Right here’s the news. You’re placing collectively or updating your checklist of small enterprise accounting providers. No person is aware of your experience and strengths higher than you. However … is that sufficient?

Not fairly. You additionally must know what providers resonate with enterprise house owners (give the folks what they need!). Learn on for a listing of accounting and tax providers for small enterprise—and past—you could contemplate providing.

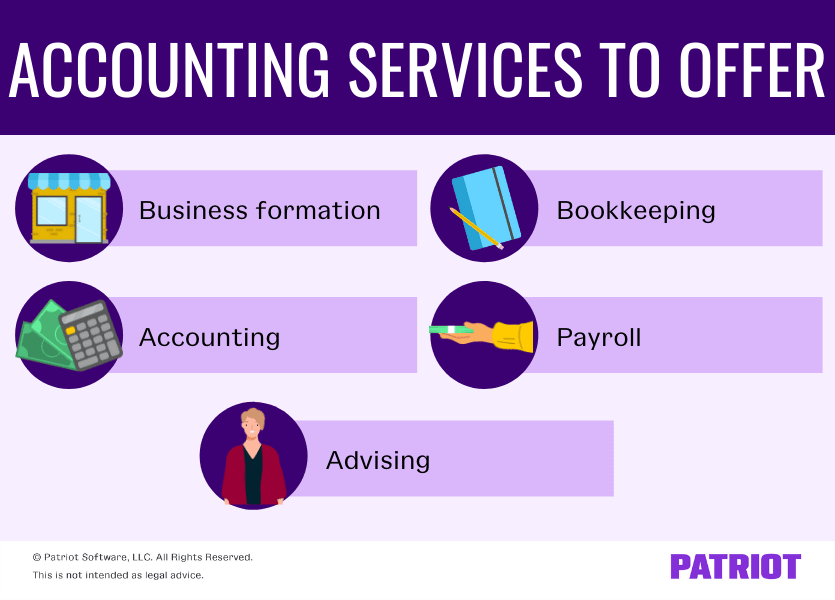

Small enterprise accounting providers to think about providing

Check out the next classes of accounting providers purchasers search for, in addition to the various providers nested beneath every:

- Enterprise formation

- Accounting

- Bookkeeping

- Payroll

- Advising

1. Enterprise formation

Do companies flip to accountants or legal professionals when forming their enterprise? Likelihood is, the reply is sure to each. Many enterprise house owners work with each accountants and small enterprise legal professionals to assist them with the intricacies of enterprise formation.

Providing enterprise formation providers will help you entice long-term purchasers at first of their work trip. You could supply providers that assist purchasers:

- Determine on a enterprise construction

- Register their enterprise with the right companies

- Finances their startup

- Get the suitable licenses and permits

- Finance their new enterprise

Beginning a enterprise is thrilling, but in addition aggravating and overwhelming. By providing providers particularly for amateur entrepreneurs, you possibly can poise your self as a trusted adviser who’s there from the get-go.

2. Accounting

Clearly, purchasers count on you to supply accounting providers for small enterprise. In spite of everything, it’s within the title. Whereas bookkeeping providers are extra administrative and transactional, accounting is the artwork of utilizing, analyzing, and deciphering that bookkeeping knowledge.

There are a number of forms of providers you possibly can categorize as true “accounting” providers, together with:

- Tax planning and consulting

- Auditing

- Money movement forecasting

- Monetary assertion evaluation and interpretation

Certain, your purchasers could use accounting software program to handle their transactions and generate monetary statements. However, your accounting providers assist purchasers interpret their knowledge, catch any knowledge entry errors, establish money movement points, solidify determination making, and extra.

3. Bookkeeping

Bookkeeping providers for small enterprise is one other service purchasers need and count on from their accountants. Once more, bookkeeping is the day-to-day activity of recording transactions and sustaining up-to-date data.

You could supply must-have providers like:

- Financial institution reconciliation

- Month-end shut

- Transaction recording

- Recordkeeping

- Accounts payable

- Accounts receivable

- Monetary assertion creation

Not all small companies use bookkeeping providers from their accountant. Many small corporations go for dealing with bookkeeping themselves utilizing spreadsheets or software program to chop prices. Perform a little research on how a lot to cost for bookkeeping to set a good worth that appeals to cost-sensitive enterprise house owners.

Need to assist your purchasers on a finances hold their books organized and up-to-date? Contemplate partnering with an accounting software program supplier to equip your purchasers with a simple solution to observe and manage their day-to-day transactions.

4. Payroll

Within the pre-software days, many accounting professionals shied away from providing payroll providers. It was time-consuming to manually run payroll for a number of purchasers and sustain with ever-changing tax legal guidelines. However now, due to on-line payroll, that is one accounting service for small enterprise you don’t wish to miss. Providing payroll providers to your purchasers is just not solely fast and straightforward, it’s anticipated.

Shoppers count on accountants to supply payroll providers. To not point out, doing so might be an effective way to supply new purchasers and upsell different providers.

In the event you determine to supply payroll providers, you could utterly deal with payroll in your purchasers’ behalf. Or, you may supply a co-branded payroll answer (i.e., software program) and let your purchasers run payroll themselves.

No matter you determine, payroll-related providers you could supply embody:

- Worker time monitoring

- Recordkeeping

- Working payroll and paying your purchasers’ workers

- Automated payroll tax filings and deposits

- Making ready and distributing Varieties W-2

- Worker advantages consulting

Make it simple on your self: Companion with a cloud payroll software program supplier to streamline your tasks so you possibly can focus in your purchasers, not the executive hardships of payroll.

5. Advising

Final however not least, one of many many hats you put on as an accounting skilled is that of a trusted advisor. So, it’s solely becoming that you simply supply advising or consulting providers.

You could assist purchasers:

- Make enterprise and administration selections

- Safe funding

- Select software program or providers that may assist their enterprise

Advising is a kind of providers that comes naturally when your purchasers flip to you for assist with their books. Or, purchasers could flip to you solely in your skilled recommendation. Regardless of the case, turning into your purchasers’ trusted advisor is a key a part of growing a robust client-accountant relationship and model loyalty.

Companies finalized? Verify. Now what?

In the event you’re able to roll along with your checklist of small enterprise accounting providers, you could be questioning what’s subsequent.

After growing or expounding on the providers you supply, your subsequent steps could embody:

- Arising with a good and aggressive pricing construction: “How a lot time will I be placing into this service? What do rivals within the space cost? How a lot are my purchasers prepared to pay?”

- Upselling and cross-selling providers: “I’m glad you’re having fun with our bookkeeping service. Have you ever heard about our new payroll service?”

- Gathering suggestions from purchasers: “Thanks for attempting out our new payroll service! How has it helped your small business?”

To let purchasers learn about any modifications to your checklist of providers, replace your accounting web site, submit about it in your social profiles, and ship out emails. It’s also possible to collect suggestions from purchasers through e-mail surveys.

This isn’t meant as authorized recommendation; for extra info, please click on right here.