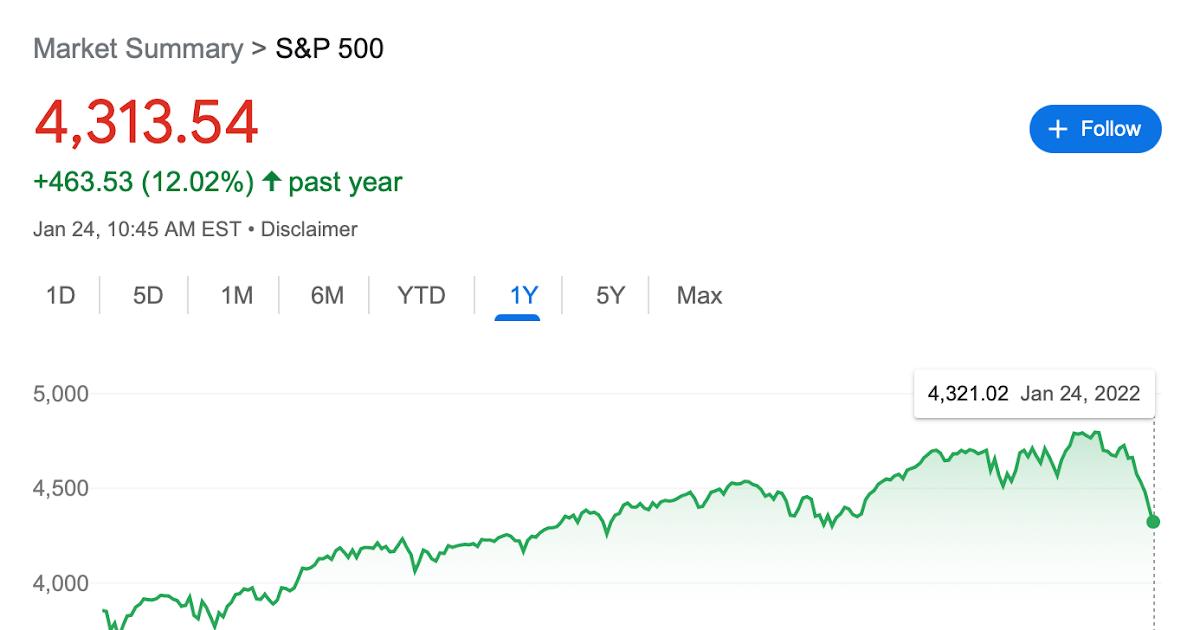

Having simply plugged “portfolios for long-term traders” once more, I actually ought to opine on its message in regards to the latest inventory market decline. If you happen to did not see this coming and get out forward of time, or if it was completely apparent to you that this was coming however you did not get off your butt and do something about it, preferring to preach on the dinner desk, simply how unhealthy do you have to really feel about it?

Not as unhealthy as you may suppose.

For as soon as, one could make a believable case what drove the market down: Traders found out that the Fed goes to lastly increase rates of interest to do one thing about inflation. Costs being considerably sticky, increased nominal rates of interest will imply a better actual rate of interest, a better actual low cost issue, and, with no change within the danger premium for shares, a better anticipated return for shares. So, the cheaper price at the moment is matched by increased returns going ahead, simply as a bond value decline is matched by increased yields. The cheaper price doesn’t, on this argument, sign decrease earnings or dividends.

If that’s the case, then a long-term investor actually has not suffered any decline in long-run buying energy. In case your plan was to carry shares for a very long time, and successfully stay off the dividends (together with all money flows), then nothing has modified. Certain, it might be higher if you happen to had gotten off your butt and offered forward of the decline. However successfully market timing is troublesome as a constant technique. Possibly inflation was all “transitory” “provide shocks” and the Fed wouldn’t must do something.

Likewise, do you have to promote now? Nicely, has the market priced in all of the doubtless interest-rate rises coming both from the Fed or from markets whether or not the Fed likes it or not? Possibly the Fed’s forecasts are proper that inflation will largely die out this 12 months. Possibly not. Place your bets. Additionally, if you happen to promote, you must have the braveness to leap again in simply when it seems to be bleakest. Successfully market timing is troublesome as a constant technique.

Is that this story proper? Rates of interest are rising, however are they rising sufficient? Listed here are three charges, 10 and 30 12 months Treasurys and 10 12 months listed TIPS. The rise is clear, however not shattering, and nonetheless smaller than the rise earlier this 12 months. Hauling out the again of the envelope, the S&P500 is down about 10% from its peak. Bond yields are up about 0.5%, implying a roughly 5% decline in worth for the ten 12 months and 15% decline in worth for the 30 12 months bonds. So we’re roughly within the ballpark.

In fact, not all the pieces else is all the time fixed. Greater rates of interest may scale back these cashflows. Or increased rates of interest may struggle inflation, which raises actual cashflows. Now we’re again to betting.

The purpose at the moment is simply to convey to life a easy risk: When actual rates of interest rise, different issues held fixed, inventory costs fall, however (by definition since I stated different issues held fixed) anticipated dividends and earnings don’t fall. An extended-term investor shouldn’t be harm. The worth you get from promoting all of your shares declines, however the price of reestablishing the portfolio and residing on it simply declined too. Equally, if the worth of all homes falls, you actually don’t care to first order, because the worth of the home you wish to purchase fell simply as a lot as the worth of the home you wish to promote. Certainly, you save on property and capital features taxes.