For greater than 5 years after launching the non-public finance app Truebill together with his two brothers, Yahya Mokhtarzada watched the subscription financial system develop.

However now that pattern has gone into reverse as rising inflation causes shoppers to rethink their discretionary spending — a improvement that Mokhtarzada, like traders and analysts, believes will unfold far past their Netflix accounts.

“So long as there’s this a lot uncertainty within the financial system, individuals are going to be more and more cautious with their cash,” mentioned Maryland-based Mokhtarzada, whose app manages subscriptions, payments and different funds.

Final yr Mokhtarzada observed that the app’s 2.5mn customers have been scrapping extra subscriptions, starting from streaming companies to meal kits. By March the cancellations have been outnumbering new sign-ups.

This week Netflix’s share value dropped greater than 35 per cent after it reported a fall in subscriber numbers for the primary time in a decade. Whereas Netflix suffered from elevated competitors, Steve Wreford, a portfolio supervisor at Lazard Asset Administration, says the squeeze on disposable incomes acted as a catalyst.

“What’s taking place with the streaming companies is the canary within the coal mine,” he mentioned. “Inflation places strain on the patron, you concentrate on which is your least valued buy, and also you then discover out which companies are actually going to wrestle in that inflationary atmosphere.”

Inflation has gathered tempo simply as shoppers have been resuming points of their pre-pandemic lives — consuming out, working from the workplace and reserving holidays. It additionally comes after Covid-19 restrictions pushed up financial savings charges: Individuals had constructed up an additional $4.2tn of money by the top of 2021, in response to the Federal Reserve.

But value rises and worries over the battle in Ukraine, which has worsened inflation, have led to a marked decline in shopper sentiment, mentioned Jessica Moulton, a senior companion at McKinsey.

“Customers’ ranges of optimism are again to mid-2020 ranges. That’s an enormous drop from the autumn,” she mentioned, citing McKinsey surveys carried out in 5 European nations and the US.

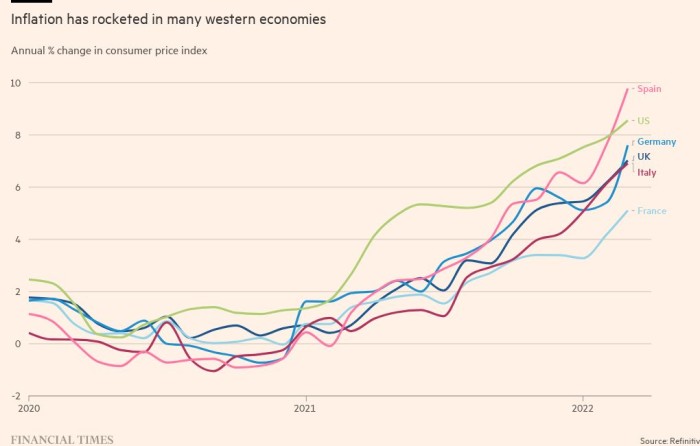

UK retail gross sales fell 1.4 per cent in March, the second consecutive month-to-month decline, as surging inflation started to chunk. Inflation of seven per cent — the speed in Germany in March — successfully cuts family discretionary spending there by 13 per cent, in response to a McKinsey evaluation.

The gloomier local weather has solid a shadow over sectors like clothes and eating places, mentioned Wreford. Buyers are taking word: international shopper discretionary shares have fallen 14 per cent for the reason that begin of the yr, towards 8 per cent for the broader MSCI World index, in response to Bloomberg knowledge. Attire teams’ shares have been notably hit.

The London-based on-line clothes retailer Asos this month reported a pointy fall in gross sales development and income, and warned that strain on incomes may outweigh the increase anticipated to accompany the loosening of Covid restrictions. Its shares are down nearly 40 per cent for the reason that begin of the yr.

Asos chief govt Mat Dunn mentioned that “rising power costs and meals inflation will weigh on discretionary spend. The subsequent three months will probably be telling as we see how these components play out on shopper discretionary revenue.”

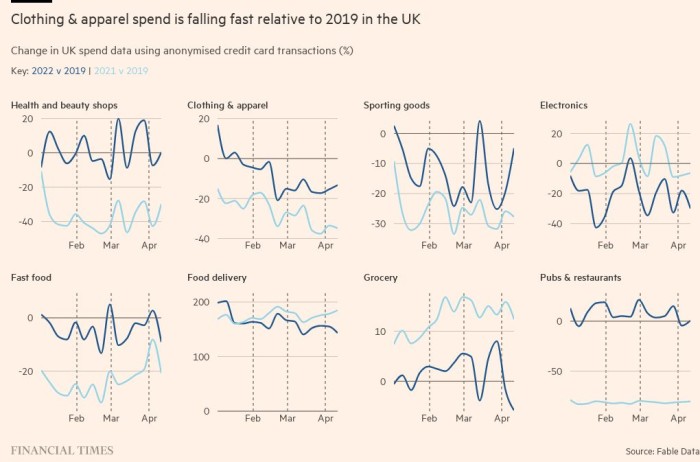

Swedish rival H&M final month additionally reported a sudden slowdown in gross sales development. Spending on attire has dropped beneath 2019 ranges within the UK, in response to knowledge supplier Fable.

This yr’s inflationary squeeze differs from previous intervals of rising costs, in following on the heels of the pandemic. Customers’ life are already in flux as they emerge from Covid-19 restrictions. Now inflation has added to strain on corporations that gained from lockdowns, like Netflix and Peloton, which have additionally needed to increase their very own costs.

The inflationary atmosphere has damped post-Covid optimism at teams like Asos that also hope to profit from a “summer season of occasions, events and weddings”, within the phrases of Dunn.

Eating places hoping for a restoration are wrestling with calls for for larger wages from their very own workers, whereas the chief govt of a London-based informal eating chain mentioned that common spend per buyer had already declined previously month.

However the identical doesn’t to date seem true of the journey trade, the place shoppers with collected financial savings look decided to spend them on journeys they missed through the top of the pandemic.

“Usually [in an inflationary environment] we’d see an impression on journey, however there’s quite a lot of pent-up demand,” mentioned Moulton.

American Airways and Delta Air Strains, the US’s largest and third-largest carriers by fleet measurement, reported report ticket gross sales in March, whereas United Airways, the second largest, predicted that the second quarter can be its most worthwhile ever.

“We’re seeing no indicators of any buyer reticence round inflation,” Ed Bastian, Delta chief govt informed the Monetary Instances, whereas Robert Isom, American chief govt, informed staff this week that “demand is as sturdy as we’ve ever seen it”.

Will Hayllar, managing companion at technique consultants OC&C, mentioned that the impression of the revenue squeeze was not completely predictable. “Customers need some issues that they be ok with. It doesn’t work out as utterly utilitarian,” he mentioned.

Meals supply companies, one other beneficiary of the pandemic, to date preserve they aren’t affected by the strain on shopper spending.

$4.2tn

Additional financial savings constructed up by Individuals by the top of 2021

Deliveroo maintained its annual steering for order quantity development in a buying and selling replace this month, saying it could be slower than 2021’s 70 per cent however nonetheless rising by 15-25 per cent on a continuing forex foundation.

Jitse Groen, chief govt of Simply Eat Takeaway, insisted this week that meals value inflation may very well be a internet profit: when eating places’ costs go up, so too does Simply Eat’s fee.

However David Reynolds, analyst at Irish funding financial institution Davy, mentioned: “We’re transferring into uncharted territory. Ordinarily on-line takeaway meals proves to be pretty resilient within the face of inflationary pressures and eating out bears the brunt.

“However with double-digit inflation not not possible, there should be dangers that customers drop some or all takeaway meals orders.”

Analysts agree that inflation has not but peaked, and that its full impression is simply simply beginning to be felt. Whereas pandemic financial savings will cushion some wealthier shoppers for a time, these on decrease incomes would be the first to really feel the squeeze as staples account for a better proportion of their disposable incomes, mentioned Wreford.

Makers of branded shopper staples have to date succeeded in passing value rises on to shoppers: Nestlé, Heineken, Danone and Procter & Gamble all mentioned this week they’d elevated costs by about 5 per cent within the three months to March, with out pushing down gross sales.

However because the strain grows, households might swap to private-label merchandise. “Client down-trading is wanting more and more possible as discretionary spend will get squeezed . . . Premium manufacturers will possible maintain up, as will worth, however ‘me too’ mass manufacturers are in danger,” mentioned Warren Ackerman, analyst at Barclays.

Some companies hope to profit from shoppers in search of low cost alternate options.

Mooky Greidinger, chief govt of Cineworld, the world’s second largest cinema chain, is betting that cinemas, not like Netflix, will profit from decrease discretionary spend: “In view of recession [consumers] can’t afford the identical journeys overseas or a £100 ticket musical however they will afford a £10 ticket to the cinema. I’m not apprehensive in any respect,” he informed the FT final month.

On the reverse finish of the dimensions, fund managers anticipate luxurious items makers to climate the storm, as their margins are excessive and rich consumers cushioned from inflation’s worst results.

Teams corresponding to France-based LVMH “have constantly been capable of increase costs to greater than offset the inflationary pressures”, mentioned Marcus Morris-Eyton, fund supervisor at Allianz.

But Mokhtarzada mentioned Truebill’s buyer base, which slants in the direction of youthful customers, has already proven a marked minimize in spending: on each petrol and groceries, the rise in complete spending has lagged behind the rises in costs, indicating a extra prudent method. “That has to point a change in shopper behaviour,” he mentioned.

Reporting by Tim Bradshaw, Steff Chávez, Alice Hancock, Patrick Mathurin and Patricia Nilsson