The preliminary section of the pandemic noticed the euro space and U.S unemployment charges behave fairly in another way, with the speed for the US rising way more dramatically than the euro space charge. Two years on, the charges for each areas are again close to pre-pandemic ranges. A key distinction, although, is that U.S. employment ranges had been down by 3.0 million jobs in 2021:This autumn relative to pre-pandemic ranges, whereas the variety of euro space jobs was up 600,000. A take a look at employment by business reveals that each areas had massive shortfalls within the lodging and meals companies industries, as anticipated. A key distinction is the federal government sector, with the variety of these jobs within the euro space up by 1.5 million, whereas the federal government sector in the US shed 600,000.

The Two Labor Markets within the Pandemic’s First Wave

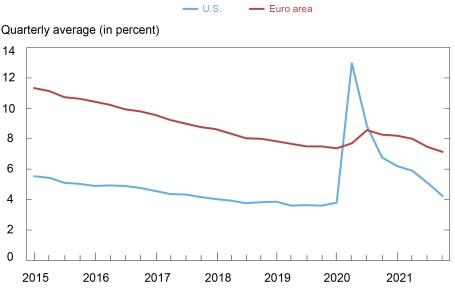

There was a hanging distinction within the responses of labor market indicators throughout the pandemic’s first wave. In the US, the unemployment charge surged from 3.5 % in February 2020 to 14.7 % in April, whereas the euro space charge stayed close to 7.5 % charge by means of Could after which solely rose to a peak of 8.6 % in August. The same divergence was evident in employment information, with the variety of U.S. jobs falling 12 % from 2019:This autumn to 2020:Q2, whereas euro space employment solely fell 3 % over that interval.

The relative stability within the euro space unemployment charge and employment ranges was by design. The area relied on job retention schemes to mitigate job losses so as to keep the bonds between employees and employers. In broad strokes, these nation applications inspired corporations to maintain their employees in place, with the governments serving to pay a part of the wage invoice and the workers accepting a minimize in hours and compensation. The European Central Financial institution estimates that just about 20 % of jobs within the euro space had been supported by job retention applications in April 2020. So, whereas U.S. hours labored fell 13 % from 2019:This autumn to 2020:Q2, euro space hours labored fell by a bigger 17 %. Euro space hours recovered rapidly to be solely 5 % under 2019:This autumn ranges by 2020:Q3, however the schemes made hours labored a shock absorber that moderated employment losses on the pandemic’s onset.

The Lingering U.S. Employment Shortfall

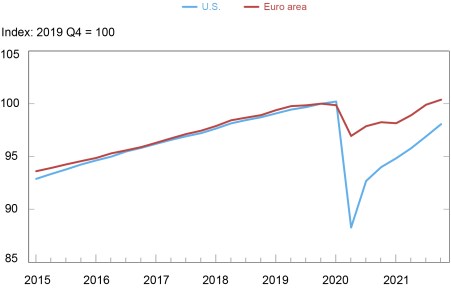

Two years into the pandemic, unemployment charges in each areas are close to pre-pandemic ranges, as seen within the charts under. Employment information, although, inform a special story, with the U.S. stage down 2 % in 2021:This autumn relative to 2019:This autumn, whereas euro space employment was barely greater. The distinction is much more pronounced if one takes into consideration that U.S. output in 2021:This autumn was up 3 % from the 2019:This autumn stage whereas euro space output was simply again to the place it was earlier than the pandemic.

Unemployment Charges Are Again to Pre-Pandemic Ranges

The Employment Restoration Has Been Slower in the US

As for why the unemployment charge and employment ranges have been giving completely different alerts in regards to the state of the 2 labor markets, keep in mind that the unemployment charge can fall both due to a rise in employment or as a result of fewer unemployed employees are actively on the lookout for a job. The similarity of the unemployment charge measures displays a compensating divergence in labor drive participation charges (LFPR). Particularly, the U.S. LFPR in 2021:This autumn was down 1.3 proportion factors from 2019:This autumn, masking the employment shortfall, whereas the euro space LFPR was again to close its pre-pandemic stage.

One doable clarification for the U.S. shortfall in employment and labor drive participation is that the euro space’s job retention schemes did effectively at sustaining the relationships between employees and their employers. As a consequence, euro space had a better time constructing employment again to pre-pandemic ranges. This speculation is sensible on the face of it, however a take a look at employment by business reveals there have been additionally explicit industries that account for a lot of employment shortfall in the US.

Employment Shortfalls by Trade

One can break down the U.S. 3.0 million jobs shortfall in 2021:This autumn relative to 2019:This autumn and the euro space’s 600,000 improve by business. In the US, a lot of the shortfall has been in three sectors, with employment in lodging and meals companies down 1.5 million, native authorities employment down 600,000, and employment in nursing/aged care amenities down 400,000. To place these losses in perspective, lodging and meals companies accounted for a ten % share of jobs earlier than the pandemic, native authorities had a ten % share, and residential/nursing care had a 2 % share, that means that 22 % of the job market accounted for nearly 85 % of the U.S. job shortfall.

It’s not stunning that the euro space lodging and meals companies sector additionally suffered steep job losses. Euro space information, solely out there by means of 2021:Q3, has this sector’s employment down 620,000 from two years prior, or a 7 % decline. The shortfall is extra modest than the U.S. expertise, with jobs down 10 % over this era.

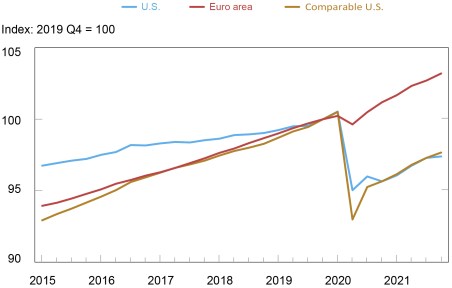

There may be one sector, although, the place the distinction is sort of palpable. The variety of jobs within the euro space’s public sector (public administration, schooling, and social work) elevated throughout the pandemic, as seen within the chart under, and whereas authorities jobs in the US fell. Particularly, the variety of euro space jobs elevated by 1.3 million from 2019:This autumn to 2021:This autumn, whereas in the US, authorities employment (U.S. federal, state, and native) had a 600,000 shortfall, with primarily all of that because of cuts in native authorities employment. Including well being care and social help, which is basically equipped by governments within the euro space, to the U.S. public sector information will increase the U.S. comparable job losses to 1 million, with a lot of the extra misplaced jobs within the residential/nursing care sector.

There Has Been a Stark Distinction in Public Sector Employment

Notice: “Comparable U.S.” sums losses within the authorities, personal schooling, and well being companies sectors.

One key issue to notice is that schooling performs a big half within the divergence. A extra detailed breakdown within the euro space is just out there by means of 2021:Q3, however schooling jobs within the euro space had been 320,000 above the extent two years prior, whereas U.S. native authorities schooling jobs (lecturers, directors, and help employees) had been down 370,000 in 2021:This autumn relative to 2019:This autumn.

Labor Provide or Labor Demand?

It’s troublesome to pin down is how a lot the U.S. jobs shortfall is because of corporations not wanting to rent again to pre-pandemic ranges (owing to depressed demand or native authorities price range constraints, for instance) and the way a lot is because of reluctant employees discouraged by low wages, poor working circumstances, or pandemic fears. One crude measure of employee reluctance is the change in job openings relative to pre-pandemic ranges. The logic is that greater openings relative to the job shortfall recommend that employees are reluctant to take jobs in that exact business. Alternatively, a low variety of job openings relative to the shortfall recommend the demand for employees is comparatively weak.

There have been 100,000 extra openings in state and native authorities schooling in 2021:This autumn than there have been 2019:This autumn (a fourth of the employment shortfall), whereas openings in lodging and meals companies had been up 750,000 (one-half of the shortfall). This evaluation would put weak labor demand as a extra vital driver behind the federal government employment shortfall and employee reluctance as an vital issue behind the lodging and meals companies shortfall.

The dialogue of how the U.S. restoration has lagged that within the euro space mustn’t distract from the outstanding rebounds in employment in each areas. It’s encouraging that U.S. employment continued to extend in early 2022 and it is going to be fascinating to see how a lot native governments replenish their schooling staffs within the close to time period. There isn’t a assurance, although, that business shares of total employment will return to the place they had been in 2019 given the disruptive nature of the pandemic.

Thomas Klitgaard is a vice chairman within the Federal Reserve Financial institution of New York’s Analysis and Statistics Group.

Disclaimer

The views expressed on this submit are these of the creator(s) and don’t essentially replicate the place of the Federal Reserve Financial institution of New York or the Federal Reserve System. Any errors or omissions are the accountability of the creator(s).