Not too long ago CBDT notified the newest ITR Types AY 2022-23 / FY 2021-22. What are the modifications within the new ITR Types for AY 2022-23? Which type to make use of for submitting ITR? Allow us to attempt to reply these questions intimately.

Let me first share with you the Revenue Tax Slab charges relevant for AY 2022-23 / FY 2021-22.

As per the Revenue Tax Act 1961, if the particular person’s earnings exceeds the fundamental restrict prescribed by the earnings tax division in a monetary yr (at the moment it’s Rs.2,50,000), must file an earnings tax return. Normally, the due dates to file ITR are thirty first July for salaried people and non-auditable corporations. For corporations and auditable corporations, it’s thirtieth September. Nevertheless, the IT Division could prolong these deadlines.

Adjustments within the ITR Types for AY 2022-23

Allow us to now focus on the foremost modifications within the ITR Types for AY 2022-23.

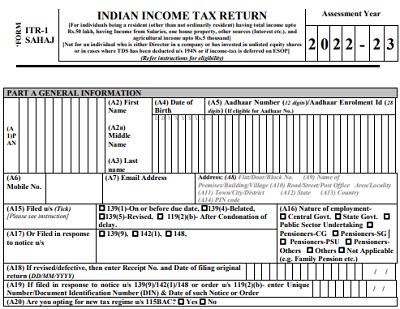

# Class of Pensioners

Within the previous ITR varieties, for Nature of Employment, a person receiving pension had to decide on the choice of ‘Pensioners’. In new ITR varieties, the next choices have been included for pensioners:

- Pensioners – CG,

- Pensioners – SC,

- Pensioners – PSU and

- Pensioners – Others.

# Reporting of Curiosity Revenue from EPF

It’s possible you’ll remember that if an worker contribution crosses greater than Rs.2,50,000 a yr (monetary yr), then curiosity accrued on such further contribution is taxed as an “Revenue from Different Sources”. Now onwards, it’s important to declare such curiosity earnings on yearly foundation and pay the tax.

Nevertheless, if such an individual has contributed to a fund wherein there is no such thing as a contribution by the employer, the restrict of Rs. 2,50,000 shall be elevated to Rs. 5,00,000.

Within the new ITR varieties, the Schedule OS (Different Sources) has been amended to include the reporting requirement of such curiosity earnings from EPF contributions.

# Reporting of international property

The ITR Types (besides ITR 1 and ITR 4) require a resident taxpayer to reveal his international property akin to shares(ESOPs, RSUs), and property in Schedule FA.

Right here there was confusion as in India FY will begin from 1st April to thirty first March. Nevertheless, in few nations, it’s normally from 1st January to thirty first December. Therefore, to keep away from the confusion, the CBDT has clarified {that a} taxpayer shall be required to report international property provided that such property have been held at any time through the “earlier yr” (of India) as additionally through the ‘related accounting interval’ (on the international tax jurisdiction).

The reporting requirement is necessary just for a taxpayer who’s a resident in India. Schedule FA isn’t required to be filed up by a taxpayer who’s ‘not ordinarily resident or is a ‘non-resident’. Underneath this schedule disclosure of assorted international property akin to International Depository Account, Immovable Property, trusts created outdoors India, and so forth., is required.

For instance, you probably have acquired shares of your employer in January 2021 and offered it in February 2021. For the earlier yr 2021-22, the related accounting interval will likely be 01-01-2021 to 31-12-2021. The transaction of buy of Share falls within the related Accounting Interval. Then, it’s important to report such International Asset in ITR although the identical isn’t held within the earlier yr 2021-22.

# Extra disclosure in case of Capital Beneficial properties

New ITR Types require the next further disclosures within the Schedule CG (Capital Beneficial properties) each Lengthy and Quick

- Date of buy and sale of land/constructing

- Nation and Zip Code if the property is located abroad

- Disclosure of FMV of capital property and consideration acquired in a hunch sale transaction

- Yr-wise particulars of the price of enchancment to land/constructing

- Separate disclosure of price of acquisition and listed price of acquisition

# Residential standing in India ITR

The earnings tax guidelines and perks of NRI are completely different from these relevant to resident Indians. For instance, From the monetary yr 2017-18, ITR 1 isn’t out there for non-residents. NRIs are purported to file returns in ITR2 in all circumstances, apart from enterprise earnings. NRIs with enterprise earnings are purported to file returns in ITR 3.

When you lived outdoors India within the final Monetary yr, Whether or not your earnings will likely be taxed in India or not relies upon upon your residential standing.

Figuring out the residential standing of a person in India is kind of a tedious train. The brand new ITR varieties give an appropriate description of various clauses resulting from which the residential standing is set. These choices are self-explanatory. The assessee has to decide on the related possibility in help of his number of residential standing.

For a resident, their World earnings is taxable in India.

For NRIs, earnings earned inside India is taxable earnings. When you earned curiosity on an NRE account and an FCNR account is non-taxable in India. However curiosity earned on an NRO account is taxable in India for an NRI. Revenue that’s earned outdoors India isn’t taxable earnings in India

Examples of Revenue earned and are taxable earnings in India:

- Wage acquired in India

- Wage for service supplied in India

- Revenue from Indian home property(Rental)

- Capital positive factors on switch of Indian property(sale of property and so forth)

- Revenue from Mounted Deposits

- Curiosity on the financial savings checking account

# New tax regime opted below Part 115BAC

Do do not forget that these with an earnings from enterprise or career can’t choose in and opt-out of the brand new tax regime yearly. As soon as a non-salaried opts out of the brand new tax regime, they can not opt-in once more for the brand new tax regime sooner or later. Kind 10IE is a declaration made by the return filers for selecting the ‘New Tax Regime’

For AY 2021-22 solely info required was if one has opted for the brand new tax regime or not. Nevertheless, for the AY 2022-23, it’s important to select from the next choices: Whether or not you’ve gotten opted for the brand new tax regime below Part 115BAC and filed Kind 10-IE in AY 2021-22For the AY 2022-23, it’s important to select from the next choices as proven within the picture under.

- Opting in now

- Not opting

- Proceed to choose

- Decide-out

# Extra info not choosing the presumptive tax scheme

The audit below Part 44AB is necessary if the overall gross sales, turnover, or gross receipt from the enterprise through the earlier yr exceeds Rs. 1 crore. Nevertheless, if the money receipt and money fee don’t exceed 5%, the audit shall be necessary if the turnover of the enterprise assessee exceeds Rs. 10 crores through the monetary yr. For the aim of computing the restrict of 5%, fee or receipt by cheque drawn on a financial institution or by a financial institution draft, which isn’t an account payee, shall be deemed to be the fee or receipt in money solely. The previous ITR Types required the assessee to furnish the response concerning money receipts and funds solely, and it didn’t think about the receipt or fee via a non-account payee cheque or DD.

The next further disclosures are required concerning Audit Data:

- Whether or not whole gross sales, turnover or gross receipt is between Rs. 1 crore and Rs. 10 crores. If not, is it under Rs. 1 crore or exceeds Rs. 10 crores?

- The brand new ITR varieties require aggregation of receipts and fee in money and non-account payee cheque or DD whereas computing the restrict of 5% as talked about above.

# Reporting of tax-deferred on ESOP

An worker can defer the fee or deduction of tax in respect of shares allotted below ESOP (specified securities) by an eligible start-up referred below Part 80-IAC. The tax is paid or deducted in respect of such ESOPs inside 14 days from the earliest of the next interval:

- After the expiry of 48 months from the top of the evaluation yr related to the monetary yr wherein ESOPs are allotted;

- From the date the assessee ceases to be an worker of the group; or

- From the date of sale of shares allotted below ESOP.

The Half B of Schedule TTI (Computation of tax legal responsibility on whole earnings) in ITR Types of AY 2021-22 reveals the disclosure of the tax quantity deferred on this respect.

The New ITR Types have inserted a “Schedule: Tax-Deferred on ESOP”. The Schedule seeks the next disclosures:

- Quantity of tax-deferred in ITR filed for AY 2021-22;

- Date of sale of specified securities and quantity of tax attributable to such sale;

- Date on which he ceased to be an worker of the group;

- Quantity of tax payable in present evaluation yr;

- Steadiness quantity of tax deferred to be carried ahead to subsequent evaluation years.

Because the outer limitation interval of 48 months from the top of the evaluation yr related to the monetary yr wherein ESOPs are allotted isn’t but over, the worker shall be liable to pay tax deferred within the evaluation yr 2021-22 within the earlier yr 2025-26.

The brand new Schedule has been inserted to maintain observe of the quantity of tax deferred by the worker and the yr it ought to be taxed. The tax payable within the present evaluation yr is exported in a brand new row launched in Schedule Half B – TTI (Computation of tax legal responsibility on whole earnings).

# Aid below Sec.89A from taxation of earnings from retirement advantages account maintained in notified nations

The place a non-resident turns into a resident in India, the quantity of earnings in his international retirement advantages account is chargeable to tax in India on an accrual foundation. Nevertheless, some nations tax such an quantity on the time of receipt. As a consequence of a mismatch within the yr of taxability of such earnings in retirement funds, the taxpayers (typically non-residents who’ve completely returned to India) face difficulties in availing of the international tax credit score in respect of tax paid outdoors India on such earnings.

Part 89A, inserted with impact from the evaluation yr 2022-23, eliminated the aforesaid issue by offering that the earnings of a specified particular person from the desired account shall be taxed in such method and for such yr as could also be prescribed by guidelines. The Board has not notified any guidelines but. Nevertheless, the brand new ITR Types have amended Schedule S (Particulars of Revenue from Wage) to reveal:

- Revenue from retirement advantages account maintained in a notified nation below Part 89A.

- Revenue from retirement profit account maintained in a rustic aside from notified nation below Part 89A.

The eligible taxpayer is allowed to assert a deduction of ‘Revenue claimed for reduction from taxation on the appliance of Part 89A’. It’s not clear but how such a deduction shall be computed?

The same disclosure needs to be made within the Schedule OS (Revenue from Different Sources) in respect of the household pension.

ITR Types AY 2022-23 / FY 2021-22 – Which type to make use of?

# Sahaj ITR 1

You need to use this way in case you are –

- Wage or pension earnings.

- Revenue / Loss from one home property (excluding circumstances the place loss is introduced ahead from earlier years).

- Agricultural earnings lower than Rs 5,000.

- Revenue from different sources like FD curiosity, curiosity on small saving schemes, Publish Workplace curiosity and so forth., (excluding Successful from Lottery and Revenue from Race Horses).

- Resident Indians, who usually are not ordinarily resident with earnings as much as Rs 50 Lakhs.

Who can’t use Sahaj ITR1?

- Complete earnings exceeding Rs 50 lakh

- Agricultural earnings exceeding Rs 5000

- In case you have taxable capital positive factors

- In case you have earnings from enterprise or career

- Having earnings from a couple of home property

- If you’re a Director in an organization

- In case you have had investments in unlisted fairness shares at any time through the monetary yr

- Proudly owning property (together with monetary curiosity in any entity) outdoors India) in case you are a resident, together with signing authority in any account situated outdoors India

- If you’re a resident not ordinarily resident (RNOR) and non-resident

- Having international property or international earnings

- If you’re assessable in respect of earnings of one other particular person in respect of which tax is deducted within the palms of the opposite particular person.

# ITR 2

You need to use this way –

- Revenue from Wage/Pension; or

- Revenue from Home Property; or

- Revenue from Different Sources (together with Winnings from Lottery and Revenue from Race Horses).

- (Complete earnings from the above ought to be greater than Rs 50 Lakhs). If you’re an Particular person Director in an organization

- In case you have had investments in unlisted fairness shares at any time through the monetary yr

- Being a resident not ordinarily resident (RNOR) and non-resident

- Revenue from Capital Beneficial properties; or

- International Property/International earnings

- Agricultural earnings greater than Rs 5,000

You’ll be able to’t use this way if –

This Kind shouldn’t be utilized by a person whose whole earnings for the AY 2020-21 consists of Revenue from Enterprise or Career.

# ITR 3

You need to use this way if –

- Carrying on a enterprise or career

- If you’re an Particular person Director in an organization

- In case you have had investments in unlisted fairness shares at any time through the monetary yr

- Return could embrace earnings from Home property, Wage/Pension and Revenue from different sources

- Revenue of an individual as a companion within the agency.

# ITR 4

The present ITR 4 is relevant to people and HUFs, Partnership corporations (aside from LLPs) that are residents having earnings from a enterprise or career. It additionally embrace those that have opted for the presumptive earnings scheme as per Part 44AD, Part 44ADA and Part 44AE of the Revenue Tax Act. Nevertheless, if the turnover of the enterprise exceeds Rs 2 crore, the taxpayer should file ITR-3.

You’ll be able to’t use this way if –

- In case your whole earnings exceeds Rs 50 lakh

- Having earnings from a couple of home property

- In case you have any introduced ahead loss or loss to be carried ahead below any head of earnings

- Proudly owning any international asset

- In case you have signing authority in any account situated outdoors India

- Having earnings from any supply outdoors India

- If you’re a Director in an organization

- In case you have had investments in unlisted fairness shares at any time through the monetary yr

- Being a resident not ordinarily resident (RNOR) and non-resident

- Having international property or international earnings

- If you’re assessable in respect of earnings of one other particular person in respect of which tax is deducted within the palms of the opposite particular person.

I’ve coated the foremost facets of the modifications and in addition the foremost guidelines of which type to make use of.