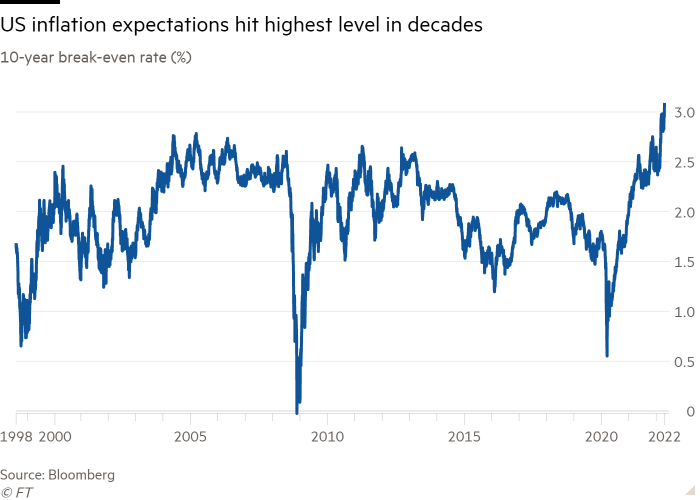

Traders’ expectations for US inflation have shot to their highest stage in a long time even because the Federal Reserve indicators an aggressive tightening of financial coverage is imminent, underscoring the problem central banks face in convincing markets they’ll tame runaway value development.

A historic bond rout has intensified this week as officers from each the Fed and the European Central Financial institution stepped up their inflation-fighting rhetoric. However the hawkish message has carried out little to arrest an increase in long-term inflation expectations, that are watched carefully by central bankers involved that they’ll turn into self-fulfilling.

The US 10-year break-even — a carefully watched gauge of market inflation expectations over the subsequent decade — climbed to three.08 per cent on Friday, the very best stage in a minimum of twenty years. Break-evens measure the distinction in conventional US authorities bond yields and people on inflation-adjusted Treasuries.

Janet Yellen, Treasury secretary, and a former Fed chief, acknowledged on Friday that the interval of elevated inflation would most likely final “for some time longer”, though she stated the speed of value development could have peaked.

Yellen’s feedback got here after Jay Powell, Fed chair, stated on Thursday that “it’s acceptable in my opinion to be transferring just a little extra shortly” to fight inflation, which is operating on the quickest tempo in 40 years, and despatched his strongest sign up to now that the central financial institution is ready to ship a half-point rate of interest enhance at its subsequent coverage assembly in Could.

“Central bankers appear to be at this level of most stress on inflation,” stated Mark Dowding, chief funding officer at BlueBay Asset Administration. “The market is giving the message that you simply had been complacent on inflation for too lengthy, it’s time to get on with it.”

Markets at the moment are pricing in extra-large 0.5 proportion level charge rises at every of the Fed’s subsequent three conferences, with hypothesis about an excellent bigger 0.75 proportion level adjustment brewing.

Krishna Guha, a former Fed staffer who’s now vice-chair at Evercore ISI, stated the chance of that form of transfer was “nonetheless very low”, however added the central financial institution wanted to speak extra clearly about its strategy to setting financial coverage.

“When Fed officers sound extra hawkish . . . market contributors understand elevated concern on the a part of the Fed in regards to the medium-term inflation outlook and replace their very own beliefs accordingly,” he stated. “So inflation break-evens enhance reasonably than lower on the hawkish shift, which in flip pushes Fed officers to sound extra hawkish, chasing their very own tails.”

Powell on Thursday additionally prompt the Fed may have to lift rates of interest to a stage that actively begins to constrain development, however pushed again on the concept the Fed might want to provoke a pointy recession with the intention to deliver inflation again to its 2 per cent goal. He affirmed {that a} “mushy touchdown” for the economic system remained the central financial institution’s aim.

That message has left some buyers questioning whether or not the Fed will enable inflation to stay elevated for longer, in line with analysts at Barclays.

Very excessive inflation expectations in markets are partly a mirrored image of the present charge of client value rises within the US, which reached 8.5 per cent in March following a surge in the price of power and meals. However even five-year five-year inflation swaps, a special measure favoured by central bankers that strips out present inflation ranges and appears on the second half of the subsequent 10 years, have hit their highest level since 2014 at 2.84 per cent.

The image is analogous within the eurozone the place five-year five-year inflation trades at 2.45 per cent, the very best since 2013. ECB president Christine Lagarde prompt on Thursday that the bloc’s financial institution will probably be much less aggressive than the Fed in performing to tame inflation as she appeared alongside Powell on the IMF panel.

Nonetheless, latest feedback from some the ECB president’s colleagues have alerted markets to the potential for earlier tightening than beforehand thought. Vice-president Luis de Guindos stated earlier this week {that a} charge enhance — the ECB’s first since 2011 — may come as early as July.

German two-year bond yields, that are extremely delicate to ECB charge expectations, climbed to their highest stage since 2013 on Friday.