Think about this: it’s time to your annual household trip.

Possibly it’s a yearly journey to the seaside. Or maybe your loved ones heads out west every year for snowboarding and snowboarding.

The truth is, it doesn’t even must be a household trip or a visit of any variety.

Possibly it’s a one-time expense that you simply’ve been laying aside, like a root canal on the dentist’s workplace. It might even be a recurring annual expense like Christmas presents for the entire household.

No matter it’s, the purpose is that it’s been in your calendar for the previous few months, however in some way, time has a sneaky manner of flying by and all of the sudden the expense is in your doorstep.

How do you pay for it? With a bank card? Do you faucet into your emergency financial savings account? Do you come up with the money for in your common financial savings account?

Regardless of who you might be, I’m positive we will all relate to the same expertise. The time to pay comes, however all you’ve gotten is that sinking feeling in your abdomen and one urgent query: how on the earth am I going to pay for all of this?

Enter: Sinking Funds.

No, they don’t have anything to do with that “sinking,” pit of your abdomen feeling. And it has nothing to do with sinking ships both.

You see, there are various methods to save cash, however the problem is that they’re both hyper-specific or too generic. Retirement accounts, for instance, are glorious methods to save cash, however their use is particular to your retirement. You may’t (or shouldn’t) pull cash out of your retirement account for these one-time, irregular, and predetermined bills.

However, whereas a financial savings account is nice to have and it is best to undoubtedly be saving, it may be troublesome to search out the motivation to avoid wasting and not using a particular objective. Plus, financial savings accounts are sometimes meant for long-term targets in any case.

These are all glorious explanation why sinking funds are so vital to your funds! However what precisely are they?

What’s a Sinking Fund?

Merely put, a sinking fund is a short-term financial savings account for a particular, predetermined upcoming expense.

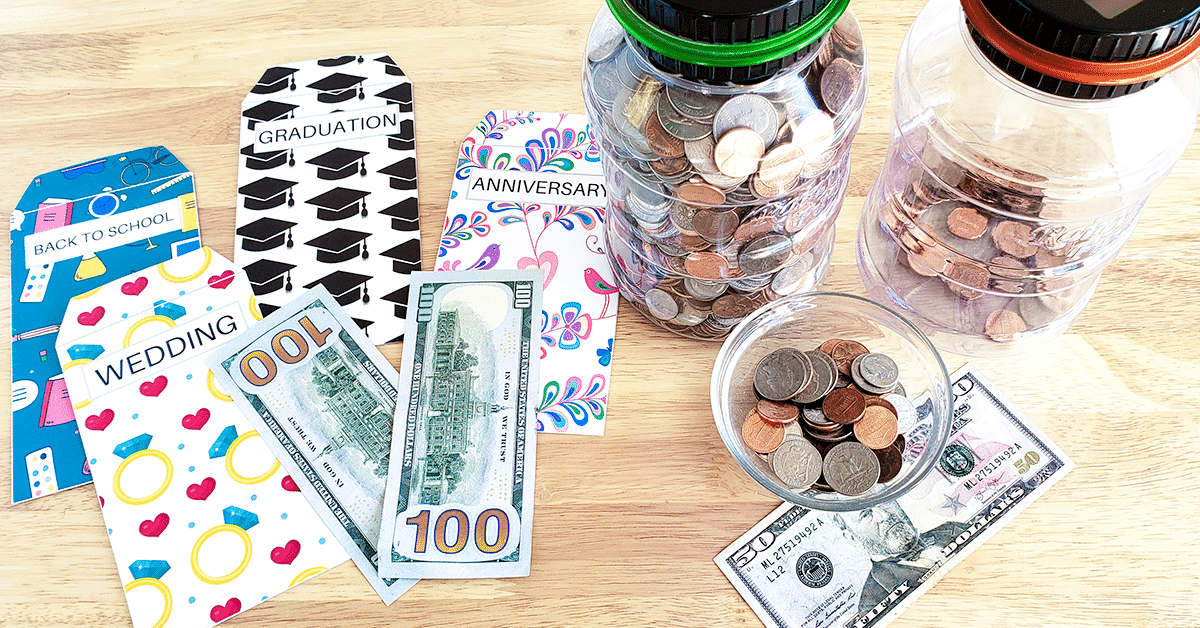

Some causes you would possibly create a sinking fund embody, however are usually not restricted to:

- Journeys or holidays

- Dental or medical work

- Weddings, child showers, and many others.

- House upkeep or auto repairs

- Upcoming holidays, birthdays, or anniversaries

Right here’s the important thing: none of these things are emergencies. These are bills you already know nicely upfront. Which means you shouldn’t be pulling cash out of your emergency financial savings to pay for these one-time, irregular bills.

Since these occasions are upcoming and also you know upfront that it is advisable pay for them, you may start saving now.

With a sinking fund, you might be being intentional about setting apart cash each single paycheck (or each single month) to have the ability to pay for these bills.

This fashion, when the time comes, you don’t have to fret about the way you’re going to pay for the expense. The cash will already be saved in your sinking fund account.

So why is it referred to as a sinking fund?

As a result of you already know the fee upfront and your financial savings objective will maintain “sinking.”

Consider it like this: let’s say you’ve been laying aside a dental process. For the sake of simple math, let’s say that this dental process prices $1,000, which implies your starting financial savings objective is $1,000.

However for those who save $100 out of your subsequent paycheck and put it into your sinking fund, you solely have $900 left to avoid wasting. And for those who save an extra $100 after your subsequent paycheck, you solely have $800 left to avoid wasting. Then $700, then $600, and so forth.

In different phrases, your remaining financial savings objective is “sinking” as you get nearer to reaching your general objective.

When integrated into your funds, a sinking fund may also help you keep out of debt and financially on-track whereas additionally permitting you to get pleasure from and spend cash on significant experiences.

For this reason I wish to name them “peace of thoughts” funds, as a result of you may pay for the necessity with out having to fret or stress about the way you’re going to pay for it.

Wouldn’t all of us like a bit of extra peace of thoughts in right now’s world?!

How To Create a Sinking Fund

Now that you’ve got a greater understanding of what a sinking fund is, let’s discover how one can make the most of one in your funds.

Right here’s the excellent news: it may be performed in as simple as 4 easy steps!

- Resolve what you might be creating the sinking fund (or “peace of thoughts” fund) for.

Let’s return to the preliminary instance of a household trip. You’ll need to put aside a bit of bit from every paycheck in order that the holiday doesn’t sneak up on you and wreck your funds.

- Decide the place you’re going to retailer your sinking fund.

In case you’re going to open a brand new account, guarantee that any minimal month-to-month necessities or charges don’t eat away at your financial savings targets.I personally like CITBank’s Financial savings Builder, which presents a 0.40% APY. The Month-to-month Savers choice is ideal for sinking funds. The $100 minimal steadiness requirement plus $100 minimal single deposit monthly to earn the very best rate of interest will assist maintain you accountable.

- Determine how a lot it is advisable save.

Some situations will likely be simpler than others to know the way a lot cash you want. For instance, for those who’re saving for a dental process, then your dental workplace ought to be capable to offer you a quote. That quote will provide you with a concrete objective to avoid wasting in the direction of.

Nevertheless, for those who’re saving for one thing like a trip or for Christmas presents, then you definitely’ll must deliberately determine the lifelike quantity it is advisable save for these targets.

- Incorporate your sinking fund into your funds.

As soon as you understand how a lot it is advisable save, merely divide that quantity by the variety of months (or paychecks) left till it is advisable pay for the expense.

For instance, in case your objective is to avoid wasting $1,000 for Christmas presents and Christmas is 10 months away, then you definitely’ll want to avoid wasting $100 every month to succeed in your objective!

Steadily Requested Questions About Sinking Funds

Under are a number of the mostly requested questions in terms of sinking funds:

What’s the distinction between a sinking fund vs. an emergency fund?

An emergency fund ought to be used for sudden bills or emergencies whereas a sinking fund is for identified and deliberate bills.

For instance, you already know that your automobile wants oil adjustments at common intervals. The price of oil adjustments is one thing which you can plan for, so it shouldn’t be taken out of your emergency fund.

Nevertheless, if one in all your tires all of the sudden pops unexpectedly, then that may be coated by your emergency fund because it’s each sudden and a real emergency (how are you going to drive with out tires?!).

Can I’ve a couple of sinking fund?

Sure! There are lots of deliberate bills that many people know will come over the course of the 12 months.

However needless to say the extra sinking funds that you’ve got, the slower the progress will likely be. Why? As a result of the cash you might be saving will likely be stretched between a number of accounts.

Listed here are some sinking funds you would possibly need to contemplate:

- Home sinking fund (give attention to gadgets your insurance coverage gained’t cowl)

- Automobile sinking fund (insurance coverage premiums, down cost in your subsequent automobile, and many others.)

- Self-employment tax sinking fund

- Christmas present sinking fund

- And so on.

Why can’t I simply use my financial savings account?

You should utilize your financial savings account to retailer your sinking fund. Nevertheless, don’t neglect that it comes right down to your intention and desired consequence. A financial savings account is great for serving to you set cash away for long-term targets, whereas a sinking fund (“peace of thoughts” fund) is for these short-term targets.

In case you determine to retailer your sinking fund in your financial savings account, just remember to’re clear in your funds and that when it’s time to spend the cash, you’re solely spending what you’ve deliberately saved for that function, quite than dipping into your long-term financial savings.

Once more, for this reason I personally like CITBank’s Financial savings Builder.

Last Ideas

After studying this text, I hope which you can see the worth in being intentional a few sinking fund.

It actually does offer you peace of thoughts, in order that when the time comes, you may spend stress-free with out guilt, fear, or anxiousness.

Isn’t that what being financially fulfilled is all about?

To be taught extra and to attach with different like-minded folks, I encourage you to affix the TBM group on Fb!