Assertion by Philip Lowe, Governor: Financial Coverage Determination

At its assembly at the moment, the Board determined to keep up the money charge goal at 10 foundation factors and the rate of interest on Change Settlement balances at zero per cent.

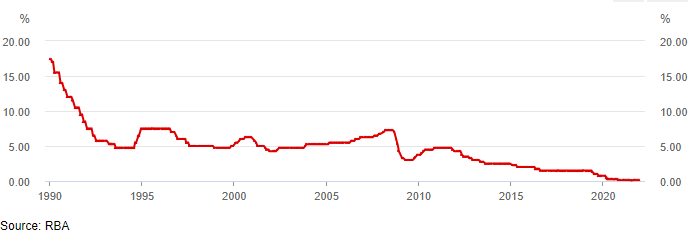

Graph of the Money Charge Goal

Bond Yields

Inflation has elevated sharply in lots of elements of the world. Ongoing supply-side issues, Russia’s invasion of Ukraine and robust demand as economies get better from the pandemic are all contributing to the upward stress on costs. In response, bond yields have risen and expectations of future coverage rates of interest have elevated.

Omicron Outbreak

The Australian financial system stays resilient and spending is choosing up following the Omicron setback. Family and enterprise steadiness sheets are in usually good condition, an upswing in enterprise funding is underway and there’s a massive pipeline of building work to be accomplished. Macroeconomic coverage settings additionally stay supportive of development and nationwide revenue is being boosted by larger commodity costs. On the similar time, rising costs are placing stress on family budgets and the floods are inflicting hardship for a lot of communities.

Labour Market

The energy of the Australian financial system is clear within the labour market, with the unemployment charge falling additional to 4 per cent in February. Underemployment can be at its lowest stage in a few years.

Job vacancies and job adverts are at excessive ranges and level to persevering with sturdy development in employment over the months forward. The RBA’s central forecast is for the unemployment charge to fall to under 4 per cent this 12 months and to stay under 4 per cent subsequent 12 months.

Wages development has picked up, however, on the combination stage, is just across the comparatively low charges prevailing earlier than the pandemic. There are, nonetheless, some areas the place bigger wage will increase are occurring. Given the tightness of the labour market, an additional pick-up in combination wages development and broader measures of labour prices is in prospect.

This pick-up remains to be anticipated to be solely gradual, though there may be uncertainty concerning the behaviour of labour prices at traditionally low ranges of unemployment.

Inflation

Inflation has elevated in Australia, however it stays decrease than in lots of different international locations; in underlying phrases, inflation is 2.6 per cent and in headline phrases it’s 3.5 per cent. Increased costs for petrol and different commodities will end in an additional raise in inflation over coming quarters, with an up to date set of forecasts to be printed in Could.

The principle sources of uncertainty relate to the pace of decision of the assorted supply-side points, developments in world power markets and the evolution of total labour prices.

Housing Markets

Monetary circumstances in Australia proceed to be extremely accommodative. Rates of interest stay at a really low stage, though fastened mortgage charges for brand spanking new loans have risen lately.

The Australian greenback change charge has appreciated because of the larger commodity costs and, in TWI phrases, is across the stage of a 12 months in the past. Housing costs have risen strongly over the previous 12 months, though some housing markets have eased lately.

With rates of interest at traditionally low ranges, it will be important that lending requirements are maintained and that debtors have sufficient buffers.

The Determination

The Board’s insurance policies in the course of the pandemic have supported progress in direction of the aims of full employment and inflation in keeping with the goal.

The Board has wished to see precise proof that inflation is sustainably inside the 2 to three per cent goal vary earlier than it will increase rates of interest. Inflation has picked up and an additional improve is predicted, however development in labour prices has been under charges which might be more likely to be in keeping with inflation being sustainably at goal.

Over coming months, vital further proof will probably be accessible to the Board on each inflation and the evolution of labour prices.

The Board will assess this and different incoming data as its units coverage to assist full employment in Australia and inflation outcomes in keeping with the goal.