The “inflation mania” that has gripped debt markets this 12 months has gone too far, in line with some buyers and analysts who say now is an effective time to grab up bonds at a reduction.

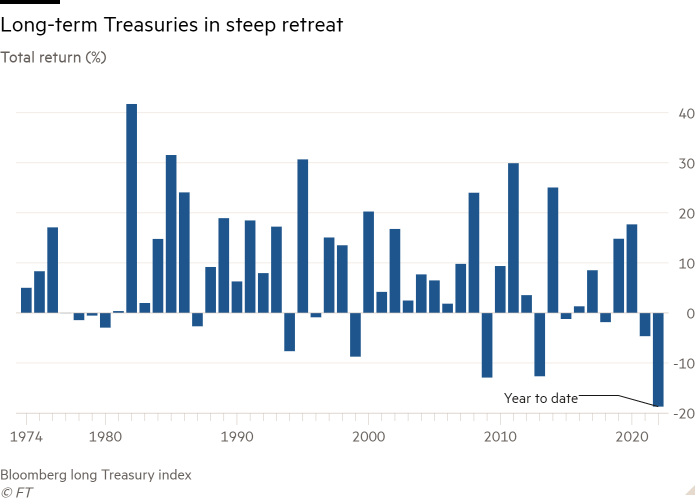

A Bloomberg index of long-term US authorities bonds has dropped greater than 18 per cent this 12 months, leaving it on monitor for its largest fall on report relationship again to 1973.

The retreat in bond costs has pushed the 10-year Treasury yield — a benchmark for bond markets world wide — to just about 3 per cent as buyers place for a fast tightening of financial coverage from the Federal Reserve and different central banks tackling hovering inflation.

However fund managers and funding banks are more and more questioning how a lot additional yields can rise as fast inflation, together with rate of interest rises designed to fight it, trigger financial development to sluggish, one thing which generally burnishes the enchantment of secure property like authorities bonds.

“We view the present degree of 10-year [US yields] as a compelling location [to buy the debt],” mentioned charges strategists at Financial institution of America on Wednesday. “Inflation concern has reached a degree of mania or panic,” the financial institution mentioned, citing the “excessive” inflows into inflation-protected bonds in addition to a spike in web searches for “inflation”.

“Our forecasts level to inflation peaking this quarter and falling steadily into 2023. We imagine this may cut back the panic degree round inflation and permit charges to say no,” Financial institution of America added.

Increased payouts now supplied by holding bonds are already proving tempting to some fund managers.

“Gosh, they’re excessive sufficient now to purchase,” mentioned Edward Al-Hussainy, senior rates of interest strategist at Columbia Threadneedle. “That’s what we’re doing.” He cautioned nevertheless, that charges may transfer greater but.

“I don’t assume you may be sure that is the highest till you get a sign from the Fed that they’ve overshot, otherwise you get a correction in danger property,” Al-Hussainy mentioned.

Even some persistent bond bears are starting to ponder whether or not the sell-off is overdone. Dickie Hodges, who manages a $3.9bn bond fund at Nomura Asset Administration, mentioned he had been “including little bits of publicity” to long-dated bonds as yields rose.

“I believe it’s too early to name the highest in yields proper now,” Hodges mentioned. “However central bankers know that elevating rates of interest materially from these ranges goes to push economies into recession. And I’m satisfied inflation goes to roll over later this 12 months, so long-end yields are beginning to look enticing.”

Nonetheless, many buyers are cautious of calling time on the bond drop too quickly. Barclays this week ditched a suggestion revealed earlier this month to purchase 10-year Treasuries after yields continued their ascent. The financial institution mentioned the percentages of the Fed “over-tightening” and pushing the US economic system right into a “exhausting touchdown” had receded, with the central financial institution as a substitute prone to enable greater inflation expectations to develop into entrenched.

A larger emphasis on decreasing the Fed’s holdings of Treasuries — along with elevating short-term rates of interest — might additionally weigh additional on long-term bonds, whose yields have been pushed down by asset purchases. Fed board member Lael Brainard mentioned earlier this month the central financial institution would start a “fast” discount of its steadiness sheet that may start as quickly as its Might assembly.

This risk has left some fund managers reluctant to purchase Treasuries — no less than for now.

“If I might shut my eyes and are available again in six months I believe I might be comfortably within the cash by shopping for right here,” mentioned James Athey, a bond fund supervisor at Abrdn. “However the potential journey to get there’s so unsure that it’s exhausting to get the timing proper. All it takes is a giant upside shock to inflation or some loose-lipped Fed converse and yields shoot up once more.”