That is the third publication of the Market’s Compass US Index and Sector ETF Examine that’s being launched on my Substack Weblog. That is the final US Index and Sector ETF Examine that might be out there to free subscribers. This week’s weblog highlights the technical adjustments of the 30 US ETFs that we monitor on a weekly foundation. There are three ETF Research that embrace the Market’s Compass US Index and Sector ETF Examine, the Developed Markets Nation (DMC) ETF Examine and the Rising Markets Nation (EMC) ETF Examine. The three Research will individually be printed each three weeks. The DMC ETF Examine might be printed subsequent week. As at all times we propose readers view the ETF Research on a lap prime, Ipad or desk prime laptop.

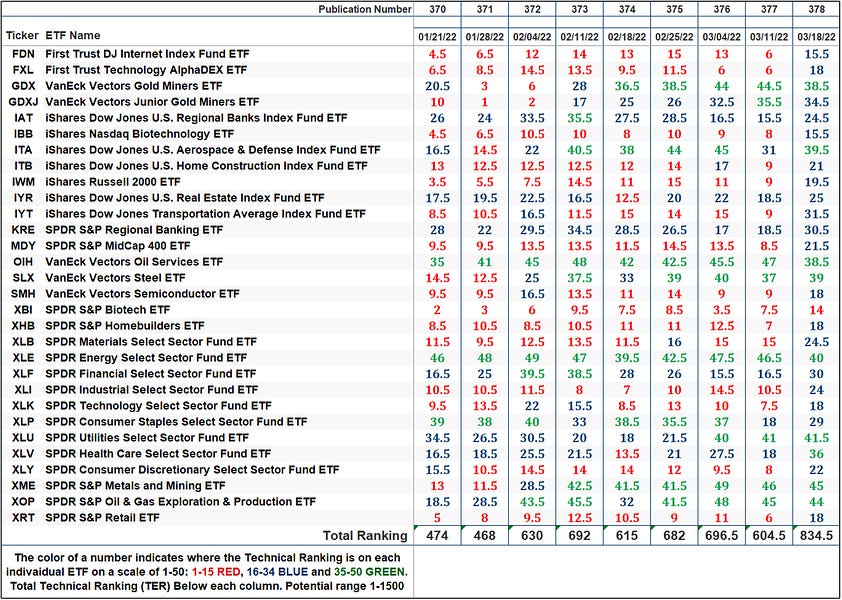

This Week’s and eight Week Trailing Technical Rankings of the 30 Particular person ETFs

The Excel spreadsheet beneath signifies the weekly change within the Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a wholly quantitative strategy that makes use of a number of technical concerns that embrace however aren’t restricted to pattern, momentum, measurements of accumulation/distribution and relative power. If a person ETFs technical situation improves the Technical Rating (“TR”) rises and conversely if the technical situation continues to deteriorate the “TR” falls. The “TR” of every particular person ETF ranges from 0 to 50. The first take away from this unfold sheet ought to be the pattern of the person “TRs” both the continued enchancment or deterioration, in addition to a change in route. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity could be seen as an overbought situation however with due warning over bought situations can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply grow to be extra overbought. A sustained pattern change must unfold within the “TR” for it to be actionable.

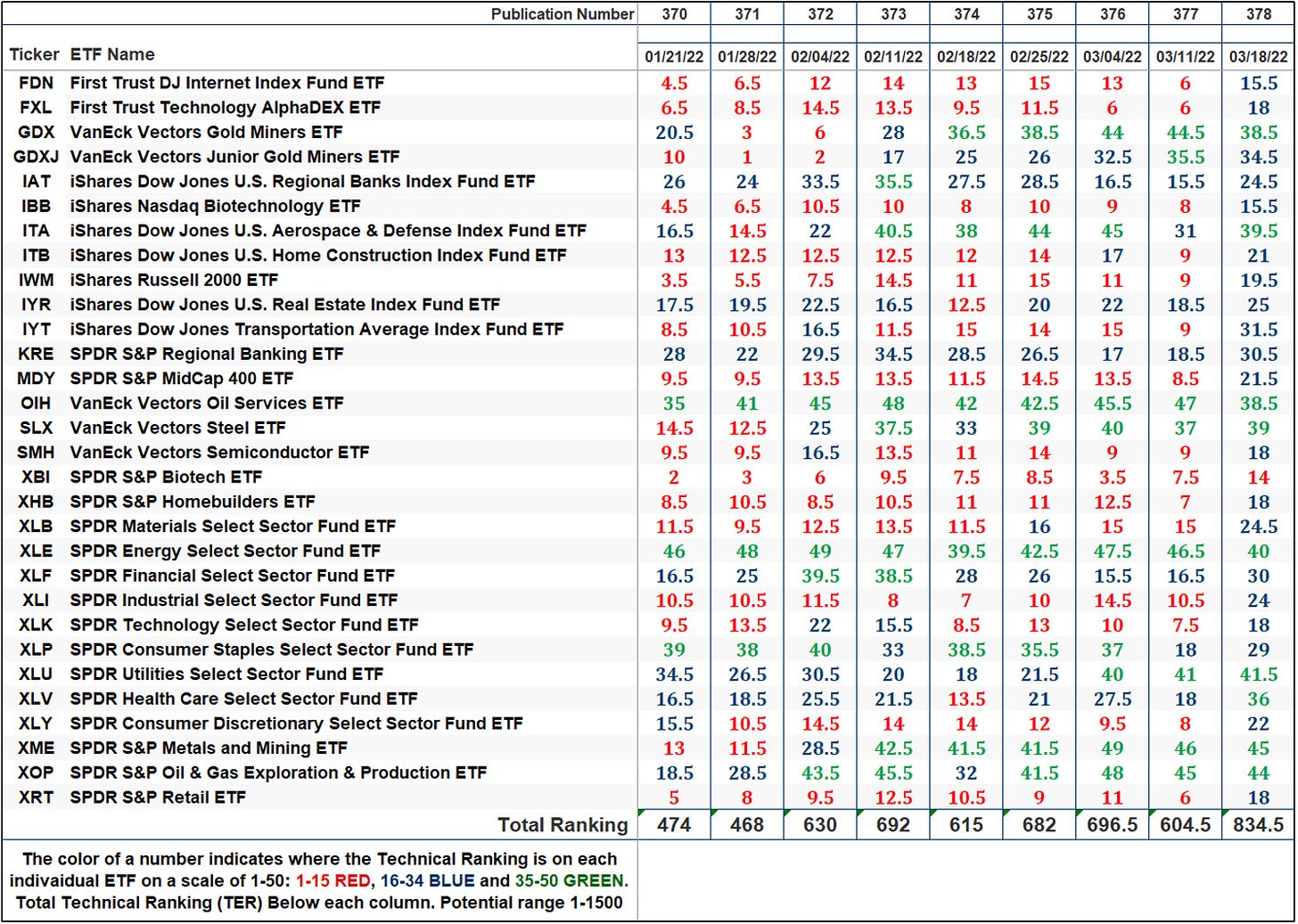

Three weeks in the past, we introduced consideration to the poor technical situation of the SPDR S&P Biotech ETF (XBI). This week the XBI was the one ETF that garnered a sub-fifteen studying including to the twelve-week run of sub-fifteen readings (Excel Spreadsheet above). This was regardless of final week’s +2.63% worth rally within the ETF. On the threat of repetition, we’re presenting an up to date chart beneath. Be aware that relative to the SPX (backside panel) there was nary a touch of enchancment relative to the massive cap index. Following the worth chart are the highest 15 holdings within the ETF.

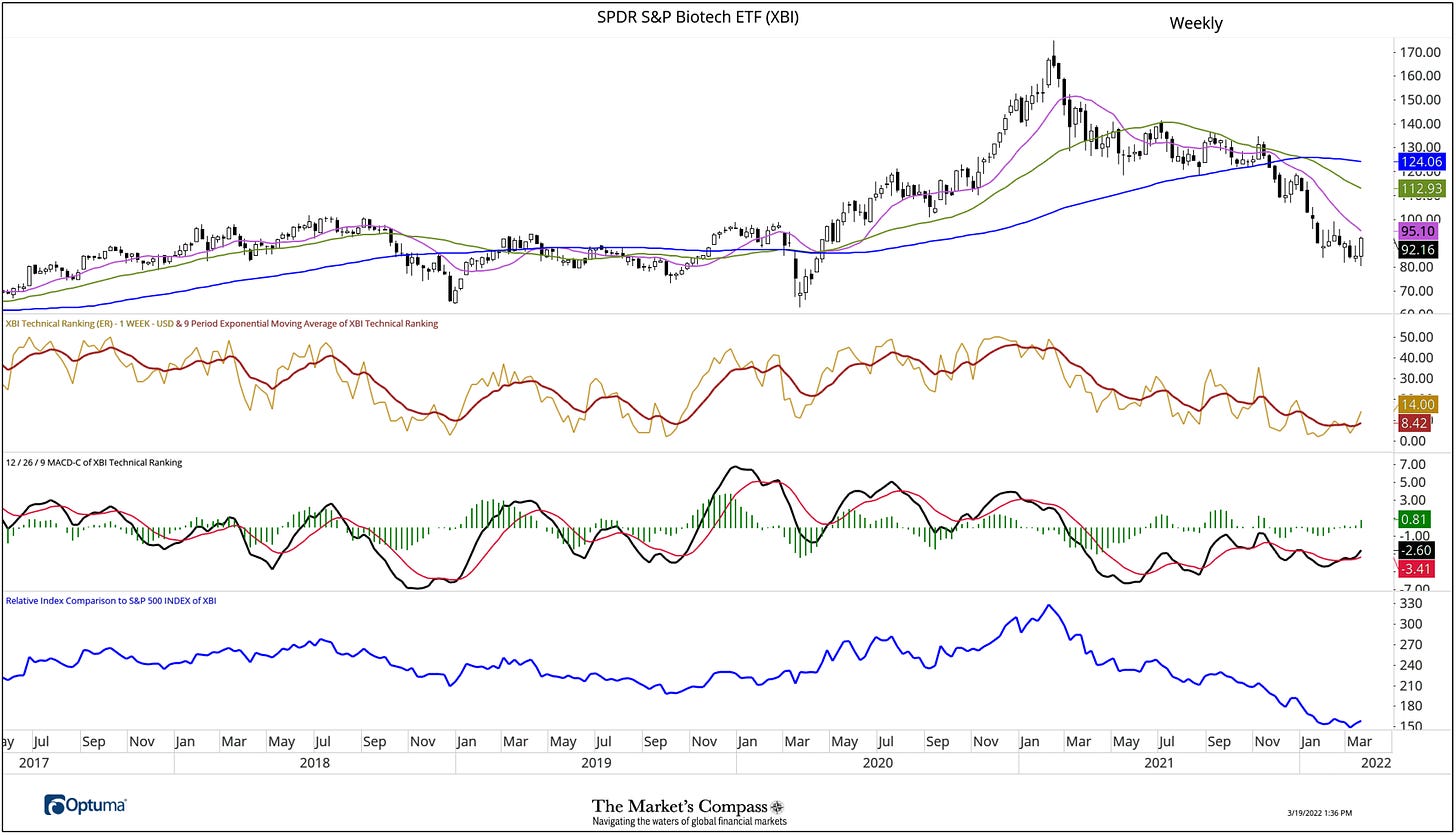

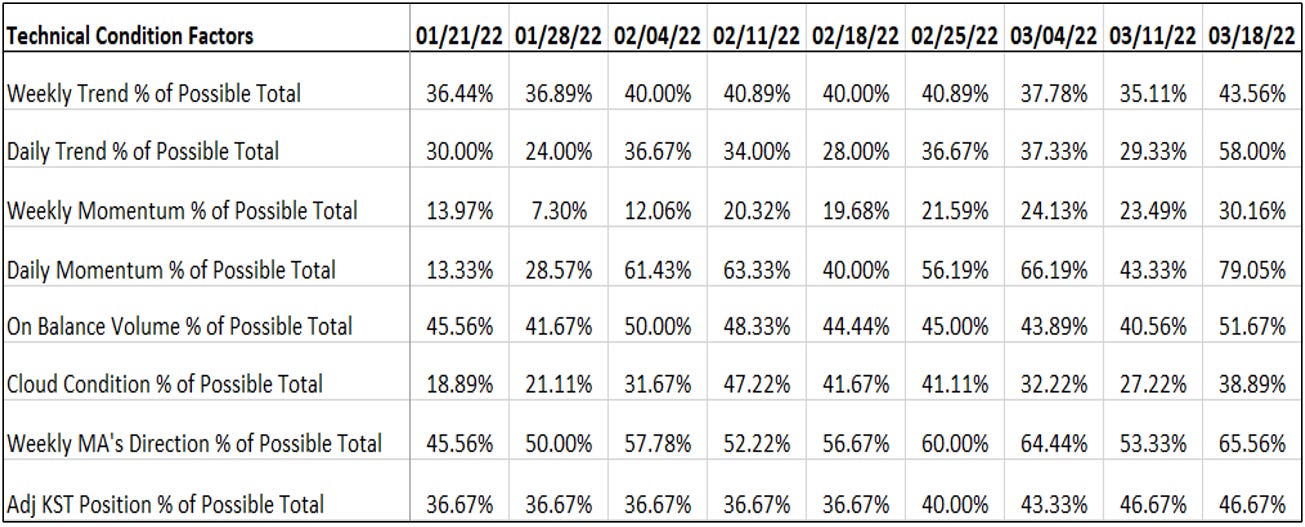

The Technical Situation Components

There are eight Technical Situation Components (“TCFs”) that decide particular person TR scores (0-50). Every of those 8 TCFs ask goal technical questions (see the spreadsheet posted beneath). If a technical query is constructive a further level is added to the person TR. Conversely if the technical query is unfavourable, it receives a “0”. A couple of TCFs carry extra weight than the others such because the Weekly Pattern Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 30 ETFs. Due to that, the excel sheet beneath calculates every issue weekly studying as a p.c of the doable complete. For instance, there are 7 concerns (or questions) within the Day by day Momentum Situation (“DMC”) of the 30 ETFs (or 7 X 30) for a doable vary of 0-210 if all 30 ETFs had fulfilled the DMC standards the studying can be 210 or 100% . This previous week a 79.05% studying of the DMC was registered, or 166 of a doable complete of 210 constructive factors. One technical take away can be if the DMC rises to an excessive between 85% and 100% it could recommend a brief time period over purchased situation was growing. Conversely a studying within the vary of 0% to fifteen% would recommend an oversold situation was growing. As a affirmation software, if all eight TCFs enhance on per week over week foundation, extra of the 30 ETF TCFs are enhancing confirming a broader market transfer greater (consider an advance/decline calculation).

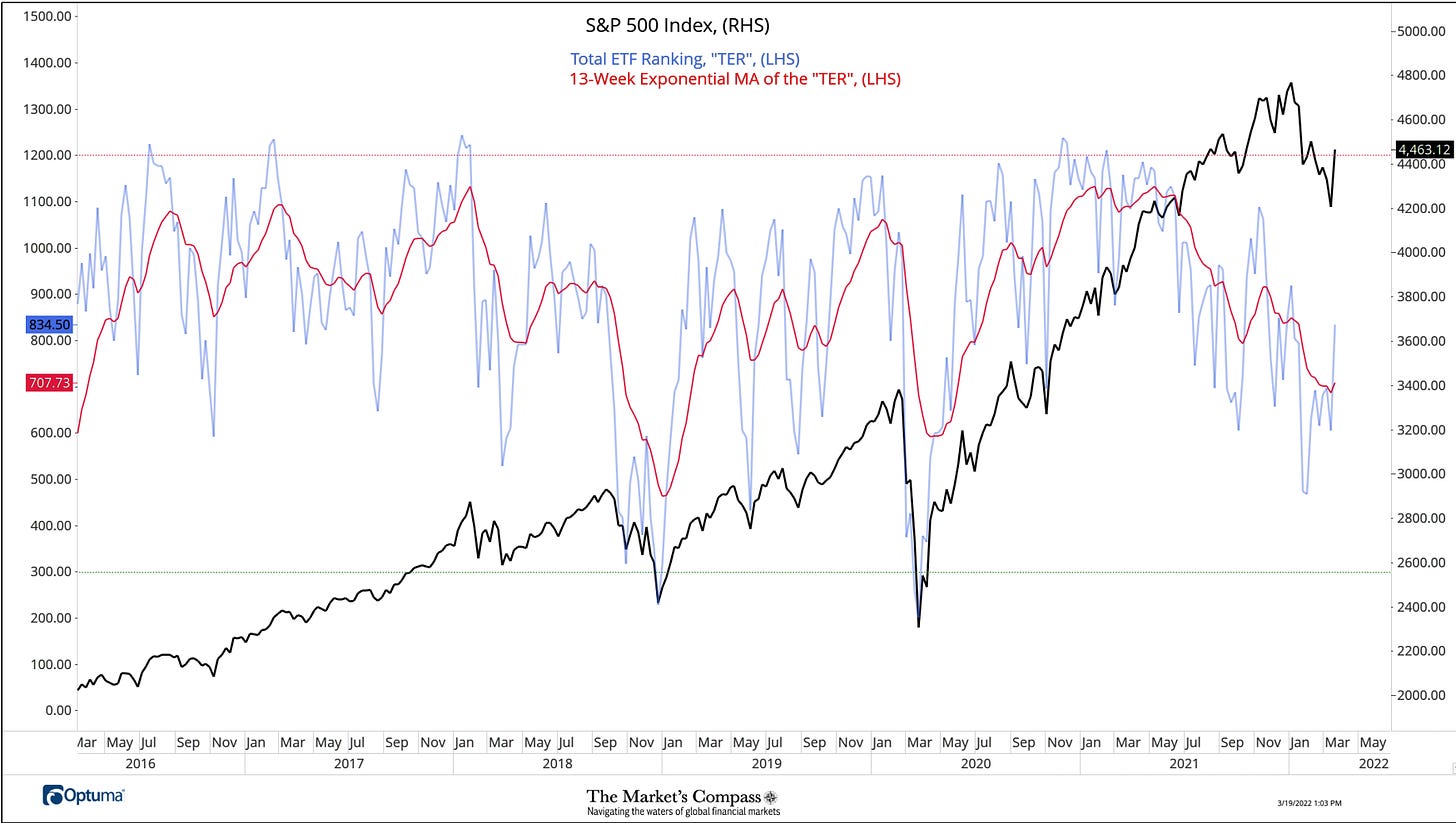

The SPX Index with This Week’s Whole ETF Rating “TER” Overlayed

The “TER” Indicator is a complete of all 30 ETF rankings and could be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence software: If the broader market as measured by the SPX Index (SP) continues to rally with no commensurate transfer or greater transfer within the “TER” the continued rally within the SPX Index turns into more and more in jeopardy. Conversely, if the SPX Index continues to print decrease lows and there’s little change or a constructing enchancment within the “TER” a constructive divergence is registered. That is, in a trend, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the “TER” will get to the 1500 stage (all 30 ETFs having a “TR” of fifty) “issues can’t get a lot better technically” and a rising quantity particular person ETFs have grow to be “stretched” the extra of an opportunity of a pullback within the SPX Index, On the flip facet the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near be in place. The 13-week exponential transferring common in Purple smooths the unstable “TR” readings and analytically is a greater indicator of pattern.

As could be seen above, the Whole Technical Rating (“TER”) rose to 834.5 from 604.5. The +38.05% achieve within the TER was one of the best WoW change within the TER because the +55.36% WoW achieve within the week ending 11/6/20 that marked the tip of a sideways 3-month correction within the giant cap index. As we’ve mentioned earlier than, one of the best ways to analytically view the longer pattern is to concentrate on the 13-week Exponential transferring common (crimson line) which continues to trace decrease regardless of the latest minor hook greater and it ought to be famous that the TER has risen again above the transferring common.

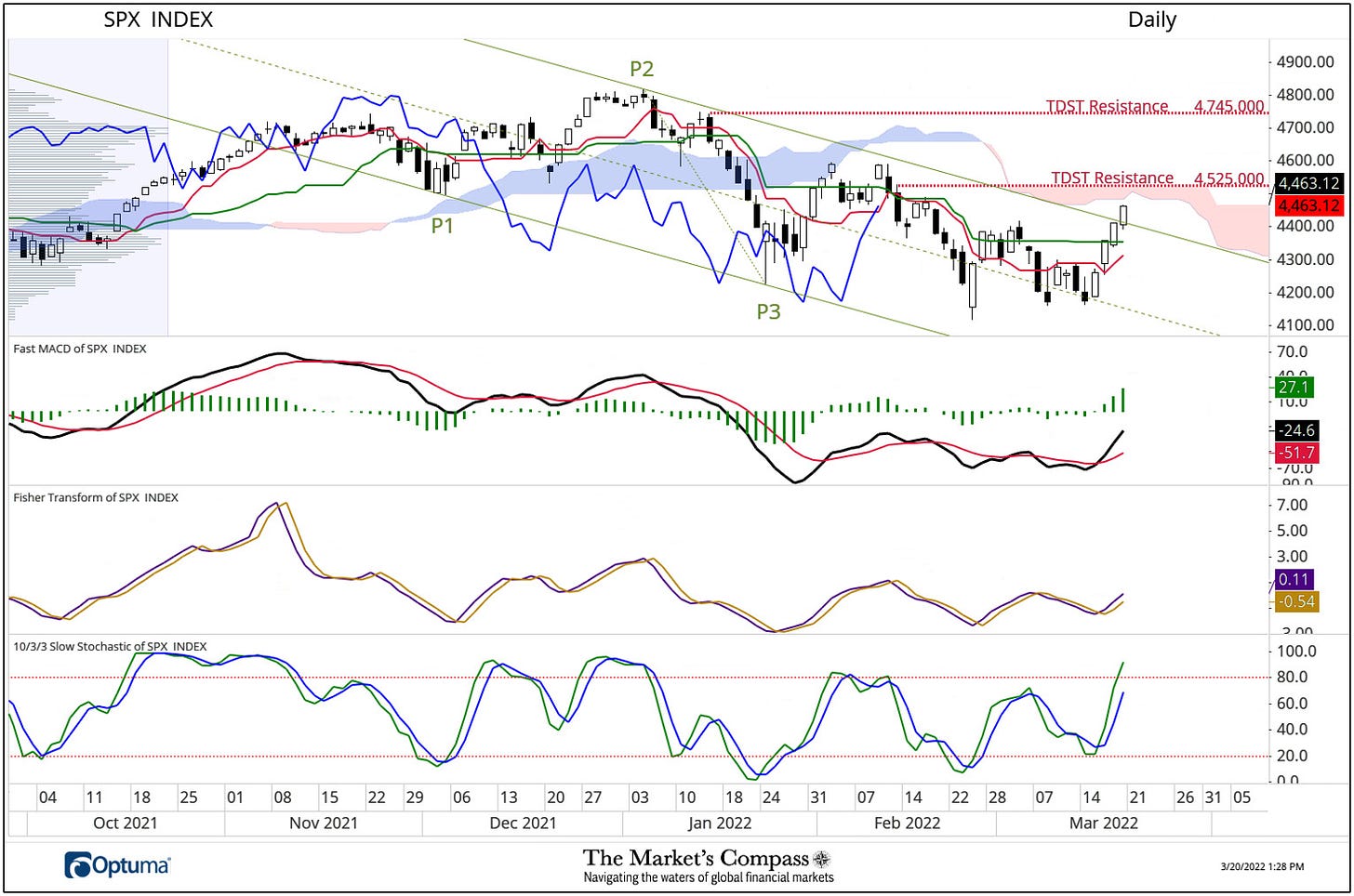

Quick time period ideas on the technical situation of the SPX Index.

In a twitter publish final Thursday we introduced consideration to the three white troopers (chart above) and though they aren’t tall in stature or good, nor are their heads and bottoms “shaven”, the three day candle sample was about to mount an assault on the Higher Parallel of the Schiff Modified Pitchfork. With Friday’s observe by way of rally the SPX overtook the Higher Parallel. The big cap index nonetheless has hurdles forward within the type of TDST resistance and the Cloud (confluence of resistance could be formidable) nevertheless it seems from a look on the momentum oscillators that the SPX has the wind at it again growing the chances that will probably be profitable in overtaking each.

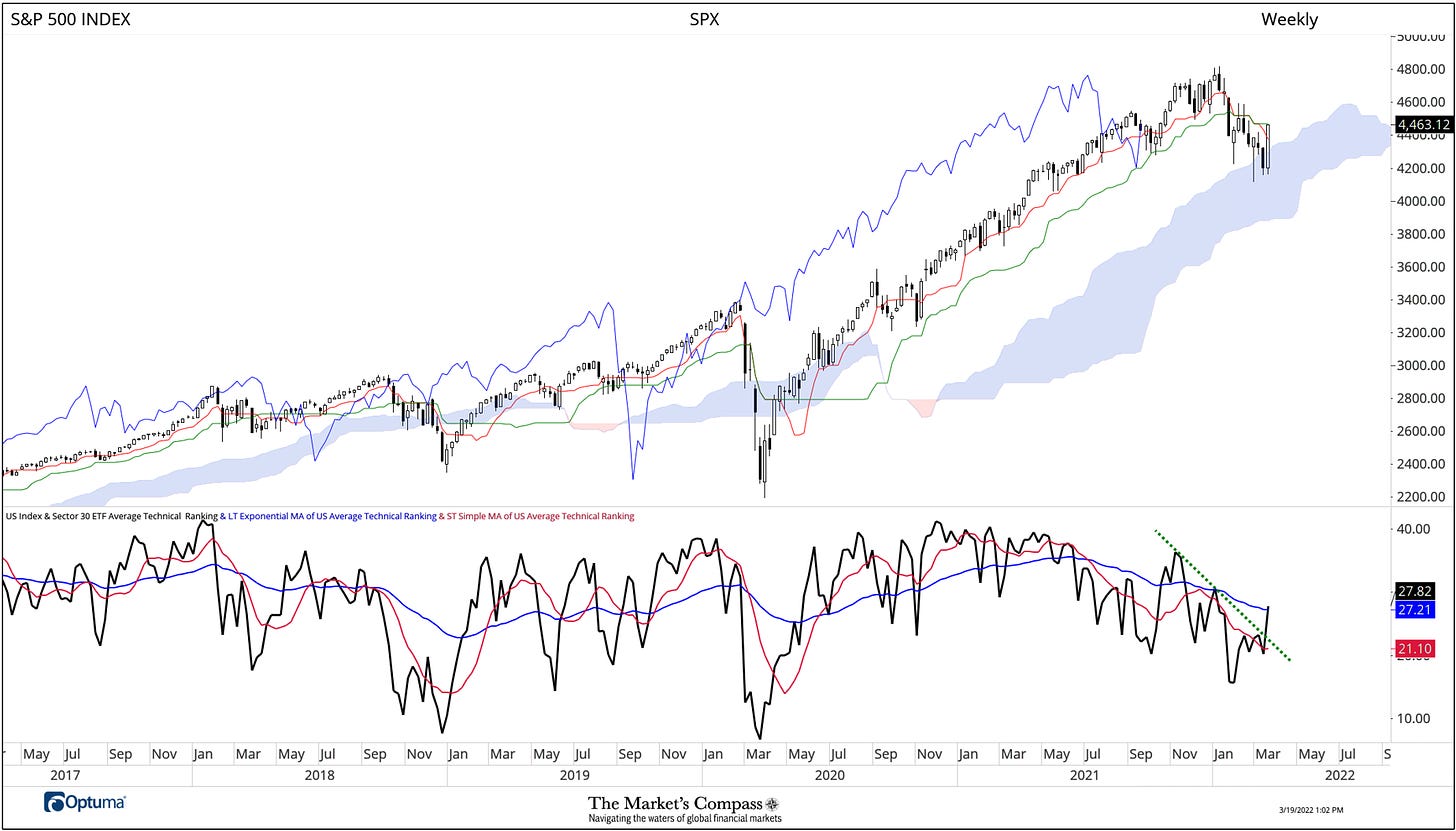

The Common Technical Rating of the 30 US Index and Sector ETFs

The weekly Common Technical Rating (“ATR”) is the typical Technical Rating (“TR”) of the 30 US Index and Sector ETFs we monitor. Just like the “TER”, it’s a affirmation/divergence or overbought/oversold indicator.

The SPX Index rallied +6.16% final week discovering it’s means again above the Weekly Cloud closing simply off the highs of the week though the advance has so far been capped by the Kijun Plot (inexperienced line). That marked one of the best weekly achieve because the November 6, 2000 weekly achieve of 239.48 factors or +7.32% that marked the tip of a nine-week sideways worth correction. The Common Technical Rating (“ATR”) rose to 27.82 which marks one of the best stage because the flip of the yr. Though the ATR didn’t print the next excessive it did breakout of the 5 month down pattern (inexperienced dashed line) and it nudged its means simply above the longer-term Exponential transferring common (blue line).

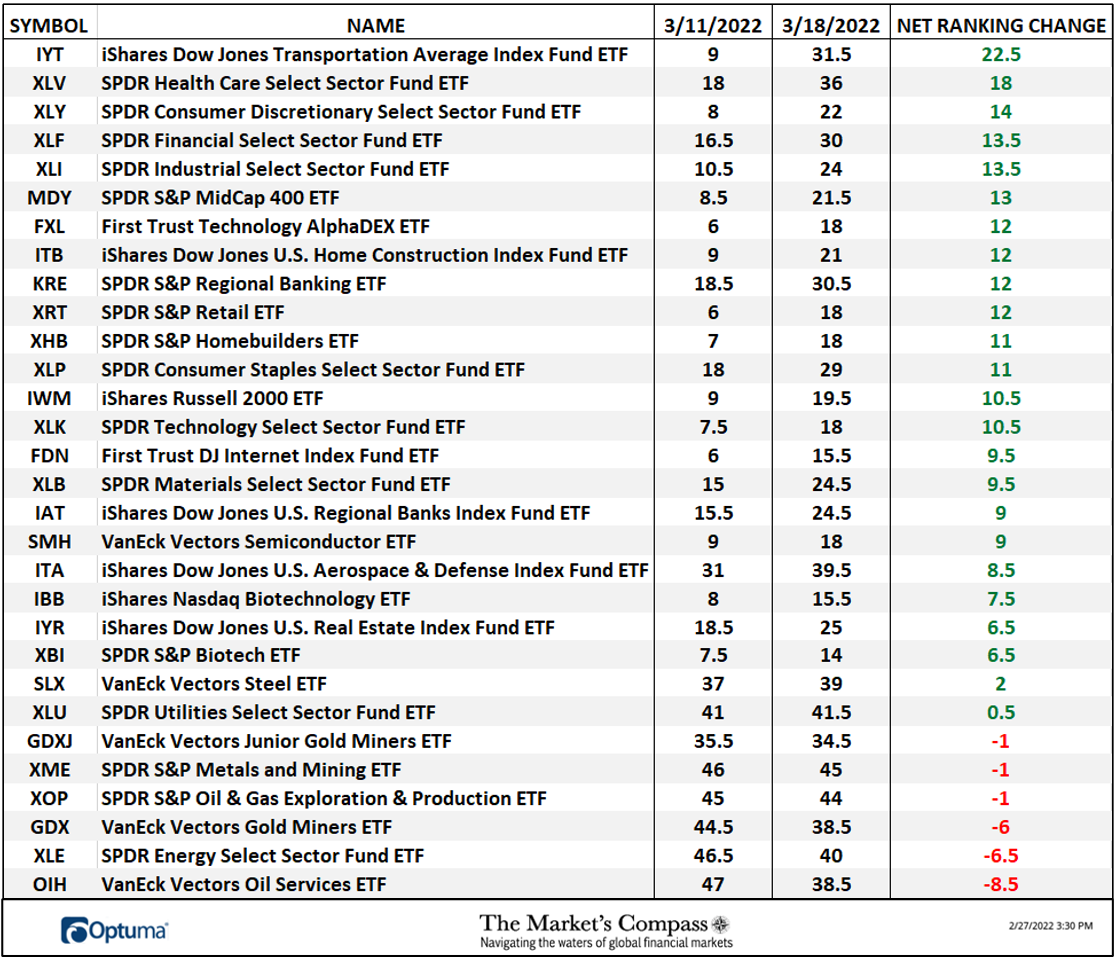

The Week Over Week Change in Technical Rankings

The most important positive factors in Technical Rating (“TR”) adjustments week over week had been in ETFs that had lagged the broader market as of late. The typical TR change of +7.67 was the most important common achieve in latest reminiscence. Twenty-four ETFs noticed positive factors of their TRs and 6 moved decrease versus the earlier week when 7 noticed improved TRs, 3 had been unchanged and 20 TRs moved low for a mean TR change of -3.07%.

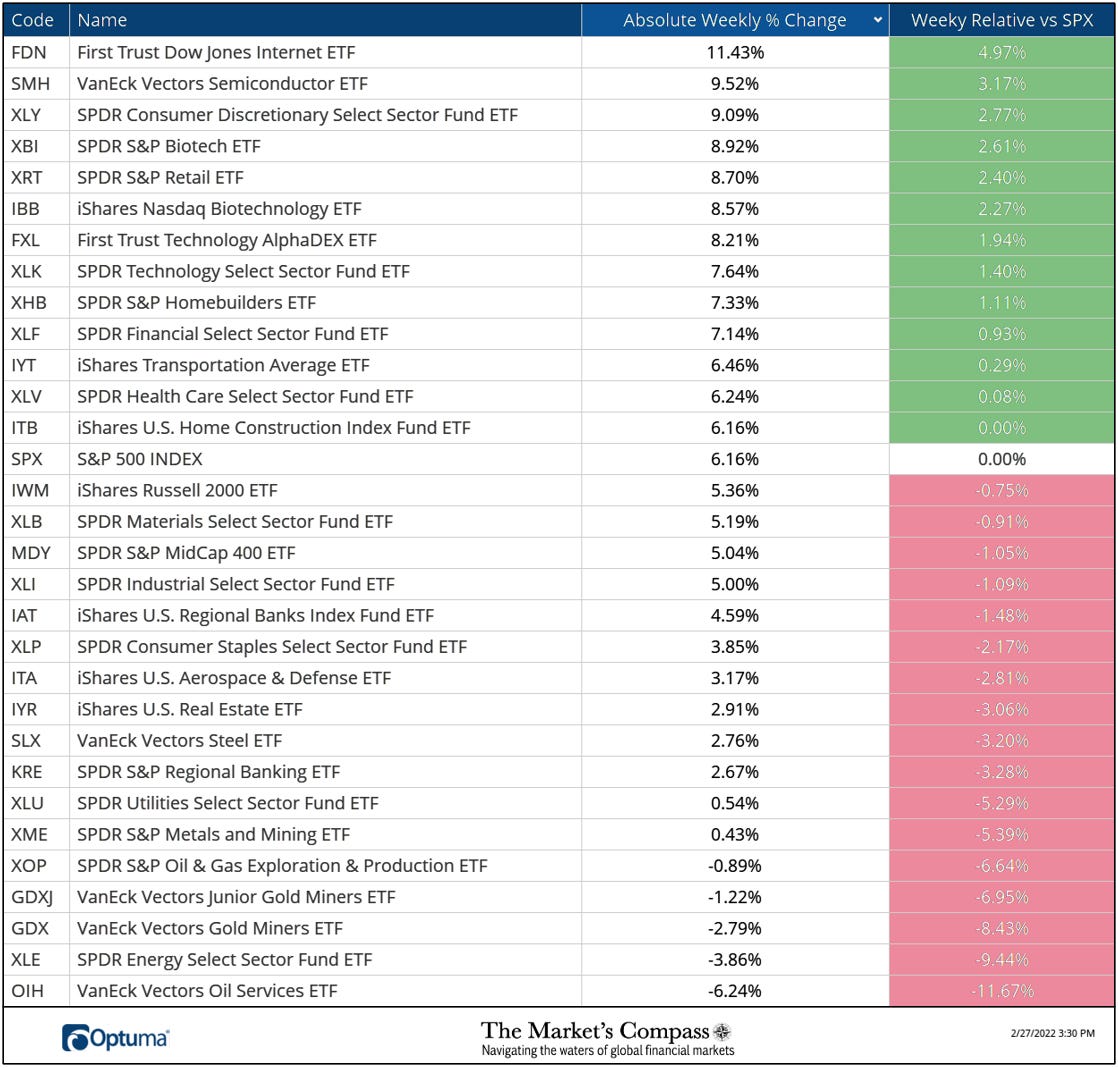

The Weekly Absolute and Relative Worth % Change of the 30 ETFs*

*Doesn’t embrace dividends

Twenty-five ETFs registered absolute positive factors on the week and 5 traded decrease. The typical absolute achieve within the 30 ETFs was +4.45%. The 2 greatest absolute performing ETFs on the week had been the First Belief Dow Jones Web ETF (FDN) and the Van Eck Vectors Semiconductor ETF (SMH) up +11.43% and +9.52% respectively. As could be seen within the unfold sheet above each ETFs ended Friday’s buying and selling session with the strongest positive factors of the 30 U.S. ETFs we monitor in these pages. Each ETFs have seen a measurable flip in worth momentum as witnessed the flip in MACD on the Day by day charts of the ETFs beneath. The highest 15 Members observe.

FDN Holdings

SMH Holdings

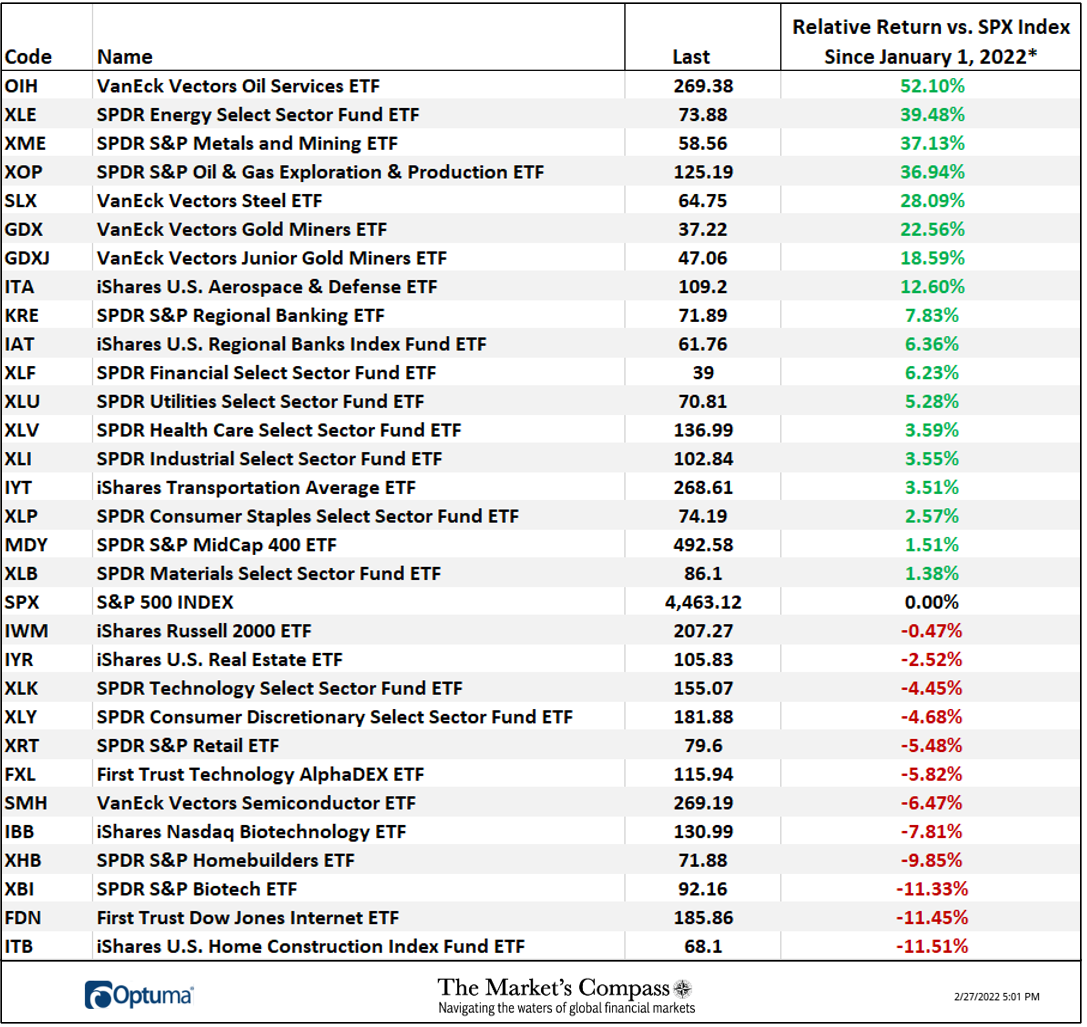

The Relative Return of the 30 ETFs Vs. the SPX Index 12 months to Date*

*Doesn’t embrace dividends

All charts are courtesy of Optuma. All ETF holdings knowledge is courtesy of Bloomberg. I invite our readers to contact me with any questions or feedback at…[email protected]