Expensive buddies,

It’s been that type of yr. Who would have guessed that I’d miss the quiet sanity of 2021?

It has been lots like that, hasn’t it?

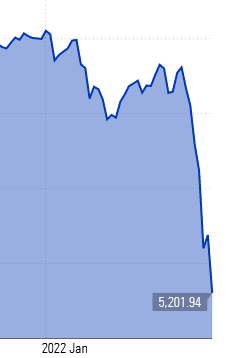

Right here’s a snapshot of 2022 so far: 67% of NASDAQ and 30% of NYSE-listed shares have suffered bear market declines (i.e., losses of greater than 20%). Main indexes noticed three-day swings of 10% or extra – down 6% then up 8% in 72 hours. The VIX (hello, Devesh!) spiked by 50%. Inflation hit a 40-year excessive and oil hit $100 for the primary time since 2014. Bitcoin, celebrated as “the brand new gold” as a result of … nicely, really I’ve no concept of what would trigger folks to assume that, dropped 10% in worth since January 1 however 50% since November. The case for gold is that its worth is unbiased of the inventory market and rises in worth throughout occasions of turmoil; crypto is doing the other. Then, too, Vladimir Putin launched a battle in Europe and the Voya Russia Fund (IIRFX) did this:

Some subset of buyers used all of this volatility to justify their choice to double-down on their publicity to market danger. Reasoning that tech shares certainly couldn’t get any extra overwhelmed down (apparently these of us weren’t available in the market in 2000) and the Fed certainly wasn’t critical about price will increase given all of the turmoil, they started repurchasing meme shares and leveraged publicity to tech. The Wall Avenue Journal reported:

Particular person and institutional buyers jumped into the market. Of the $3.6 billion that buyers poured into U.S. fairness ETFs this week, round a fifth went to the ProShares UltraPro (TQQQ), which supplies turbocharged publicity to the Nasdaq, FactSet information by means of Thursday present. (“Ukraine Disaster Upends Investing Playbook for 2022,” 2/27/2022)

That fund is, by the way in which, down 40% yr up to now.

My colleagues are most likely extra scarred and fewer blindly optimistic about how this all would possibly play out. As you dive additional into the problem, you’ll discover:

Devesh Shah, the creator of the VIX, helps you perceive how one can survive drawdowns.

Lynn Bolin, whose drive is constructing purpose-built portfolios, walks by means of managing danger in a rising price setting.

I provide an replace of a 2021 article on the draw of a stock-light portfolio, wanting on the danger and return profiles of Constancy’s household of Asset Supervisor funds, by means of January 2022.

Mark Freeland, conscious that April 15th (really April 18th this yr) is looming, walks buyers by means of the maze of fund tax guidelines.

For visible learners, Charles previews the cool new MFO Premium charts perform.

And The Shadow highlights business information and developments – it’s beginning to appear to be 25% of all mutual funds are desirous about turning into ETFs – that struck us as compelling.

Wars and rumors of wars

You’ll hear of wars and rumors of wars, however see to it that you’re not alarmed. Such issues should occur, however the finish continues to be to return. Nation will rise in opposition to nation, and kingdom in opposition to kingdom. There will likely be famines and earthquakes in numerous locations. All these are however the starting of the beginning pains. Matthew 24: 6-8

The Russian invasion of Ukraine would possibly, in the long run, transform a turning level. It would possibly be the deadly miscalculation that unseats Vladimir Putin. It would unite Europe and revitalize NATO. It would shake American conservatives from their current isolationism. It would transfer Sweden and Finland to extend army coordination with their European neighbors, encourage German management of the western alliance, or strengthen the hand of front-line international locations dealing with Russia. It would cement a way of nationwide identification among the many various ethnic teams in Ukraine. It would goof together with your portfolio, or not. (Morningstar shared a listing of bond funds with actually substantial publicity to Russia.)

However within the quick time period, it’s a huge human tragedy inflicted on young children, frightened dad and mom, and anxious elders. The United Nations stories 500,000 folks made homeless in per week. Kids, and kids’s hospitals, have grow to be collateral injury in Putin’s assault. Lately will settle a weight on them that may by no means be totally lifted.

I used to be referred to as upon, a few years and relatively too many wars in the past, to learn aloud a part of Mark Twain’s “Warfare Prayer” (1916). It was impressed, presumably, by a rising tide of assist for US involvement in The Nice Warfare. A church stuffed with these about to go to battle, and with their ebullient neighbors, confronts “an aged stranger [who] entered and moved with sluggish and noiseless step up the primary aisle, his eyes fastened upon the minister, his lengthy physique clothed in a gown that reached to his toes, his head naked, his white hair descending in a frothy cataract to his shoulders.” He bore, he introduced, a message “from Almighty God.” The message was that their pro-war prayers can be answered, so long as they affirmed the unstated a part of what their prayer entailed:

assist us to wring the hearts of their unoffending widows with unavailing grief; assist us to show them out roofless with their little kids to wander unfriended within the wastes of their desolated land in rags and starvation and thirst, sports activities of the solar flames in summer season and the icy winds of winter, damaged in spirit, worn with travail, imploring thee for the refuge of the grave and denied it—

For our sakes who adore Thee, Lord, blast their hopes, blight their lives, protract their bitter pilgrimage, make heavy their steps, water their manner with their tears, stain the white snow with the blood of their wounded toes!

Twain’s passage ends, “It was believed afterward that the person was a lunatic as a result of there was no sense in what he stated.”

These of us who’ve the luxurious of worrying about how a lot it prices to fill our pick-ups and SUVs, or in regards to the vicissitudes of the NFL low season, ought to attempt to assist elevate as a lot of the burden from them as we will.

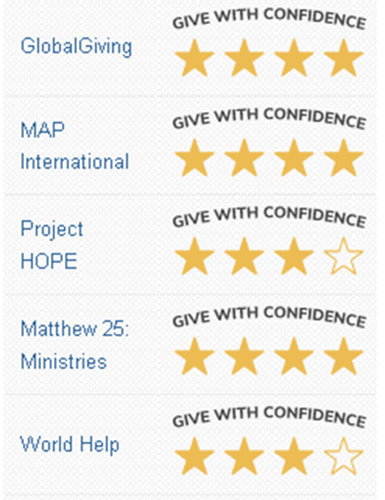

Please take a second and provides no matter help you’ll be able to to the folks of Ukraine. The UN Refugee Company has helped relatively greater than 11 million displaced folks through the years and accepts on-line donations. Charity Navigator highlights a handful of charities that strike them as accountable actors. I’m undecided who, amongst them, is “finest.” My very own conclusion was that giving cash to good folks proper now is best than giving cash to nice folks finally. That led me to donate to the UN Refugee program and, by means of Charity Navigator, to Save the Kids, Catholic Reduction Companies, and International Giving’s Ukraine Disaster Reduction fund.

Please take a second and provides no matter help you’ll be able to to the folks of Ukraine. The UN Refugee Company has helped relatively greater than 11 million displaced folks through the years and accepts on-line donations. Charity Navigator highlights a handful of charities that strike them as accountable actors. I’m undecided who, amongst them, is “finest.” My very own conclusion was that giving cash to good folks proper now is best than giving cash to nice folks finally. That led me to donate to the UN Refugee program and, by means of Charity Navigator, to Save the Kids, Catholic Reduction Companies, and International Giving’s Ukraine Disaster Reduction fund.

It’s diversification, of a form.

In the meantime, different points grind on

The magisterial IPCC Sixth Evaluation report, launched on February 28, 2022, supplied the most recent consensus on the “impacts, adaptation and vulnerability” of local weather change. They concluded that “risks of local weather change are mounting so quickly that they may quickly overwhelm the power of each nature and humanity to adapt” (“Local weather Change Is Harming the Planet Sooner Than We Can Adapt, U.N. Warns,” New York Occasions, 2/28/22).

As an funding matter, two questions come up. (1) Is it price doing something with my portfolio? And (2) in that case, what?

Is it well worth the effort?

The Wall Avenue Journal has a long-standing file of skepticism about sustainable investing. Their most sustained broadside got here in a week-long sequence of articles by James Macintosh in January, decrying “the sustainable funding craze” (1/23/2022) and concluding “ESG investing can do good or can do nicely, however don’t anticipate each” (1/24/2022). Mr. Macintosh’s positions are that ESG funds are a advertising and marketing rip-off, they misdirect consideration from important political initiatives, they usually essentially sacrifice actual funding beneficial properties in pursuit of illusory social items. I’m notably skeptical of articles the place the conclusion predates the examination of the proof, and this has been the Journal’s conclusion for a very long time. The proof seems to be extra like, “nicely, sure, some funds are gimmicky and suck however that’s not an inherent attribute of the group.”

Morningstar provided a transparent and blessedly quick response, Jon Hale’s “What The Wall Avenue Journal Missed About Sustainable Investing” (1/28/2022). Don Phillips, a managing director at Morningstar and former Alpha Canine, extends among the arguments in “A Higher Case for ESG” (2/11/2022). Right here’s the synopsis: ESG buyers, particular person {and professional} alike, are neither silly nor delusional. They know that this could solely be part of any effort to handle the consequences of local weather change, nevertheless it would possibly nicely be an important half as a result of it provides an important and ongoing supply of strain on company decision-makers.

However the place to take a position?

There are not less than two paths to contemplate. One is to put money into overtly ESG funds with a protracted efficiency file and clearly articulated self-discipline. An enormous variety of funds have solely not too long ago stapled the “ESG” designation to their operations, which regularly means the long-term data are meaningless and the standard of the ESG dedication is doubtful.

The second path is infrastructure funds. These funds put money into the businesses which can be addressing the important adjustments to our constructed setting, from energy grids to water crops and seawalls. They supply an attention-grabbing complement to ESG funds as a result of most, although not fairly all, ESG funds put money into progress shares whereas nearly all infrastructure funds put money into worth shares.

In our April difficulty, we’ll use an interview with the managers of the First Sentier Buyers American Listed Infrastructure Fund (FLIAX), a brand new institutional fund from a long-standing workforce, as a lens by means of which to have a look at the group.

“The workforce continues to be engaged on it”

Between December 1, 2021, and February 2022, 158 new open-end and exchange-traded funds had been launched. Due to a perplexing glitch, Morningstar.com’s Premium Fund Screener says solely 11 funds had been launched in that interval. We’ve been in dialog with Morningstar’s retail assist and media groups, this yr and final, who agree that it’s an issue. The standing, as of February 28, 2022, is “the workforce continues to be engaged on the highlighted difficulty and we’re but to obtain any replace from them.” We’ll replace you if the issue will get resolved.

The larger weak spot is that the Morningstar screener, not like the MFO Premium one, can not concurrently search mutual funds and ETFs. A separate ETF-only screener was tremendous within the days when ETFs had been all passive funds and largely insignificant ones, however the rising tide of fund-to-ETF conversions makes it clear that direct comparisons are important. The nice of us at Morningstar responded, most not too long ago, “We now have taken this as an enhancement and forwarded the identical to the involved workforce.”

Actually, it’s not an non-obligatory change. The fund screener is sort of meaningless if its outputs aren’t built-in with the ETF screener. For those who want that performance and have $120, relatively than a five-digit quantity for a Morningstar Direct seat, I’d actually suggest you take a look at the MFO Premium screener.

In memoriam

We observe with disappointment the passing of David W. James (1967-2022). Mr. James was the director of analysis at James Funding Analysis, a agency launched by his father Frank James, and a co-manager on all 4 of the James funds. Mr. James was engaged to be married and was, by all accounts, a superb and loving individual. His older brother, Barry, leads each the agency and the groups guiding the James funds. We want all of them peace.

We observe with disappointment the passing of David W. James (1967-2022). Mr. James was the director of analysis at James Funding Analysis, a agency launched by his father Frank James, and a co-manager on all 4 of the James funds. Mr. James was engaged to be married and was, by all accounts, a superb and loving individual. His older brother, Barry, leads each the agency and the groups guiding the James funds. We want all of them peace.

Thanks, as ever!

Due to our devoted contributors this month: to the beneficiant of us behind the Weeks Household Charitable Fund, Gardey Monetary Advisors (welcome again, guys!), and the nice of us at S&F Funding Advisors. And, most particularly, to our subscribers: Gregory, William, Brian, David, William, Doug.

If you want MFO to thrive within the yr forward, please assist it … both financially or by reaching out to Devesh, Mark, Lynn, and Invoice to allow them to know that you just admire their dedication and are considering their insights. You’d be shocked at how far a bit of encouragement goes!

On behalf of the parents at MFO,