Because the Russian delegation ready to talk at Wednesday’s G20 assembly, finance ministers and central financial institution governors from the US, EU, UK and Canada obtained up and walked out.

They didn’t keep to take heed to what Russian finance minister Anton Siluanov, who joined nearly, or his deputy Timur Maksimov, who was within the room, nor Elvira Nabiullina, the top of Russia’s central financial institution, needed to say in regards to the world financial system.

Christine Lagarde tweeted a photograph of those unlikely protesters within the cavernous atrium of the IMF’s HQ2 constructing. “We stand with #Ukraine and in opposition to Russia’s warfare of aggression,” the president of the European Central Financial institution stated.

Vitriolic language from usually mild-mannered finance officers equivalent to US Treasury secretary Janet Yellen, who condemned Russia’s “unlawful, unprovoked warfare in opposition to Ukraine”, highlights how the invasion dominated this week’s spring conferences of the IMF and World Financial institution in Washington.

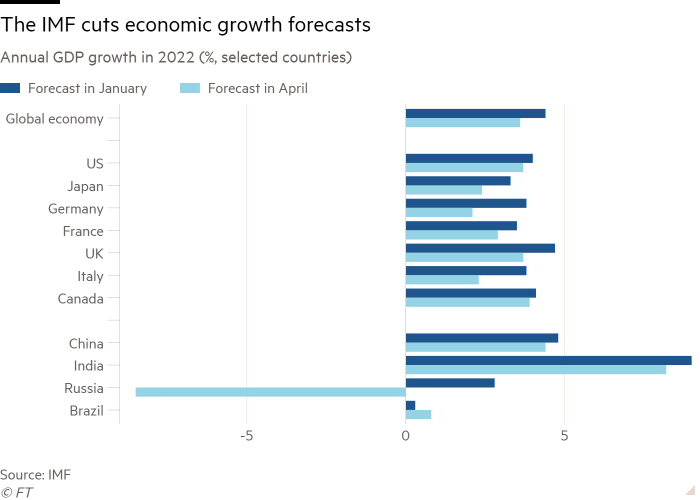

Kristalina Georgieva, IMF managing director, stated on a number of events that the invasion was a “huge setback” for the worldwide financial system, because the fund slashed forecasts for 2022 from the 4.4 per cent estimated as just lately as January to three.6 per cent.

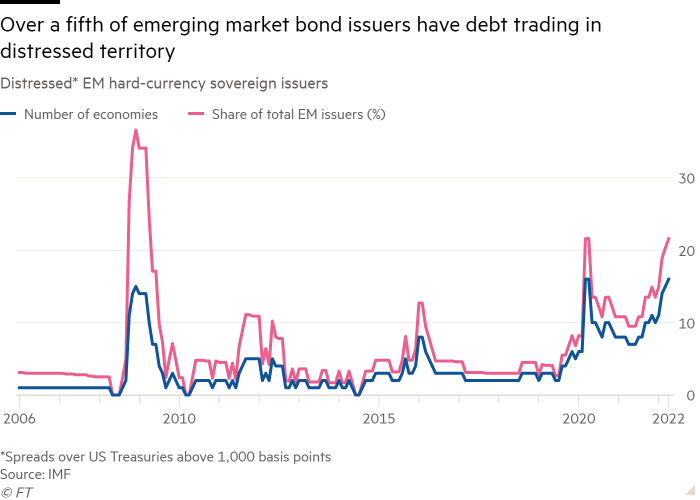

The impact of the warfare in Ukraine in elevating meals and vitality costs would create a “human disaster” in lots of poorer international locations, stated David Malpass, head of the World Financial institution, whereas the IMF’s fiscal and monetary stability departments warned of debt misery amongst poorer international locations as they face an ideal storm of accelerating inflation, decrease development and better US rates of interest.

Ukraine is about to lose 35 per cent of output this yr and appealed for extra assist with its budgetary disaster. It would want $5bn a month for the following three months simply to maintain the nation operating.

Georgieva urged richer international locations to step up and supply the funding required. “Piling extra debt on prime of those they already carry on this setting of sharply lowered revenues and considerably elevated expenditures [is] simply not sensible,” she stated.

Although Russia accounts for less than 2.7 per cent of the worldwide financial system, it turned clear this week that its re-emergence as a pariah nation would undermine world co-operation.

The G20, which has few formal guidelines and acts as a invaluable speaking store among the many world’s largest economies, was fully stymied by Russia’s continued participation and the walkout by western nations.

It was unable to publish a communique of its dialogue, leaving Indonesia — which chairs the group this yr — within the invidious place of attempting to speak up the achievements of its presidency at a time of acrimony and walkouts.

This culminated in essentially the most surreal second throughout the post-meeting information conferences when Sri Mulyani Indrawati, Indonesia’s finance minister, admitted that discussions had been held “underneath difficult circumstances”, solely to be contradicted by Febrio Kacaribu, head of the nation’s fiscal coverage company, who stated “the spirit of collaboration and multilateralism was actually displaying throughout the assembly”.

Few consider the G20 now lives as much as its billing as “the premier discussion board for worldwide financial co-operation”.

The G7 wish to kick Russia out of those discussions and issued a press release saying the US, Japan, Germany, France, UK, Italy and Canada “remorse[ted] participation by Russia in worldwide fora, together with G20, IMF and World Financial institution conferences this week”.

Russia’s refusal to lie low additionally meant the IMF’s governing physique, the Worldwide Financial and Monetary Committee, was unable to agree a communique.

The IMF managing director had little progress to exhibit from the week’s discussions and negotiations. In Georgieva’s closing information convention, she talked of “very concrete takeaways of our assembly”, highlighting an settlement to determine a Resilience and Sustainability Belief on the IMF to assist poor international locations finance longer-term challenges, such because the transition to wash vitality. The one drawback with this was that the settlement to determine this financing mechanism was truly struck final October.

As a substitute of trumpeting the OECD’s 2021 world tax settlement in its assertion to the IMF, the worldwide organisation barely talked about it as a result of deadlines are already slipping.

The worldwide group’s “frequent framework” to deal with debt misery by bringing collectively all private and non-private sector collectors barely capabilities as a result of, as Georgieva stated, “there aren’t any clear, established processes and timelines”.

Nevertheless, Georgieva spoke for a lot of in saying that though the IMF couldn’t publish statements that require consensus settlement, Russia’s invasion had elevated, somewhat than diminished, the necessity for worldwide co-operation in financial issues. “The overwhelming majority of the membership sees this disaster as proof that we have now to co-operate, evaluate notes on insurance policies [and] discover methods through which we are able to act in solidarity,” she stated.

The way forward for financial policymaking could lie in regional groupings for co-operation somewhat than world fora.

Pierre-Olivier Gourinchas, IMF chief economist, highlighted the consequence of such a transfer, saying in an interview with the Monetary Instances: “If we turn out to be a world of many various blocs, we must undo numerous the built-in economies that we’ve constructed and provide chains that we’ve constructed . . . and construct one thing else that’s extra slender [and] smaller in scope.”

“There might be adjustment prices [and] there might be effectivity losses and that would result in a rise in unit prices as a result of issues are usually not finished as effectively as earlier than,” he added.

“If we’re in a world through which we have now completely different blocs, then I don’t precisely understand how the [IMF] can operate. Does it turn out to be an establishment that works for one bloc however not the others? How does it work throughout completely different elements of the world? It’s definitely not one thing that might be fascinating on many, many fronts.”