For those who’ve simply acquired your annual bonus or have financial savings that you just gained’t be utilizing within the close to time period, leaving it in your financial institution may not be such a good suggestion anymore, particularly as inflation continues to creep upwards. Listed here are some options you may think about as a substitute.

Even for these of us who’re in a position to withstand life-style inflation (i.e. spending extra as your revenue goes up), we’re not resistant to the results of financial inflation. However what’s extra worrying is that the most recent information for Singapore confirmed our headline inflation has not solely been creeping upwards, however is sort of on the highest within the final decade.

Not solely are meals costs and transport fares going up, however generally, nearly all the things is costlier at the moment than earlier than. The identical goes for larger oil and fuel costs (which have gone up much more as a result of Russia-Ukraine disaster) and pandemic-related provide chain disruptions similar to port closures, international commodity costs have been on the rise as nicely.

With the intention to counter the creeping inflation and guarantee value stability within the medium time period, the Financial Authority of Singapore (MAS) acted to additional tighten its financial coverage earlier this yr (forward of schedule). However will or not it’s sufficient?

Why is inflation unhealthy for savers?

Think about you’ve $10,000 in your financial institution financial savings account which pays you 1% curiosity each year which implies after a yr, you should have $10,100. But when inflation is working at 4%, you’ll have wanted to generate $400 of curiosity on this similar capital with the intention to preserve the identical shopping for energy that you just began with.

Therefore, though you “earned” $100 out of your financial savings, you’ve a poorer shopping for energy now. That’s what we imply after we say your financial savings get eroded by inflation.

Sidenote: As a substitute of 1%, Singapore’s banks are inclined to pay simply 0.05% on most financial savings accounts, together with in your Supplementary Retirement Scheme (SRS) funds.

Now, if you happen to’re about to retire in a couple of years time, because of this you successfully have “much less” on your retirement – particularly with even fundamental meals costs rising. And if inflation persists or goes even larger, your cash will get you much less meals / transport / residing necessities as annually passes. Therefore, the probability of you not having sufficient to dwell on turns into an increasing number of stark.

And if the inflation fee in your principal bills go up larger than your wage (e.g. medical inflation tends to outpace core inflation), then it’ll be even worse.

Add within the impending GST hike of two%, and also you’ll quickly see that preserving your cash within the financial institution might most likely not be the wisest factor to do.

How can I cease my financial savings from being eroded by inflation?

There are 2 methods to beat inflation: both in the reduction of in your bills, or develop your cash. However if you happen to’re already working on a lean finances and have nowhere else to chop, you’ll must develop your cash as a substitute. This may be finished via a wide range of devices – mounted deposits, endowment funds, and even investments.

On the time of writing, the best mounted deposit is:

- Hong Leong Finance: 0.90% p.a. for 36 months (minimal $20,000)

- CIMB: 0.75% p.a. for 18 months (minimal $10,000)

With charges like these, it’s no surprise that savers are actually turning to short-term endowment plans with 1, 2 or 3 years of dedication. Not solely does it preserve their funds protected (e.g. from scammers), but additionally permits them to at the very least get extra again than what they might have in any other case had they left it within the financial institution.

For those who’re searching for charges larger than 1%, listed here are another devices you may think about as nicely:

- Singapore Financial savings Bond (SSB): 0.71% p.a. for the primary yr (minimal $500) or a mean return of 1.41% p.a. in 3 years

- GREAT SP Sequence 6: 1.68% p.a. after 3 years (minimal $10,000)

For those who want an choice that retains full liquidity in trade for a decrease payout fee, then the SSB may very well be a good selection – you get 0.71% within the first yr, and if you happen to go away it to compound, this grows to 1.17% after 2 years, and 1.41% on the finish of three years.

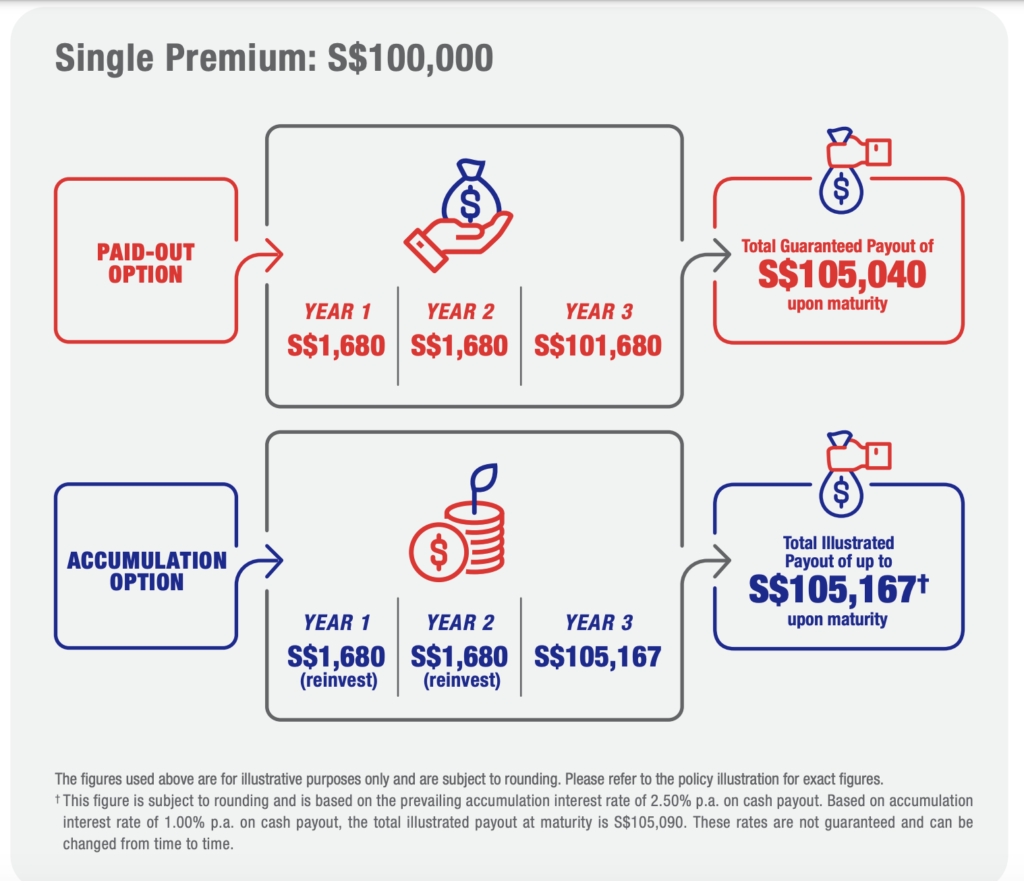

Nonetheless, if you happen to already know now that you just’re unlikely to want the cash for the subsequent 3 years, then you is perhaps higher off making use of for the GREAT SP Sequence 6 as a substitute, as you’ll get a better fee of 1.68% p.a. after 3 years. What’s extra, you may decide to receives a commission the 1.68% annually, so that you get some money whereas ready throughout these 3 years. In any other case, you may as well go away the payout to build up so that you just stroll away with a doubtlessly larger payout upon maturity of the coverage.

However what if banks increase their rates of interest anytime quickly?

With the Fed’s rate of interest hike final week (with extra to return later this yr), some persons are cautious and are hoping that this may in flip, result in our banks right here in Singapore to start out providing larger rates of interest on financial savings accounts as nicely. However even the Fed has stated so themselves that they could or might not have the ability to roll out their hikes due to the unsure setting, so it’s as much as readers in the event that they wish to rely on this taking place.

My view is, even when that occurs, banks will seemingly implement conditions for shoppers to fulfil earlier than they get to benefit from the larger curiosity. This might embody standards similar to having to spend extra in your bank card, add usually to your deposits each month, take up a house mortgage with the financial institution, and even buy certainly one of their investments or insurance coverage merchandise earlier than you qualify. In spite of everything, this has turn into the brand new norm for high-yield financial savings accounts in Singapore the place shoppers are made to “work” to get a better curiosity.

Besides that if you happen to can’t meet their standards or have already maxed out this avenue (the upper rates of interest are often capped to a restrict e.g. the primary $80,000), then the remainder of your money continues to be successfully incomes solely the baseline rate of interest of 0.05% p.a.

Which implies you continue to want to search out one other place on your funds.

GREAT SP Sequence 6

The demand for the earlier GREAT SP Sequence had been so excessive that they had been absolutely subscribed inside weeks of launch. Therefore, Nice Japanese has not too long ago introduced that they’ve launched one other tranche – excellent news for many who missed out beforehand.

GREAT SP Sequence 6 is a single-premium endowment plan and lasts for 3 years, which supplies 1.68% p.a. assured returns upon maturity. Right here’s what you should be aware of:

- 1.68% p.a. assured returns upon maturity

- Minimal premium ranging from $10,000

- Assured returns is utilized to complete premium quantity (not like a tiered payout mannequin) i.e. you might enroll with $100,000 and nonetheless get 1.68% p.a. on the complete sum upon maturity

- Comes with insurance coverage protection towards loss of life and whole and everlasting incapacity (TPD)

- No medical examination or underwriting required

Who it may very well be good for

So long as you’ve spare money that isn’t incomes something greater than at the very least 1.5% for the subsequent 3 years, then it’s price trying out GREAT SP Sequence 6.

Curiously, lots of my readers subscribed to the earlier tranches on behalf of their aged dad and mom, because it was:

- a great way to not solely defend their funds (for the reason that capital is assured upon maturity)

- an honest fee of return

- and in addition get the advantages of fundamental insurance coverage protection whereas doing so

Additionally it is vital to contemplate your choices towards different options i.e. the place else can you set this sum of cash, and may you have the ability to safe a better fee of return there? Lots of my readers’ have aged dad and mom who’re now not incomes an revenue / don’t use a bank card / now not have a house mortgage to finance. Generally, these individuals wouldn’t have the ability to meet the standard standards set by sure financial institution accounts and thus don’t qualify for larger curiosity.

After all, be aware that placing your cash in a financial institution / mounted deposits offers you the flexibleness to withdraw anytime with none penalty in your unique capital, not like short-term endowment plans.

If short-term endowment plans sound like one thing you’ll discover advantageous (whether or not you’ve $10k, $20k, $50k, $200k or extra), you may try extra data on GREAT SP Sequence 6 right here.

Disclosure: This submit is written in collaboration with Nice Japanese, who fact-checked the supplied product details about GREAT SP Sequence 6. All opinions on this submit are mine.

T&Cs apply. Protected as much as specified limits by SDIC.

This commercial has not been reviewed by the Financial Authority of Singapore.

The data introduced is for common data solely and doesn’t have regard to the particular funding targets, monetary scenario or explicit wants of any explicit particular person. You might want to search recommendation from a monetary adviser earlier than making a dedication to buy this product. For those who select to not search recommendation from a monetary adviser, you need to think about whether or not this product is appropriate for you.

Vital Notice: As shopping for a life insurance coverage coverage is a long-term dedication, an early termination of the coverage often includes excessive prices and the give up worth (if any, that’s payable to you) could also be zero or lower than the full premiums paid.