Landlords have needed to take care of faux tenant purposes for years. However rental rip-off artists upped their sport and have gotten more and more sly of their makes an attempt to evade background checks for rental properties.

How are you going to defend your self and your funding from these con artists? We wished to share what to be careful for and the right way to search for discrepancies in purposes.

Beneath, you’ll study what landlords have to know in regards to the rising variety of rental scams.

How are you going to defend your funding from rental scams?

Rental scams can go away an actual property investor out of hundreds of {dollars} in misplaced lease or property damages. The very best line of protection? Landlords have to vet their tenants correctly. Critically, discover out as a lot as you’ll be able to about the kind of particular person you’re entrusting to dwell in your funding.

For instance, my property administration firm has put a number of checks in place to display screen candidates. We’ve created a screening matrix to attain candidates on components like credit score, earnings, previous rental historical past, and late balances.

With years of expertise, our staff created this matrix as a scoring system to evaluate threat. Candidates obtain a “rating” between 0.00 to six.25 or greater (the decrease, the higher):

- 0.00 – 3.50 Low Threat (Safety Deposit = 1-month lease or 1-month surety bond)

- 3.75 – 5.00 Common Threat (Safety Deposit = 1-month lease or 2-month surety bond)

- 5.25 – 6.00 Greater Threat (Safety Deposit = 3-month lease or 3-month surety bond)

- 6.25 + Denied or co-signer required

This matrix offers us a fast goal strategy to assessment candidates, however as you’ll see beneath, it’s not at all foolproof. So that you’ll have to get your personal investigator hat and magnifying glass out.

Who commits fraud and why?

The explanations for committing fraud fluctuate as a lot because the individuals committing the crime. Some can’t afford the lease, some don’t have any intention of paying lease, and others wish to disguise earlier monetary transgressions.

As we speak, almost everybody can alter copies of “official paperwork” with their telephones. Generally, it’s important to dig deeper to uncover the rip-off.

Don’t get me flawed; we don’t at all times assume everybody’s out to tug one over on our shoppers. But when somebody has nothing to cover, they shouldn’t get defensive whenever you begin asking questions.

By the way in which, if somebody does get defensive, take that as a purple flag and contemplate denying their utility.

But when the numbers don’t add up, addresses don’t take a look at, or social media profiles counsel somebody very completely different, ask why.

Detecting fraudulent pay stubs

Once more, most candidates are trustworthy potential tenants who wish to lease your property and pay lease appropriately. Nevertheless, these few unhealthy apples imply it’s important to maintain your guard up.

When an applicant submits their proof of earnings, particularly pay stubs, pay shut consideration to the deductions and watermarks. Look to see if examine numbers match pay stubs, too.

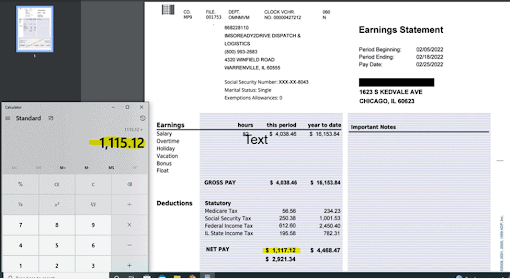

Right here’s a latest instance of a fraudulent pay stub my firm acquired (names have been altered for privateness):

You’ll see that the deductions on the paystub didn’t add up appropriately. Additionally, in case you look carefully on the precise aspect of the examine, it says “ADP”. Nevertheless, there isn’t any ADP brand on the high of the paystub. Most ADP checks present the brand.

Does that make your Spidey Sense tingle? It ought to! Time to get out that magnifying glass, higher referred to as Google, to study extra in regards to the applicant’s employer.

If a fast search doesn’t flip up the supposed employer or if an aged particular person solutions the “enterprise” telephone confused about why you’re calling, get suspicious. Generally whenever you ask for extra documentation like a W-2, the scammer is aware of you’re onto them, and so they vanish. Contemplate your self fortunate for having dodged a bullet.

Figuring out fraudulent documentation

Even when somebody submits documentation with tax IDs or supervisor info, I like to recommend you affirm all the pieces. We’ll see candidates claiming to have labored for a spot for 5 years. We found that the “firm” solely filed for an LLC 4 months in the past upon additional analysis. Hmmm, one thing doesn’t add up.

Issues can get bizarre when a fraudulent utility will get submitted on behalf of a completely completely different particular person. Use courtroom data to confirm loads of info that’s submitted. These data can present tons of information (from visitors tickets to divorce proceedings to handle discrepancies).

Credit score checks can unearth curiosities like mortgages in different cities or signatures on deeds that don’t match utility signatures. Once more, dwell by the motto: belief however confirm.

Closing ideas

None of those discoveries makes my staff super-sleuths (though they’re fairly superior). I wished to exhibit the effort and time we put into ensuring we approve the precise individuals and keep away from rental scams.

An excellent assessment course of makes everybody’s job a lot simpler. Matrix scores solely present a part of the story. They assist weed out the straightforward denials, however it’s important to use your instinct to unearth these scammers.