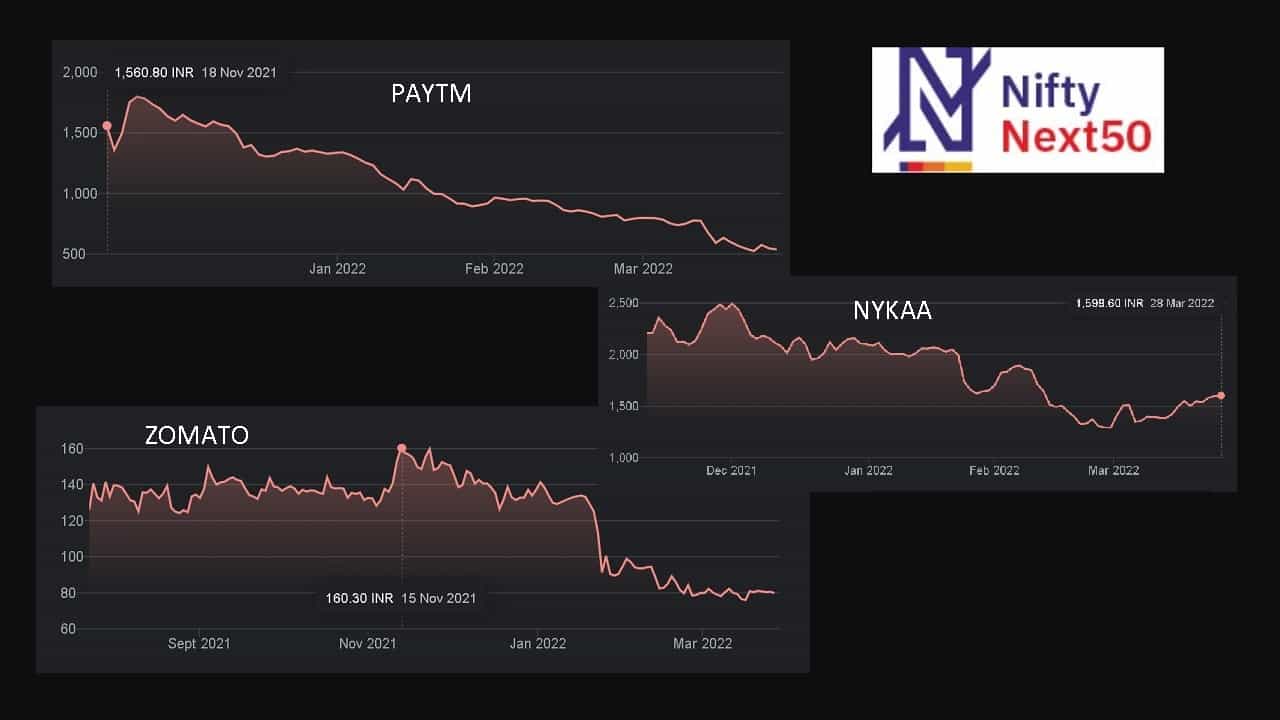

A reader asks, “Ought to traders look to cut back/eradicate publicity to Nifty Subsequent 50 as a result of the NSE has not too long ago modified its inclusion criterion that has allowed new firms like Paytm (One 97 Communications Ltd.), Zomato and Nykaa (FSN E-Commerce Ventures Ltd. ) to be a part of the index from March thirty first 2022?”

On Feb twenty fourth 2022, the NSE introduced that the “Minimal itemizing

historical past requirement in case of a brand new itemizing and corporations traded subsequent to the scheme of association for company occasions” was revised from three months to at least one month”

To begin with, this rule applies to all NSE indices and never simply Nifty Subsequent 50. Second of all, if the rule had not been modified, Zomato and Paytm would have been included within the subsequent index rejig and they’re unlikely to be worthwhile even then!

Third of all and maybe a very powerful takeaway in that is: whereas lively funds are topic to fund supervisor threat, passive funds are topic to curator threat. Nothing emphasises this higher than this visitor article: Knowledge Mining in Index Development: Why Buyers have to be cautious.

The information mining reference applies extra to issue indices than to capitalization-weighted indices. For instance, at this time if you happen to take a look at an element index like momentum or alpha or high quality or low volatility, every part seems to be hunky-dory. If the longer term pans out in a different way, the index curator can fortunately change the choice guidelines.

The ethical is, the powers that management the inventory market hold altering the foundations. A debate on whether or not the change is justified or not is a ineffective pursuit. The purpose is, traders, can’t run from choice dangers!

For instance, in Aug 2019, NSE modified the choice standards from “solely these fairness shares that have been listed and traded on the change have been eligible for inclusion within the Nifty indices” to “all fairness shares which are traded (listed and traded and never listed however permitted to commerce) on the change are eligible for inclusion within the Nifty indices,”.

If the NSE website was a bit extra user-friendly it might be simple to fish out a number of such circulars from their archive. I fully agree with the reader that every one this leaves a nasty style within the mouth.

I’m not too frightened concerning the inclusion of Paytm or Zomato. I don’t suppose these two firms on their very own can deliver down Nifty Subsequent 50 returns. The index can do this by itself fairly nicely!

Be aware: Some readers appear to have misinterpreted our latest article – Is it time to exit from Nifty Subsequent 50? – as a name to exit the index. That’s not the case. Sure, when in comparison with Nifty 50, NN50 has executed poorly and we had solely urged readers to query in the event that they wish to wait or not.

Not all our calls go proper and we should evaluation now and again and make a name with out remorse. We now have additionally proven (after the publication of the above article) that the Nifty Subsequent 50 nonetheless stays an excellent mid cap passive fund though a irritating one: Axis Nifty Midcap 50 Index fund Evaluation.

So, Paytm/Zomato or no Paytm/Zomato, the character of Nifty Subsequent 50 is unlikely to vary. It will undergo intervals of no returns and sudden booms. Solely these for whom persistence is appropriate (for his or her wants) ought to contemplate it. There isn’t any have to rethink investing in NN50 due to the latest adjustments within the index inclusion criterion. Not a lot goes to vary. Tomorrow there may very well be loss-makers within the Nifty or Sensex too. This doesn’t imply lively funds will do higher.

There are in fact a number of deep questions right here.

- Ought to SEBI enable loss-making firms to listing?

- Ought to indices embrace loss-making firms?

- If loss-making firms are included within the index will their worth not be artificially inflated?

We shouldn’t have solutions and even opinions on this (they’re of little worth anyway). We’re nonetheless reminded of this change from the film Margin Name (the contexts are completely different although).

Sam Rogers: The true query is: who’re we promoting this to?

John Tuld: The identical individuals we’ve been promoting it to for the final two years, and whoever else ever would purchase it.

Sam Rogers: However John, if you happen to do that, you’ll kill the marketplace for years. It’s over.

Sam Rogers: And also you’re promoting one thing that you simply *know* has no worth.

John Tuld: We’re promoting to prepared patrons on the present truthful market value.

On the finish of the day, that’s all there may be to it – the present truthful market value. Doesn’t matter how the underlying enterprise is doing. If # of patrons > # of sellers, the value strikes up. If it’s the reverse, the value falls. One can’t anticipate each selections (purchase/promote) to be logical!

Whether or not it’s an lively mutual fund or a passive mutual fund, we advocate traders deal with them as black bins with a label (the NAV). If we open the field and look into the portfolio, we are going to all the time discover one thing to be sad with. It’s an unproductive occupation and is greatest prevented.

It’s best to deal with the chance and reward of a mutual fund on the NAV stage and never fret about issues we can’t management. Who is aware of how the longer term will pan out! At this time’s loss-makers possibly tomorrow’s giants or vice-versa!

Do share if you happen to discovered this convenient

About The Creator

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product growth. Join with him by way of Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on numerous cash administration subjects. He’s a patron and co-founder of “Charge-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first writer of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product growth. Join with him by way of Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You may be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on numerous cash administration subjects. He’s a patron and co-founder of “Charge-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Use our Robo-advisory Excel Template for a start-to-finish monetary plan! Now with a brand new demo video! ⇐ Greater than 900 traders and advisors use this!

Our flagship course! Study to handle your portfolio like a professional to realize your objectives no matter market circumstances! ⇐ Greater than 2700 traders and advisors are a part of our unique neighborhood! Get readability on methods to plan to your objectives and obtain the mandatory corpus it doesn’t matter what the market situation is!! Watch the primary lecture without cost! One-time cost! No recurring charges! Life-long entry to movies! Cut back worry, uncertainty and doubt whereas investing! Learn to plan to your objectives earlier than and after retirement with confidence.

Our new course! Enhance your earnings by getting individuals to pay to your expertise! ⇐ Greater than 620 salaried staff, entrepreneurs and monetary advisors are a part of our unique neighborhood! Learn to get individuals to pay to your expertise! Whether or not you’re a skilled or small enterprise proprietor who desires extra shoppers by way of on-line visibility or a salaried individual wanting a facet earnings or passive earnings, we are going to present you methods to obtain this by showcasing your expertise and constructing a neighborhood that trusts you and pays you! (watch 1st lecture without cost). One-time cost! No recurring charges! Life-long entry to movies!

My new guide for youths: “Chinchu will get a superpower!” is now out there!

Most investor issues may be traced to an absence of knowledgeable resolution making. We have all made dangerous selections and cash errors after we began incomes and spent years undoing these errors. Why ought to our youngsters undergo the identical ache? What is that this guide about? As dad and mom, if we needed to groom one potential in our youngsters that’s key not solely to cash administration and investing however for any facet of life, what would it not be? My reply: Sound Choice Making. So on this guide, we meet Chinchu, who’s about to show 10. What he desires for his birthday and the way his mother or father’s plan for it and train him a number of key concepts of resolution making and cash administration is the narrative. What readers say!

Should-read guide even for adults! That is one thing that each mother or father ought to train their children proper from their younger age. The significance of cash administration and resolution making primarily based on their desires and desires. Very properly written in easy phrases. – Arun.

Purchase the guide: Chinchu will get a superpower to your baby!

How one can revenue from content material writing: Our new book for these excited by getting facet earnings by way of content material writing. It’s out there at a 50% low cost for Rs. 500 solely!

Wish to verify if the market is overvalued or undervalued? Use our market valuation instrument (will work with any index!), otherwise you purchase the brand new Tactical Purchase/Promote timing instrument!

We publish mutual fund screeners and momentum, low volatility inventory screeners .each month.

About freefincal & its content material coverage Freefincal is a Information Media Group devoted to offering authentic evaluation, experiences, evaluations and insights on developments in mutual funds, shares, investing, retirement and private finance. We accomplish that with out battle of curiosity and bias. Comply with us on Google Information. Freefincal serves greater than three million readers a yr (5 million web page views) with articles primarily based solely on factual data and detailed evaluation by its authors. All statements made will probably be verified from credible and educated sources earlier than publication. Freefincal doesn’t publish any paid articles, promotions, PR, satire or opinions with out knowledge. All opinions introduced will solely be inferences backed by verifiable, reproducible proof/knowledge. Contact data: letters {at} freefincal {dot} com (sponsored posts or paid collaborations won’t be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Purpose-Primarily based Investing

Printed by CNBC TV18, this guide is supposed that will help you ask the correct questions, search the proper solutions, and because it comes with 9 on-line calculators, you can too create customized options to your life-style! Get it now. Additionally it is out there in Kindle format.

Printed by CNBC TV18, this guide is supposed that will help you ask the correct questions, search the proper solutions, and because it comes with 9 on-line calculators, you can too create customized options to your life-style! Get it now. Additionally it is out there in Kindle format.

Gamechanger: Overlook Startups, Be part of Company & Nonetheless Dwell the Wealthy Life You Need

This guide is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally enable you journey to unique locations at a low value! Get it or present it to a younger earner.

This guide is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally enable you journey to unique locations at a low value! Get it or present it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low-cost flights, funds lodging, what to do when travelling, how travelling slowly is best financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 199 (immediate obtain)

That is an in-depth dive evaluation into trip planning, discovering low-cost flights, funds lodging, what to do when travelling, how travelling slowly is best financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 199 (immediate obtain)

Free android apps