After years of record-breaking appreciation, property values are going through their first actual take a look at since 2019, as mortgage charges quickly rise and put downward strain on housing costs. As such, many actual property traders are rightfully questioning if they need to make investments now earlier than charges rise, or if they need to look forward to a attainable value correction.

This is a vital query for actual property traders, and by chance, we are able to reply it for ourselves with basic math.

On this article, I’ll discuss you thru how returns would differ should you purchased now versus ready for a “crash”. I’ll additionally reveal how you should use calculators on BiggerPockets to do these calculations your self.

The variables

The query I’m looking for to reply is — ought to I make investments now earlier than charges rise additional? Or ought to I look forward to a possible value correction? There are simply two variables we have to think about to reply these: rates of interest and residential costs.

Let’s create two eventualities. The primary is shopping for now (mid-April 2022), the place rates of interest for an investor on a 30-year fixed-rate mortgage are about 5% and the median dwelling value within the U.S. is $400,000.

The second state of affairs goes to be a market crash state of affairs, the place the median dwelling value declines by 10% to $360,000, however that doesn’t occur till the top of 2022, at which rates of interest for an investor enhance to about 5.75%.

To be clear, I’m not saying {that a} crash goes to occur. I personally assume the extra doubtless state of affairs is that value development begins to flatten out within the coming months, and even perhaps decline in some unspecified time in the future throughout the subsequent 12 months or so. However, I don’t assume a ten% contraction is probably going.

General, low stock and demographic demand will doubtless put upward strain on housing costs and counteract the impact of rising rates of interest. Nonetheless, we’re in unusual occasions, and the path of the housing market is unclear.

For the aim of this text, I’m going to mannequin what I’d think about a real “crash” state of affairs – which is a ten% decline in dwelling values. After all, there are limitless eventualities we may run, however since I hear so many questions on the “crash” state of affairs I believe it’s probably the most fascinating one to mannequin.

In each eventualities, I assumed hire costs of $2800/month and forecast a median of three% appreciation post-purchase. I did this as a result of even when costs do occur to say no a bit within the coming 12 months or two, I anticipate robust appreciation within the housing market over the following 10 years. I acknowledge hire may go down in a “crash” state of affairs, however I need to restrict the variety of variables within the evaluation, so I saved hire the identical in each eventualities.

Evaluation

To make this evaluation as simple as attainable, I’m going to plug in my assumptions to the BiggerPockets rental property calculator.

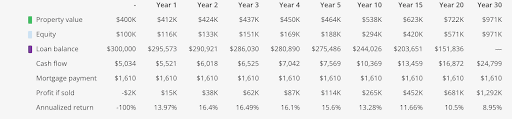

Situation 1: Purchase now

Buy Value : $400,000

Down Cost: $100,000 (25%)

Closing Prices: $7,000 closing prices

Annual Appreciation: 3%

Mortgage Particulars: 5% rate of interest, 30-year fastened price

Lease: $2800

View Full Calculator Report Right here

In Situation 1, if I owned the property for 10 years, the worth of this fictional home would enhance to $538,000, and I’d be incomes over $10k/12 months in money movement after a decade of gradual hire will increase. If I went to promote the property after 10 years, I’d earn a revenue of $265,000, which is sweet for a 13.28% annualized price of return. Stable returns!

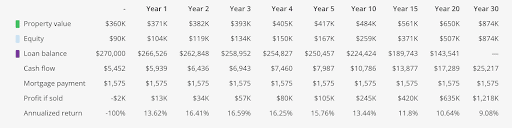

Situation 2: Await a value drop (10% value correction)

Buy Value : $360,000

Down Cost: $90,000 (25%)

Closing Prices: $7,000 closing prices

Annual Appreciation: 3%

Mortgage Particulars: 5.5% rate of interest, 30-year fastened price

Lease: $2800

You’ll be able to take a look at the complete calculator report right here.

In Situation 2, if I owned the property for 10 years, the worth of this fictional home would enhance to $484,000, and I’d be incomes nearly $11k/12 months in money movement. In case you’re questioning why the worth of the property is much less, it’s because of the truth that in each eventualities I assume a median of three% appreciation. In Situation 2, we had a place to begin of $360,000, versus $400,000 for Situation 1.

If I went to promote the property after 10 years, I’d earn a revenue of $245,000, which is sweet for a 13.44% annualized price of return, barely increased than Situation 1.

Breakdown

As you’ll be able to see from these two analyses, the distinction between the 2 eventualities isn’t very appreciable. The whole revenue is bigger for Situation 1 ($265,000 vs $245,000), however the price of return is increased for Situation 2 (13.44% vs. 13.28%). It is because you place $90,000 right down to earn $245,000 in Situation 2 whereas, in Situation 1, you place down $100,000 to earn $265,000.

If it looks like I doctored the inputs to make the outcomes come up comparable (which I do for the aim of rationalization typically), I didn’t. I simply got here up with a market crash state of affairs that’s inside motive and that is the way it performed out.

Frankly, I used to be fairly shocked to see how comparable these two eventualities labored out, and I discovered the outcomes encouraging. It’s cheap to be fearful in regards to the market and the place we’re going over the following few months.

Getting the outcomes of this evaluation and discovering that “investing now or in a ten% correction is about the identical” made me really feel extra assured in my very own investing technique.

My ideas available on the market

Though this can be a complicated market, I’m nonetheless actively on the lookout for offers, and right here’s why.

I personally imagine the market will flatten out and even go barely damaging in some unspecified time in the future within the coming 12 months or two. However, it’s extremely tough to time the market. I can simply see the market appreciating extra within the coming months as nicely. General, I’m not attempting to time that market as a result of I’ve achieved that previously and misplaced.

As I stated at first of this text, there are two variables on this equation: rates of interest, and property values. One in all these variables is unclear and the opposite is fairly sure. By way of property values, I’ve private hypotheses about what’s going to occur within the coming years, however these are simply my private opinions. However, mortgage charges are nearly assured to extend. The Fed is insistent on controlling inflation and bond yields are rising quickly – making mortgage charges go up. As a result of the path of rates of interest is predictable, however property worth development isn’t, I’m attempting to make selections primarily based on the variable I can higher forecast.

Even when the market does right within the subsequent 12 months or two, I personally assume one thing alongside the traces of a 5% correction is extra doubtless than 10%, regardless of it nonetheless being a risk. A 5% drop, which I’ll name Situation 3, yields the worst returns of all: $244,000 in revenue at a 13% annualized return. This occurs as a result of the lower in costs isn’t sufficient to offset the rising rates of interest. So, though the distinction is negligible in the long term, shopping for now has a slight benefit over what I believe most realistically will occur within the coming years.

All of those eventualities are higher than what I believe various investments provide. With inflation consuming away 8% of cash’s worth yearly proper now, I really feel a powerful crucial to speculate my cash. Money is dropping worth quickly and I don’t need to let my spending energy slip away. Bonds have a damaging actual rate of interest (they don’t even hold tempo with inflation) and are unattractive.

I do spend money on the inventory market, however I don’t assume I’ll get a 13% annualized return over the following 10 years within the inventory market, and I don’t know sufficient about crypto to place any significant slice of my web price into that asset class. I’ll admit, I’m biased towards actual property as a result of I do know it finest, however I genuinely imagine it’ll outperform all different asset courses over the following 10 years.

After all, these are simply my assumptions and emotions in regards to the market. On the finish of the day, it’s as much as every particular person investor to make their very own forecasts of the market. In actual fact, BiggerPockets launched its latest podcast, On The Market, which is hosted on my own and is designed that can assist you kind your individual technique primarily based on altering market situations.

Upon getting a way of the place you assume the market would possibly go, run your individual analyses! Use the BiggerPockets calculators like I did to find out for your self if now is an effective time to speculate, or should you’re higher off ready, primarily based by yourself assumptions of the place housing costs and rates of interest are going.

The calculators make it tremendous simple! So don’t be stunted by worry – run the numbers for your self and make a data-driven knowledgeable choice about your technique.

On The Market is offered by Fundrise

Fundrise is revolutionizing the way you spend money on actual property.

With direct-access to high-quality actual property investments, Fundrise means that you can construct, handle, and develop a portfolio on the contact of a button. Combining innovation with experience, Fundrise maximizes your long-term return potential and has shortly change into America’s largest direct-to-investor actual property investing platform.