My “Ideas on Inflation Safety” essay, which appeared in MFO’s February 2022 difficulty, targeted totally on the position of various main asset courses in offering an inflation buffer on your portfolio. The article was targeted particularly on the efficiency of funds and ETFs with substantial publicity to TIPS (Treasury Inflation-Protected Securities) and related merchandise. I highlighted the promise of short-duration TIPS funds.

In passing, I additionally famous the long-term potential position of home shares and Fairness REITS in defending in opposition to inflation, whereas mentioning their two major drawbacks. One, they don’t reply nicely to inflation within the short-term; and two, they act poorly in extreme market drawdowns. This previous month, Feb 2022, was a well timed demonstration of the above reasoning.

I discussed that “a part of an asset’s job is to assist shield the portfolio throughout a monetary disaster. Dangerous property – Fairness, REITs, and Shares – whereas nice for taking part in long-term development, should not good at capital preservation in powerful market situations. To show the purpose, I pointed to a one-month drawdown endured by the Vanguard REIT Fund throughout the Covid-19 pandemic of Feb/March 2020.

A Reader Challenges

That prompted a problem from a considerate reader who has appreciable experience within the fund trade. A energetic trade of views occurred, pushed partially by totally different takes on how lengthy a drawdown should final with a purpose to be of fabric concern. (Would a 50% decline in your portfolio that lasted two weeks be “higher” than a 25% decline that resolved in two months?) That’s a query value pursuing.

It is a two-part query:

- Simple half: the calculations

- Troublesome half: why do the drawdowns matter and for whom?

Half 2 of this query can also be an awesome alternative to debate one of the vital tough and imminent issues in investing:

- What’s a drawdown?

- How ought to we outline it? How do most traders expertise drawdowns? and

- How do profitable traders virtually and psychologically take care of drawdowns?

Calculating Drawdowns

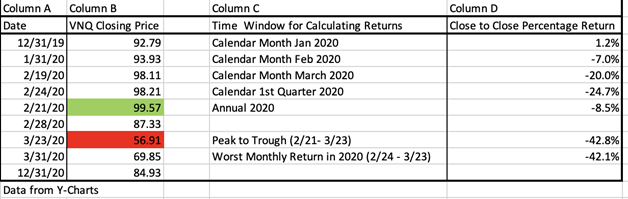

First, let’s take a look at the calculations. I’ve picked some dates across the begin of the Covid-19 Pandemic because it pertains to my feedback on Fairness REITs within the TIPS article. As a proxy for the Vanguard Actual Property fund, I’ve chosen the Vanguard Actual Property ETF (VNQ, a fund I personal and like).

As we are able to see from the worth historical past in Column B, 2020 was a really unstable 12 months for VNQ. Beginning the 12 months round ~93, the fund rallied in late February ’19 to round $99. Nearly 4- weeks later, it crashed and skilled a closing low of ~ $57. The return between these 2 dates is ~ adverse 42%. That is the return I had in thoughts and quoted after I wrote the article.

The reader identified, additionally accurately, that the calendar month-to-month returns in Feb ’20 and March ’20 had been adverse 7% and adverse 20% respectively. Due to this fact, claiming that fund had a “1- month” return of adverse 42% is wrong. He identified that solely a dealer, not an investor, would name Peak to Trough utilizing a 4-week intra-month interval as a drawdown.

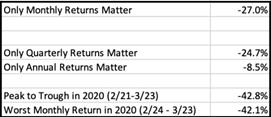

Based on Investopedia, a drawdown is a peak-to-trough decline throughout a particular interval for an funding, buying and selling account, or fund. Since every investor has their very own definition of a particular interval, there may be a number of proper solutions for outlining drawdowns. VNQ’s 2020 drawdowns may be:

Is any of those drawdowns extra reputable than the others? In a short time, we are able to divine that the best drawdown reply lies within the eyes of the beholder. When the market strikes as a lot because it did in 2020, lots of widespread definitions and reference factors we take as a right not work. The market is made up of many traders, every of whom might take a look at the world in another way.

Why do drawdowns matter, and for whom?

Nonetheless, the extra attention-grabbing query right here is why ought to traders care about drawdown? Why is it necessary to debate and be taught from the drawdown in Fairness REITs within the 12 months 2020? Once we ponder this query in-depth, we be taught rather a lot in regards to the means of investing. Allow us to now spend a while fascinated with the harder drawdown questions.

Within the discipline of investing, there are two principal regrets:

- when an asset goes up rather a lot, and we don’t personal it

- when an asset goes down rather a lot, and we do personal

The primary remorse is once we miss shopping for one thing that goes on to have an outstanding rally. “We had an opportunity to purchase Tesla at $30, however we didn’t. We missed shopping for Tesla!” would fall on this class. This loss is named alternative loss. Traders consider how a lot cash we might have made if we had pulled the set off. No uninvested cash is definitely misplaced. Individuals keep in mind missed investments maybe in the same option to recalling a missed likelihood of falling in love with somebody. There is no such thing as a means of understanding how it might have labored out for us, however our thoughts likes to imagine it might have been nice. The human thoughts can nearly all the time (ultimately) rationalize missed alternatives because the position of future in life. As a result of funding alternatives preserve arising, a sensible individual would possibly maybe be capable of be taught from previous missed alternatives and act in another way sooner or later.

The second remorse traders expertise is once they have purchased an asset and it goes down rather a lot in worth. Everybody defines what “rather a lot” means in another way. Each investor who has invested lengthy sufficient has skilled sharp selloffs of their portfolio.

Usually, when the worth of an asset goes down greater than 20-30%, that’s a correct drawdown! Traders within the asset really feel it viscerally. It hurts to know {that a} deliberate choice made to purchase XYZ, to personal XYZ, has now resulted in a considerable discount of the cash we had as soon as related to XYZ. This sense is totally different than alternative loss. Drawdown-driven losses have the potential to overhaul an individual’s complete system. “I might have accomplished this, I ought to have accomplished that, I’d have had this way more cash…” are ideas that fill the thoughts. Drawdowns may be traumatic and generally financially catastrophic. When such a drawdown happens, traders have three decisions. Promote the funding, purchase extra, or do nothing. Portfolio choices made throughout such instances are consequential to the long-term monetary well being of the investor.

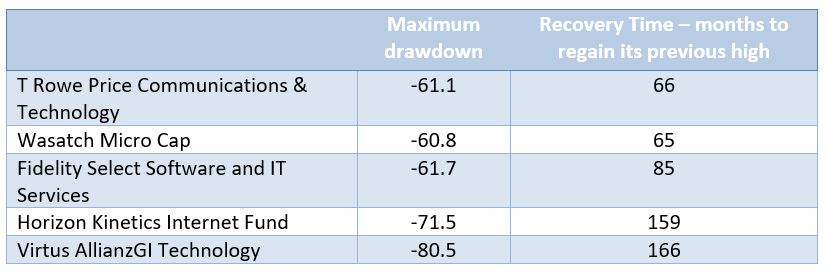

It’s way more widespread for particular person shares to expertise giant drawdowns than it’s for complete main asset courses. Furthermore, a person inventory has the potential for chapter. When a inventory halves, it’s a very tough second for an investor. Will the inventory be the subsequent Lehman Brothers in 2008 or the subsequent Amazon in 2002? Ought to the investor purchase extra, exit the inventory, or do nothing. Exactly as a result of safety choice is so tough, many seasoned traders who understand they haven’t the ability and don’t wish to rely upon luck, search returns as a substitute from asset allocation.

How do considerate traders construction portfolios to organize for inevitable drawdowns?

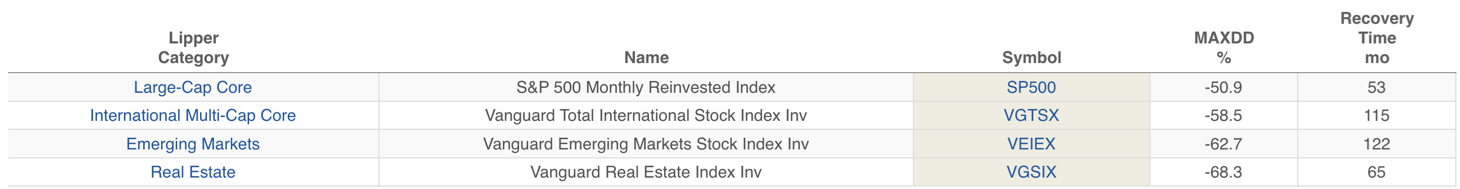

Considerate traders select to personal a diversified basket of shares to forestall the psychological panics related to occasional drawdowns in particular person shares or anybody asset class. A significant asset class, just like the S&P 500 basket of shares, can halve in worth, however won’t go bankrupt. In reality, each in 2003 and in 2009, the S&P 500 went down about 50% from peak to trough. Shopping for/proudly owning the S&P 500 down 50% is a safer guess than shopping for anybody inventory down 50 %.

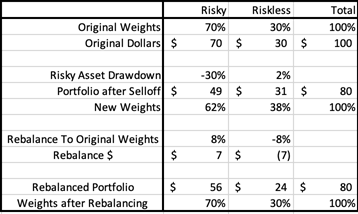

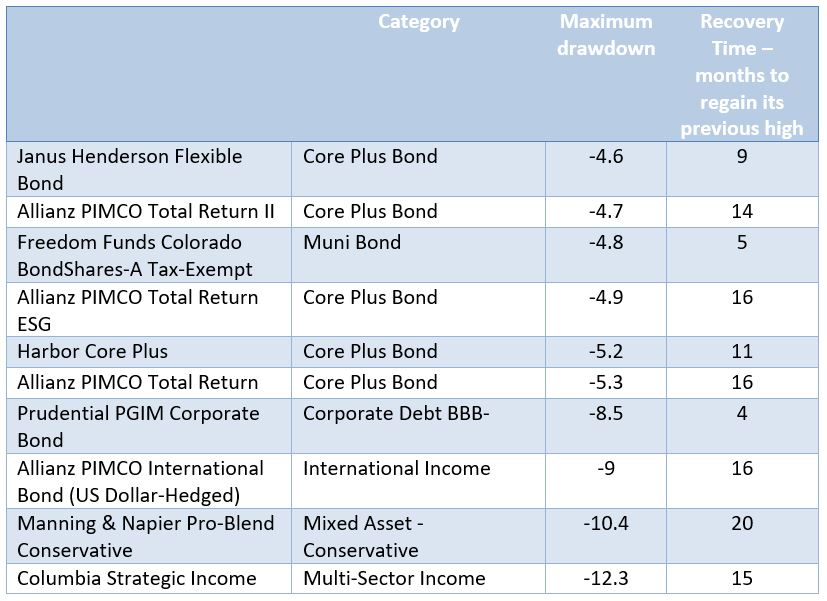

Not solely do these traders diversify inside an asset class, however additionally they diversify throughout asset courses. By proudly owning a mix of Dangerous and Riskless asset courses, skilled traders anticipate that drawdowns will unexpectedly happen, that not all drawdowns may be predicted upfront, however a system does exist to take care of eventual drawdowns. Having Riskless property offers a buffer zone in sharp selloffs. By then promoting Riskless property and shopping for Dangerous property, traders can rebalance portfolios: purchase low and promote excessive.

Drawdowns are inevitable and painful for all traders. However utilizing a mix of main asset courses, asset allocation, and portfolio rebalancing, we are able to harness the identical drawdowns and capitalize on them.

A Easy Dangerous/Riskless Portfolio

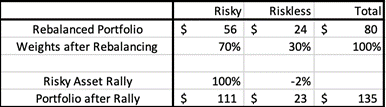

Right here is an instance of a portfolio with a beginning worth of $100 break up 70/30 between Dangerous (Shares) and Riskless property (short-term T-Payments). On this instance, after a 30% drawdown in Dangerous property and a 2% enhance in Riskless property, the investor is left with $80. Unhealthy, however not catastrophic. She then decides to Rebalance again to the 70/30 weights. This requires shopping for the Dangerous Asset which has suffered the drawdown – the “Purchase low” half.

Fortunately for her, the drawdown ends, the market turns round, and Dangerous property go on to rise 100% in worth over the subsequent few years. Riskless property dump 2%. How does the portfolio do?

She will be able to rebalance as soon as once more right here and execute the “Promote Excessive” half.

What if she had not rebalanced the portfolio throughout the drawdown?

Thus, we see that rebalancing the portfolio added an incremental $7 of worth to her portfolio in comparison with not rebalancing.

Sensible Features of Rebalancing Portfolios

Drawdowns may be painful, however they are often helpful to rebalance. But, one should pose the deeper query: how do I do know when a significant drawdown has occurred and that I ought to observe rebalancing? It requires trying on the portfolio periodically, calculating share weights of asset courses within the portfolio, and executing trades to really rebalance.

Those that purchase and by no means take a look at their portfolio face the same state of affairs to the philosophical experiment – If a tree falls in a forest and nobody is round to listen to it, does it make a sound? I not too long ago discovered that my mother-in-law is holding shares her husband purchased within the Sixties!

The sensible actuality is that most individuals do take a look at their portfolios with some regularity. Some traders rent skilled wealth managers to handle portfolios. Different traders are hands-on and wish to handle their very own portfolios. The character of the investor and the way carefully she manages her portfolio drives the frequency of market commentary.

That commentary frequency in flip lets you divine if the VNQ had a 42% drawdown in Feb- March 2020 or a 20% selloff within the month of March 2020. The magnitude of your perceived drawdown determines if and when you’ll rebalance your portfolio.

Month-end/Calendar Pushed Rebalancing

Some traders select a calendar-driven set off, that’s, month-end or quarter-end, to observe the progress of the funding portfolio and to rebalance if the chance is accessible. With as little as 4 (quarterly) to 12 (month-to-month) observations in a 12 months, they eschew the each day volatility of the market. The tendency of this group is to properly let the mud settle earlier than making substantial funding modifications.

For these within the enterprise of cash administration, it is very important lay out clear, systematic guidelines for workers, whereas concurrently offering helpful steering to purchasers. Utilizing calendar month-to-month returns for all funding choices helps managers inform their traders, “In no calendar month had been any of your funds down greater than 20% within the 12 months… As we now have all the time maintained, we’ll solely rebalance on the finish of each month.” It is a sturdy and discretion-free message. It affords enterprise continuity and peace of thoughts for the investor. It’s virtually very helpful.

The shortcoming of the month-to-month rebalancing system is it most definitely will miss wealthy intra-month alternatives to rebalance by shopping for Dangerous property at engaging ranges. For instance, the VNQ made a low of ~ $57 on March 23rd, 2020. By March 31st, 2020, the VNQ had rallied 23% to ~ $70. Month-end portfolio watchers didn’t fret the intra-month lows, however additionally they missed a chance to purchase cheaply.

Versatile Rebalancing

Because the 2007 housing disaster, we now have seen that markets have been liable to more and more excessive strikes. This volatility makes extra frequent rebalancing rewarding for some traders. Traders who select to take a look at the market with each day frequency should still imagine within the strategic energy of long-term asset allocation, however additionally they wish to take benefit if the market has overreacted within the close to time period.

Because the way more eloquent Girl Gaga has stated, “I need your ugly, I need your illness.” These traders carefully monitor and sometimes rebalance their portfolios in months with extraordinary volatility.

Whereas calendar-based rebalancers have the comfort of dates to reallocate between property, each day market observers get no such respite. They want different instruments. One device such traders can use is to rebalance at each 10% selloff within the Dangerous asset. In an excessive case, when peak to trough asset drawdowns begin to method the worst-case state of affairs for a significant asset, such ranges can be utilized to reallocate aggressively (as a lot as one’s threat urge for food will enable). The date of the month is immaterial. All traders have the next fee of success once they keep on with a system that most closely fits their pure tendencies. The each day market observer have to be cautious to not overtrade.

What’s the psychological significance of rebalancing throughout extreme drawdowns?

Firstly, allow us to do not forget that to make cash in investing, we have to be grasping when others are fearful. The individual promoting VNQ at $56 might be the identical one that purchased it at $99. Their worry is our alternative. However we are able to solely reap the benefits of this chance if we act. Sitting round twiddling our thumbs ain’t gonna assist. Rebalancing will.

Second, each investor will get psychologically destroyed in sharp drawdowns. Allow us to assume: what can we do to boost our sport in such miserable moments? We are able to consider the long run and what we are able to do in the present day that will likely be useful sooner or later. Rebalancing, calculating new asset allocations, deciding what to purchase, what to promote, and tax loss harvesting are actions that may use the portion of our mind that offers with analytical work. Slowly, our emotional state can step again, and our analytical self can take management. The magic begins occurring once we begin believing in ourselves once more.

At the moment’s market and conclusion

The present market drawdown is nearly as good a time as any for a chance to use the present of rebalancing. Yr-to-Date the US Equities benchmark is down about 9% and US Fairness REITs are down 11%. If anybody has any doubts, the 12 months 2022 has made it clear that no investor is aware of what the long run holds. Making an attempt to rationalize and analyze financial and political occasions is sweet, however what does it do for the portfolio? In the meantime, utilizing the drawdown alternative to rebalance as acceptable is absolutely actionable, and may be an investor’s finest good friend. Work out a system that’s best for you and keep on with it.

On this article, I’ve tried to indicate that in extremely unstable intervals, definitions of drawdowns will differ. That is to be anticipated. Totally different traders design techniques based mostly on what works for them. It isn’t the definition of the drawdown that issues, it’s what you do throughout the drawdown that may assist your future monetary self.