GRIP Make investments is a fintech platform and provides various funding merchandise to the retail traders.

The financial institution mounted deposits have been yielding low returns for nearly 2 years now. YTMs (Yield-to-maturity) of excellent credit score high quality debt funds have additionally come down. Rates of interest on small financial savings schemes are additionally a lot decrease than they was a few years. Curiosity earnings on varied debt merchandise has gone down throughout the board.

Tough occasions certainly for retail mounted earnings traders.

Throughout such occasions, it’s pure for traders to discover merchandise that provide larger returns, particularly such merchandise that resemble financial institution mounted deposits. I wrote about coated bonds in an earlier submit. Each product has deserves and demerits, and coated bonds aren’t any completely different. It’s simple to give attention to excessive returns, however dangers should even be appreciated. As an investor, it will be important that you simply weigh the potential threat and reward after which determine.

On this submit, I’ll evaluate one other such product that guarantees to supply larger returns. Lease and Stock Finance from Grip (an funding platform). The pre-tax returns as talked about on the web site are in 20-22% p.a. Fairly excessive for a set earnings product, isn’t it?

Let’s discover out extra concerning the merchandise from GRIP funding platform and their threat and return profile. I’ll use Grip, Grip Make investments and Grip Funding platform interchangeably on this submit.

Grip Make investments: Lease and Stock Finance: The way it works?

- Your cash is invested in a restricted legal responsibility partnership (LLP). You change into a associate within the agency. For every transaction/deal, a brand new LLP is shaped.

- The LLP (the lessor) buys the asset (say a truck) and leases the asset to the lessee (say a transportation firm). The lessee makes lease funds (rental funds) frequently.

- Grip Make investments takes a 1-2% minimize on all of the lease funds. The LLP pays the taxes at 30% on earnings and the income are distributed to the traders (companions).

- Earnings distributed by an LLP to its companions are exempt from tax within the palms of the companions (traders) beneath Part 10(2A) of the Revenue Tax Act.

- Profit resulting from depreciation on bought asset: Depreciation is a non-cash expense merchandise, helps cut back taxes and improve money income.

- Return kicker resulting from GST enter credit score: The LLP will need to have paid GST whereas buying the belongings. And can acquire GST on lease funds. In absence of enter credit score, the GST collected must be handed to the Authorities. Nonetheless, the GST enter credit score can set off the GST collected on lease funds and therefore the LLP can hold the GST collected with itself (till GST enter credit score is wiped off).

Grip Make investments: How a lot returns you get?

The marketed returns are within the vary of 20-22% p.a. pre-tax.

Listed below are a few such offers proven on the web site in December 2021. And we are going to attempt to calculate the post-tax returns for you for these offers.

Word that these are pre-tax returns. Pre-tax to whom? To LLP? Earlier than or after Grip Make investments fee?

Or pre-tax to you?

Nicely, this pre-tax return is predicated on the lease earnings obtained by the LLP. And that is earlier than Grip Make investments fee and naturally the taxes paid by the LLP.

Subsequently, you received’t earn such excessive marketed return.

Then, how a lot would you get?

The great half is that the Grip Make investments has offered tentative cashflows to traders in an illustration for every of those offers. Since these pay-outs are exempt within the palms of the traders, you get a good suggestion of the post-tax returns.

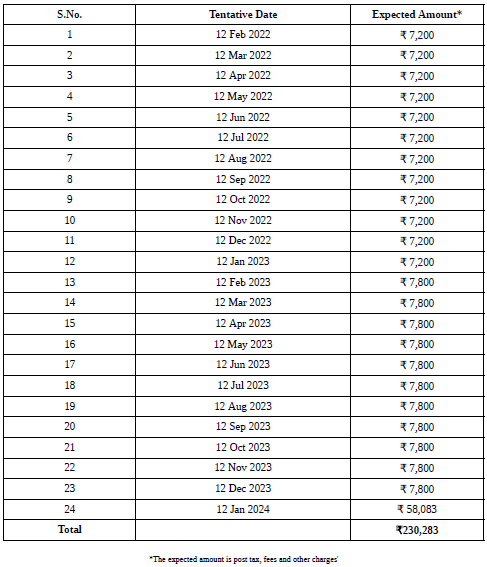

Let’s take a look at the illustration for Lightning Logistics.

Assume you make investments Rs 2 lacs.

In case you use IRR perform on above cashflows, you get a month-to-month IRR of 0.95% monthly. Or about 11.4% each year post-tax. Nonetheless very excessive, however far cry from 21.4% highlighted on the deal web page.

Let’s take a look at one other deal (Azure).

Once more, the IRR is simply about 11.43% p.a.

This doesn’t look good. Grip Make investments is aware of that the investor returns received’t be 20-22% p.a. Additionally they know that the traders would give attention to this variety of 20-22% p.a. To their credit score, they’ve offered rationalization in FAQs. They’ve shared illustrations that can be utilized to calculate precise post-tax returns to traders. Nonetheless, what number of traders would try this? Subsequently, whereas they’re technically appropriate, they aren’t utterly sincere. Whereas it’s unfair for me to query the corporate’s intent, this looks as if an try to mislead traders.

11-12% p.a. from a set earnings product on a post-tax continues to be an superior return (albeit with a variety of threat). That is virtually fairness like return. They need to have merely highlighted this return to the traders.

Grip Make investments: Leasing and Stock Finance: What are the dangers?

That is no free lunch, proper?

All of the above return calculations assume that issues go in keeping with the plan. There isn’t any assure of that occuring. Your threat publicity is concentrated. If there may be any fraud/drawback with the lessor/lessee, chances are you’ll not get the anticipated funds and even lose the principal.

Sure, there are safeguards resembling repossession of leased belongings in case of default on lease/rental funds. The repossessed asset may be bought or leased out to a different vendor. Superb however I do know little about enforceability of contracts. Hold such dangers in thoughts.

Unsure who’s the regulator for such merchandise. If issues go south, you wouldn’t know who to achieve out to.

How do you play this?

That you must return to fundamentals of portfolio building. Since we’re contemplating a set earnings product on this submit, I’ll remark solely on building of mounted earnings portfolios.

You possibly can view your mounted earnings portfolio as consisting of core and satellite tv for pc portfolio.

Within the core (mounted earnings) portfolio, you management for each rate of interest and credit score threat. A core mounted earnings portfolio would have.

- Financial institution Fastened Deposits

- PPF/EPF

- Submit-office schemes

- RBI Floating price Bonds (sure, this could fall right here)

- Treasury payments

- Authorities Bonds (if you’re shopping for for curiosity earnings)

- Choose variants of debt fund schemes (liquid funds, cash market funds)

- Extremely-Brief or quick period debt funds (with good credit score high quality portfolio)

- Any funding the place you aren’t bothered about rate of interest actions or defaults within the underlying portfolio.

The core portfolio ought to comprise a minimum of 60-70% of the mounted earnings portfolio. It might probably even be 100%.

Within the satellite tv for pc (mounted earnings) portfolio, you calm down on both rate of interest or credit score threat. OR calm down on each varieties of dangers.

- Brief period however low credit score high quality bonds (or mutual funds)

- Good credit score high quality however lengthy period bonds (or mutual funds)

- Low credit score high quality and lengthy period bonds (or mutual funds)

Grip Make investments merchandise don’t have a lot of rate of interest threat. However these merchandise do carry heavy credit score threat. It’s a single occasion threat too. Even credit score threat debt funds carry a variety of credit score threat, however such funds put money into bonds from a number of corporations.

In mounted earnings investments, there isn’t any free lunch. The additional return comes at the price of larger threat, whether or not you respect it or not. No person desires to borrow at 16-18% p.a. This itself means the transaction is dangerous. From what I may perceive from a podcast on Grip Make investments merchandise, the lease rental is within the vary of 16-18% p.a. The marketed curiosity is larger resulting from GST enter credit score and depreciation profit.

Do you have to keep away from Grip Make investments or different related merchandise?

I’m not keen on taking an excessive amount of threat in my mounted earnings portfolio. Therefore, I received’t be very eager on such merchandise.

Nonetheless, it could be unfair for me to come back down closely on merchandise whose construction I don’t utterly perceive. Furthermore, it’s good to have funding choices and for that corporations like Grip Make investments and Wint Wealth deserve credit score. And sure, the returns are very engaging (regardless of the apparent dangers).

Subsequently, for those who should think about such merchandise, you should hold the next issues in thoughts.

- Contemplate such merchandise as a part of your satellite tv for pc mounted earnings portfolio. You could restrict the publicity.

- I might not be snug with greater than 5-10% of mounted earnings portfolio in such merchandise.

- Unfold the cash throughout 5-10 such merchandise. This (alongside in level 2) would be certain that you don’t make investments greater than 1% in a single transaction.

- Recognize the credit score threat concerned. It’s possible you’ll not get your a refund.

- Recognize the focus threat/fraud threat concerned.

- Don’t simply financial institution on authorized safety that such merchandise appear to offer in case of defaults by counterparties. Authorized system in our nation is gradual and you’ll lose endurance.

- Don’t go by fancy 20-22% returns posted on the deal web page. Calculate the IRR to get the true sense of returns. And determine if the return is definitely worth the threat.

Don’t think about such merchandise alternative for low-return financial institution mounted deposits. Financial institution FDs don’t have any credit score threat. Grip Make investments merchandise do.

Further Hyperlinks/Assets

Paisa Vaisa Podcast on Lease and Stock Finance