On this report, we have a look at how dynamic bond funds have altered their portfolio over the previous couple of months in anticipation of an rate of interest hike.

Bond market sentiment is monitored by way of the bond yield which is inversely proportional to bond value. If yield fall, it implies current bonds have turn into extra invaluable (larger value). This implies rates of interest are falling or is anticipated to fall. That’s newer bonds will provide decrease curiosity so current bonds are in demand.

If the yield will increase, the value of current bonds falls because the market expects larger charges from newer bonds. That is how the 10Y gilt yield has behaved within the final 10 years.

Discover the steep enhance in yields over the previous couple of months. This implies the markets expect an rate of interest hike.

The funding technique of dynamic bond funds: Usually, when the rates of interest are anticipated to fall, the dynamic bond fund supervisor will enhance publicity to long-term bonds. When the rates of interest are anticipated to extend, the fund supervisor will transfer to short-term bonds. So allow us to discover out what they’ve completed over the previous few months.

Notice: The next knowledge is simply meant for instructional functions and shouldn’t be construed as funding recommendation. Dynamic bond fund managers speculate on bond provide and demand they usually might get it mistaken.

To understand this resolution danger, the typical (weighted)portfolio maturity in years for dynamic bond funds is tabulated beneath.

| Date | Common Portfolio Maturity in years (March 2022 |

| Nippon India Dynamic Bond(G) | 8.1900 |

| Axis Dynamic Bond Fund-Reg(G) | 7.9600 |

| HDFC Dynamic Debt Fund(G) | 6.5100 |

| Kotak Dynamic Bond Fund-Reg(G) | 6.2300 |

| ICICI Pru All Seasons Bond Fund(G) | 5.8800 |

| Mirae Asset Dynamic Bond Fund-Reg(G) | 4.7200 |

| Baroda BNP Paribas Dynamic Bond Fund(G) | 4.7100 |

| Mahindra Manulife Dynamic Bond Yojana-Reg(G) | 4.7000 |

| IIFL Dynamic Bond Fund-Reg(G) | 4.4100 |

| Union Dynamic Bond(G) | 4.1500 |

| IDFC Dynamic Bond Fund-Reg(G) | 4.1300 |

| Aditya Birla SL Dynamic Bond Fund-Reg(G) | 2.9700 |

| DSP Strategic Bond Fund-Reg(G) | 2.6900 |

| UTI Dynamic Bond Fund-Reg(G) | 2.5700 |

| Quantum Dynamic Bond Fund(G)-Direct Plan | 2.1800 |

| Canara Rob Dynamic Bond Fund-Reg(G) | 2.0600 |

| IDBI Dynamic Bond(G) | 2.0500 |

| PGIM India Dynamic Bond Fund(G) | 1.3500 |

| SBI Dynamic Bond Fund-Reg(G) | 1.1900 |

| JM Dynamic Bond Fund-Reg(G) | 1.0800 |

| L&T Flexi Bond Fund-Reg(G) | 1.0200 |

| Tata Dynamic Bond Fund-Reg(G) | 0.4600 |

| ITI Dynamic Bond Fund-Reg(G) | 0.1470 |

Discover the unfold in common maturity. Funds like Nippon India Dynamic Bond, Axis Dynamic Bond Fund, and HDFC Dynamic Debt Fund are predominantly invested in long run bonds whereas the remainder of the class holds decrease tenure bonds. Funds from Tata and ITI have cash market devices of their portfolios!

So this implies just some funds will do effectively if the speed hike is introduced and we do not know which. It is because of this, that we suggest not utilizing dynamic bond funds.

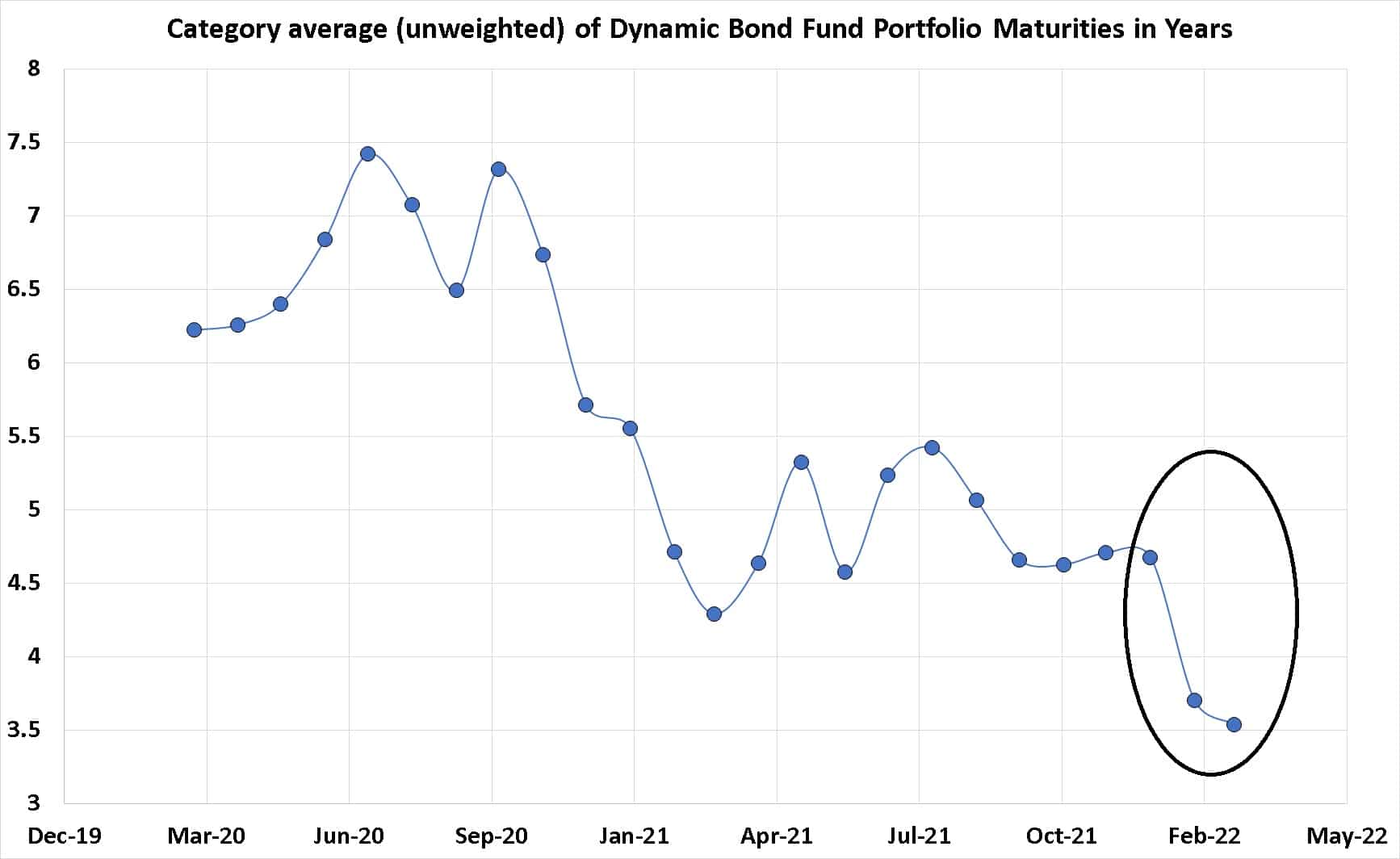

The class common (unweighted) of Dynamic Bond Fund Portfolio Maturities in Years with latest drop akin to yield hike proven within the oval.

Subsequent, we think about the share change in common portfolio maturity from Dec 2021 to March 2022.

| Fund | Change |

| ITI Dynamic Bond Fund-Reg(G) | -96% |

| IDBI Dynamic Bond(G) | -73% |

| L&T Flexi Bond Fund-Reg(G) | -68% |

| Tata Dynamic Bond Fund-Reg(G) | -65% |

| Quantum Dynamic Bond Fund(G)-Direct Plan | -59% |

| PGIM India Dynamic Bond Fund(G) | -56% |

| UTI Dynamic Bond Fund-Reg(G) | -53% |

| Union Dynamic Bond(G) | -42% |

| Aditya Birla SL Dynamic Bond Fund-Reg(G) | -33% |

| Baroda BNP Paribas Dynamic Bond Fund(G) | -26% |

| ICICI Pru All Seasons Bond Fund(G) | -17% |

| IDFC Dynamic Bond Fund-Reg(G) | -13% |

| DSP Strategic Bond Fund-Reg(G) | -9% |

| Mirae Asset Dynamic Bond Fund-Reg(G) | -9% |

| Mahindra Manulife Dynamic Bond Yojana-Reg(G) | -8% |

| HDFC Dynamic Debt Fund(G) | -7% |

| IIFL Dynamic Bond Fund-Reg(G) | -5% |

| Nippon India Dynamic Bond(G) | -5% |

| JM Dynamic Bond Fund-Reg(G) | -4% |

| Axis Dynamic Bond Fund-Reg(G) | -3% |

| Canara Rob Dynamic Bond Fund-Reg(G) | -2% |

| SBI Dynamic Bond Fund-Reg(G) | 3% |

| Kotak Dynamic Bond Fund-Reg(G) | 8% |

Most funds have lowered decreased publicity to longer-term bonds since Dec 2021. Some have drastically modified portfolio character whereas funds from SBI and Kotak have marginally elevated publicity to long-term bonds.

Funds with drastic modifications in bond tenure sometimes have low AUM. For instance:

| Fund | March 2022 AUM (Crores) |

| ITI Dynamic Bond Fund-Reg(G) | 24.5040 |

| IDBI Dynamic Bond(G) | 19.1296 |

| L&T Flexi Bond Fund-Reg(G) | 57.8501 |

| Tata Dynamic Bond Fund-Reg(G) | 168.6028 |

| Quantum Dynamic Bond Fund(G)-Direct Plan | 85.6402 |

| PGIM India Dynamic Bond Fund(G) | 125.2633 |

| UTI Dynamic Bond Fund-Reg(G) | 354.8948 |

Whereas a number of the massive funds haven’t change their portfolio a lot.

| Fund (Change in Avg maturity from Dec 21 to March 22) | March 2022 AUM (Crores) |

| ICICI Pru All Seasons Bond Fund(G) (-17%) | 6062.2324 |

| IDFC Dynamic Bond Fund-Reg(G) (-13%) | 2677.4547 |

| Nippon India Dynamic Bond(G) (-5%) | 4507.0992 |

| Axis Dynamic Bond Fund-Reg(G) (-3%) | 2467.2599 |

| SBI Dynamic Bond Fund-Reg(G) (+3%) | 2389.1505 |

| Kotak Dynamic Bond Fund-Reg(G) (+8%) | 2274.5155 |

Though it can’t be stated conclusively, the decrease AUM funds appear to have larger “flexibility”.

In abstract, most dynamic bond funds have began shifting to shorter-term bonds over the previous couple of months. They’re prone to proceed on this vein within the close to future as a fee hike is anticipated within the subsequent quarter. Buyers holding debt mutual funds appropriate for his or her long run objectives after understanding the underlying dangers needn’t react to this growth.

Do share for those who discovered this convenient

About The Writer

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product growth. Join with him by way of Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You could be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for teenagers. He has additionally written seven different free e-books on numerous cash administration matters. He’s a patron and co-founder of “Price-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Know-how, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product growth. Join with him by way of Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You could be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for teenagers. He has additionally written seven different free e-books on numerous cash administration matters. He’s a patron and co-founder of “Price-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Use our Robo-advisory Excel Template for a start-to-finish monetary plan! Now with a brand new demo video! ⇐ Greater than 900 buyers and advisors use this!

Our flagship course! Study to handle your portfolio like a professional to realize your objectives no matter market circumstances! ⇐ Greater than 2700 buyers and advisors are a part of our unique group! Get readability on plan in your objectives and obtain the mandatory corpus it doesn’t matter what the market situation is!! Watch the primary lecture at no cost! One-time cost! No recurring charges! Life-long entry to movies! Cut back worry, uncertainty and doubt whereas investing! Learn to plan in your objectives earlier than and after retirement with confidence.

Our new course! Enhance your revenue by getting folks to pay in your abilities! ⇐ Greater than 620 salaried workers, entrepreneurs and monetary advisors are a part of our unique group! Learn to get folks to pay in your abilities! Whether or not you’re a skilled or small enterprise proprietor who needs extra shoppers by way of on-line visibility or a salaried individual wanting a aspect revenue or passive revenue, we are going to present you obtain this by showcasing your abilities and constructing a group that trusts you and pays you! (watch 1st lecture at no cost). One-time cost! No recurring charges! Life-long entry to movies!

My new ebook for teenagers: “Chinchu will get a superpower!” is now accessible!

Most investor issues could be traced to an absence of knowledgeable resolution making. We have all made unhealthy choices and cash errors after we began incomes and spent years undoing these errors. Why ought to our youngsters undergo the identical ache? What is that this ebook about? As dad and mom, if we needed to groom one skill in our youngsters that’s key not solely to cash administration and investing however for any facet of life, what wouldn’t it be? My reply: Sound Determination Making. So on this ebook, we meet Chinchu, who’s about to show 10. What he needs for his birthday and the way his father or mother’s plan for it and train him a number of key concepts of resolution making and cash administration is the narrative. What readers say!

Should-read ebook even for adults! That is one thing that each father or mother ought to train their children proper from their younger age. The significance of cash administration and resolution making based mostly on their needs and wishes. Very properly written in easy phrases. – Arun.

Purchase the ebook: Chinchu will get a superpower in your little one!

Tips on how to revenue from content material writing: Our new e-book for these fascinated with getting aspect revenue by way of content material writing. It’s accessible at a 50% low cost for Rs. 500 solely!

Need to verify if the market is overvalued or undervalued? Use our market valuation device (will work with any index!), otherwise you purchase the brand new Tactical Purchase/Promote timing device!

We publish mutual fund screeners and momentum, low volatility inventory screeners .each month.

About freefincal & its content material coverage Freefincal is a Information Media Group devoted to offering unique evaluation, experiences, opinions and insights on developments in mutual funds, shares, investing, retirement and private finance. We accomplish that with out battle of curiosity and bias. Observe us on Google Information. Freefincal serves greater than three million readers a 12 months (5 million web page views) with articles based mostly solely on factual info and detailed evaluation by its authors. All statements made will likely be verified from credible and educated sources earlier than publication. Freefincal doesn’t publish any paid articles, promotions, PR, satire or opinions with out knowledge. All opinions offered will solely be inferences backed by verifiable, reproducible proof/knowledge. Contact info: letters {at} freefincal {dot} com (sponsored posts or paid collaborations is not going to be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Purpose-Primarily based Investing

Printed by CNBC TV18, this ebook is supposed that will help you ask the suitable questions, search the proper solutions, and because it comes with 9 on-line calculators, you can even create customized options in your way of life! Get it now. Additionally it is accessible in Kindle format.

Printed by CNBC TV18, this ebook is supposed that will help you ask the suitable questions, search the proper solutions, and because it comes with 9 on-line calculators, you can even create customized options in your way of life! Get it now. Additionally it is accessible in Kindle format.

Gamechanger: Neglect Startups, Be a part of Company & Nonetheless Dwell the Wealthy Life You Need

This ebook is supposed for younger earners to get their fundamentals proper from day one! It should additionally aid you journey to unique locations at a low value! Get it or present it to a younger earner.

This ebook is supposed for younger earners to get their fundamentals proper from day one! It should additionally aid you journey to unique locations at a low value! Get it or present it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low cost flights, price range lodging, what to do when travelling, how travelling slowly is healthier financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 199 (prompt obtain)

That is an in-depth dive evaluation into trip planning, discovering low cost flights, price range lodging, what to do when travelling, how travelling slowly is healthier financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 199 (prompt obtain)

Free android apps