The Biden administration continues to quote momentary provide disturbances because the trigger for prime inflation. Following the Client Value Index (CPI) launch earlier this month, which reported a wide ranging 8.5 % enhance in costs from March 2021 to March 2022, Press Secretary Jen Psaki was requested the extent to which the White Home was involved. Psaki reiterated her feedback from the day prior to this, telling reporters “we anticipated it to be elevated due to Putin’s invasion; due to the impression on power costs.”

Do momentary provide disturbances clarify the excessive inflation now we have skilled during the last 12 months? There is no such thing as a denying that provide chains had been severely disrupted by the pandemic and corresponding restrictions on financial exercise. Equally, Russia’s invasion of Ukraine has diminished the provision of oil and threatens to scale back agricultural output, as nicely. On their very own, such disturbances would push costs up.

However provide disturbances play a bit half within the total inflation story. The composition and timing of the value hikes, the Federal Reserve’s projections of inflation, and the noticed will increase in actual variables all recommend that at this time’s inflation is basically the results of extreme nominal spending, not momentary provide disturbances.

Let’s begin with the declare that costs are elevated as a result of Russia’s invasion of Ukraine. Oil costs are larger at this time than they might have been within the absence of the invasion. However we should think about the magnitude. The cross by way of from oil to different items simply isn’t sufficiently big to elucidate a lot of the inflation noticed at this time.

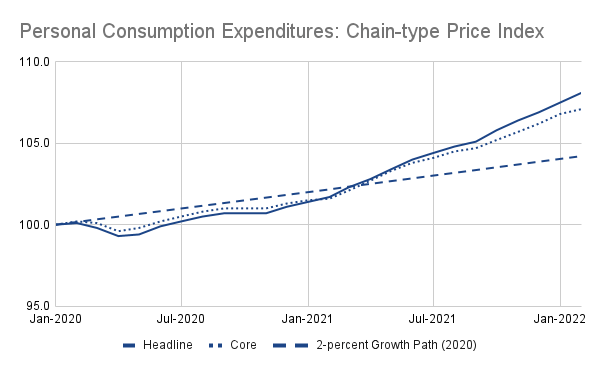

The Private Consumption Expenditures: Chain Sort Value Index, which is the Fed’s most popular measure of inflation, is introduced in Determine 1. I embrace each headline and core value ranges, the latter of which excludes meals and power costs. I additionally embrace a 2-percent progress path projected from January 2020, which exhibits how costs would have developed had the Fed hit its common inflation goal over the course of the pandemic.

The information in Determine 1 clearly present that meals and power costs have risen extra quickly during the last 12 months than the costs of different items and companies. However in addition they present that costs are very excessive even after excluding these costs. Whereas all costs have grown at a continuously-compounding annual charge of three.7 % since January 2020, all costs excluding meals and power have grown almost as quick, at 3.3 %. The core value stage is 2.9 proportion factors larger at this time than it might have been had the Fed hit its 2 % common inflation goal. The headline charge, which incorporates meals and power, is simply 1 proportion level larger.

The timing of the value hikes additionally suggests there’s way more to the story than mere provide disturbances. Inflation started accelerating in October. Clearly, that was months earlier than Russia invaded Ukraine. Furthermore, most of the provide disturbances related to the pandemic and corresponding restrictions on exercise had eased up or had been within the strategy of easing up by that time, which ought to have put downward stress on costs. Why did costs rise extra quickly as provide constraints eased up?

Nor are the Fed’s projections of inflation in step with a temporary-supply-disturbance story. Short-term provide disturbances are momentary. The pandemic and corresponding restrictions diminished our potential to provide. However they won’t cut back our potential to provide endlessly. The lifting of restrictions, vaccine rollout, and gradual acceptance {that a} gentle model of the virus is endemic will finally allow manufacturing to return to regular, even when it has not accomplished so already. Likewise, the warfare in Ukraine will finish in some unspecified time in the future—and, at the moment or someday thereafter, meals and power manufacturing will return to regular. When manufacturing returns to regular, so too do costs. However that’s not what the Fed is projecting. As a substitute, the Fed is projecting that costs will stay completely elevated. Why would a brief provide disturbance trigger a everlasting enhance within the stage of costs?

Think about additional what else one would count on to watch within the information if provide constraints had been driving costs larger. When provides are constrained, actual (inflation-adjusted) incomes are decrease. Individuals reply by decreasing their actual consumption. We see this over the course of the pandemic. Actual private consumption expenditures fell after which remained beneath development in 2020. But it surely has since recovered. Immediately, individuals are consuming roughly what they might have been consuming had the provision disturbances by no means occurred.

It’s common when speaking about GDP to speak about how speedy progress has been: Sooner than the previous, sooner in US than in different nations, sooner than forecasters anticipated, simply plain quick.

However that is in critical pressure with the supply-side arguments folks make on inflation.

— Jason Furman (@jasonfurman) April 20, 2022

Jason Furman, who served as Chair of the Council of Financial Advisors below President Obama, precisely describes the stress between two conflicting narratives provided by the White Home and others:

The primary is that the financial rebound has been surprisingly speedy, outpacing what forecasters anticipated and setting this restoration other than the aftermath of earlier recessions.

The second argument is that inflation has reached its current heights due to surprising supply-side developments, together with supply-chain points like semiconductor shortages, an unexpectedly persistent shift from companies to items consumption, a lag in folks’s return to the workforce, and the persistence of the virus.

Clearly, each of those arguments can’t be true. Like me, Furman finds the primary to be extra convincing. “Sturdy actual (inflation-adjusted) GDP progress means that financial exercise has not been considerably hampered by provide points, and that the current inflation is usually pushed by demand,” he writes.

Why, then, are costs so excessive at this time? Briefly, the Fed has didn’t stabilize nominal spending.

The equation of alternate is a helpful id that reminds us MV = PY, the place M is the provision of cash, V is the revenue velocity of cash, P is the value stage, and Y is actual output. When the Fed stabilizes nominal spending (MV), modifications in actual output (Y) coincide with offsetting modifications within the value stage (P). That’s the provision disturbance story: diminished actual output has pushed up costs. However that’s not what has occurred.

The truth is, the Fed has not stabilized nominal spending. We don’t observe velocity straight. However, because the equation of alternate is an id, we will measure nominal spending (MV) because the product of P and Y—that’s, nominal gross home product. From 2010 to 2020, nominal GDP grew at a constantly compounding annual charge of three.9 %. It has grown a lot sooner within the time since, at 5.1 %. Not like provide disturbances, sooner nominal spending drives up each costs and actual output, which is what we’re seeing at this time.

Understandably, the Biden administration needs to deflect blame for at this time’s excessive inflation. They’ve advised the pandemic, grasping firms, and now Russian President Vladimir Putin are liable for larger costs. Sadly for the administration, their politically-convenient supply-side tales clarify far too little. Immediately’s inflation is primarily the results of extreme nominal spending, which the Fed might have and will have offset.