Opposite to what many enterprise house owners and buyers assume, the money movement formulation is kind of simple and never that difficult.

Desk of Contents

- Free Money Stream Method

- Working Money Stream Method

- Internet Money Stream Method

- Discounted Money Stream Method

- The place Can You Discover a Dependable Money Stream Calculator?

- Backside Line

Sadly, many enterprise house owners fail to understand the money movement idea and implement it of their enterprise. It’s why 30% of companies fail because of operating out of cash. About 60% of enterprise house owners say that they don’t perceive the money movement formulation and don’t know a lot about finance and accounting.

Because you’ve opened this text, congratulations on taking step one in the direction of understanding it. You’re heading in the right direction to with the ability to monitor your money movement and grasp something to do with your corporation funds.

On this publish, we’re going to take a look at three money movement formulation, their advantages, and what they let you know about your corporation. Don’t fear if this appears to be like like an alien idea. We’ll break the formulation right down to the newbie degree.

Free Money Stream Method

The free money movement formulation is without doubt one of the most essential money movement formulation. Most enterprise house owners use the free money movement formulation to plan and finances. The formulation’s foremost profit is that it helps you perceive how a lot cash is really out there or free to make use of.

With this formulation, you may reply questions akin to:

- Are you able to afford to pay for brand spanking new enterprise software program?

- Do you could have sufficient funds to pay your contractors once they ship you an bill?

- How a lot money do it’s a must to spend on personalised presents in your shoppers?

What Is Free Money Stream Method?

Calculating your corporation’ money movement is kind of simple. What you want is the corporate’s steadiness sheet or revenue assertion so that you could pull the essential numbers.

First, let’s have a look at the monetary metrics you’ll be needing:

- Internet Revenue: Internet Revenue is the revenue you stay with after deducting all enterprise bills from gross revenue. You’ll be able to name it your revenue. You will discover the determine within the Revenue Assertion.

- Working Capital: Working Capital represents the capital it’s worthwhile to run the day-to-day enterprise operations. It’s the distinction between enterprise property and liabilities. You’ll be able to calculate it by discovering the distinction between your property and liabilities in your steadiness sheet.

- Depreciation/Amortization: Bear in mind, many enterprise property, together with tools, lose worth as time goes by. Depreciation is the measure of how that worth is misplaced. However, amortization is factoring in an asset’s preliminary value and breaking it down over its lifetime. You will discover the mentioned metrics in your Revenue Assertion.

- Capital Expenditure: Capital expenditure is the cash you spend on your corporation’s fastened property, akin to actual property, land, or tools. You will discover the capital expenditure on the Money Flows Assertion.

With this in thoughts, let’s have a look at what the formulation appears to be like like:

Free Money Stream = Internet Revenue + Depreciation/Amortization – Working Capital – Capital Expenditure

Free Money Stream Case Examine

Let’s have a look at a real-life instance of how one can apply the above formulation in your corporation. Invoice runs an actual property brokerage agency and desires to calculate his free money movement to see if he can afford to rent an accountant for 10 hours a month.

Will’s annual financials seem like the next:

- Internet Revenue: $100,000

- Depreciation/Amortization: $0

- Change in Working Capital: $12,000

- Capital Expenditure: $3,000

As such, that is how Invoice will calculate his enterprise’s free money movement:

[$100,000] + [$0] – [$12,000] – [$3,000] = $85,000

It means there’s $85,000 out there in money for him to reinvest again into his enterprise.

Working Money Stream Method

As we’ve seen, free money movement offers you an concept of how a lot money it’s a must to reinvest again into your corporation. Nevertheless, there’s a slight drawback with its method; it doesn’t present a transparent image of your common each day money movement. It’s as a result of its formulation doesn’t think about any irregular spending, investments, or earnings.

For instance, let’s say you promote one among your massive enterprise property. Utilizing the earlier formulation, your free money movement would enhance. Nevertheless, it doesn’t mirror your precise enterprise money movement. That is the place the working money movement formulation is available in.

Why is the working money movement formulation essential?

Whenever you’re on the lookout for financing for your corporation, lenders or enterprise capital companies are extra possible to take a look at your working money movement because it represents the everyday money movement for your corporation. The identical applies whenever you need to begin working with a monetary advisor or an accountant.

Associated: Actual Property Stays Among the many Greatest Money Stream Investments

What Is Working Money Stream Method?

As we mentioned within the free money movement above, you additionally want your corporation revenue assertion and steadiness sheet to calculate your working money movement.

Additionally, be aware that once we discuss with Working Revenue within the formulation, we imply the distinction between complete income and working bills, like employee wages and value of products bought.

That is the way you get money movement from operations formulation:

Working Money Stream = Working Revenue + Depreciation – Taxes + Change in Working Capital

Working Money Stream Case Examine

Following Invoice’s enterprise instance above, let’s assume that is how his enterprise financials seem like:

- Working Revenue: $100,000

- Depreciation: $0

- Taxes: $10,000

- Change in Working Capital: -$15,000

That is how Invoice will calculate his working money movement:

[$100,000] + [$0] – [$10,000] + [-$15,000] = $75,000

As such, Invoice makes an annual working money movement of $75,000 from his common working bills.

Internet Money Stream Method

Merely put, Internet Money Stream (NCF) is a metric used to inform the sum of money that went out and in of a enterprise’s account inside a selected interval. If the cash that got here in was greater than the cash that went out, the enterprise skilled a constructive money movement. If the other is true, then the enterprise was working on a adverse money movement.

The primary advantage of NCF is that it lets the enterprise proprietor see if the enterprise is doing properly or if there’s a danger of submitting for chapter. Constant durations of constructive money movement show that the enterprise is doing properly and will be able to develop. Inversely, a adverse money movement implies that the enterprise is struggling.

To calculate your corporation’s NCF, it’s worthwhile to entry your money movement assertion and have a look at the financing actions, investing actions, and working actions.

What Is the Method for Internet Money Stream?

From how we’ve outlined internet money movement, the straightforward formulation can be as follows:

Internet Money Stream = Complete Quantity of Money In – Complete Quantity of Money Out

Nevertheless, we will additional develop that formulation to make it extra complete, as follows:

Internet Money Stream = Internet Money Stream from Financing Actions + Internet Money Stream from Working Actions + Internet Money Stream from Investing Actions

In case you don’t perceive, right here’s a breakdown of the metrics:

- Internet Money Stream from Financing Actions: The distinction between the money flowing in from financing actions, akin to enterprise loans, and money outflows from financing actions, akin to mortgage repayments.

- Internet Money Stream from Investing Actions: The distinction between money influx from investing actions, akin to promoting funding property, and money outflow from investing actions, akin to shopping for fastened property.

- Internet Money Stream from Working Actions: Examples of internet money movement in working actions embrace the change in internet enterprise revenue for the precise interval. You can too embrace the variations to steadiness the online money influx or outflow for enterprise working actions.

Internet Money Stream Case Examine

Let’s consider Iman from one other firm who desires to calculate her enterprise’ internet money movement. Under are the numbers she will get from her assertion of money movement:

- Internet Money Stream from Working Actions: $70,000

- Internet Money Stream from Financing Actions: $20,000

- Internet Money Stream from Investing Actions: -$50,000

That is what her internet money movement calculations will seem like:

[$70,000] + [$20,000] + [-$50,000] = $40,000

Iman realizes a constructive money movement of $40,000 inside that particular interval. It is a good signal and he or she ought to work to make sure she maintains a constructive money movement.

Discounted Money Stream Method

Discounted money movement (DCF) formulation is used to guage the price of return a enterprise would possibly generate sooner or later. The formulation is used to find out the worth of an organization’s funding based mostly on the estimated future money movement of the enterprise.

Enterprise house owners additionally use DCF to find out the present worth of an asset or funding by evaluating its monetary projections and taking a look at how a lot it may earn sooner or later.

The primary advantage of DCF is that it helps enterprise house owners and professionals oversee or might determine to make enterprise adjustments to their processes, akin to hiring new staff or buying new tools.

What Is Discounted Money Stream Method?

The DCF formulation provides all of the money flows for each reporting interval after which divides the entire by one plus the low cost price raised to the ability of n. That is what the formulation appears to be like like:

DCF = [(Cash Flow) ÷ (1 + r) ^1] + [(Cash Flow) ÷ (1 + r) ^2] + [(Cash Flow) ÷ (1 + r) ^n]

Let’s breakdown the formulation as follows to grasp it higher:

- Money movement represents your corporation’s free money movement. Bear in mind, it’s the cash left after subtracting employee and contractor funds, working bills, and capital expenditures.

- R represents the low cost price. It is the same as the weighted common value of capital (WACC). The WACC is the common price your corporation expects to pay the stakeholders to fund its property.

- N is the interval quantity that your organization is reporting. For instance, in the event you’re reporting quarterly experiences, the n worth represents quarter one, then quarter two, and so forth.

Watch out when calculating your organization’s discounted money movement formulation. Easy inaccuracies in estimating future earnings and return on funding can result in undesired outcomes.

Additionally, the principle limitation of the DCF formulation is that it requires plenty of assumptions. For example, it’s worthwhile to estimate future money flows from an organization funding, but future money flows rely upon market demand, competitors, know-how, and different unexpected circumstances.

Should you estimate the long run money flows too excessive, you would possibly select an funding which may not repay as anticipated. Estimating too low may make the funding appear too pricey and lead to missed alternatives.

Associated: How Do You Obtain a Optimistic Money Stream in Actual Property?

The place Can You Discover a Dependable Money Stream Calculator?

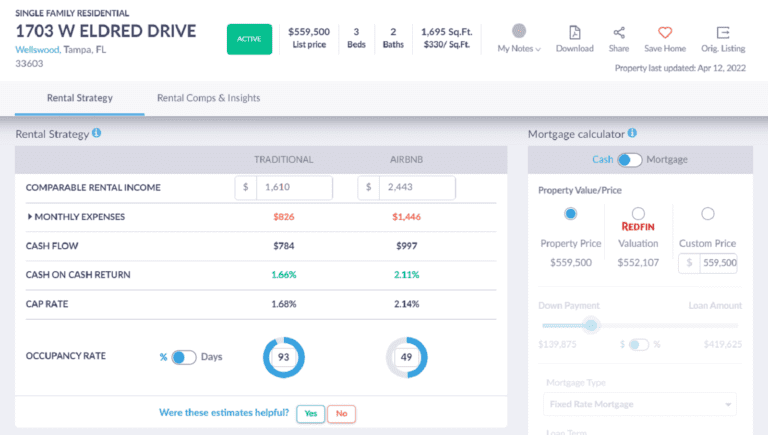

Now that we’ve understood the essential money movement formulation, you may be questioning how one can really calculate your corporation’s money movement. Mashvisor’s rental property calculator is the very best instrument for doing so, whether or not you’re incomes passive revenue or managing your properties your self.

For starters, Mashvisor is an actual property funding software program whose foremost objective is equipping actual property buyers with correct information and the proper instruments to make sensible funding selections. You’ll be able to ebook a demo to see how one can profit from our instruments.

Mashvisor’s property calculator makes use of machine studying and AI algorithms, massive information, and predictive analytics. As well as, it comes with interactive capabilities. The instrument offers you with correct estimates for each conventional and short-term rental methods. All of the mentioned options make it the very best instrument to calculate money movement out there.

The instrument carries out the next capabilities:

1. Estimates Month-to-month Property Bills

As we’ve seen with most money movement formulation, it’s worthwhile to think about property bills. Mashvisor offers you with correct projections of the sum of money you may anticipate to spend when proudly owning and managing the property. The bills embrace one-time prices, akin to closing charges, and recurring bills, akin to upkeep.

Our platform makes use of rental comps to make sure our information and estimates are correct. For the reason that calculator is interactive, you may change any figures you’re feeling don’t match the market scenario.

2. Estimates Month-to-month Rental Revenue

Mashvisor additionally offers dependable estimates for the month-to-month rental revenue you may anticipate to make. It additionally offers estimates for each conventional and Airbnb rental methods. Similar to the month-to-month bills, you too can modify the revenue projections in case your analysis means that issues may be totally different.

3. Calculates Money Stream

After getting the estimates for bills and revenue at hand, Mashvisor’s calculator then helps you calculate your funding property’s money movement. The money movement you get is for each conventional and Airbnb rental methods. You can too modify the rental revenue and financing charges to see how they’d have an effect on the money movement. This fashion, you may see how one can maximize your rental property’s money movement.

Mashvisor’s Money Stream Calculator helps decide your funding property’s money movement for each conventional and Airbnb rental methods.

4. Calculates the Return on Funding

Because it doesn’t account for the entire money invested, money movement isn’t enough to find out whether or not a rental property is price investing in. It’s essential to calculate the return on funding earlier than you may purchase funding properties.

Mashvisor’s calculator additionally calculates return on funding metrics, akin to money on money return and cap price for each rental methods.

Backside Line

This money movement formulation information has proven us that the calculations aren’t as difficult as one would assume. You need to spend money on a possibility that ensures you constructive money movement. In any case, that’s the one means an funding alternative would make sense.

One of the simplest ways to spend money on good funding properties is through the use of Mashvisor instruments. Enroll with us right now for a 7-day free trial, adopted by 15% off of your quarterly or annual subscription.