The onset of the COVID-19 pandemic introduced substantial monetary uncertainty for a lot of People. In response, government and legislative actions in March and April 2020 offered unprecedented debt aid by briefly reducing rates of interest on Direct federal scholar loans to 0 % and mechanically putting these loans into administrative forbearance. In consequence, almost 37 million debtors haven’t been required to make funds on their scholar loans since March 2020, leading to an estimated $195 billion price of waived funds by way of April 2022. Nonetheless, 10 million debtors with personal loans or Household Federal Training Mortgage (FFEL) loans owned by industrial banks weren’t granted the identical aid and continued to make funds throughout the pandemic. Information present that Direct federal debtors slowed their paydown, with only a few making voluntary funds on their loans. FFEL debtors, who weren’t lined by the automated forbearance, struggled with their debt funds throughout this time. The difficulties confronted by these debtors in managing their scholar loans and different money owed counsel that Direct debtors will face rising delinquencies as soon as forbearance ends and funds resume.

Information and Definitions

On this evaluation, we use information from the New York Fed Client Credit score Panel, an anonymized, nationally consultant 5 % pattern of credit score stories from Equifax. Though we don’t immediately observe the proprietor of a mortgage, we use the executive forbearance occasion to kind loans into one among three mutually unique classes. The primary consists of Direct loans disbursed by the federal authorities and a few legacy loans disbursed beneath the FFEL program and now owned by the federal authorities. The second and third classes embody remaining loans that weren’t lined by the curiosity waiver or computerized forbearance: FFEL loans nonetheless owned by industrial banks and personal loans which have been both originated by personal entities or have been federal loans refinanced into the personal market. The desk under particulars these loans, denoted Direct, FFEL, and personal loans, on the eve of the pandemic.

Direct mortgage debtors have decrease credit score scores, greater balances, and maintain over 85 % of excellent balances

| Direct | FFEL | Non-public | |

|---|---|---|---|

| Whole debt excellent | $1.3 trillion | $133 billion | $95 billion |

| Delinquent however not defaulted fee (in %) | 5.3 | 5.4 | 5.0 |

| Median stability per borrower | $18,773 | $10,143 | $14,087 |

| Median age | 33 | 41 | 39 |

| Median credit score rating | 654 | 687 | 713 |

Notes: All values are as of February 2020. Direct loans additionally embody loans disbursed by way of the Household Federal Training Mortgage (FFEL) program however subsequently bought to the federal authorities. FFEL loans solely embody FFEL loans nonetheless owned by industrial banks.

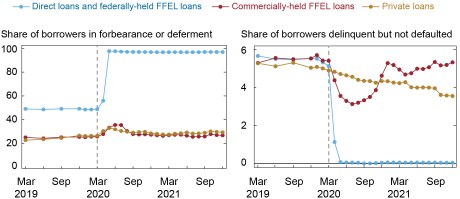

Scholar Mortgage Forbearance and Delinquency throughout the Pandemic

The chart under exhibits the share of debtors in both deferment or forbearance (left) and the share of debtors with a scholar mortgage at the least ninety days delinquent however not in default (proper) because the first quarter of 2019. Our calculation of the delinquency fee differs from the everyday calculation within the New York Fed’s Quarterly Report on Family Debt and Credit score as a result of we deal with debtors as a substitute of balances and we exclude defaulted loans. Previous to the pandemic, the share of debtors in forbearance remained secure throughout all three scholar mortgage varieties with FFEL loans and personal loans at round 26 % and Direct loans at roughly double the speed largely because of the greater share of debtors in in-school deferment. After the onset of the pandemic, forbearance rose throughout all mortgage varieties with Direct loans rising to nearly one hundred pc on account of administrative forbearance. Consequently, all beforehand delinquent however not defaulted loans have been marked present, driving this fee to zero throughout the pandemic. In the meantime, scholar mortgage debtors with both personal or FFEL loans wanted to request voluntary forbearance from their mortgage servicer. The speed of forbearance for personal loans elevated from 26 % in February 2020 to 33 % in Might 2020 earlier than steadily declining. The forbearance fee for FFEL debtors elevated from 26 % in February 2020 to a peak of 36 % in June 2020 earlier than falling to ranges on par with personal loans.

Forbearance introduced Direct debtors present all through the pandemic, however struggling FFEL debtors solely bought a short reprieve

Observe: FFEL is Household Federal Training Mortgage.

Like Direct loans, many beforehand delinquent FFEL loans have been marked present throughout forbearance driving the delinquency fee from 5.4 % simply earlier than the pandemic to a low of three.1 % in July 2020. Since voluntary forbearance for FFEL loans sometimes lasted only some months, delinquency started to extend once more late in 2020 earlier than one other spherical of stimulus funds firstly of 2021 drove one other small decline. From March 2021, delinquency for FFEL debtors continued to rise, returning to pre-pandemic ranges by the tip of 2021. In contrast, personal mortgage debtors weathered the pandemic remarkably effectively with delinquency charges declining all through the pandemic to a low of three.6 % on the finish of 2021.

The Evolution of Scholar Mortgage Balances throughout the Pandemic

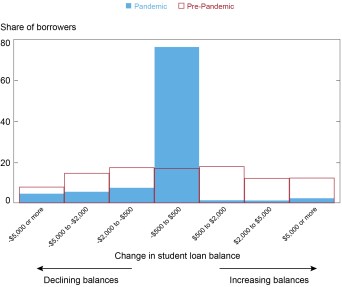

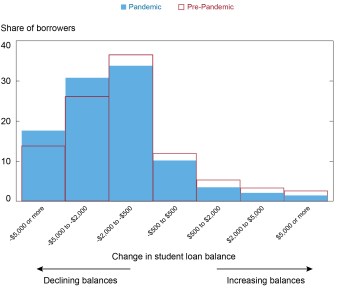

To higher perceive the evolution of debtors’ mortgage balances throughout the pandemic, we examine modifications in balances throughout the pandemic (between April 2020 and December 2021 – blue bars) to modifications in balances previous to the pandemic (between June 2018 and February 2020 – crimson bars). We embody solely these scholar mortgage debtors who took out their final mortgage previous to October 2017 to deal with those that are not initiating new loans.

Previous to the pandemic, Direct mortgage debtors have been almost break up between these making progress on their loans (40 %) and people with growing balances (43 %). Whereas growing balances are typical for the small subset of delinquent debtors, that is extra generally due to the provision of Earnings-Drive Reimbursement (IDR) plans, the place debtors pay a share of their disposable earnings as a month-to-month cost, which is usually too small to cowl accruing curiosity. IDR debtors in destructive amortization can have growing balances regardless of making on-time funds, and this has change into extra widespread lately. Nonetheless, the share of debtors with growing balances dropped to almost zero throughout the pandemic on account of administrative forbearance and the non permanent 0 % rate of interest. Of the debtors who had growing balances previous to the pandemic, 83 % had no change of their stability throughout the pandemic forbearance whereas 9 % made some progress. In the meantime, Direct mortgage debtors with declining balances pre-pandemic have been extra prone to have declining balances throughout the pandemic with 34 % persevering with to cut back balances on their loans and 66 % not lowering them.

Most Direct debtors made no funds throughout the pandemic forbearance

Notes: The pre-pandemic interval denotes the change in scholar mortgage balances between June 2018 and February 2020. The pandemic interval denotes the change in scholar mortgage balances between April 2020 and December 2021.

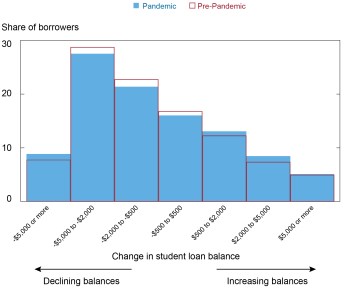

The following chart particulars the evolution of balances for debtors with FFEL loans, which didn’t obtain computerized forbearance. Previous to the pandemic, the next share of those debtors had declining balances (59 %) than Direct mortgage debtors (40 %). Because the final FFEL loans have been distributed in 2010, FFEL debtors are, on common, older, have greater credit score scores, and have much less beneficiant IDR plans than Direct debtors, components main them to have rising balances much less incessantly. In the course of the pandemic, the vast majority of FFEL debtors didn’t change their paydown habits. Nonetheless, at the least some FFEL debtors have been capable of speed up the speed of paydown, leading to a rise of 1 proportion level for these paying down most aggressively. In the meantime, the share of FFEL debtors with growing balances grew by 2 proportion factors. The expansion in growing balances was partly because of the improve in elective forbearance for FFEL debtors since curiosity was nonetheless accruing, however a small proportion of them struggled, lacking funds after they had beforehand been making them.

Some FFEL debtors struggled with funds throughout the pandemic whereas others accelerated paydown

Notes: The pre-pandemic interval denotes the change in scholar mortgage balances between June 2018 and February 2020. The pandemic interval denotes the change in scholar mortgage balances between April 2020 and December 2021.

The final chart under exhibits how debtors with personal loans modified their paydown patterns throughout the pandemic. These debtors have been extra prone to improve their fee of paydown throughout the pandemic. In comparison with the earlier twenty months, personal mortgage debtors have been much less prone to have growing balances, make no progress, or make small progress on their loans and have been extra prone to make bigger stability reductions than within the earlier yr. The share of personal mortgage debtors paying down at the least $2,000 elevated by 9 proportion factors, from 40 % to 49 %. This acceleration in paydown by personal scholar mortgage debtors and a few FFEL debtors was probably aided by a number of rounds of stimulus funds, which we confirmed in a earlier put up drove giant reductions in bank card debt throughout the first yr of the pandemic, nonetheless we don’t discover a comparable stimulus-fueled paydown for Direct debtors.

Non-public scholar mortgage debtors accelerated paydown throughout the pandemic

Notes: The pre-pandemic interval denotes the change in scholar mortgage balances between June 2018 and February 2020. The pandemic interval denotes the change in scholar mortgage balances between April 2020 and December 2021.

Classes from FFEL Debtors

We consider that the expertise of the FFEL debtors exiting forbearance in late 2020 foreshadows future compensation difficulties for Direct debtors as soon as required funds resume. Debtors with bank-held FFEL loans, who didn’t obtain computerized forbearance, have been extra prone to wrestle with funds throughout the pandemic. Some FFEL debtors have been capable of keep away from delinquency by way of forbearance, however delinquency charges elevated shortly after the forbearance interval ended. Additional, delinquency amongst beforehand forborne FFEL debtors was not restricted to their scholar loans. We discover that these debtors skilled 33 % greater delinquency on their non-student, non-mortgage debt after exiting forbearance than the Direct debtors who remained in forbearance. Though debtors will probably face a more healthy financial system going ahead, Direct mortgage holders have greater debt balances, decrease credit score scores, and have been making much less progress on compensation than FFEL debtors previous to the pandemic. As such, we consider that Direct debtors are prone to expertise a significant rise in delinquencies, each for scholar loans and for different debt, as soon as forbearance ends.

Policymakers have thought of a number of proposals to melt the tip of the forbearance program that has helped to easy cashflow for many scholar debtors throughout the pandemic recession. These proposals vary from briefly not reporting missed funds to credit score bureaus to outright cancellation of federal scholar loans. Suspending the reporting of delinquencies will definitely stop cost difficulties from showing on a borrower’s credit score report and permit debtors to raised ease into compensation, however these compensation points will nonetheless exist beneath the floor. These considerations have motivated a debate on scholar mortgage cancellation which would be the matter of an upcoming put up.

Jacob Goss is a senior analysis analyst within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Daniel Mangrum is an economist within the Financial institution’s Analysis and Statistics Group.

Joelle Scally is a senior information strategist within the Financial institution’s Analysis and Statistics Group.

Disclaimer

The views expressed on this put up are these of the authors and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the authors.