Please use the menu beneath to navigate to any article part:

In case you promote a dud funding property, you will have to pay capital acquire tax (CGT), promoting prices after which stamp responsibility once more while you reinvest… it may be a really costly train!

And you probably have owned the property for some time, it’s most likely placing cash in your pocket every month (i.e. greater than masking its bills — no costing you something) and the CGT might be important — much more purpose to not promote it, proper?

That is what I wish to examine in additional element.

Specifically, how dangerous does the property’s efficiency should be to warrant promoting?

What’s a dud property funding?

An investment-grade property ought to have a median development price within the vary of seven% and 10% (or extra) each year over the long term (primarily based on a historic inflation price of between 2% and three% p.a.).

In fact, the property’s worth may not admire by this quantity evenly yearly — however you’ll be able to common out the expansion price over a protracted interval.

You should have owned the property for 10 to fifteen years for its previous development to be a dependable and significant indicator.

You probably have owned the property for lower than this, your “timing” probably has a better affect on its previous development versus the precise fundamentals of the asset.

Subsequently, you probably have owned the property for lower than 10 years you need to evaluate its previous development to the ‘market’ i.e. how have comparable properties carried out over the identical interval.

Some sectors of the property market carry out in another way at completely different instances as implied in this weblog.

A dud property is one which has appreciated at lower than 7% p.a. and/or not saved up with its friends.

What are the prices of creating the change?

In case you do determine to divest a property it’s worthwhile to think about the prices of doing so.

These embody:

- Promoting prices — together with agent promoting charges, advertising and marketing and promoting, any repairs that should be made to get the property prepared on the market and attainable staging.

- CGT —multiply your acquire by 23.5% and that will provide you with an estimate of the CGT you’ll have to pay. That’s should you bought a property for $400k and the buying prices had been say $22k (stamp responsibility, authorized charges, and so on.) then the associated fee base is $422k. In case you promote the property for $650k much less $17k for promoting prices, then your gross acquire is $211k ($650k much less $17k much less $422k). In case you held the asset for greater than a yr, you’ll be able to low cost the acquire by 50% which brings it right down to $105.5k and this quantity is taxed at your marginal price — let’s use 47% to be conservative = $49,585 of tax payable (being 23.5% of the gross acquire).

- Buying prices — the stamp responsibility payable with respect to a alternative funding property plus any price for asset choice recommendation (patrons’ agent charges).

My evaluation

I’ve financially modelled the affect of promoting a dud funding, paying the CGT and reinvesting in the next high quality property.

For this instance, I assumed that the property was bought in Could 1991 for $141k and is now value $650k which equates to a 5.8% p.a. development price.

The associated mortgage stability is $145k.

The property’s rental revenue is $22,000 gross p.a.

While the property is producing a optimistic money stream in any case bills of circa $10k p.a., its development price has underperformed.

The median development price for Melbourne over this similar interval was 7.1% p.a. which incorporates all properties i.e. a number of non-investment grade property.

Realistically, with astute asset choice, you need to be capable to beat the median return.

If the investor sells this property, they must pay for CGT — I estimate $115k — which is a number of tax to pay!

Nonetheless, in the event that they do promote this property and reinvest in a greater asset, the benefits are:

- they’ll use the after-tax money proceeds to scale back their non-tax-deductible debt (residence mortgage); and

- in the long term, a superior capital development price will generate important worth.

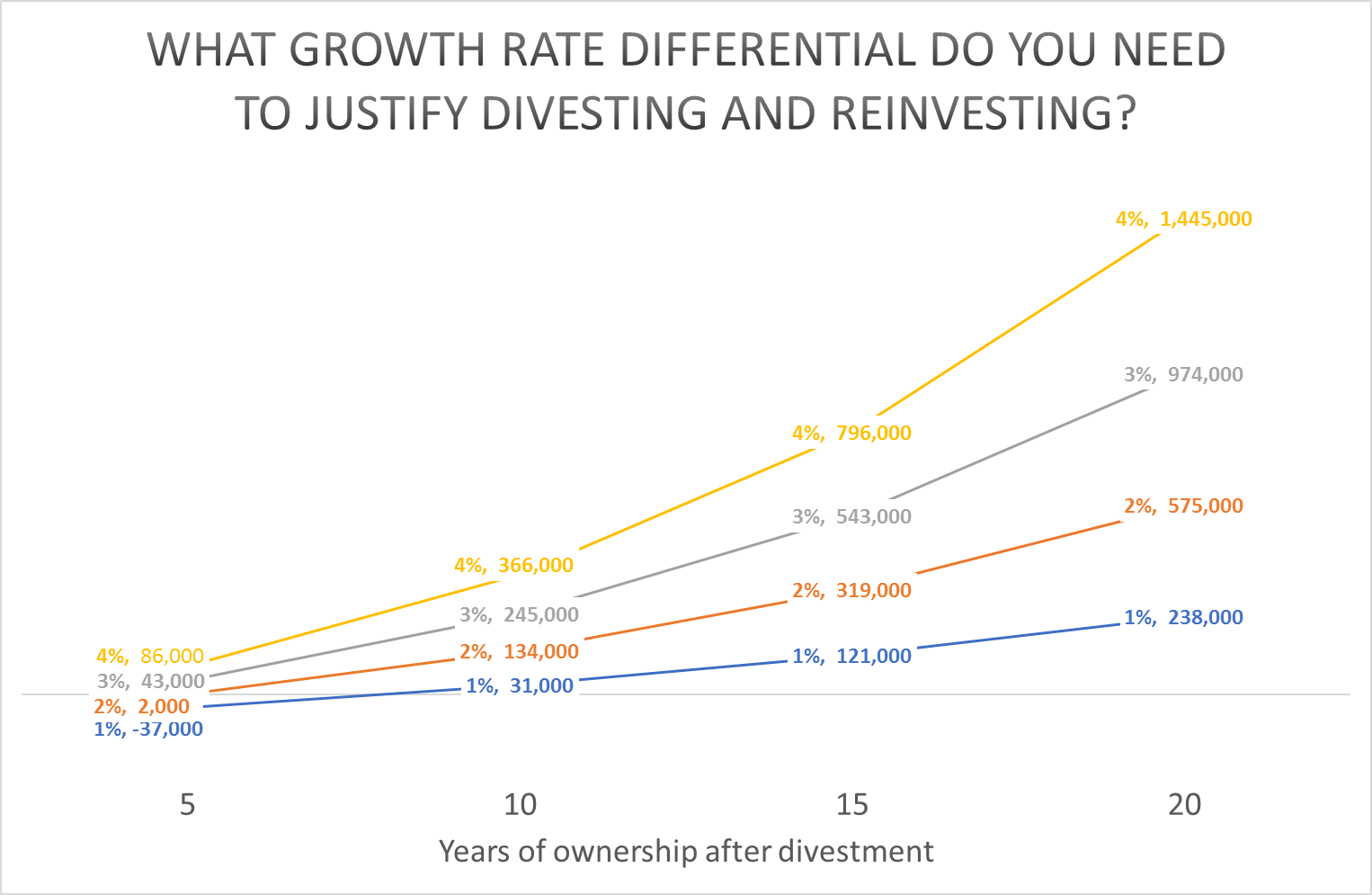

I financially modelled this situation which is illustrated within the chart beneath (click on to enlarge).

I clarify this chart beneath.

What does the above chart inform us?

The chart tasks the distinction in general wealth in at the moment’s {dollars} (i.e. excluding inflation) after 5, 10, 15 and 20 years.

It measures the affect of a 1%, 2%, 3%, and 4% annual development price differential.

That’s, what if the alternative property appreciates at 1% + 5.8% = 6.8%, or 2% + 5.8% = 7.8% p.a. and so forth.

For instance, if this investor divests of their current asset and invests in a alternative property that grows at 7.8% p.a., after 15 years the investor can be $319,000 higher off (web of all prices) in at the moment’s {dollars}.

The monetary mannequin takes under consideration the affect on money stream, the good thing about having the ability to cut back non-tax-deductible debt, the affect of assorted capital development charges, and the chance price and time worth of cash.

Basically, what I’m making an attempt to establish is how significantly better does the brand new (alternative) property must be to greater than offset the prices related to divesting and reinvesting.

As you’ll be able to see from the above, the reply is {that a} efficiency of near (or greater than) 2% p.a. increased than your current “dud” asset produces a superior monetary end in the long term.

With monetary selections like this, you need to suppose long-term.

The issues it’s worthwhile to think about

This is just one situation and naturally, you need to get personalised monetary and property recommendation earlier than making any resolution to divest an asset.

Some issues it’s worthwhile to think about embody:

- The relative efficiency of your current funding property and the size of time you might have owned it. If the efficiency has been very poor over a protracted time frame, then the proof is compelling. Nonetheless, if the efficiency has simply been “okay”, however not nice and also you haven’t owned the property for a very long time then I’d most likely advise you to carry onto it for a short while longer.

- The quantity of your own home mortgage and the quantity of fairness within the funding property to be disposed of. The benefit of promoting an funding property with a number of fairness is that it means that you can cut back your own home mortgage (which gives important compounding financial savings). Nonetheless, in case your funding has little fairness and/or your own home mortgage is small, then it can have little affect.

- The quantity of CGT. Let’s face it, nobody likes paying taxes! It’s a bitter tablet to swallow. If there may be little CGT to pay, then the choice to divest a dud asset is considerably simpler.

- Your borrowing capability and money stream. You could think about your skill (and funds) to reinvest in case you are to get rid of a dud asset. Subsequently, it’s worthwhile to get recommendation on what your present borrowing capability is having contemplating the financial institution’s parameters and your money stream place.

This weblog was initially revealed in July 2018 and has been republished for the good thing about our many new subscribers.

ALSO READ: 3 inquiries to ask earlier than promoting your funding property