus the robo software can be utilized to evaluate how quickly a consumer is able to retire by altering the retirement age and present asset and earnings sources.

Video Information

The right way to use the Robo Advisory Software to examine in case you are able to retire

Get the Robo Advisory Software

The software is an Excel file with macros. It is going to work on Mac Excel and Home windows Excel. All inputs are totally customisable. It may be used for business functions as properly. As of Feb 2022, 900+ buyers and monetary advisors are utilizing the software. Customers will get all future updates as properly.

Get the robo software by paying Rs. 5160 (Immediate Obtain. No refunds allowed). For assist write to freefincal [AT] Gmail [DOT] com.

Exterior India? Then use this Paypal hyperlink to pay USD 80 (Kindly write to freefincal [AT] Gmail [DOT] com after you pay).

Do share in the event you discovered this handy

About The Writer

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product growth. Join with him through Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You might be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for teenagers. He has additionally written seven different free e-books on varied cash administration matters. He’s a patron and co-founder of “Payment-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product growth. Join with him through Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You might be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for teenagers. He has additionally written seven different free e-books on varied cash administration matters. He’s a patron and co-founder of “Payment-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Use our Robo-advisory Excel Template for a start-to-finish monetary plan! Now with a brand new demo video! ⇐ Greater than 900 buyers and advisors use this!

Our flagship course! Study to handle your portfolio like a professional to realize your objectives no matter market situations! ⇐ Greater than 2700 buyers and advisors are a part of our unique group! Get readability on how you can plan in your objectives and obtain the mandatory corpus it doesn’t matter what the market situation is!! Watch the primary lecture without spending a dime! One-time cost! No recurring charges! Life-long entry to movies! Scale back concern, uncertainty and doubt whereas investing! Discover ways to plan in your objectives earlier than and after retirement with confidence.

Our new course! Improve your earnings by getting folks to pay in your expertise! ⇐ Greater than 620 salaried staff, entrepreneurs and monetary advisors are a part of our unique group! Discover ways to get folks to pay in your expertise! Whether or not you’re a skilled or small enterprise proprietor who needs extra shoppers through on-line visibility or a salaried individual wanting a facet earnings or passive earnings, we are going to present you how you can obtain this by showcasing your expertise and constructing a group that trusts you and pays you! (watch 1st lecture without spending a dime). One-time cost! No recurring charges! Life-long entry to movies!

My new e book for teenagers: “Chinchu will get a superpower!” is now accessible!

Most investor issues might be traced to a scarcity of knowledgeable resolution making. We have all made dangerous selections and cash errors after we began incomes and spent years undoing these errors. Why ought to our youngsters undergo the identical ache? What is that this e book about? As dad and mom, if we needed to groom one skill in our youngsters that’s key not solely to cash administration and investing however for any side of life, what wouldn’t it be? My reply: Sound Resolution Making. So on this e book, we meet Chinchu, who’s about to show 10. What he needs for his birthday and the way his father or mother’s plan for it and educate him a number of key concepts of resolution making and cash administration is the narrative. What readers say!

Should-read e book even for adults! That is one thing that each father or mother ought to educate their children proper from their younger age. The significance of cash administration and resolution making primarily based on their needs and wishes. Very properly written in easy phrases. – Arun.

Purchase the e book: Chinchu will get a superpower in your little one!

The right way to revenue from content material writing: Our new e book for these all for getting facet earnings through content material writing. It’s accessible at a 50% low cost for Rs. 500 solely!

Wish to examine if the market is overvalued or undervalued? Use our market valuation software (will work with any index!), otherwise you purchase the brand new Tactical Purchase/Promote timing software!

We publish mutual fund screeners and momentum, low volatility inventory screeners .each month.

About freefincal & its content material coverage Freefincal is a Information Media Group devoted to offering unique evaluation, reviews, opinions and insights on developments in mutual funds, shares, investing, retirement and private finance. We achieve this with out battle of curiosity and bias. Comply with us on Google Information. Freefincal serves greater than three million readers a yr (5 million web page views) with articles primarily based solely on factual data and detailed evaluation by its authors. All statements made might be verified from credible and educated sources earlier than publication. Freefincal doesn’t publish any paid articles, promotions, PR, satire or opinions with out knowledge. All opinions offered will solely be inferences backed by verifiable, reproducible proof/knowledge. Contact data: letters {at} freefincal {dot} com (sponsored posts or paid collaborations is not going to be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Objective-Primarily based Investing

Printed by CNBC TV18, this e book is supposed that can assist you ask the best questions, search the proper solutions, and because it comes with 9 on-line calculators, you too can create customized options in your way of life! Get it now. It is usually accessible in Kindle format.

Printed by CNBC TV18, this e book is supposed that can assist you ask the best questions, search the proper solutions, and because it comes with 9 on-line calculators, you too can create customized options in your way of life! Get it now. It is usually accessible in Kindle format.

Gamechanger: Overlook Startups, Be part of Company & Nonetheless Dwell the Wealthy Life You Need

This e book is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally enable you to journey to unique locations at a low value! Get it or reward it to a younger earner.

This e book is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally enable you to journey to unique locations at a low value! Get it or reward it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low-cost flights, price range lodging, what to do when travelling, how travelling slowly is healthier financially and psychologically with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 199 (on the spot obtain)

That is an in-depth dive evaluation into trip planning, discovering low-cost flights, price range lodging, what to do when travelling, how travelling slowly is healthier financially and psychologically with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 199 (on the spot obtain)

Free android apps