Eyeing the costs at a Budapest market corridor, retired college nurse Maria Veres stated she was grateful for an enormous January pension bonus from Viktor Orban’s authorities. It inspired her to vote to re-elect the premier this month, however the windfall is sort of gone already.

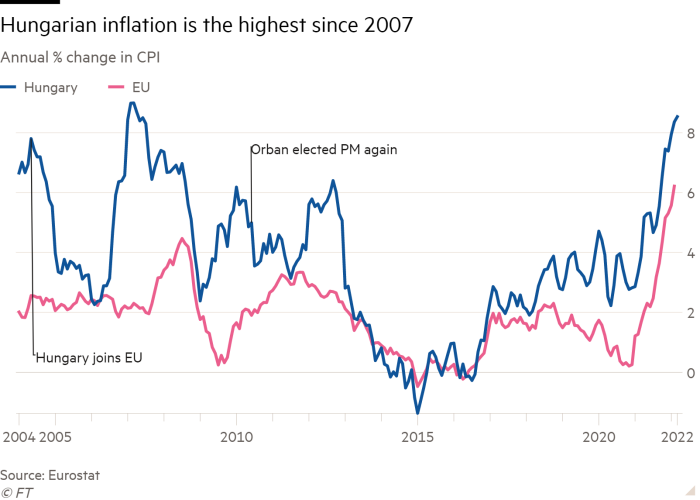

Hungary’s highest inflation in 15 years is slicing into her freshly padded financial savings however has not but hit her confidence in Orban, who she expects can shield residents from rising costs and different financial issues.

“These value tags are horrific,” she stated, taking a look at a dozen eggs costing about 600 forints, or simply over €1.50, up one-third from a 12 months in the past. “This kind of inflation, I assumed it was a factor of the previous. I hope Orban defends us from this one way or the other.”

Whereas he’s buoyed by a fourth consecutive election win that extends his tenure because the EU’s longest-serving chief, Orban — who has stated he’s decided “to protect monetary stability” — faces a few of the largest financial challenges of his time in workplace.

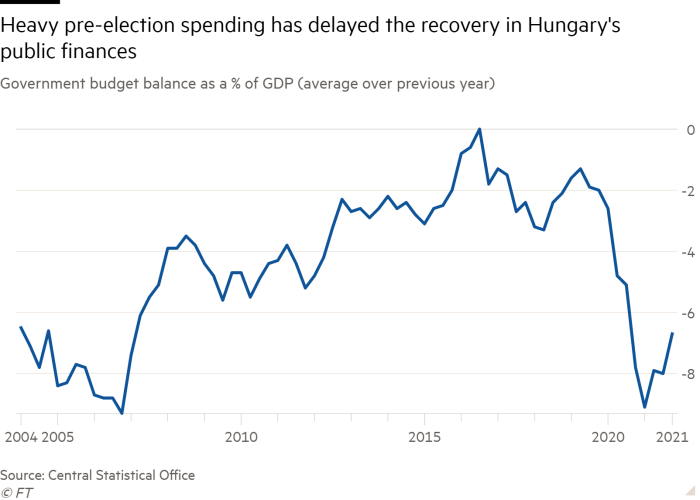

Hovering vitality prices are straining Hungary’s capacity to keep up state-imposed value caps, whereas world disruption from Russia’s invasion of Ukraine is denting prospects for progress. Heavy pre-election spending, and a row with Brussels that’s delaying greater than €7bn in EU help, is additional constraining room for financial manoeuvre.

The EU funds are supposed to finance initiatives to spice up Hungary’s restoration from the pandemic. Orban needs to borrow the funds within the meantime however analysts stated that may improve Budapest’s debt ranges and financing prices.

“If we will entry [recovery funds], we should take smaller steps towards the monetary market; if not, then we shall be pressured to take bigger ones,” Orban advised journalists this month, calling the technique “prefinancing” till the EU cash arrives.

A part of the squeeze on Hungary’s funds stems from Orban’s generosity within the run-up to the April 3 election. The federal government gave away about €5bn within the first quarter in household tax rebates and pension bonuses. It additionally now faces decrease progress and tax receipts due to the financial disruption attributable to the Ukraine battle.

KBC’s Hungarian economist David Nemeth stated the EU funds “would go a good distance to assist remedy the finances issues” for Orban, who might then spend extra on sustaining value caps and different measures to battle inflation.

Regardless of his want for EU money, Orban has stated he is not going to make concessions to enhance relations with the EU. “Irrespective of the stress on us, we are going to by no means again down,” Orban stated.

Fitch Scores stated this month that Orban’s clear election victory, and Brussels’ choice to begin a course of to penalise alleged rule of legislation abuses within the nation, “might sign a hardening of each side’ stances” and threaten progress forecasts.

It additionally warned {that a} deterioration in governance requirements in Hungary might undermine investor confidence and have an effect on the nation’s credit standing. Budapest’s score is now two notches into funding grade with a steady outlook from all three main score businesses.

Decrease scores would elevate borrowing prices. A detrimental spiral of upper debt, rising debt funds and decrease credit score scores is a risk, stated Peter Oszko, Hungary’s final finance minister earlier than the Orban period, which started in 2010.

“Market debt may be very costly, hurts the finances steadiness, the curiosity on it’s rising, however [Orban] can faucet that for some time, hoping for an settlement with the EU,” stated Oszko. “Time is tight however he’ll attempt to take his time, attempt just a few vetoes, kind just a few alliances.”

Oszko stated the federal government ought to fear most about inflation. “Orban shouldn’t be afraid to levy further taxes on profitable enterprise sectors or difficulty bonds, so long as he can keep away from leaning on the voters immediately,” he stated. “However a sustained double-digit inflation fee hurts everybody.”

Gergely Suppan, an economist at Takarekbank, stated he anticipated Orban would halt funding or enable the finances deficit to exceed 5 per cent, in contrast with the EU’s standard 3 per cent restrict, earlier than he touches value caps, which maintain fuel payments beneath €100 a month for a median family, far beneath western Europe’s.

“If market costs had been launched, most individuals would fail to pay their payments,” stated Suppan. “Utility costs haven’t modified since 2014, throughout which period web salaries greater than doubled. We might deal with 10, 20 per cent, however a fivefold improve could be nonsensical.”

Orban has not dominated out extra taxes on sectors like finance, vitality, telecommunications and retail. “Whether or not particular taxes on multinationals or others grow to be mandatory is as much as the EU,” he stated. “If Europe is unable to halt the vitality value improve, we shall be pressured to take steps in Hungary.”

Peter Virovacz, an economist with ING, stated a fiscal adjustment of about 1 per cent of gross home product may very well be achievable through spending cuts however better recalibration would imply tax will increase.

“We wouldn’t count on measures affecting the tax burden on labour however fairly some sectoral taxes [in] banking, telecommunication and/or retail,” Virovacz stated. “The caveat with these may very well be that firms will move on the prices to households — which might strengthen inflation additional.”