A

comparability of the extent of power value will increase for customers in

the UK and France has attracted loads of consideration. The French

authorities, in a presidential election yr, has been fast to restrict

the extent of any enhance for the

shopper ensuing from large will increase in wholesale costs

following the restoration from the pandemic and, extra just lately, Putin’s

invasion of Ukraine. In distinction within the UK the

regulator, Ofgem, has set a really giant enhance in its value

cap, which can be painful for all UK customers from this Spring. (On

the origins of the worth cap see Giles Wilkes right here.)

This

in flip has reopened the controversy between two totally different kinds of

relationship between the federal government and components of the power trade:

nationalisation (EDF is essentially owned by the French authorities) or

regulation of privately owned firms (as within the UK). Many

customers will naturally see the flexibility of the federal government to

straight restrict power costs as a bonus of the nationalisation

mannequin. As well as a lot has been manufactured from the massive enhance in earnings of many power firms.

Any

dialogue on this subject can simply get slowed down in particulars. It’s

essential to tell apart between power

provide (e.g. BP and Shell) and distribution (within the UK, dominated

by the Massive

6).

The

earnings of the previous are sure to rise when costs rise by much more

than the price of extracting power. Within the UK Ofgem regulates power

distribution, and when power market costs rise this will increase the

prices these firms need to pay. That is the rationale for the rise in

Ofgem’s value cap, though that appears to be according to a latest

giant

enhance in earnings

of the Massive 6.

I

need to summary from this element by fascinated by a single

(‘vertically built-in’) power firm that each provides and

distributes. The reason being that I need to deal with the excellence between

costs and earnings (or who advantages from increased costs). It’s

doable for the federal government to permit increased costs, however to tax the

earnings these increased costs deliver to firms, and use these

‘windfall taxes’ to switch cash to customers or for another

socially helpful goal. I need to argue right here that that is precisely

what needs to be occurring proper now.

Costs

ship out alerts to each customers and corporations. Increased costs suggest a

commodity has seen a discount in provide or an increase in demand, which

encourages customers to economise on utilizing the commodity the place they

can. Equally the upper earnings that have a tendency to come back with increased costs

encourage corporations to speculate extra to supply extra of the commodity. The

value sign is doing a helpful job on each accounts.

Nevertheless

with power, which on the margin is produced by burning carbon, it’s

additionally very important that we take into consideration local weather change, which is continuing

largely unchecked in an alarming

means. World warming is usually described by economists because the

world’s largest externality, by which they imply that the necessity to

cut back local weather change by consuming much less carbon will not be mirrored in costs.

From

the perspective of decreasing carbon utilization the upper costs for gasoline

and electrical energy are helpful. It’s good to encourage much less use of

power as a result of that helps cut back local weather change. By widening the hole

between carbon primarily based power manufacturing and renewables, increased costs

additionally encourage inexperienced power provide. Nevertheless increased power costs additionally

encourage extra extraction of oil and gasoline, and nationwide governments usually do not cease power corporations doing this (some could

certainly encourage it).

It

is on this context that we have to contemplate a latest proposal

from the European Fee. They recommend member international locations tax the

earnings power firms constructed from latest power value spikes and make investments

the income in renewable power and energy-saving renovations. In

doing this, the proposal suggests, EU governments wouldn’t be

falling foul of EU guidelines.

The

essential level is that ‘extra’ earnings are taxed, fairly than

what the cash is spent on. Tax will increase aren’t usually straight

linked to how that cash is spent (they don’t seem to be hypothecated).

Within the UK extra money is desperately wanted by the poorest to assist pay

increased meals and power payments, and that’s finest supplied by elevating

ranges of Common Credit score. Whether or not the federal government does that from

basic taxation, another means or from a windfall tax is

incidental past media bulletins.

The

goal of a windfall tax on power firms is to make sure that the

excessive earnings made by these corporations don’t find yourself as paying for

funding in non-green power manufacturing, or as dividends or capital

good points (from share buy-backs)

to house owners of the shares of these corporations, however are directed to a extra

socially helpful finish.

What

are the arguments in opposition to taxing the earnings generated by excessive market

costs? Let’s have a look at an FT editorial

entitled “Windfall taxes on power firms are a nasty thought”.

Amongst many paragraphs, the one substantive argument seems to be

this:

“Stability

is vital to selling each funding and spending — each of which

drive financial progress. Predictable and fixed rules are

identifiers of a society ruled by the rule of legislation.”

Stability,

the final word final resort of the conservative, is a non-argument in

this case, as I might be fairly completely happy to enshrine within the rule of legislation a

tax schedule for these firms that taxes very excessive earnings at a

excessive marginal fee. Redirecting excessive earnings to both inexperienced

funding or increased advantages to the poor would additionally drive financial

progress, with fairly extra drive than if the earnings find yourself with

shareholders. The editorial has all of the hallmarks of some poor junior

scribe being informed to jot down one thing about why windfall taxes are a

unhealthy thought, and having to scrape the barrel to seek out any first rate

argument. I’m glad to see that Chris Giles, senior FT economics

editor, has just lately written in favour of windfall taxes on power

firms within the FT right here. (Extra bogus arguments are debunked by Michael Jacobs right here.)

One

argument in opposition to nationalisation is that politicians come below big

stress to maintain costs low, as customers (who’re additionally voters) see

the fast good thing about decrease costs, whereas the upper taxes, decrease

spending or no matter that’s the counterpart of subsidizing power is

extra opaque. A regulator will not be below related electoral stress, and

can guarantee costs ship applicable alerts. Nevertheless such an argument

in opposition to nationalisation can solely be made if the federal government is

ready to implement windfall taxes on power firms when their

earnings are very excessive, and that’s one thing the UK authorities has

not to this point been ready to do.

This

argument can be central to the Chancellor’s Spring Assertion

tomorrow. The Decision Basis units out a few of his choices

right here.

A lower in gas responsibility, although broadly anticipated, simply subsidises CO2

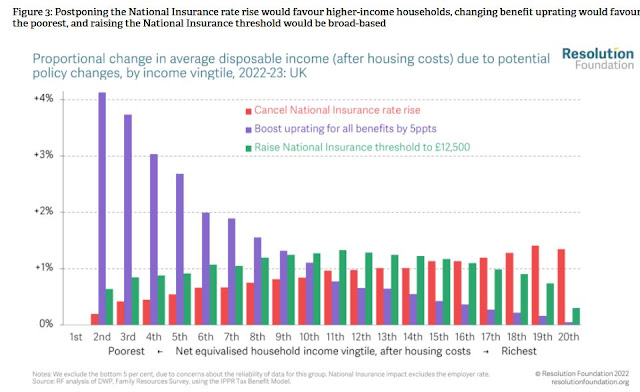

emissions at a major value to the general public. Hardly shocking from successive Conservative Chancellors who hold promising to place up gas responsibility and hold failing to take action, making nonsense of claims it is a inexperienced authorities. On different measures, Sunak ought to deal with a giant uprating in common profit which offers

most assist to those that want it, because the Decision Basis reveals.

However

there are few votes for him in serving to the poor, in order that consequence

appears much less prone to occur.

Postscript (24/03/22): Sunak’s Spring Assertion reveals that Sunak has not given up hope of quickly changing Johnson as Prime Minister. He introduced a set of measures that did little to deal with the price of dwelling disaster most individuals face, did little to assist the economic system, however was designed to attraction to a majority of Conservative MPs that Sunak must develop into Prime Minister. So what does his package deal inform us concerning the common Tory MP?

First, their ideology has not progressed a lot from Thatcherism. They need tax cuts and a smaller state, and Sunak used the price of dwelling disaster to provide them each. With authorities spending plans already fastened in nominal phrases, increased inflation produced a squeeze on spending however increased taxes, and Sunak used that extra income to supply some modest tax cuts. This ideology is totally unsuited to the occasions, as each Johnson and Sunak had acknowledged by elevating well being spending and taxes by much more within the Autumn, but it surely stays what Conservative MPs are comfy with. Neoliberalism could also be dying, but it surely lives on within the minds of many Conservative MPs.

Second, most Conservative MPs nonetheless regard tackling local weather change as ‘inexperienced crap’ that they need to make a token of supporting however is not going to let get in the best way of their ideology or electoral fortunes. So we had some VAT reduction for insulation and warmth pumps (the token), however there was no windfall tax on power firms (see above) however as a substitute a lower in gas responsibility to encourage extra automobile use. The phrases web zero didn’t seem in his speech, maybe as a result of it did not happen to Sunak that it ought to, however extra probably as a result of he needs to have these MPs that need to scrap the online zero dedication on board.

Third, Conservative MPs are landlords fairly than tenants, so he promised to chop revenue tax charges earlier than the election whereas on the similar time placing up nationwide insurance coverage contributions. That is virtually giving with one hand whereas taking with the opposite, besides that nationwide insurance coverage contributions aren’t paid by anybody who will get their revenue from sources aside from working, like landlords or that favourite Tory voting group, pensioners. A certain means of interesting to Conservative MPs is to attraction to their pockets. Total, if we mix this assertion with choices taken final Autumn, the Chancellor will not be serving to working folks cope with the price of dwelling disaster, however making that disaster a lot worse, as this OBR chart reveals. The common wage is anticipated to fall by 1% earlier than tax in comparison with final yr, however by 3% after tax by subsequent yr as Sunak’s tax rises take maintain.

The UK’s value of dwelling disaster is largely the Chancellor’s alternative as he places deficit targets above the wants of working folks.

Fourth and worst of all, your typical Conservative MP doesn’t care one jot concerning the poor or disabled, and certainly is kind of completely happy to stigmatize these on advantages if that brings electoral benefit. Whereas the Conservative social gathering pretends to be inexperienced, it does not even fake to care about poverty. As I notice above, the only best measure to assist those that want it most to climate the price of dwelling disaster – to maintain meals on their plates and homes heat – was a rise in common credit score, however that was not a part of Sunak’s plan. Certainly the entire funds was designed to assist center earners on the expense of the poor, whose out and in of labor advantages can be uprated by previous inflation whereas present inflation is greater than double this. The explanation for this indifference has little or no to do with Sunak’s private wealth, and fairly extra to do with who votes Conservative. One of the simplest ways to attraction to a Conservative MP is to attraction to these prone to vote for them.

So we obtained a Spring Assertion that Conservative MPs can cheer, however will enable an estimated 1.3 million within the UK to fall into absolute poverty. We obtained a Spring Assertion that, mixed with earlier choices, will make the price of dwelling disaster far worse for the common employee, however is sweet for landlords, pensioners and people with unearned revenue. A Spring Assertion that ignores the chance to divert document power firm earnings into serving to the poor and greening the economic system. A Spring Assertion that displays one man’s want for energy, and the way unrepresentative and out of contact with working folks most Conservative MPs are.