Local weather change may have an effect on banks and the monetary techniques they anchor via numerous channels: more and more excessive climate is one (Monetary Stability Board, Basel Committee on Financial institution Supervision). In our latest employees report, we measurement up this channel by finding out how U.S. banks, massive and small, fared in opposition to disasters previous. We discover even probably the most damaging disasters had insignificant or small results on financial institution stability and small and constructive results on financial institution earnings. We conjecture that restoration lending after disasters helps stabilize bigger banks whereas smaller, native banks’ data of “unmarked” (flood) hazards could assist them navigate catastrophe danger. Federal catastrophe assist appears to not act as a financial institution stabilizer.

Financial institution Catastrophe Publicity

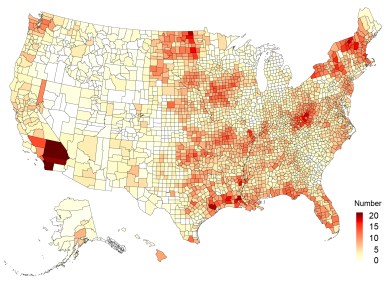

We studied the consequences of all FEMA climate disasters between 1995 to 2018. FEMA disasters are “official” disasters, declared by the President on the request of governors. If granted (some aren’t) the declaration releases federal monetary assist to lined affected areas. The map under exhibits the place, and the way usually, disasters strike. Most counties had been hit by not less than one whereas counties in southern California, the Midwest, and alongside coasts skilled fifteen or extra during the last quarter century.

Variety of FEMA Climate Disasters by County: 1995 – 2018

We measure banks’ publicity to catastrophe by their relative share of branches in a county occasions the quantity of property damages wrought by a catastrophe (utilizing SHELDUS harm estimates). We pay particular consideration to “excessive disasters”—these within the 90th percentile of damages. For example, think about a financial institution with half of its branches situated in a county, which branches characterize one tenth of all financial institution branches situated there. If an excessive catastrophe destroys $100 million in property within the county, the financial institution‘s publicity is $5 million ($100 million x 0.5 x 0.10). We additionally look specifically at banks with all their branches in only one county; these hyper-local banks within the “eye” of the storm could also be extra susceptible (given publicity) than multi-county banks that may draw on liquidity from branches elsewhere. Briefly, we checked out how probably the most extreme disasters affected probably the most susceptible banks.

Disasters Affect Estimates

Utilizing regression fashions, we estimated the impression of utmost catastrophe publicity on normal stability measures together with mortgage loss charges, default danger, and earnings. Banks don’t trigger the climate, so the correlations are plausibly causal.

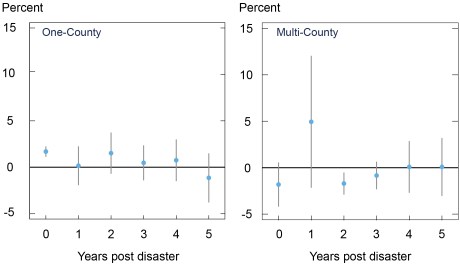

The estimates for mortgage loss charges are proven under. If the 95 p.c confidence band via the estimate consists of zero, we are saying that the estimated impact just isn’t statistically important. We see on the left that loss charges at single-county banks rise about 2 p.c above common within the 12 months of the catastrophe however return to common thereafter. Loss charges at multi-county banks by no means improve considerably. Their losses spike in 12 months one however the estimate is imprecise, starting from -3 p.c to 12 p.c. In any case, their losses rapidly return to common. General, these mortgage loss impacts appear modest and short-term.

Mortgage Loss Charges after Excessive Climate Disasters,

by Financial institution Footprint

Notes: Plotted is the estimated change in mortgage loss (charge-off) charges given a regular deviation improve in excessive catastrophe publicity. The change is expressed as a share of the common loss price. “Excessive disasters” are these in 90th percentile (by damages) of all FEMA disasters. The bands via the estimates are 95 p.c confidence bands. The estimates use annual U.S. financial institution knowledge over 1995-2018. One-county banks have all their branches situated in a single county.

We additionally discover modest results on default danger, or moderately, distance-to-default (Z rating). We see within the prime panel under that default danger at multi-county banks is unaffected by excessive disasters. The image for single-county banks is much less benign, as we anticipated. They edged about one p.c nearer to default after excessive disasters, and the impact persists over the medium run. Whereas regarding to the financial institution and supervisors, the impression doesn’t appear destabilizing. The common financial institution moved over 10 p.c nearer to default in the course of the 2008 banking disaster (a number of occasions extra for banks most affected by the disaster).

Furthermore, disasters should not essentially dangerous for banks; excessive disasters are likely to improve banks’ backside line, because the decrease panels present. The will increase in earnings are small, to make certain, however the image doesn’t recommend eroded earnings over the medium time period.

Default Threat and Income after Excessive Climate Disasters,

by Financial institution Footprint

Notes: Proven are the estimated change distance-to-default (prime) and financial institution earnings (backside) given a regular deviation improve in excessive catastrophe publicity. The adjustments are expressed as a share of the common loss price. “Excessive disasters” are these in 90th percentile (by damages) of all FEMA disasters. The bands via the estimates are 95 p.c confidence bands. The estimates use annual U.S. financial institution knowledge over 1995-2018. One-county banks have all their branches situated in a single county.

Mitigated Disasters?

We thought-about three components which may clarify banks’ resilience, beginning with FEMA catastrophe assist. Though FEMA assist goes primarily to households, it may buttress banks not directly. To analyze, we in contrast counties that acquired assist to neighboring counties that didn’t—disparities that may mirror political friction (Gasper 2015). We discover that banks within the former (that’s, aided) counties didn’t fare considerably higher, given damages, suggesting FEMA assist just isn’t the primary, financial institution stabilizer.

A second potential stabilizer is just the truth that climate disasters improve the demand for loans. Households and enterprise alike might have credit score to rebuild and restore following a damaging occasion (the Financial institution of America burnished its repute with beneficiant “handshake” loans after the devastating San Francisco earthquake and hearth in 1906). Banks’ earnings on new loans can offset losses on prior loans and even, as we discovered, strengthen their backside traces considerably. We affirm (following others) that lending by multi-county banks improve after disasters. If elevated mortgage demand stabilizes banks in opposition to disasters, it would clarify why FEMA assist appears to not—as that assist could also be an alternative choice to loans.

“Native data” is a 3rd potential stabilizer we think about. Small, domestically based mostly banks are recognized to have nearer relationships with debtors than extra distant, bigger banks (Rajan and Petersen). Accordingly, we conjecture that native banks might also be higher knowledgeable about flood hazard the place they function. Utilizing digitized variations of FEMA’s historic flood maps, we discover that one-county banks keep away from mortgage lending in zones the place floods are extra frequent than flood maps would predict. Figuring out the lay of the land could assist them handle flood dangers.

Last Issues

The modest catastrophe results we discover for U.S. banks appear in keeping with the ECBs local weather stress assessments carried out final 12 months in addition to research mentioned in our paper. Warning is suggested, even so. First, we appeared backward; if the disasters looming are orders of magnitude worse than excessive disasters previous, stability considerations stay. Second, we ignored (for lack of information) the stabilizing advantages of property insurance coverage. In a world with out insurance coverage, climate disasters would absolutely be worse for banks. In fact, prudently supervised banks may be anticipated to keep away from lending in opposition to uninsurable belongings. Third, as we famous at first, local weather change may have an effect on financial institution stability via different channels.

Kristian Blickle is an economist within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Donald Morgan is an assistant vice chairman within the Financial institution’s Analysis and Statistics Group.

cite this submit:

Kristian Blickle and Donald Morgan, “Local weather Change and Monetary Stability: The Climate Channel,” Federal Reserve Financial institution of New York Liberty Road Economics, April 4, 2022. https://libertystreeteconomics.newyorkfed.org/2022/04/climate-change-and-financial-stability-the-weather-channel/.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially mirror the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the duty of the creator(s).